Miscellaneous Tax Templates

Welcome to our Miscellaneous Tax resource page! Here, you will find all the information you need regarding miscellaneous taxes, also referred to as miscellaneous tax forms or miscellaneous tax filings.

Miscellaneous taxes encompass a wide range of taxes that do not fall under specific categories. These taxes are often applicable to various circumstances and can include fees, levies, and other types of payments required by federal, state, and local tax authorities.

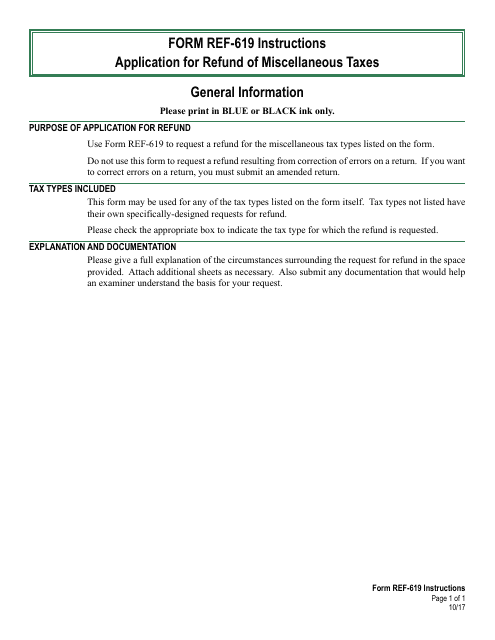

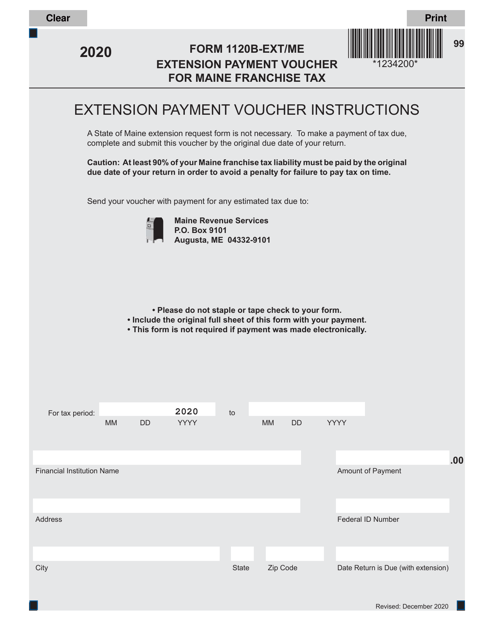

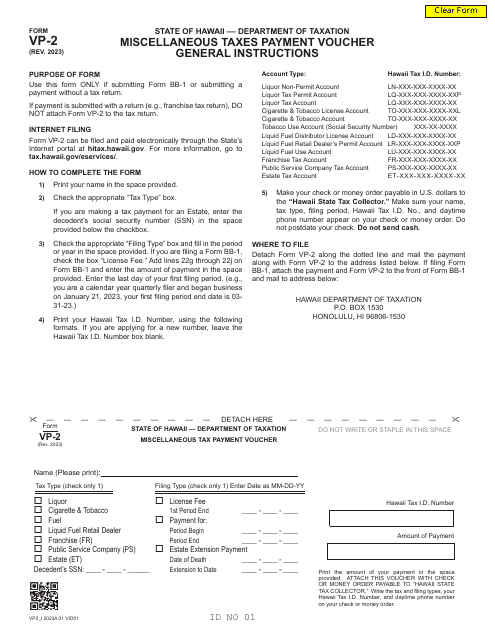

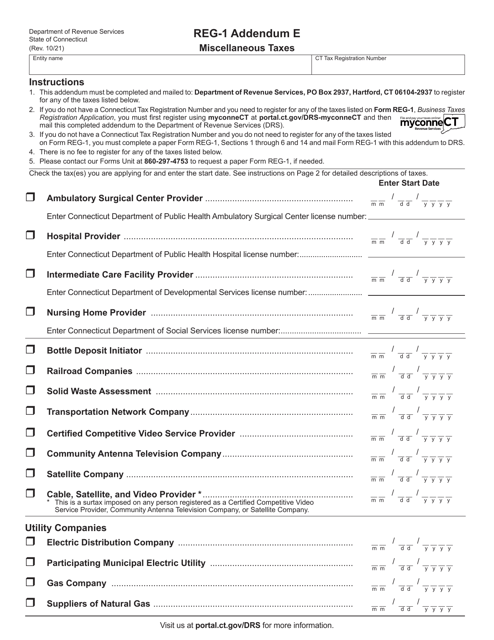

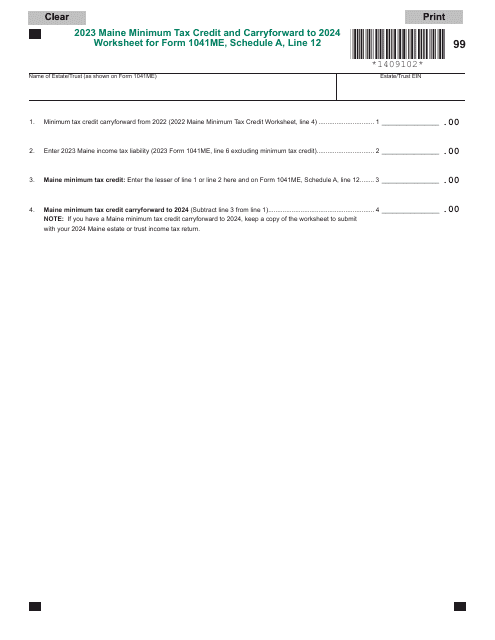

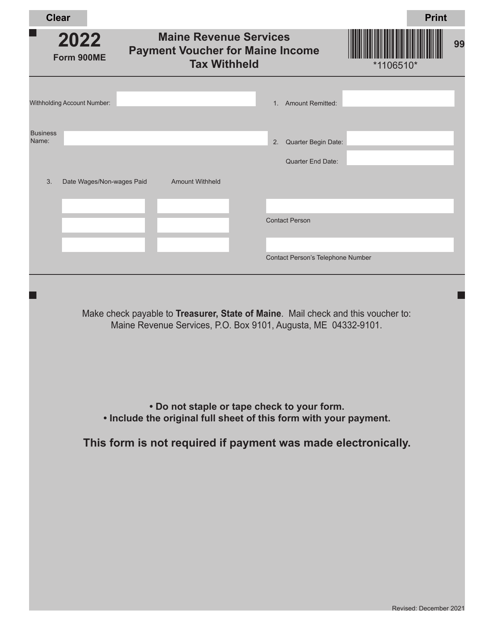

Our comprehensive collection of miscellaneous tax forms covers a variety of tax obligations from different jurisdictions. Whether you need to file an application for refunds of miscellaneous taxes, make extension payments for franchise taxes, or submit miscellaneous tax payment vouchers, we have the appropriate forms to meet your needs.

In our document library, you will find forms like the VT Form REF-619 Application for Refund of Miscellaneous Taxes from Vermont, Form 1120B-EXT/ME Extension Payment Voucher for Maine Franchise Tax, Form VP-2 Miscellaneous Taxes Payment Voucher from Hawaii, Form REG-1 Addendum E Miscellaneous Taxes from Connecticut, and Form 900ME Payment Voucher for Maine Income Tax Withheld, among many others.

We understand that navigating the world of miscellaneous taxes can be complex and time-consuming. That's why we've compiled this vast collection of miscellaneous tax forms, all conveniently accessible in one place. Our user-friendly platform makes it easy for you to search for the specific forms you need and streamline your tax filing process.

Whether you are an individual, a business owner, or a tax professional, our Miscellaneous Tax resource page is your go-to destination for all your miscellaneous tax requirements. Trust us to provide you with accurate and up-to-date tax forms, helping you stay compliant with your tax obligations.

Browse our extensive collection of miscellaneous tax forms today and simplify your tax filing process.

Documents:

8

This Form is used for applying for a refund of miscellaneous taxes paid in the state of Vermont.

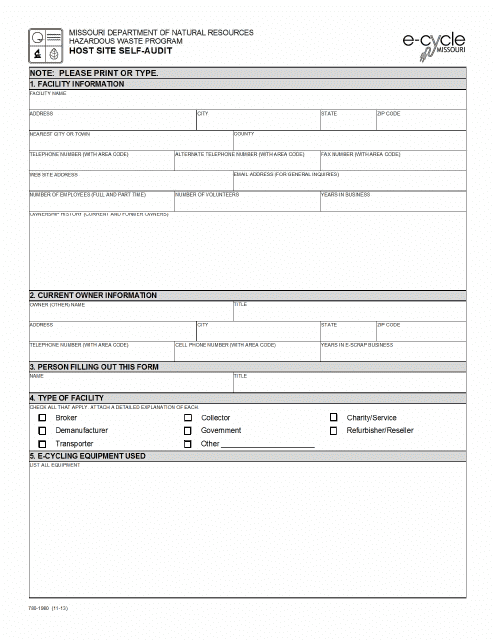

This Form is used for conducting a self-audit for host site compliance in Missouri.

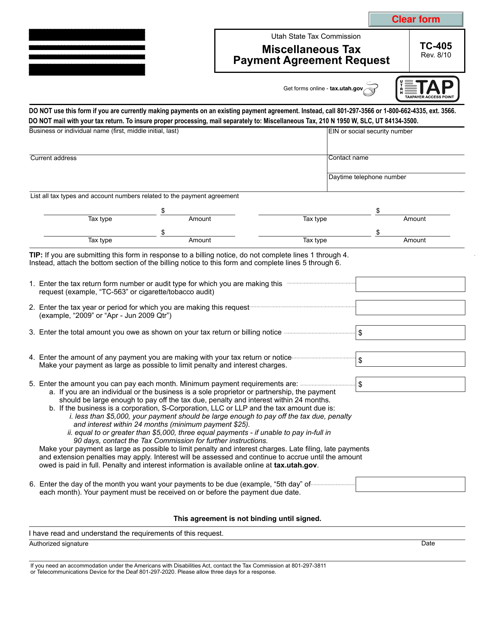

This Form is used for taxpayers in Utah to request a miscellaneous tax payment agreement.