Sole Proprietorship Templates

Are you a small business owner who runs their business as an individual? Are you the sole owner and operator of your business? Look no further, because you are operating as a sole proprietorship!

A sole proprietorship, also known as a sole proprietorship or sole proprietorships, is a type of business structure where an individual owns and operates their business. As a sole proprietor, you have complete control over your business, and you are personally responsible for all aspects of your operation.

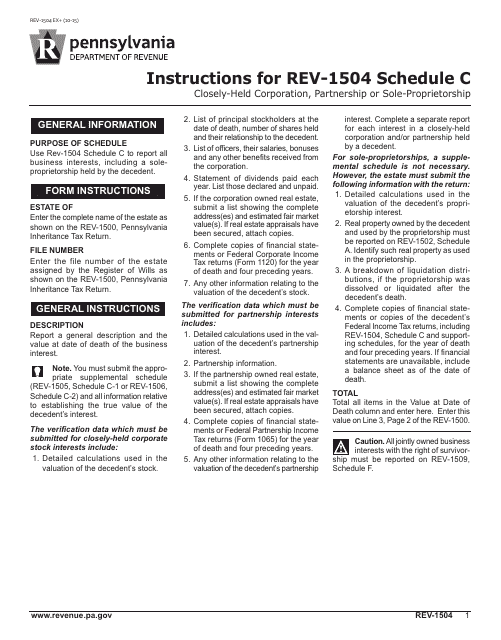

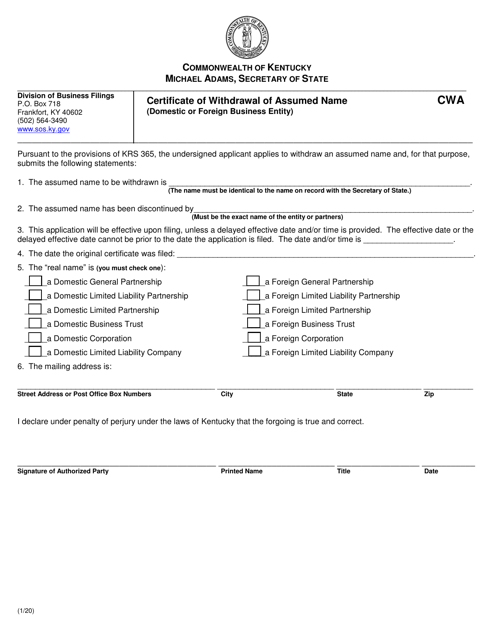

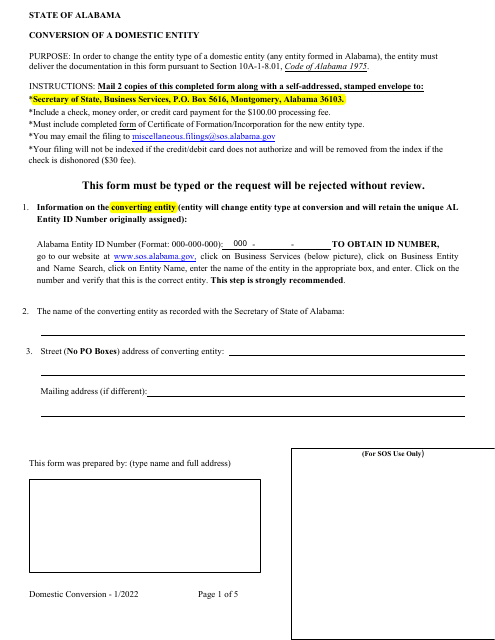

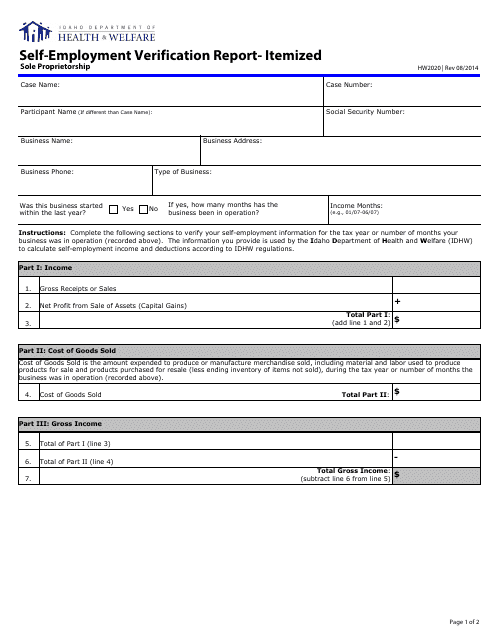

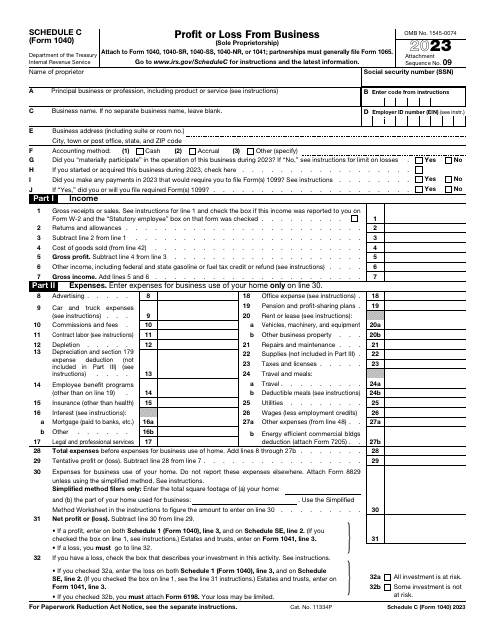

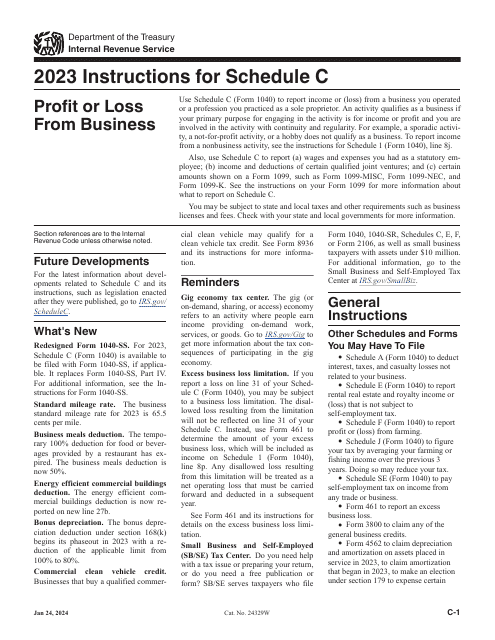

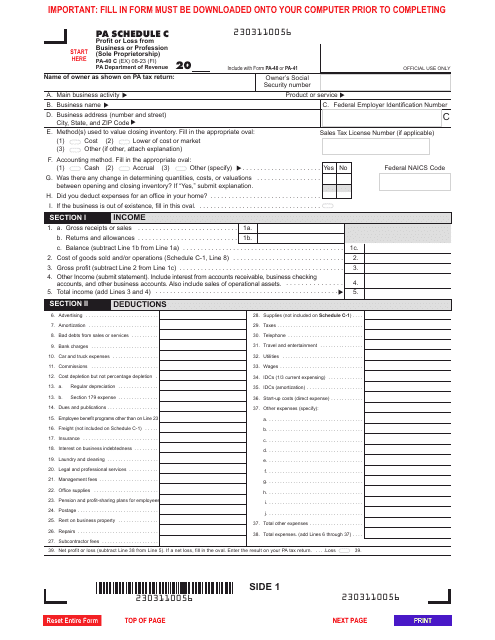

To ensure compliance and to access certain benefits, there are various documents that you may need as a sole proprietor. For instance, depending on your state, you may need to file a Form REV-1504 Schedule C Closely-Held Corporation, Partnership, or Sole-Proprietorship in Pennsylvania. In Idaho, you may need to submit a Form HW2020 Self-employment Verification Report- Itemized (Sole Proprietorship) to provide proof of your self-employment income. Additionally, for your annual tax filings, you will need to complete an IRS Form 1040 Schedule C Profit or Loss From Business (Sole Proprietorship) to report your business income and expenses accurately.

Moreover, there are other documents that may be required based on your location and business activities. In California, for example, you may need to obtain a Surety Bond to ensure the financial security of your sole proprietorship. Additionally, if you operate under a different name than your own, you may need to file a Fictitious Business Name Statement with the City and County of San Francisco, California.

Running a sole proprietorship offers flexibility and control, but it also comes with certain responsibilities. Remember to stay compliant and organized by obtaining and maintaining all the necessary documents for your sole proprietorship. Whether it's tax forms, self-employment verifications, or other legal requirements, ensuring your business is properly documented will provide peace of mind and help you navigate the world of sole proprietorship with confidence. Start gathering the required paperwork today, and let your sole proprietorship thrive!

Documents:

68

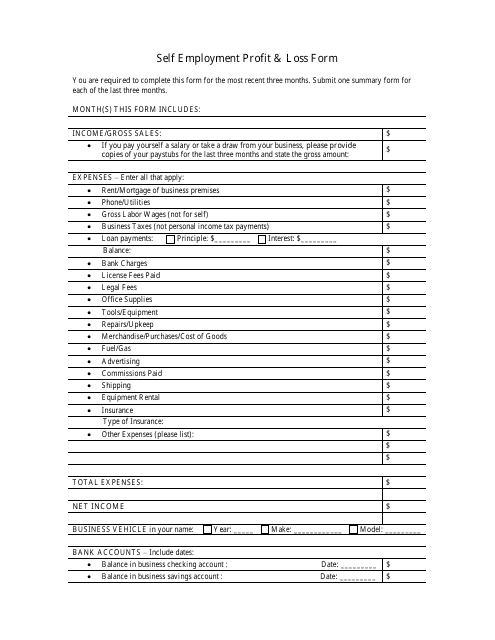

This form is used for reporting the profit and loss from self-employment. It helps individuals to calculate their income and expenses and determine the net profit or loss from their self-employed activities.

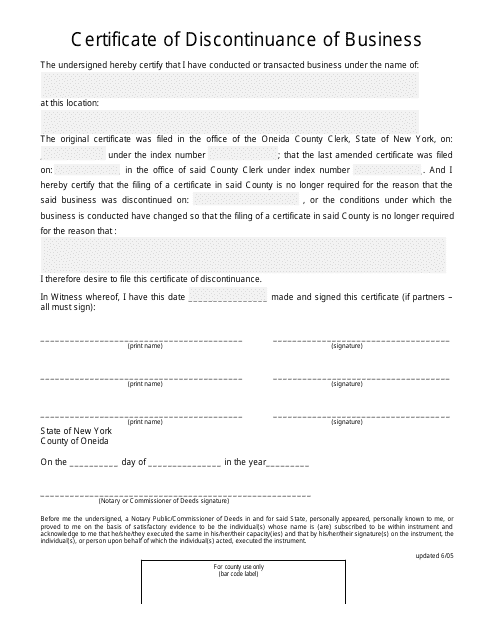

This document indicates that a business in Oneida County, New York has ceased its operations.

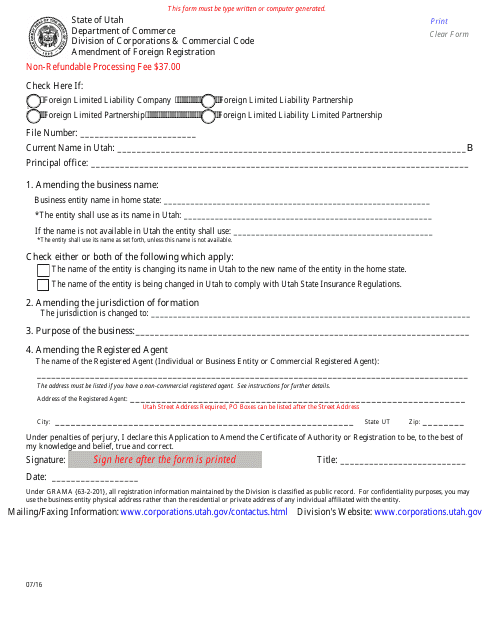

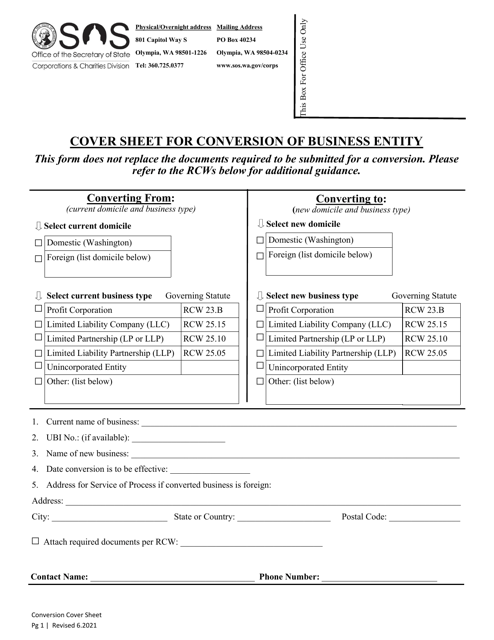

This document is used for making changes to a foreign registration in the state of Utah. It allows businesses that are registered in another country to modify their registration information in Utah.

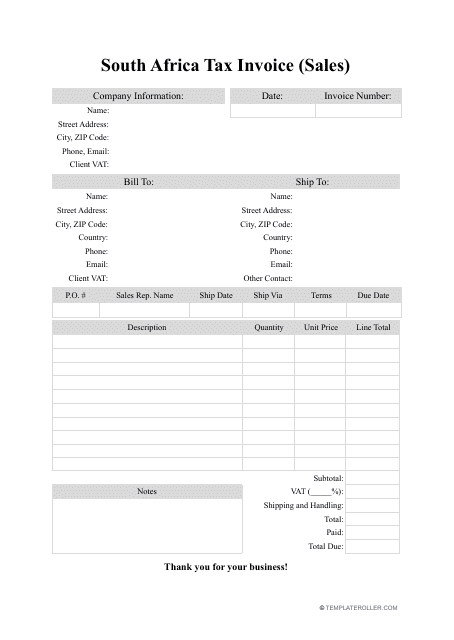

This type of document is a template for creating a sales tax invoice in South Africa.

This Form is used for reporting income and deductions for a closely-held corporation, partnership, or sole-proprietorship in the state of Pennsylvania. It provides specific instructions on how to fill out Schedule C of Form REV-1504.

Form REV-1504 Schedule C Closely-Held Corporation, Partnership or Sole-Proprietorship - Pennsylvania

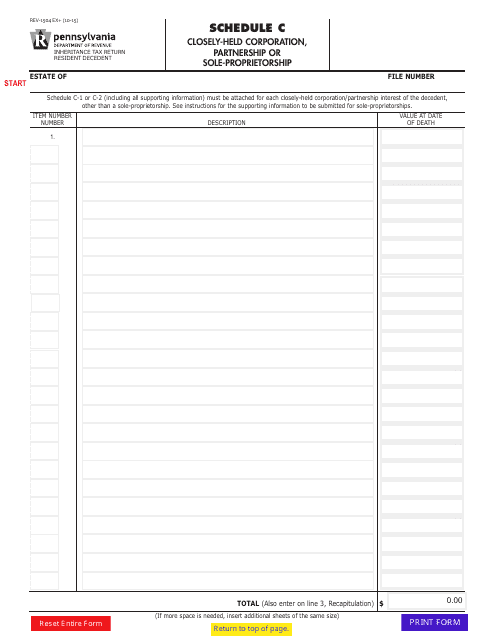

This Form is used for reporting the income, deductions, and credits of a closely-held corporation, partnership, or sole-proprietorship in the state of Pennsylvania.

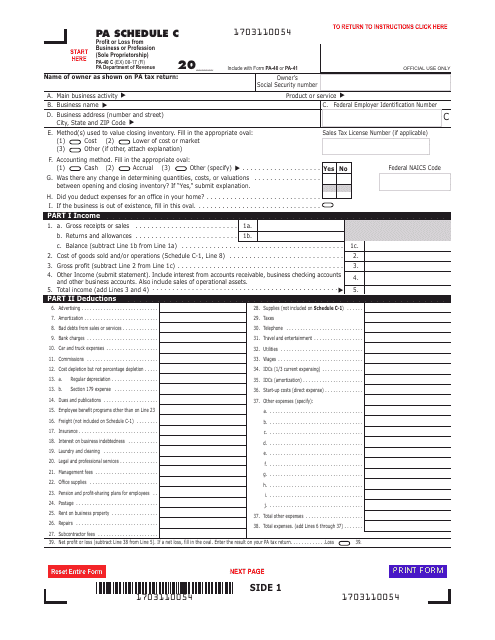

This document is used to report the profit or loss from a sole proprietorship business or profession in Pennsylvania.

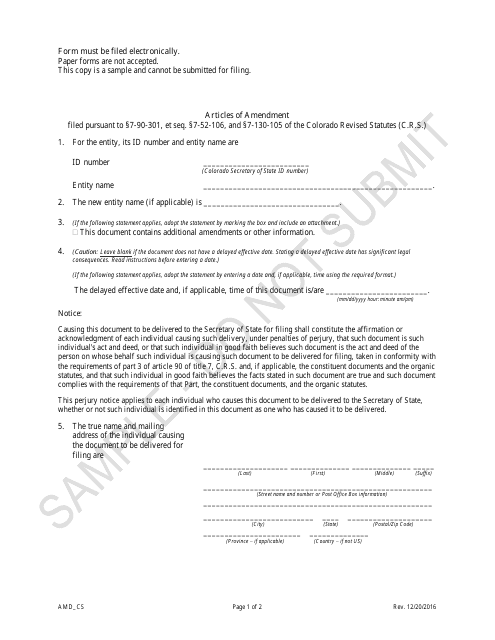

This document is used for making changes to a Corporation Sole in the state of Colorado. It allows for amendments to be made to the structure or purpose of the corporation.

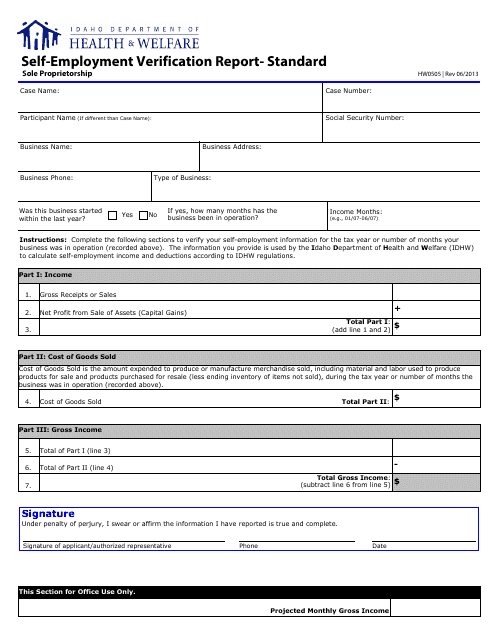

This Form is used for self-employed individuals in Idaho to verify their income and business details to the government. It is specifically for sole proprietorship businesses.

This Form is used for self-employed individuals in Idaho to report income and expenses in an itemized format, specifically designed for sole proprietors. It is a verification report that helps in assessing the financial status of self-employed individuals.

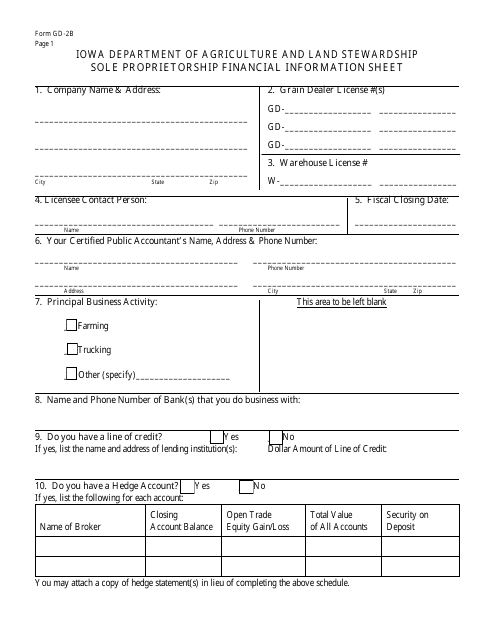

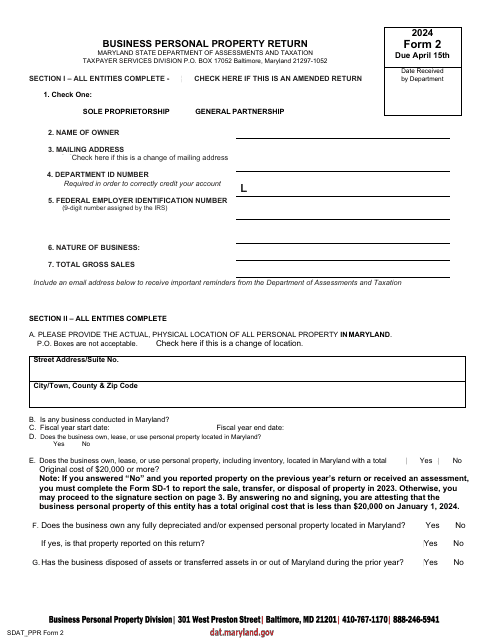

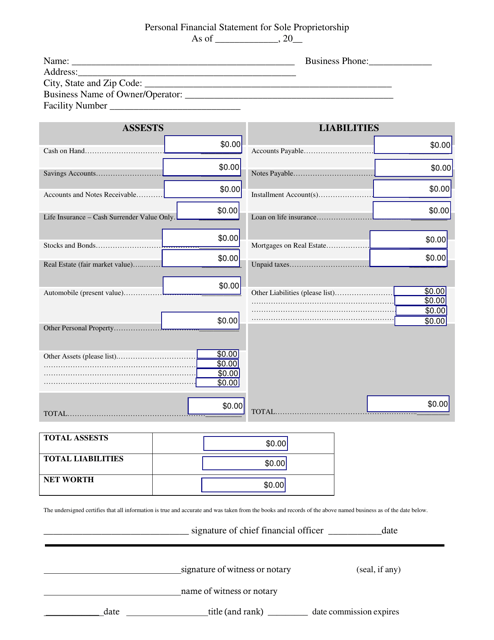

This Form is used for collecting financial information of sole proprietorships in the state of Iowa. It is important for individuals operating as sole proprietors to fill out this form accurately to provide a comprehensive overview of their financial situation.

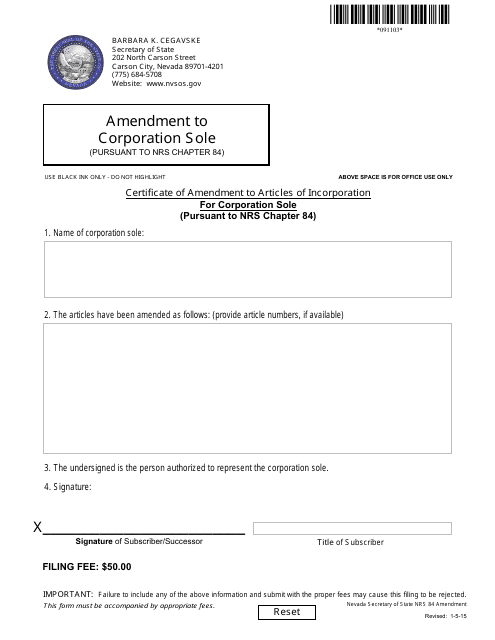

This form is used for filing a Certificate of Amendment to Articles of Incorporation for a Corporation Sole in the state of Nevada, as required by NRS Chapter 84.

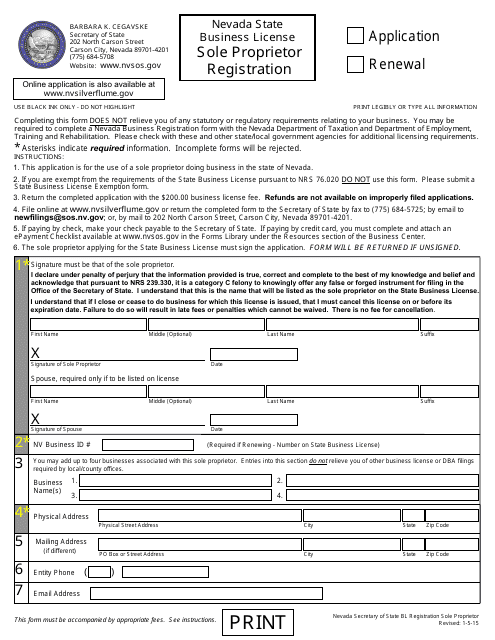

This form is used for registering or renewing a Sole Proprietorship in the state of Nevada. It is necessary for individuals operating businesses as sole proprietors to complete this form to legally establish their businesses.

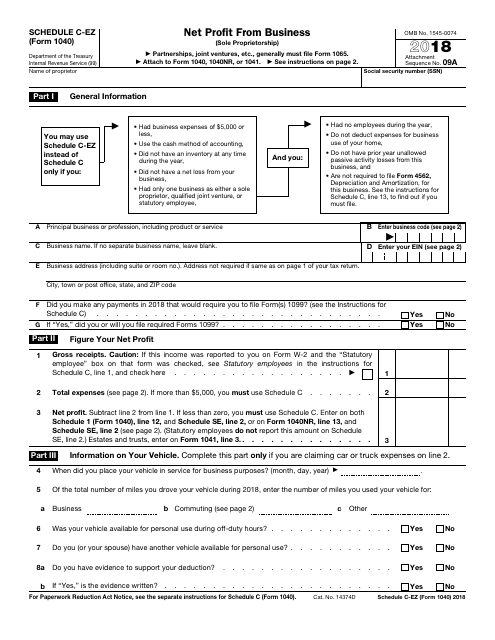

Complete this form in order to report income and loss from a business, qualified joint venture, or profession where you were the sole proprietor. This form is a simplified version of Schedule C. The document relates to the series of IRS 140 form series that is used for reporting and deducting of various types of income and losses.

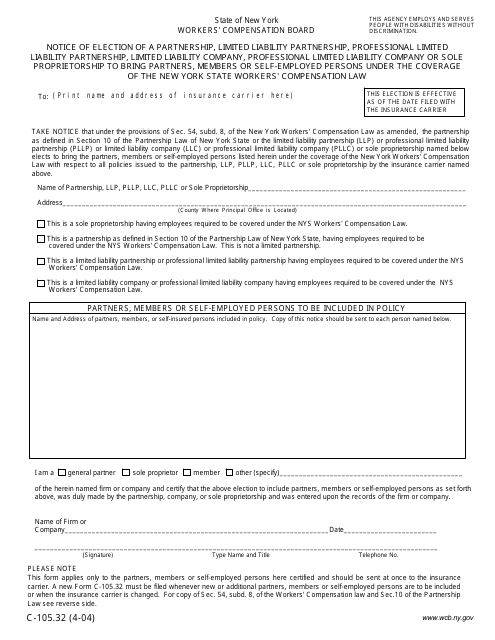

This Form is used for notifying the New York State Workers' Compensation Board of the election of a partnership, limited liability partnership, limited liability company, or sole proprietorship to bring partners, members, or self-employed persons under the coverage of the New York State Workers' Compensation Law.

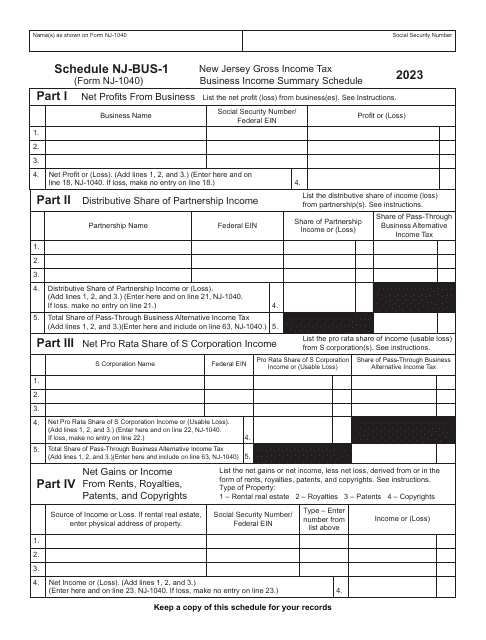

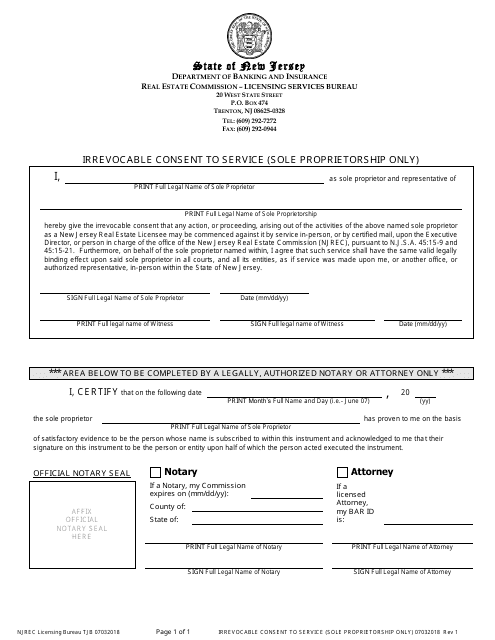

This type of document is used for obtaining an irrevocable consent to service for a sole proprietorship in the state of New Jersey.

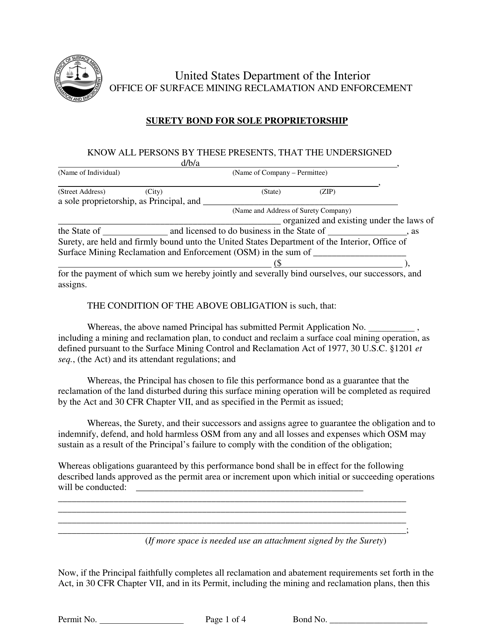

This type of document is a form of insurance that provides financial protection for a sole proprietorship business. It ensures that the business owner will fulfill their obligations and obligations to clients or customers.

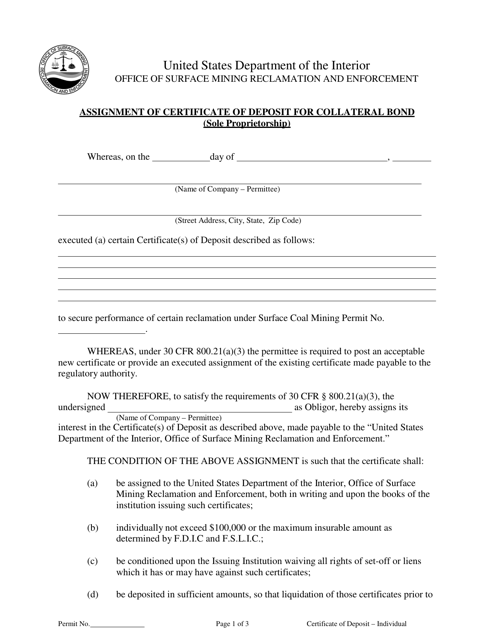

This document is for transferring a Certificate of Deposit as collateral for a bond for a sole proprietorship.

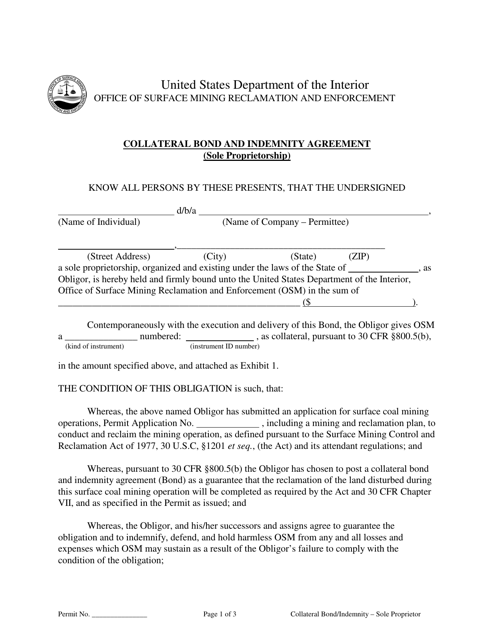

This document is used for creating an agreement between a sole proprietorship and a party providing collateral. It outlines the terms and conditions of the collateral bond and indemnity.

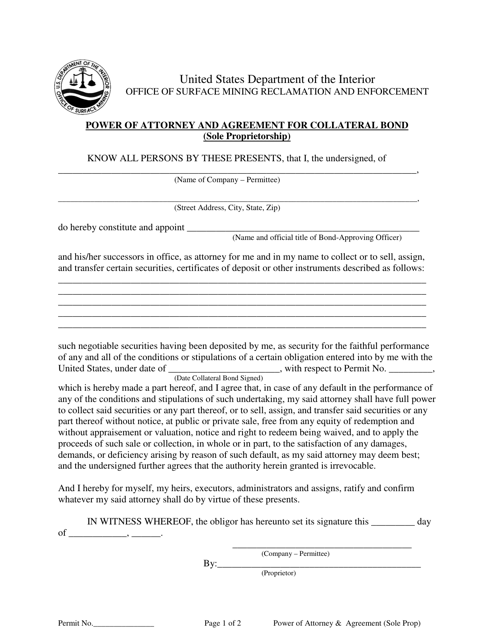

This document is used for granting someone the authority to act on behalf of a sole proprietorship and to secure a collateral bond.

This document provides instructions for individuals who operate a sole proprietorship to report their business profit or loss on their IRS Form 1040 or 1040-SR. It guides taxpayers through the process of filling out the Schedule C section of the form and provides explanations of the various sections and line items related to business income and expenses.

This Form is used for canceling an Assumed Business Name in Oregon.

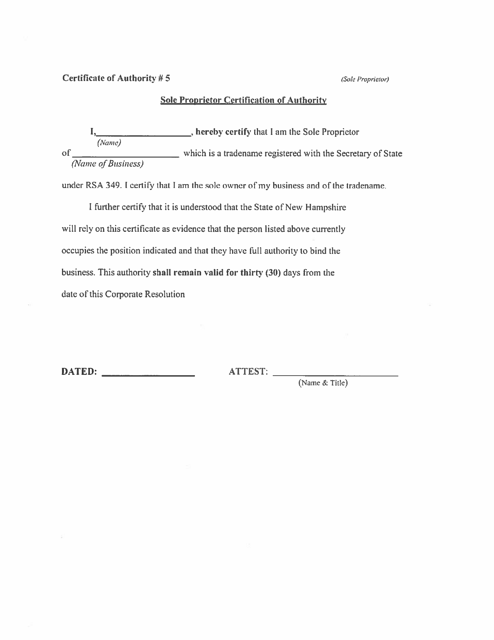

This Form is used for Sole Proprietor Certification of Authority in the state of New Hampshire.

This document is used for reporting the financial status of a sole proprietorship business in Montana. It includes details of assets, liabilities, and net worth.

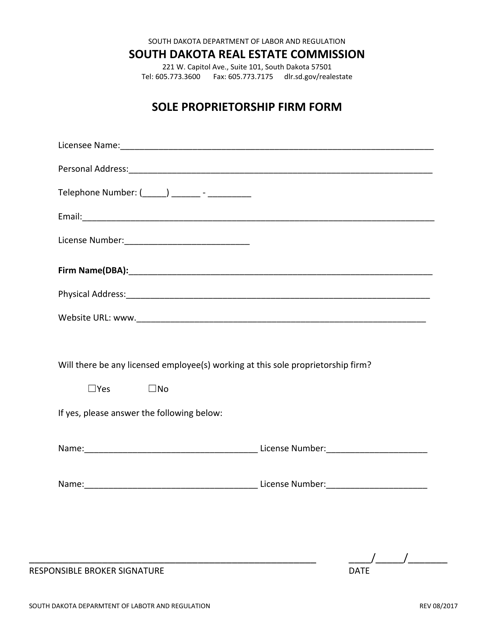

This form is used for registering a sole proprietorship firm in South Dakota.