Sales Tax Filing Templates

Are you a business owner overwhelmed by the complexities of filing sales tax returns? Look no further! Our sales tax filing documents collection provides you with all the resources you need to stay compliant and avoid hefty fines.

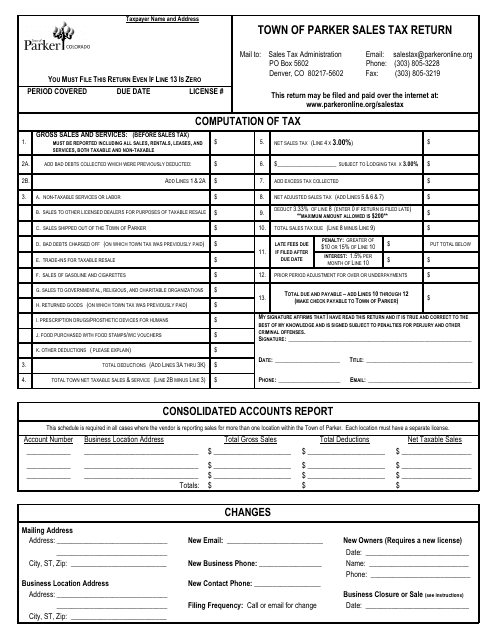

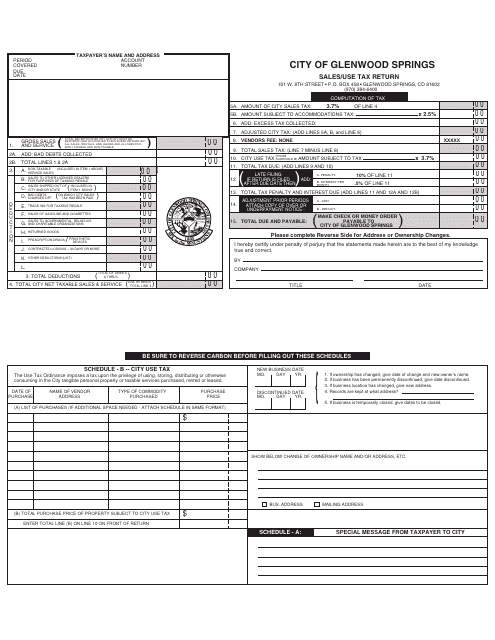

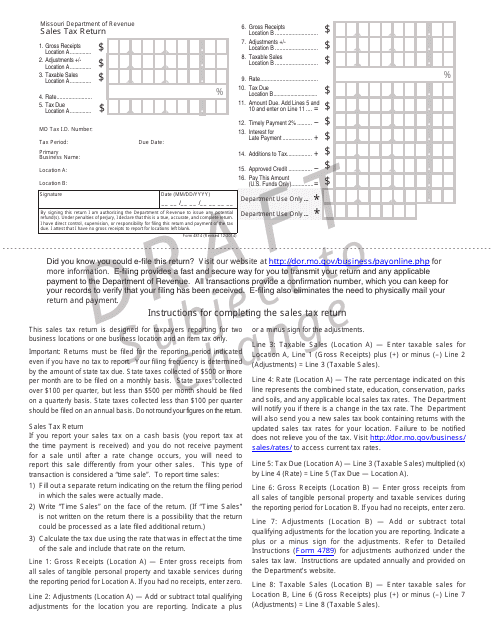

Our comprehensive sales tax filing system includes a wide range of forms for different jurisdictions, such as the Sales Tax Return Form used by the Town of Parker, Colorado, or the Sales/Use Tax Return Form required by the City of Glenwood Springs, Colorado. If you operate in Missouri, our collection also features the draft version of the Form 4814 Sales Tax Return for your convenience.

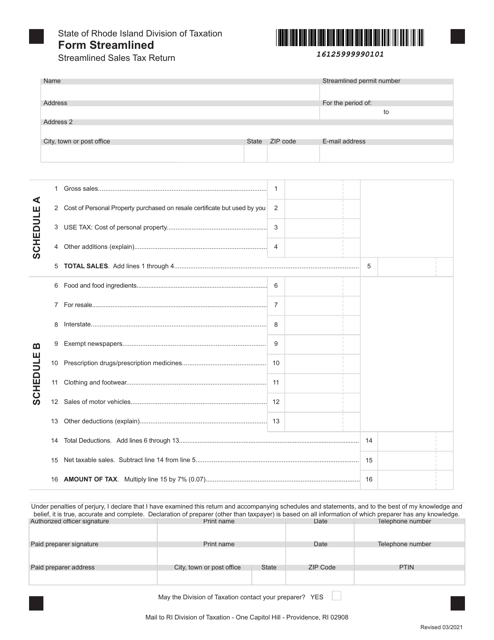

We understand that navigating the sales tax landscape can be challenging, especially with each state having its own set of rules and regulations. That's why our collection even includes the Streamlined Sales Tax Return for Rhode Island, which simplifies the filing process for businesses that qualify.

To ensure accuracy and compliance, our collection also features detailed instructions, like the Instructions for Form CDTFA-401 State, Local, and District Sales and Use Tax Return for California businesses.

Say goodbye to the stress of sales tax filing and access our user-friendly documents collection today. Whether you refer to it as sales tax filing or any other alternate name, our collection is designed to enhance your filing experience and help you meet your tax obligations with ease.

Documents:

9

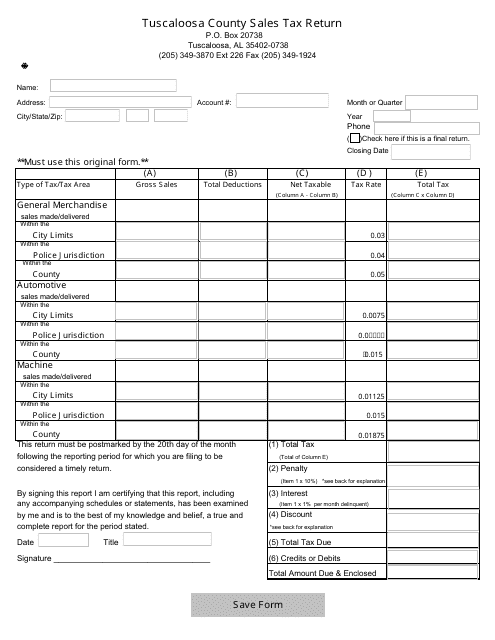

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

This form is used for filing sales tax returns in the Town of Parker, Colorado. It is used by businesses to report and remit the sales tax collected from their customers.

This Form is used for reporting and paying sales and use taxes to the City of Glenwood Springs, Colorado.

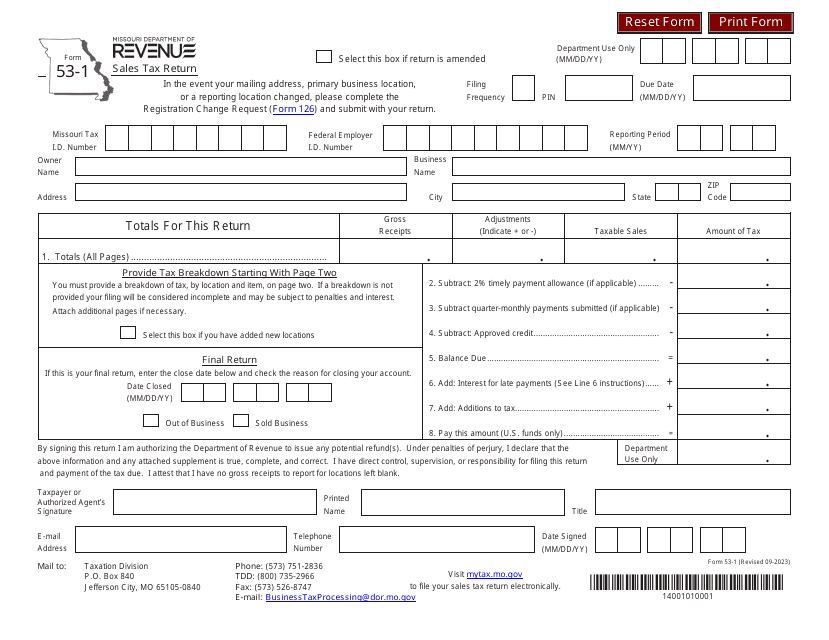

This Form is used for filing sales tax return in the state of Missouri.

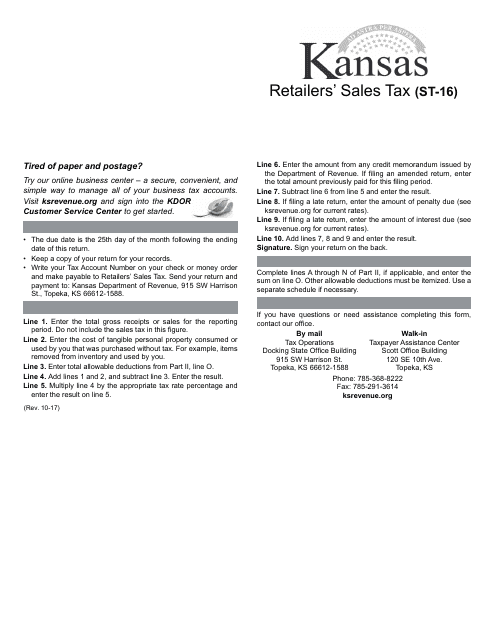

This Form is used for retailers in Kansas to file their sales tax return.

This document is for filing the Streamlined Sales Tax return in the state of Rhode Island. It is used by businesses to report their sales tax collections and remit the taxes owed to the state.

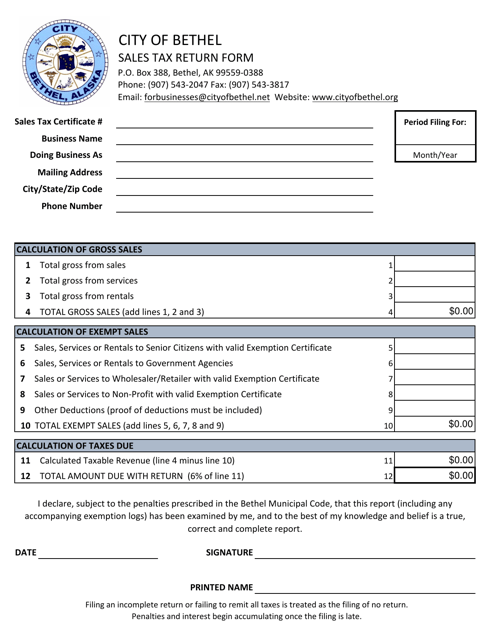

This form is used for reporting and submitting sales tax returns to the City of Bethel, Alaska. It is required for businesses operating within the city limits to collect and remit sales tax on their sales transactions.