Partnership Income Tax Templates

Are you a partner in a business? If so, you'll need to be familiar with partnership incometax requirements. Understanding how partnership income tax works is essential to ensure compliance with the law and avoid penalties.

Partnership income tax refers to the tax obligations that partnerships, such as general partnerships and limited liability partnerships (LLPs), must fulfill. To file partnership income tax returns accurately, partners need to assess and report their share of the partnership's income, deductions, credits, and other relevant information.

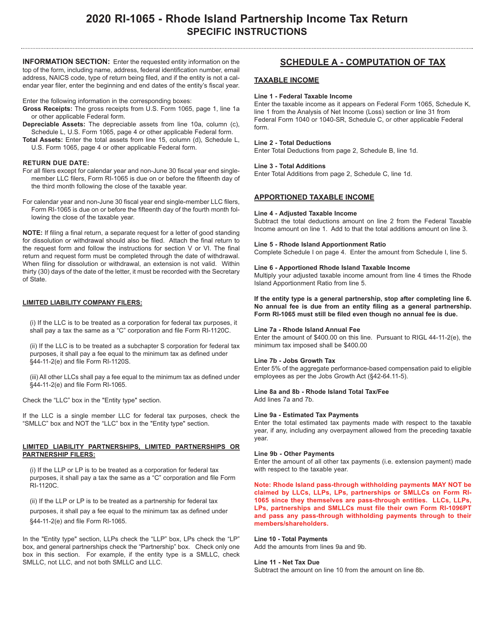

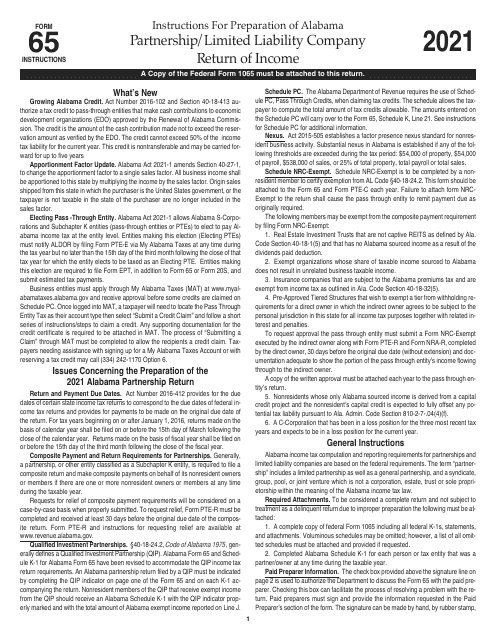

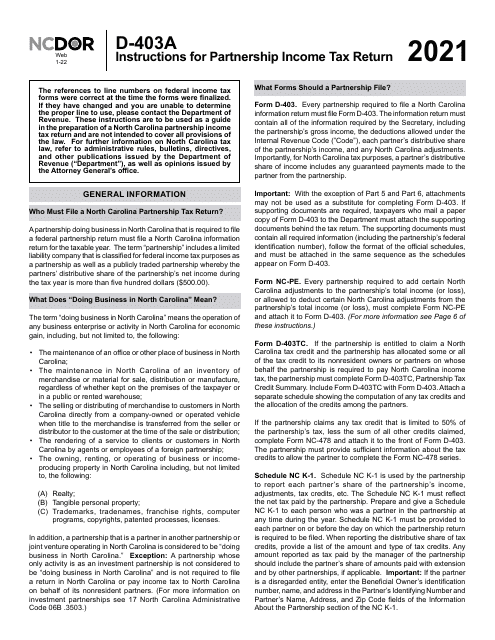

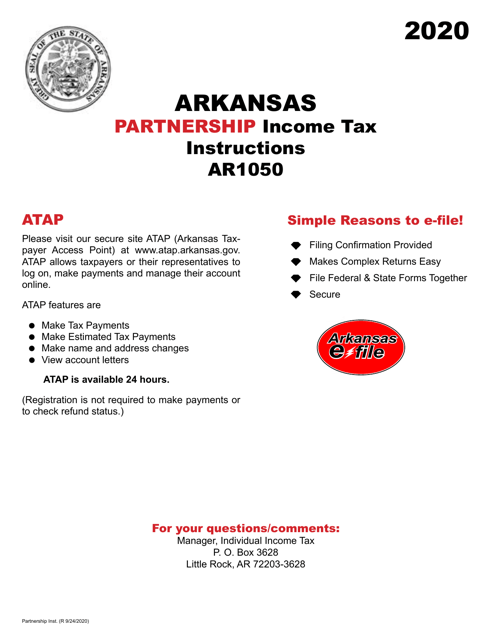

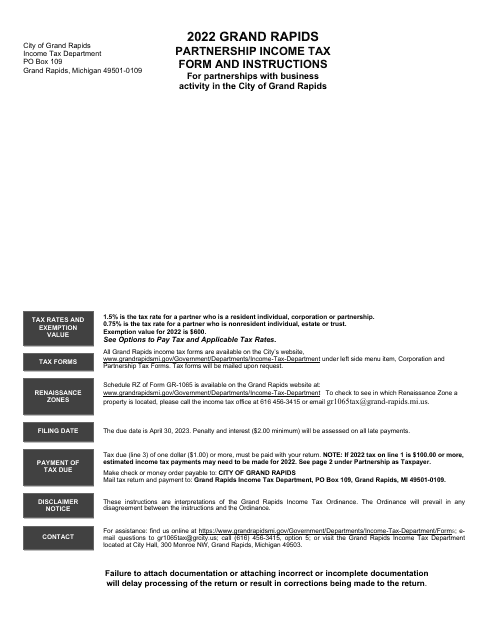

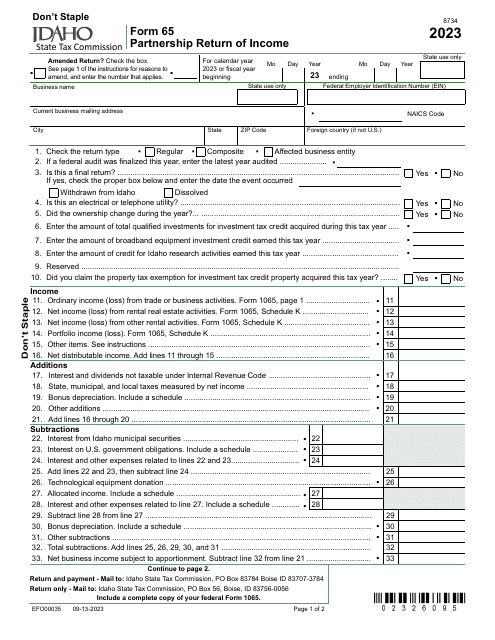

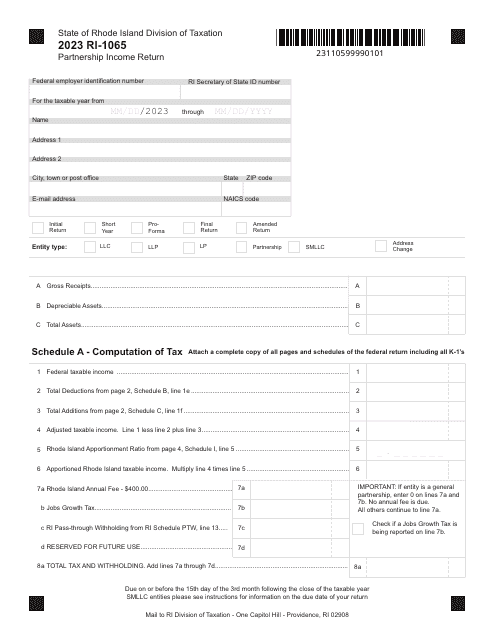

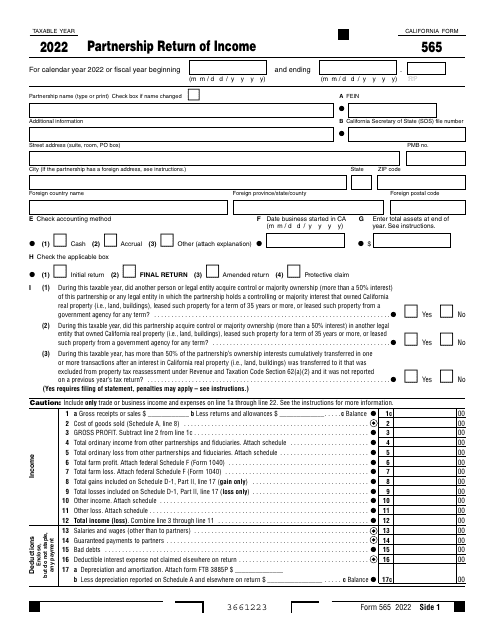

Partnership income tax returns can vary depending on the state where the business is located. For instance, in Rhode Island, the form used is Form RI-1065 Partnership Income Return. In North Carolina, you'll need to fill out Form D-403 Partnership Income Tax Return. Similarly, Arkansas requires partners to file Form AR1050 Arkansas Partnership Income Tax Return, while the City of Grand Rapids, Michigan, mandates the use of Form GR-1065 Partnership Income Tax. In California, partners must submit Form 565 Partnership Return of Income.

To ensure accuracy and avoid any errors in your partnership income tax returns, it is crucial to read and follow the instructions provided by each respective state when filing. These instructions outline the specific requirements, guidelines, and deadlines that partners must adhere to when preparing and submitting their returns.

Navigating partnership income tax can be complex, but staying informed and fulfilling your tax obligations is essential for the success and compliance of your partnership. With the right knowledge and understanding of partnership income tax, you can proactively manage your tax responsibilities and contribute to the financial growth of your business.

Documents:

8

This document is used for filing the Arkansas Partnership Income Tax Return in the state of Arkansas. It provides instructions on how to report partnership income and deductions for tax purposes.