Federal Excise Tax Templates

Federal Excise Tax Information and Resources

Unlock a wealth of information on federal excise taxes with our comprehensive collection of documents. Whether you're a business owner, tax professional, or simply curious about how these taxes work, our extensive library of resources has you covered. Our documents cover various aspects of federal excise taxes, providing valuable insights, guidelines, forms, and instructions.

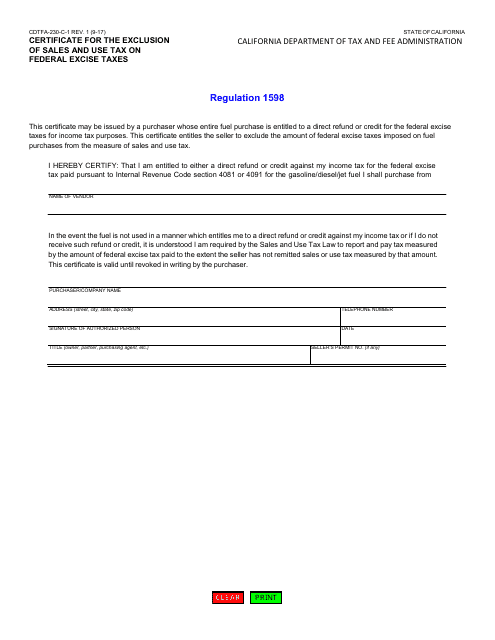

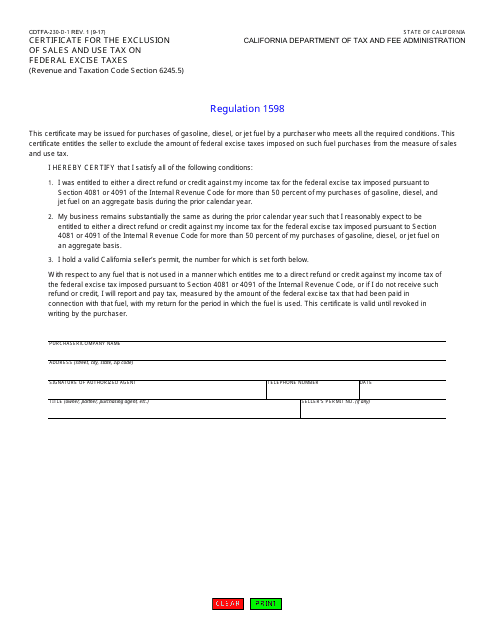

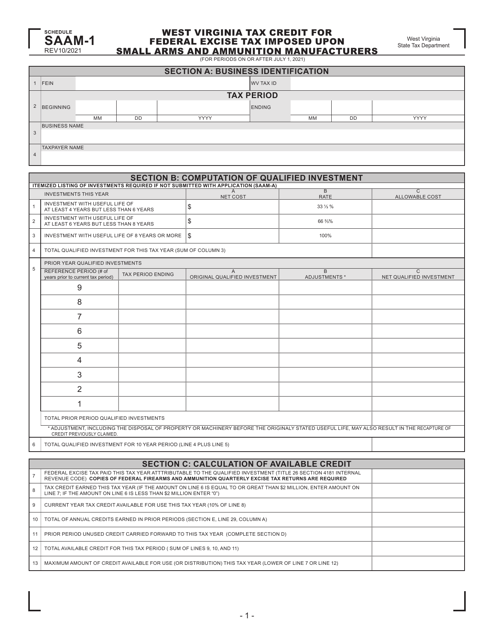

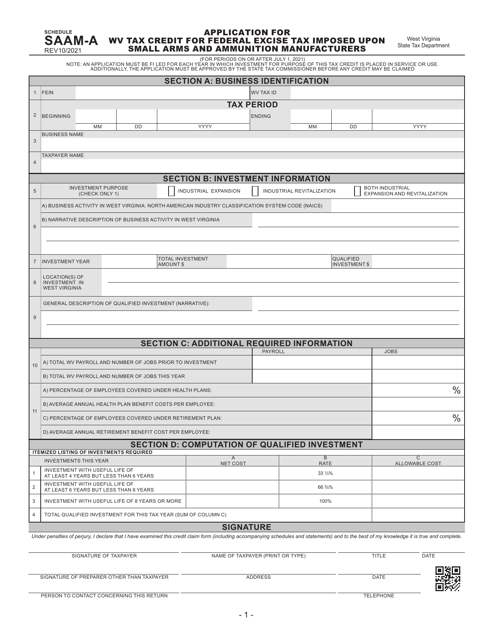

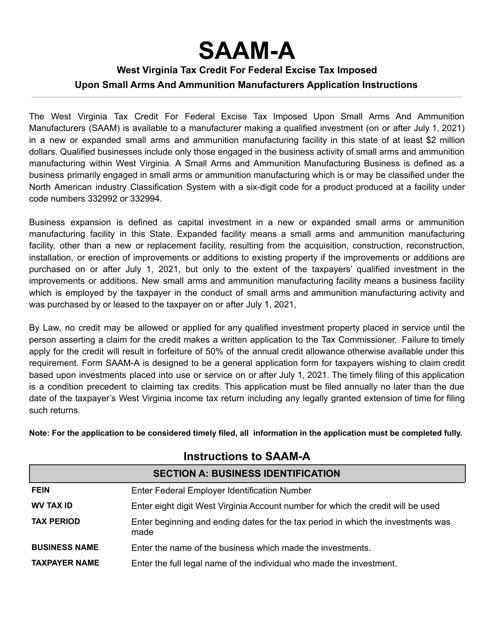

Learn about the intricacies of federal excise taxes, their impact on different industries, and the intricacies of compliance. Discover the different forms and schedules associated with federal excise taxes, such as Form CDTFA-230-C-1, Form XE8, and Schedule SAAM-A. Dive into the world of IRS Form 720, the comprehensive quarterly federal excise tax return form.

Stay informed about changes in federal excise tax legislation, exemptions, and credits. Our collection features up-to-date information that can help you navigate the complex world of federal excise taxes effectively and efficiently. Whether you're looking for general information or need specific guidance on completing tax forms, our resources have you covered.

Explore our extensive library today and gain the knowledge you need to understand, comply with, and navigate the realm of federal excise taxes. Start accessing our documents to unlock valuable insights and resources.

Documents:

13

This form is used for certifying the exclusion of sales and use tax on federal excise taxes in California.

This form is used for requesting an exclusion of sales and use tax on federal excise taxes in the state of California.

This Form is used for claiming the SAAM-1 West Virginia Tax Credit for the federal excise tax imposed upon small arms and ammunition manufacturers in West Virginia.

This Form is used for applying for a tax credit in West Virginia for federal excise tax imposed upon small arms and ammunition manufacturers.

This form is used for applying for a tax credit in West Virginia for federal excise tax imposed upon small arms and ammunition manufacturers.

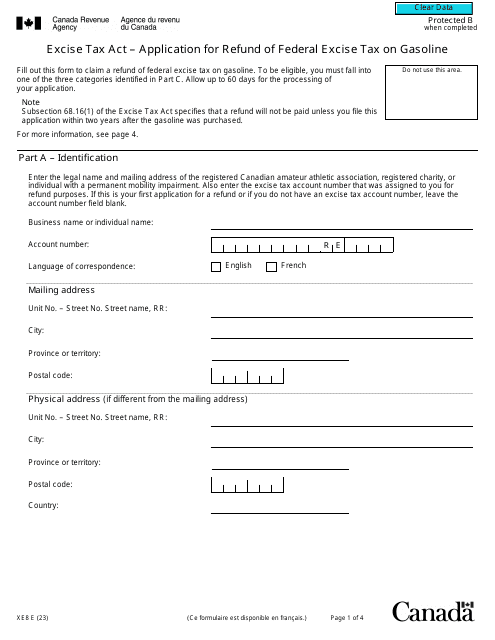

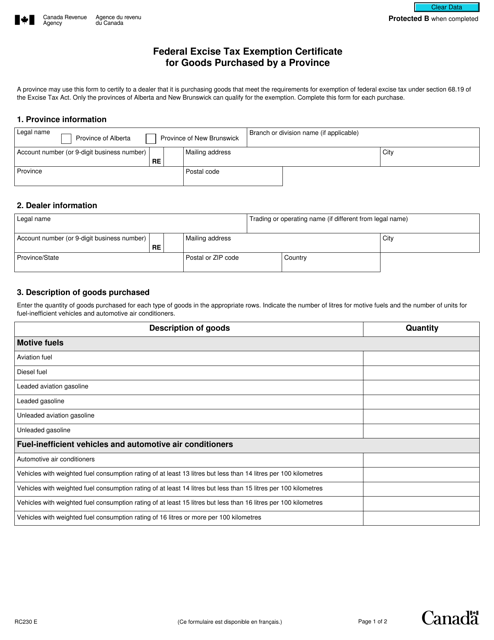

This form is used for applying for an exemption from federal excise tax on goods purchased by a province in Canada.