Employee Payroll Templates

Employee Payroll: Streamlining Your Payroll Operations

Managing employee payroll can be a complex and time-consuming task for any organization. From accurately calculating wages and deductions to ensuring compliance with tax laws, it's crucial to have a reliable system in place. That's where our employee payroll solutions come in.

Our comprehensive suite of tools and resources is designed to simplify the payroll process, making it more efficient and accurate. Whether you're a small business or a large corporation, our employee payroll system can help you streamline your operations and save valuable time and resources.

With our employee payroll solutions, you can automate the entire payroll process, from inputting hours and calculating wages to generating pay stubs and distributing payments. Our secure online platform allows you to easily manage payroll data, ensuring accuracy and confidentiality.

In addition to payroll processing, our system also offers a wide range of features to support your HR and finance departments. From tax form generation to benefits administration, our employee payroll platform can handle it all. With customizable reporting capabilities, you can generate insights and analytics to inform your decision-making process.

Our employee payroll solutions are designed to be user-friendly and intuitive, even for those with limited payroll experience. We provide comprehensive training and support to ensure a smooth transition and ongoing assistance whenever you need it.

Don't let the complexities of payroll management bog down your business. Take advantage of our employee payroll solutions and experience the benefits of a streamlined, efficient payroll process. Say goodbye to manual calculations and paperwork, and say hello to a more productive and accurate payroll system.

Discover the power of our employee payroll solutions today and see how they can transform your business operations. Don't let payroll be a burden – let us help you simplify and optimize this crucial aspect of your business. Contact us now to learn more about our employee payroll system and how it can benefit your organization.

Documents:

20

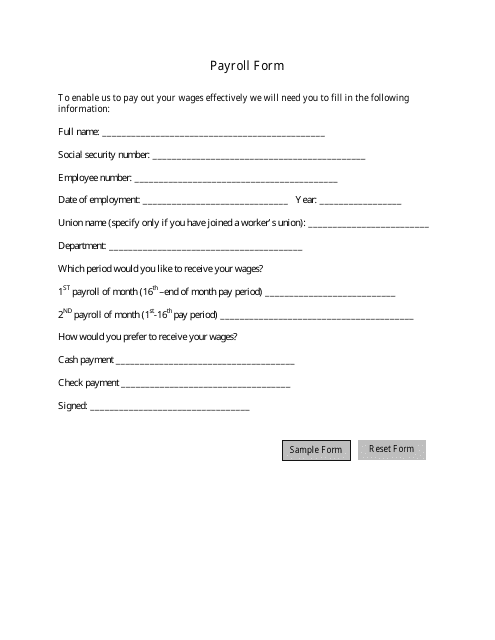

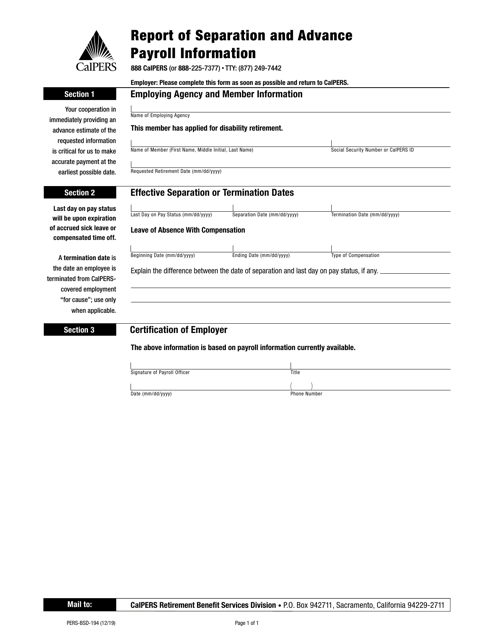

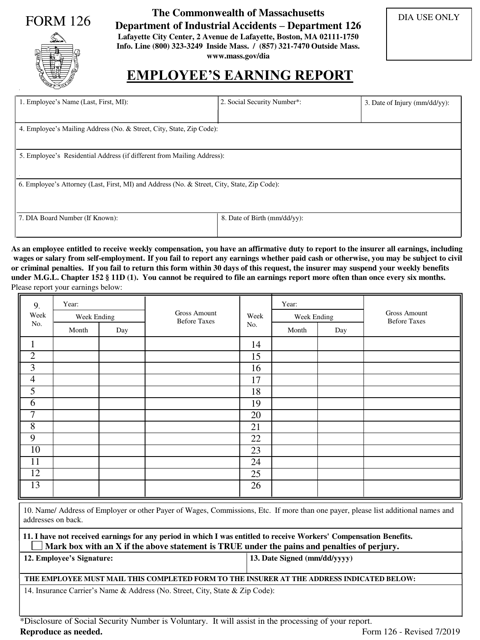

This form is used for reporting employee wages and withholding taxes to the government. It helps employers calculate payroll taxes and ensures employees are paid correctly.

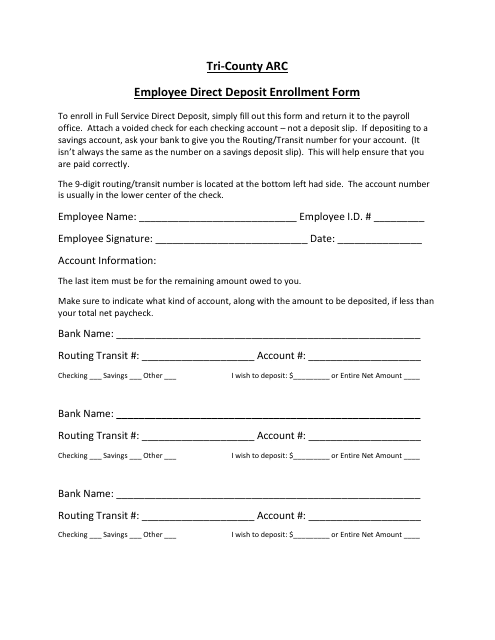

This Form is used for enrolling in direct deposit for employees of Tri-County Arc.

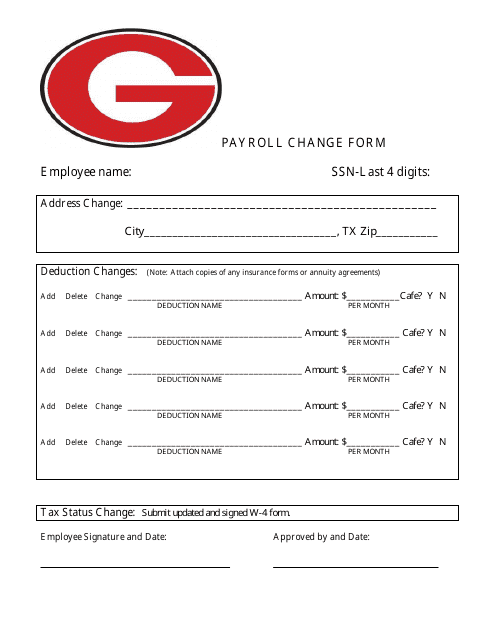

This form is used to make changes to an employee's payroll information in the state of Texas.

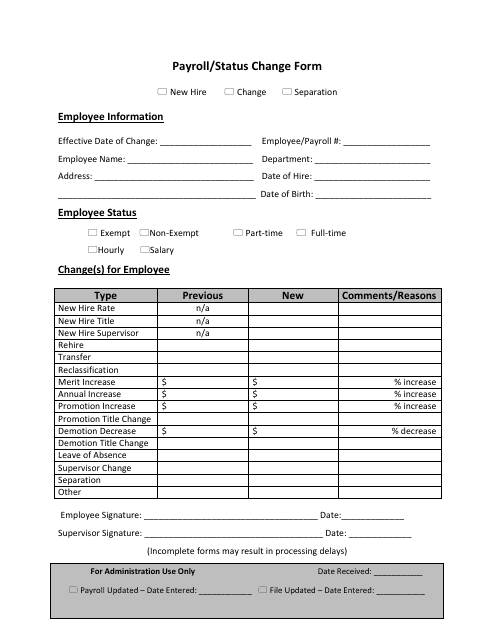

This Form is used for making changes to payroll or employment status.

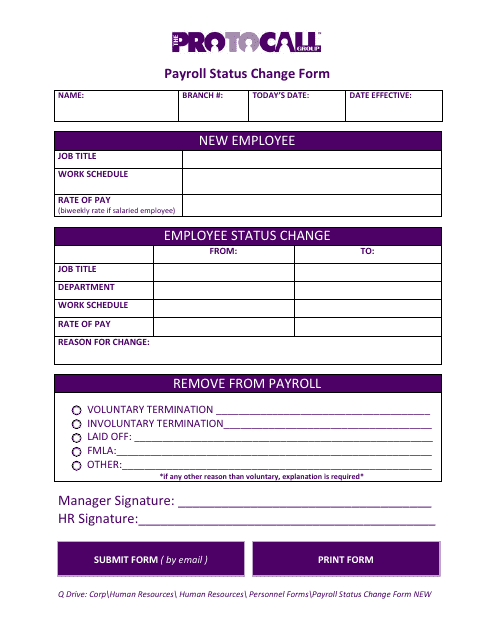

This Form is used for making changes to an employee's payroll status.

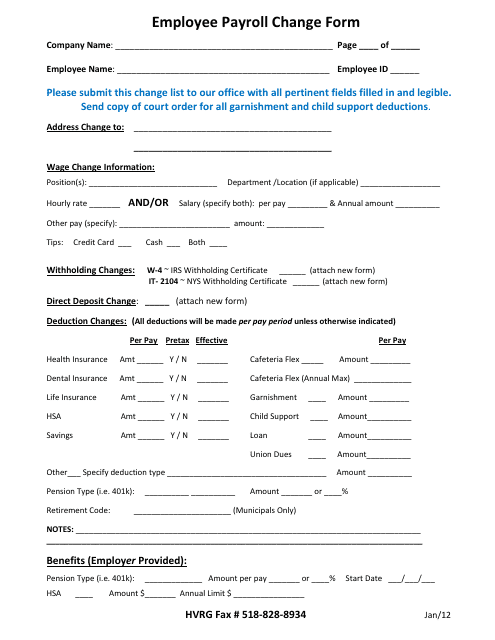

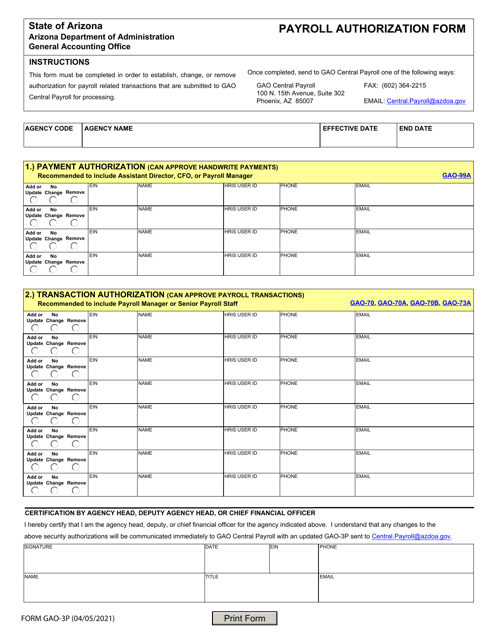

This document is used for making changes to an employee's payroll information, such as salary, deductions, or banking details.

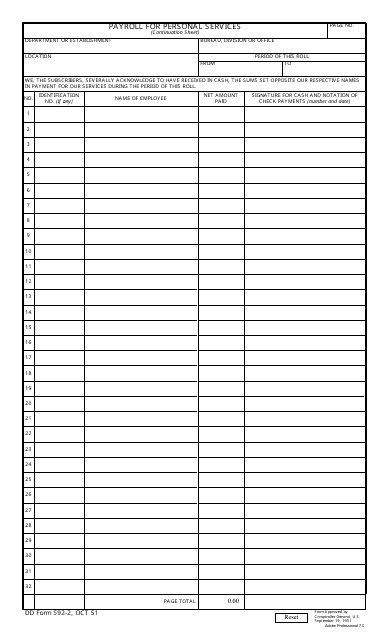

This document is used for payroll purposes in tracking personal services.

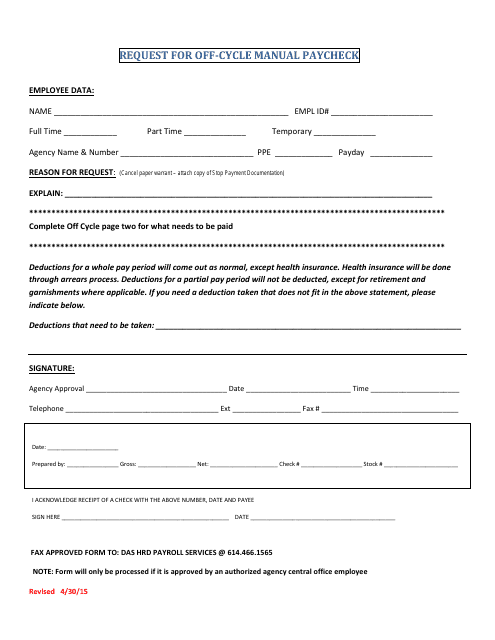

This type of document is used to request for a manual paycheck outside of the regular pay cycle in the state of Ohio.

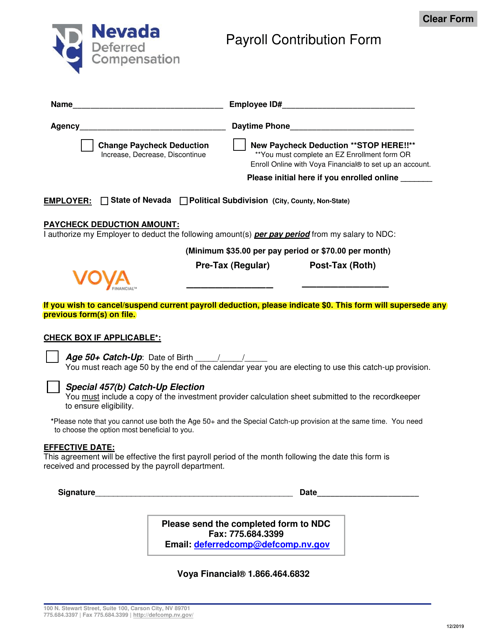

This form is used for reporting and documenting payroll contributions in the state of Nevada. It is necessary for employers to accurately document and submit these contributions in order to comply with state laws and regulations.

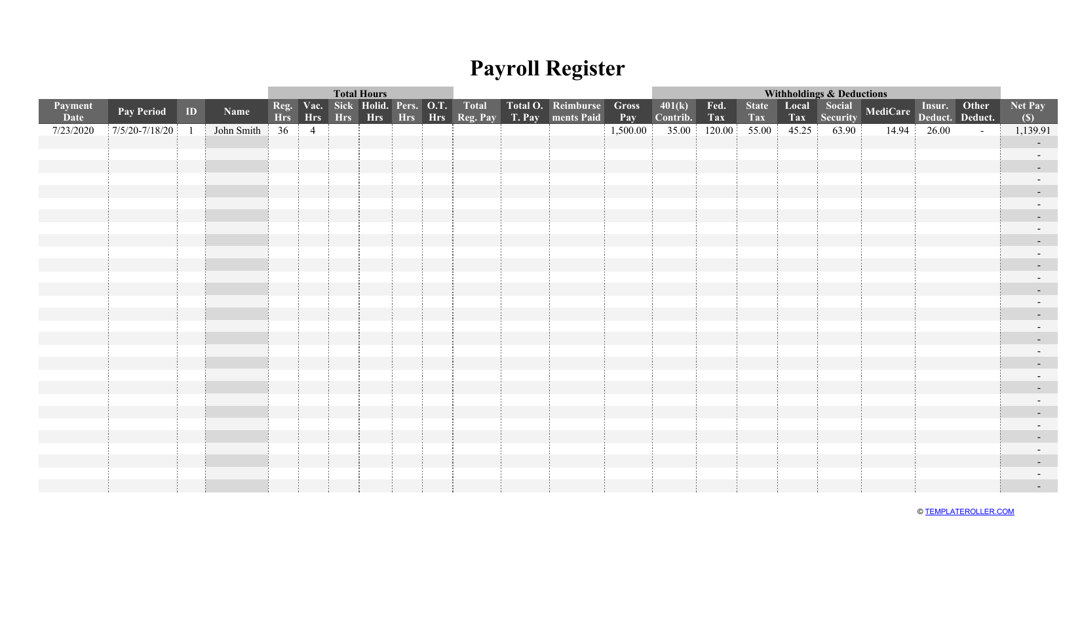

This report is usually represented as an electronic spreadsheet or online application and indicates a worker's payroll information for a certain period of time.

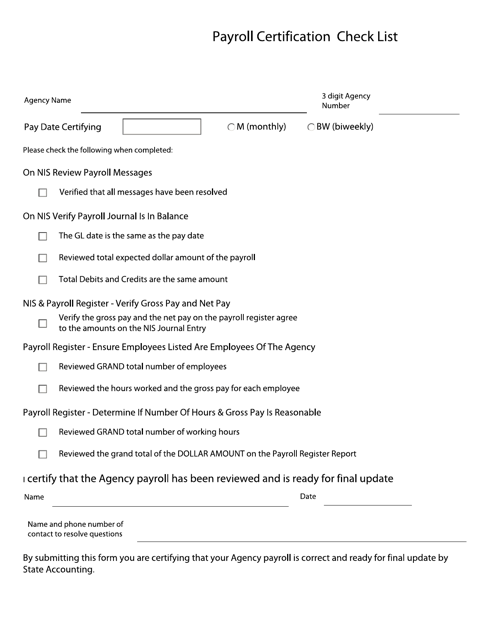

This document is a checklist used for payroll certification in Nebraska. It helps ensure that all necessary steps are followed and requirements are met for payroll processing. It can be used by employers to verify compliance with state regulations.

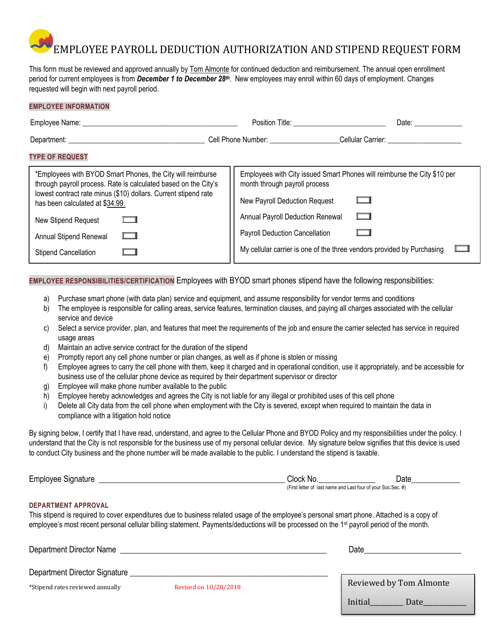

This form is used for authorizing payroll deductions and requesting stipends for employees of the City of Grand Rapids, Michigan.

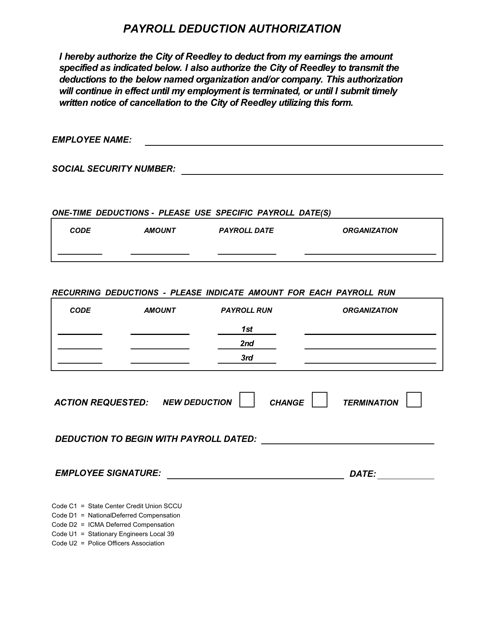

This Form is used for authorizing payroll deductions for employees of the City of Reedley, California.

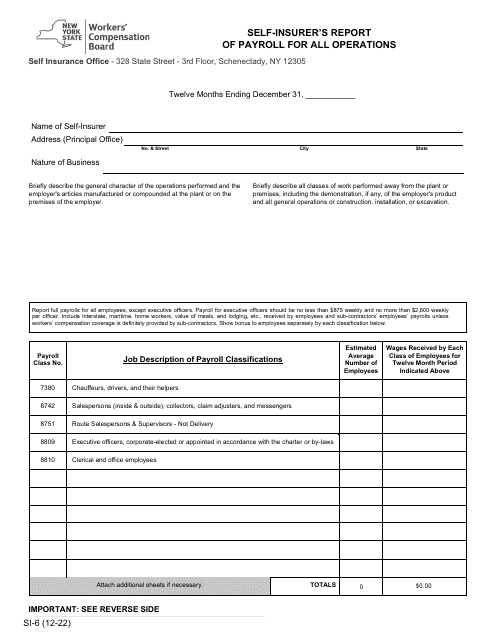

This Form is used for self-insurers in New York to report their payroll for all operations.