Tax Reimbursement Templates

Are you looking for a way to get money back on taxes you have paid? Look no further than our tax reimbursement services. Also referred to as tax reimbursement forms, our services assist individuals and businesses in reclaiming their hard-earned money.

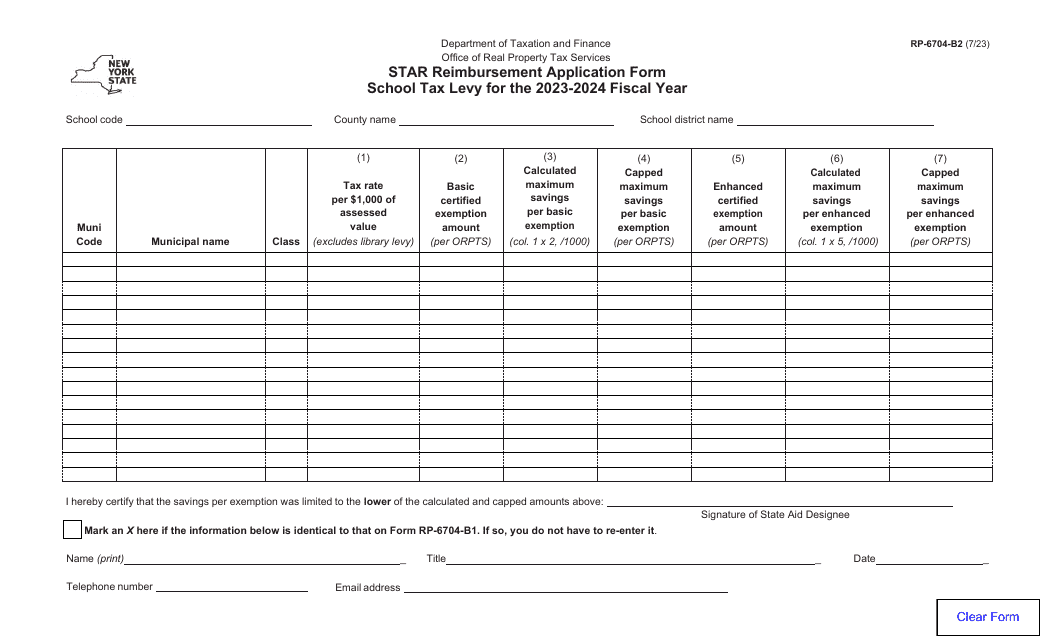

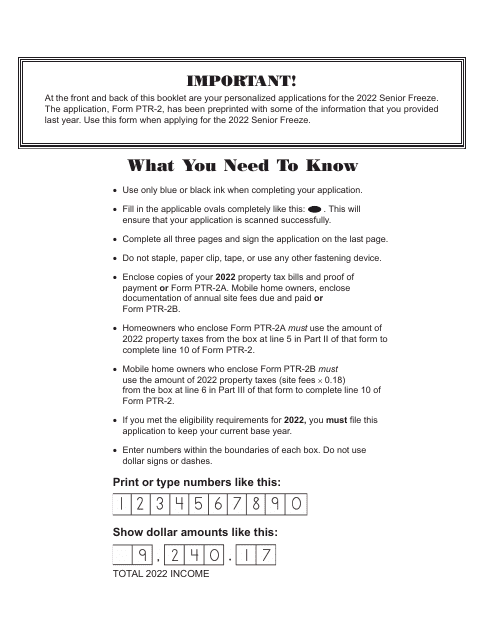

We offer a variety of forms and applications, such as the Application for Excise Tax Reimbursement in Maine and the Form PTR-I Property Tax ReimbursementIncome Report in New Jersey. These documents are designed to help you recoup any overpaid taxes and ensure you receive the refund you deserve.

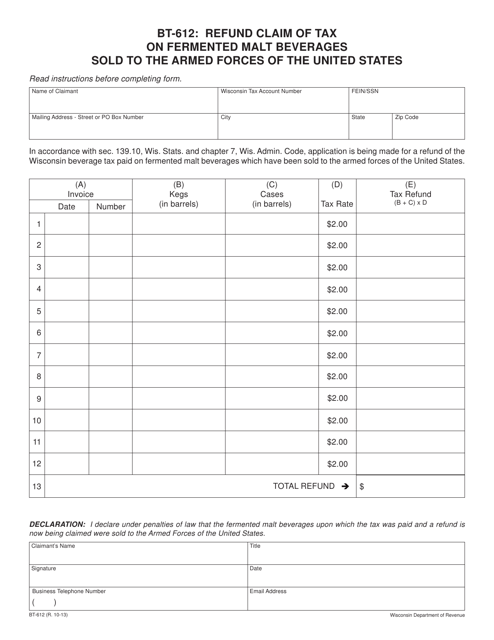

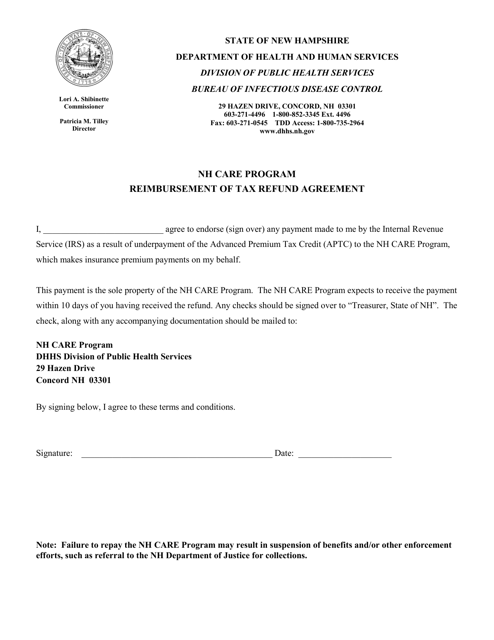

Whether you are a business seeking a refund claim for tax on fermented malt beverages sold to the armed forces of the United States, as outlined in the Form BT-612 in Wisconsin, or an individual participating in the Nh Care Program and seeking reimbursement of tax refund, we are here to assist you.

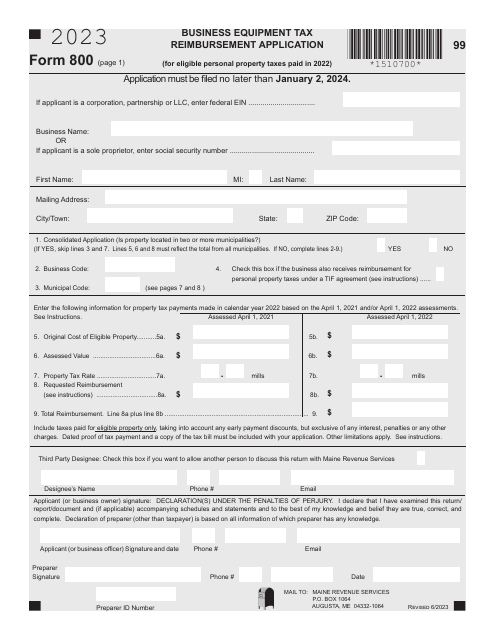

Our services extend to businesses as well, with the Form 800 Business Equipment Tax Reimbursement Application being available in Maine. No matter your unique situation or location, our tax reimbursement services can help you navigate the complex world of tax forms and maximize your refund.

Don't let your hard-earned money slip away. Explore our tax reimbursement services today and reclaim what is rightfully yours.

Documents:

12

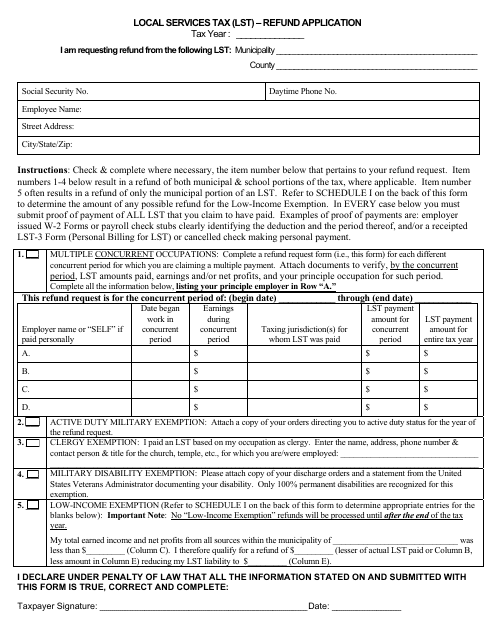

This Form is used for applying for a refund of the Local Services Tax (LST).

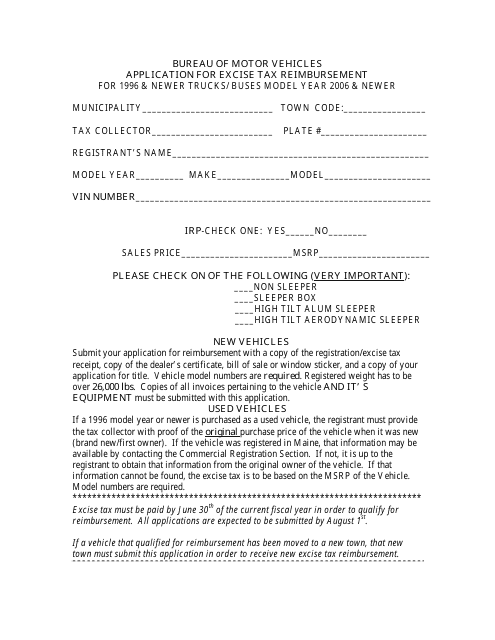

This form is used for applying for reimbursement of excise tax paid in the state of Maine.

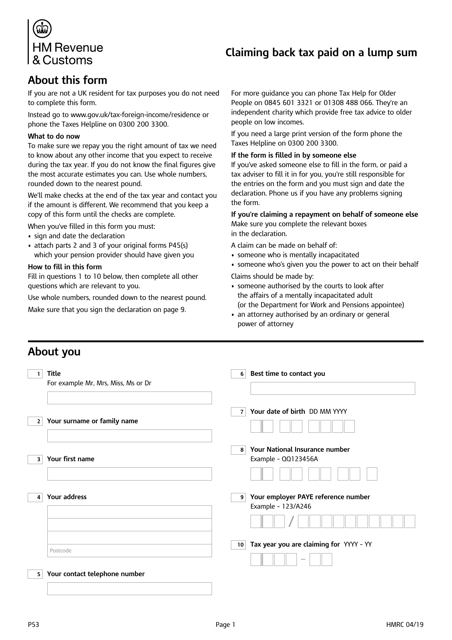

Individuals that reside in the United Kingdom may use this form when they want to claim back tax the government owes them on a lump sum they have obtained.

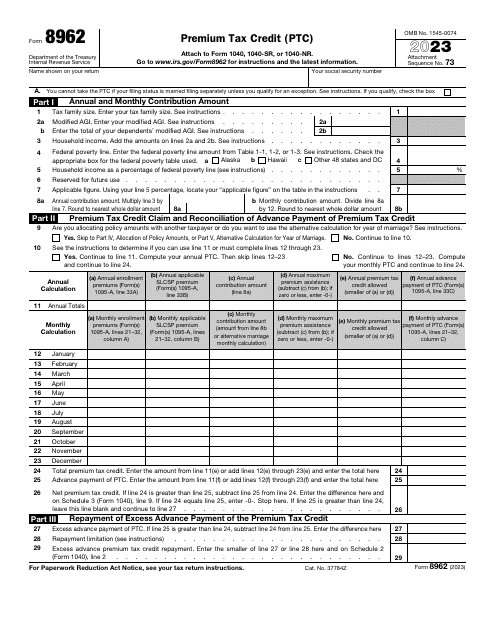

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.

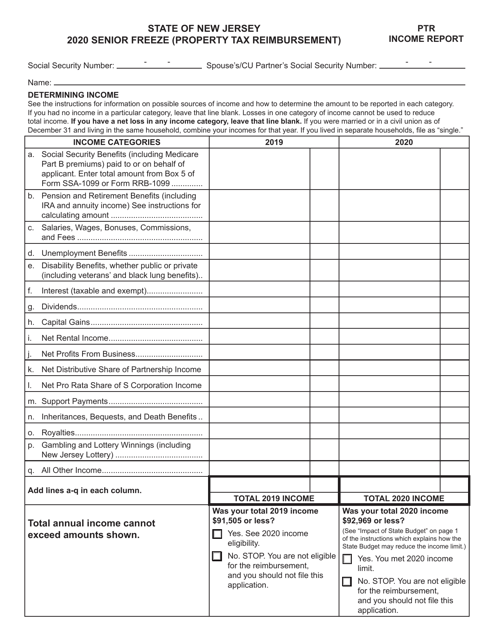

This Form is used for reporting property tax reimbursement income in New Jersey. It is used by taxpayers to report their income earned from property tax reimbursements and calculate any potential tax liability.

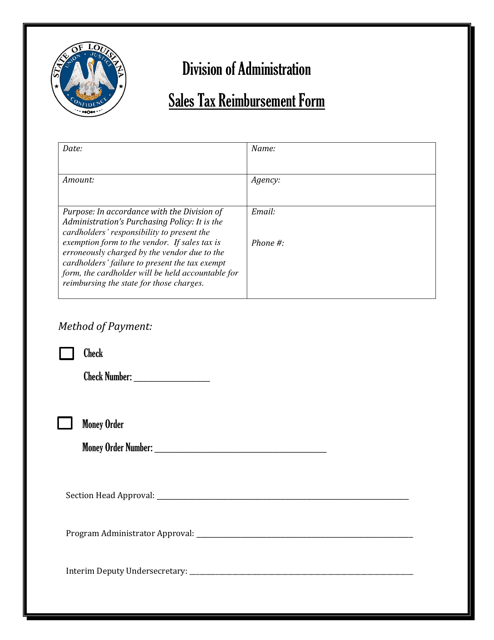

This form is used for requesting a reimbursement of sales tax paid in Louisiana.

This Form is used for claiming a refund of tax on fermented malt beverages sold to the Armed Forces of the United States in Wisconsin.

This document is used for the reimbursement process of tax refunds under the NH Care Program in New Hampshire. It outlines the agreement for receiving funds back from the state.