Health Savings Account Templates

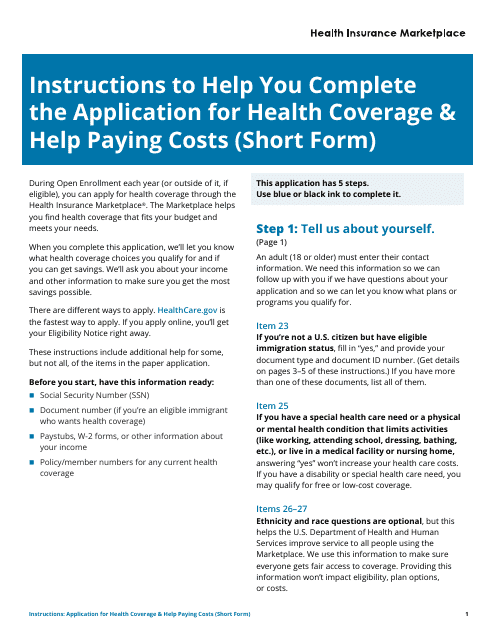

Looking to save money on healthcare expenses? Explore the world of Health Savings Accounts (HSAs). HSAs offer a tax-advantaged way to set aside funds specifically for medical expenses. Whether you are self-employed, have a high-deductible health plan, or simply want to take control of your healthcare costs, HSAs can provide a range of benefits.

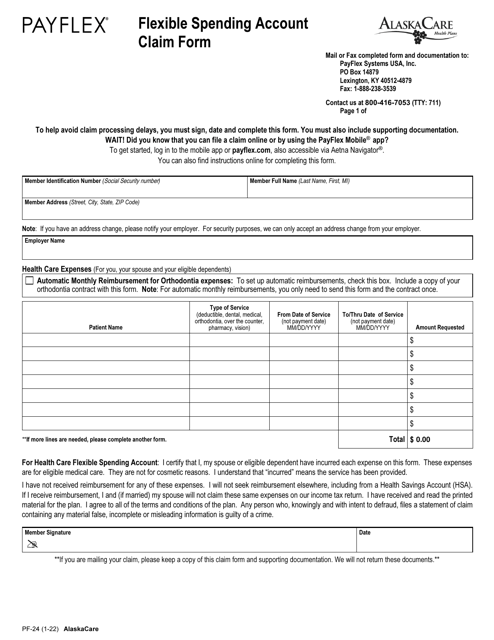

Also known as health savings accounts or health savings account forms, HSAs come with a variety of options to suit your individual needs. These accounts are designed to help you save for qualified medical expenses, including doctor visits, prescriptions, and even certain over-the-counter items. By contributing to an HSA, you can set aside pre-tax dollars, reducing your overall taxable income and potentially lowering your tax liability.

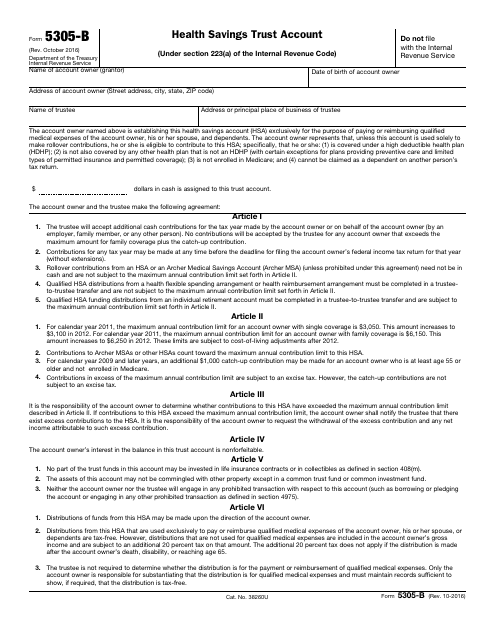

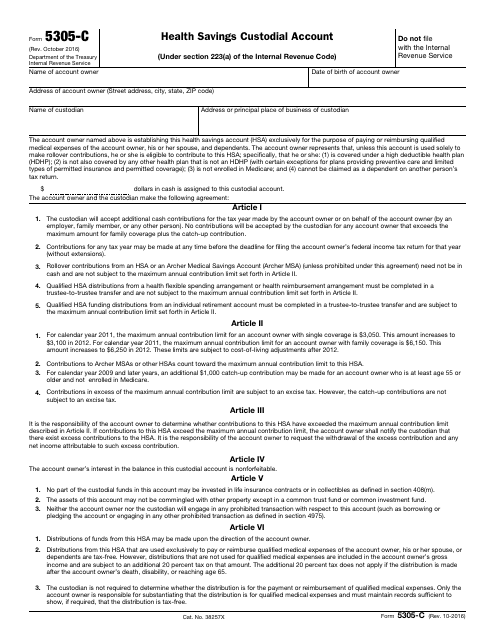

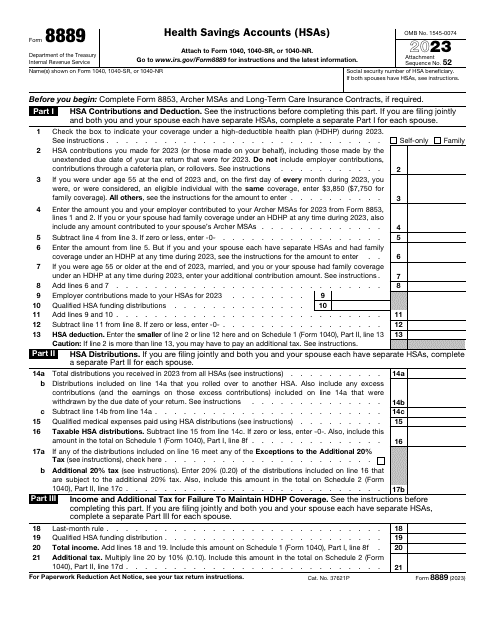

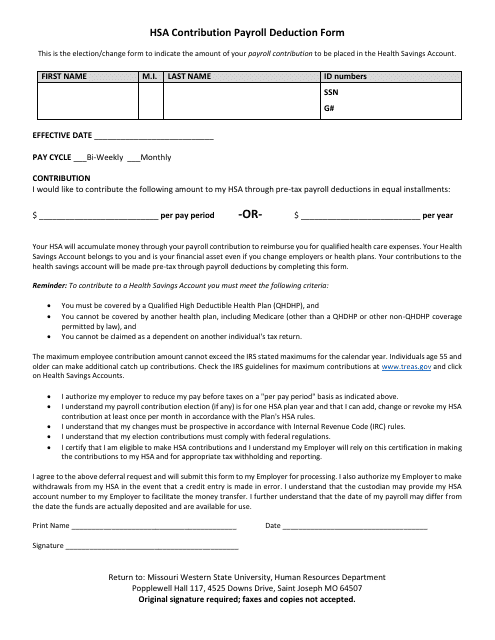

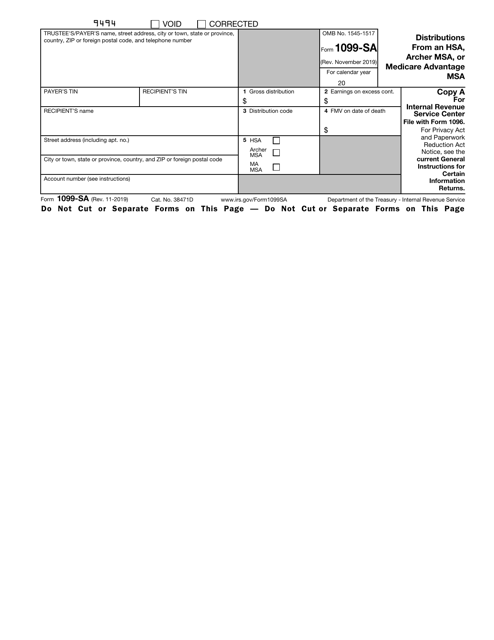

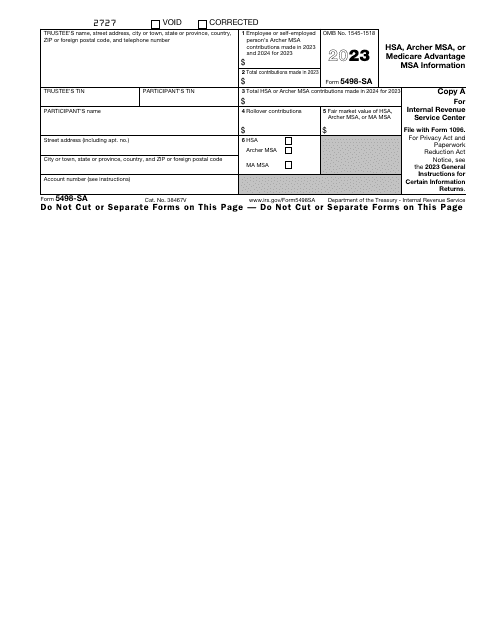

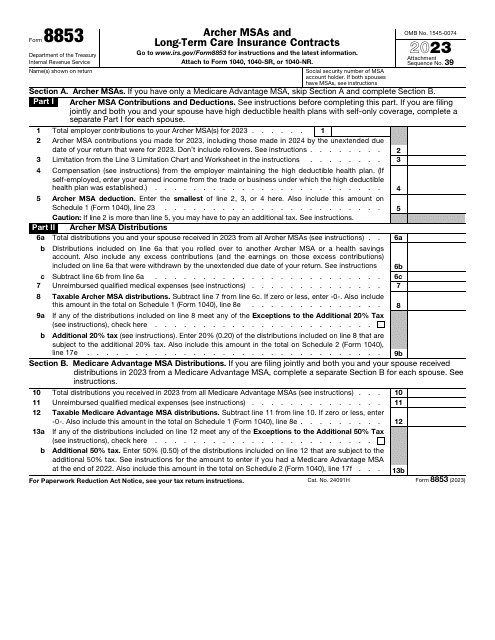

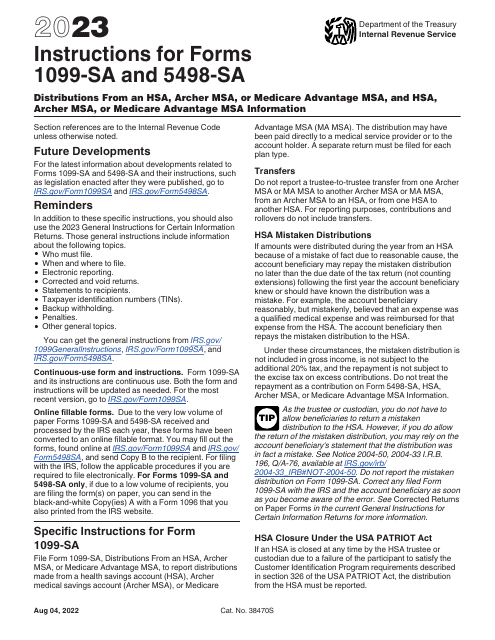

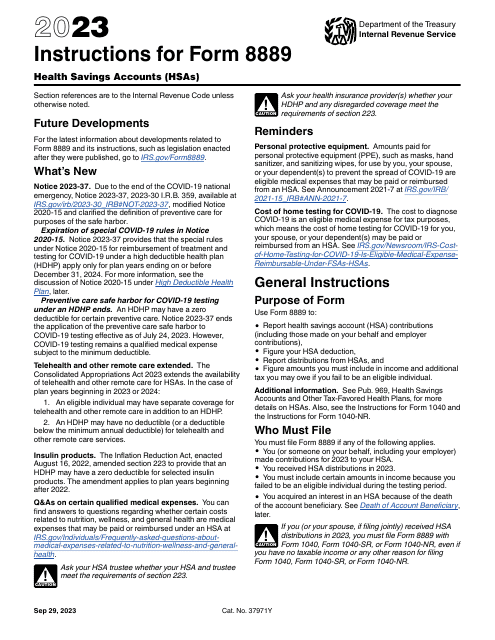

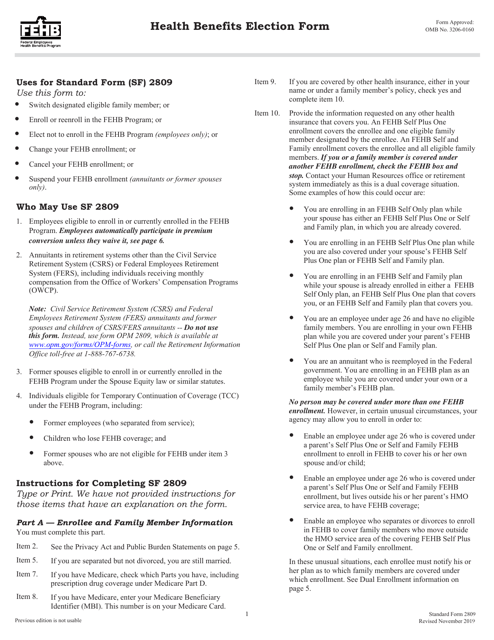

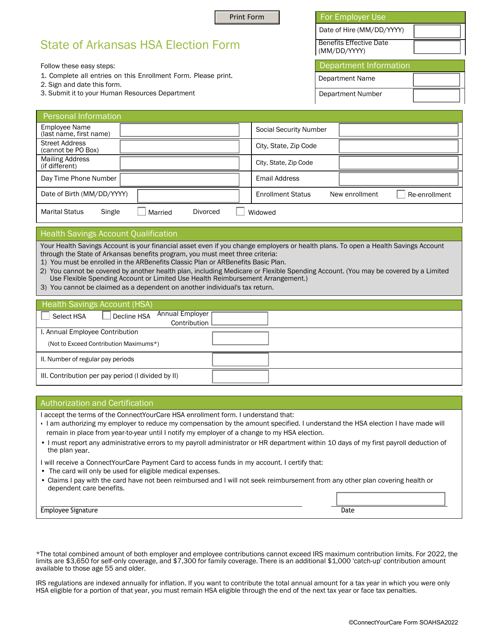

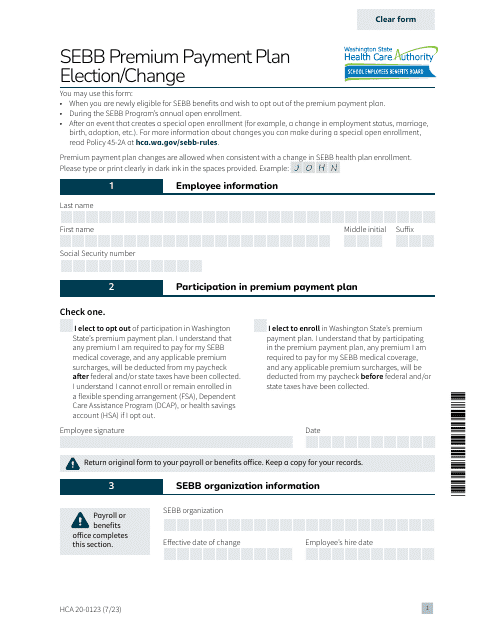

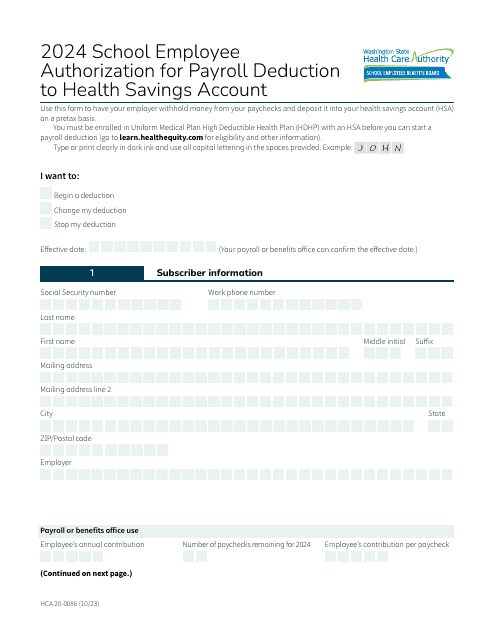

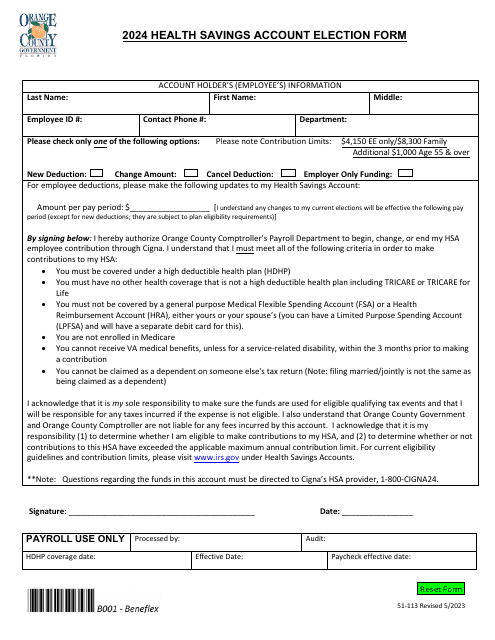

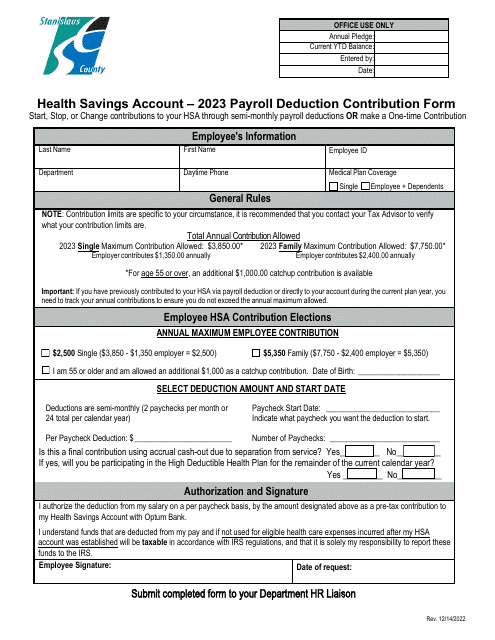

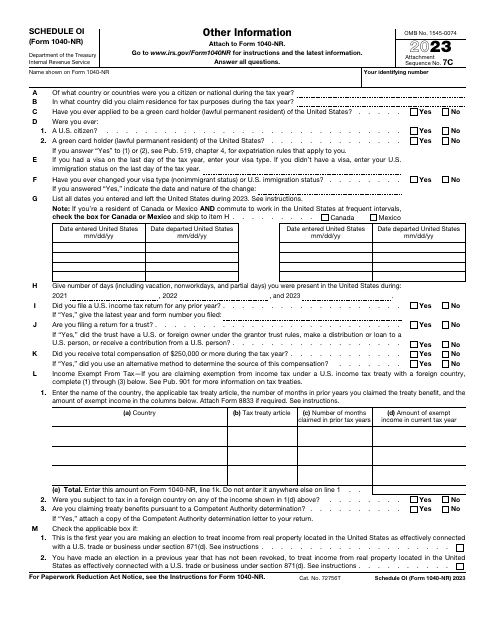

To get started with an HSA, you may need to fill out forms such as the IRS Form 5305-C Health Savings Custodial Account or the HSA Contribution Payroll Deduction Form. These forms will help establish your account and ensure that your contributions are deposited correctly. Additionally, the IRS Form 5498-SA provides information on contributions made to your HSA, Archer MSA, or Medicare Advantage MSA, while the IRS Form 8889 is used to report contributions, distributions, and other HSA-related activities.

Understanding the ins and outs of HSAs can be a bit complex, but fortunately, there are resources available to guide you through the process. The Instructions for IRS Form 8889 Health Savings Accounts (HSAs) provide step-by-step guidance on completing the form, ensuring you comply with all necessary regulations.

Take control of your healthcare expenses and start saving with an HSA. Explore the range of health savings account forms available to you and discover the potential tax advantages and flexibility that these accounts offer. Whether you're an individual or an employer, a health savings account can be a valuable tool for managing and saving on healthcare costs.

Documents:

44

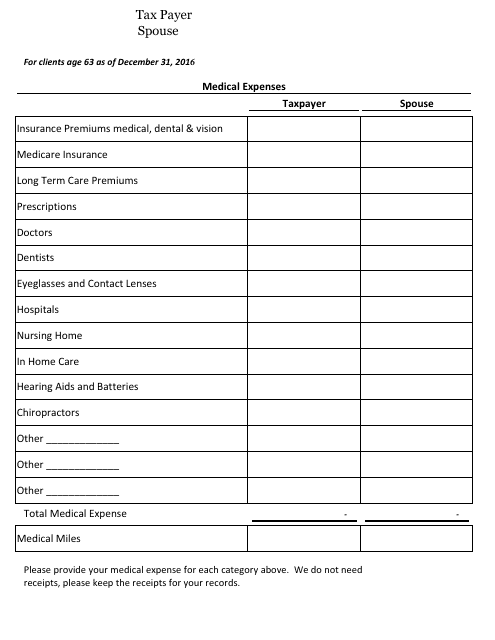

This document is a worksheet used to track and calculate medical expenses. It helps individuals or families keep a record of their medical costs for tax purposes or for insurance reimbursement.

This Form is used for making payroll deductions towards your HSA contributions at Missouri Western State University.

This is a formal document used by particular healthcare-related savings account custodians and trustees to furnish information about the contributions made to those accounts.

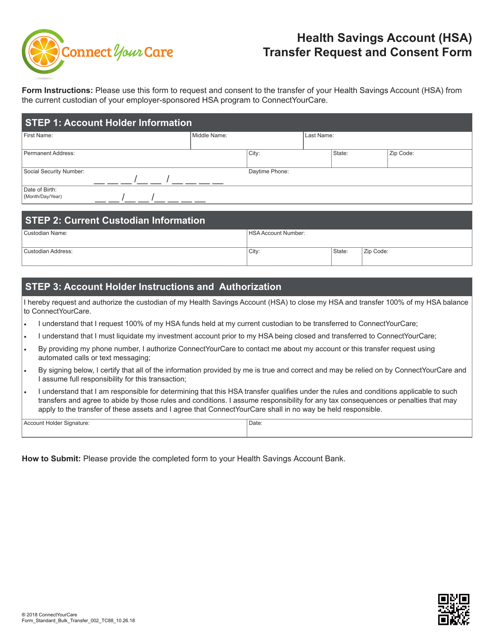

This document allows individuals to request the transfer of their Health Savings Account (HSA) funds and gives consent for the transfer in the state of Arkansas.

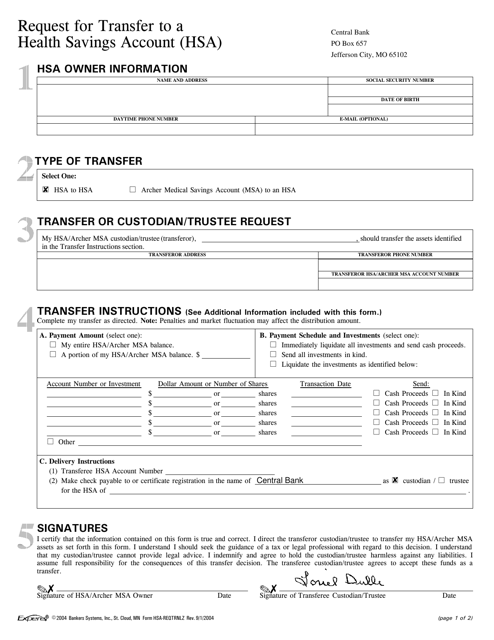

This form is used for requesting a transfer to a Health Savings Account (HSA) in South Carolina. It allows individuals to consolidate their healthcare funds and take advantage of HSA benefits.

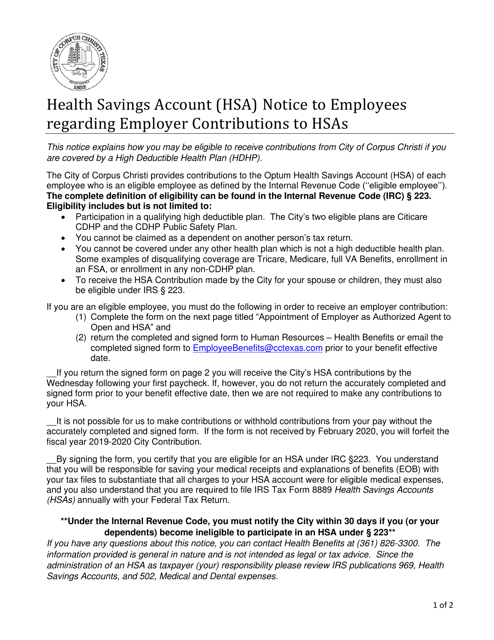

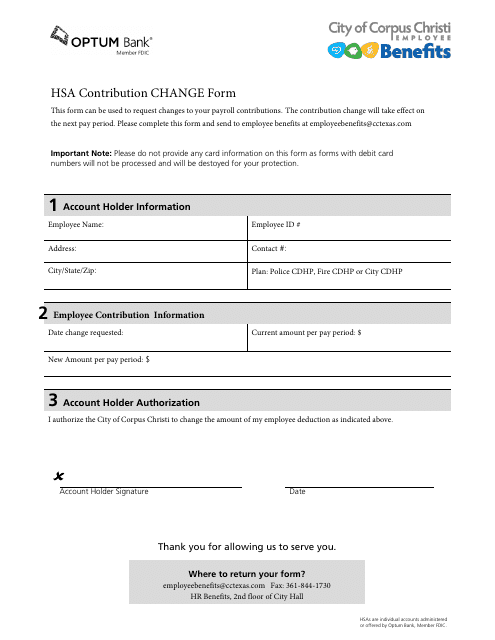

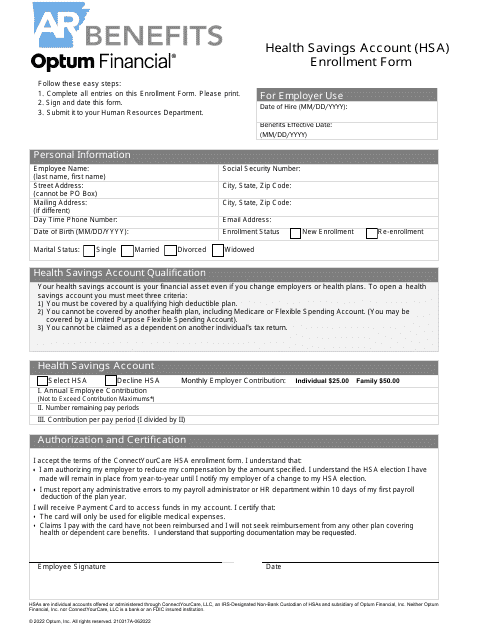

This Form is used for enrolling in a Health Savings Account (HSA) provided by the City of Corpus Christi, Texas.

This form is used for making changes to your HSA (Health Savings Account) contribution with the City of Corpus Christi, Texas.