Electronic Files Templates

Are you tired of dealing with stacks of paper documents? Looking for a more efficient and organized way to manage your files? Look no further than our electronic files solution. Also known as electronic filing, electronic document filing, or electronic form filing, this method allows you to store, organize, and access your documents electronically.

Say goodbye to paper clutter and hello to a streamlined and eco-friendly approach. With our electronic files system, you can easily file and retrieve important documents with just a few clicks. Whether it's tax forms, health coverage records, or annual reports, our electronic filing solution is designed to meet your needs.

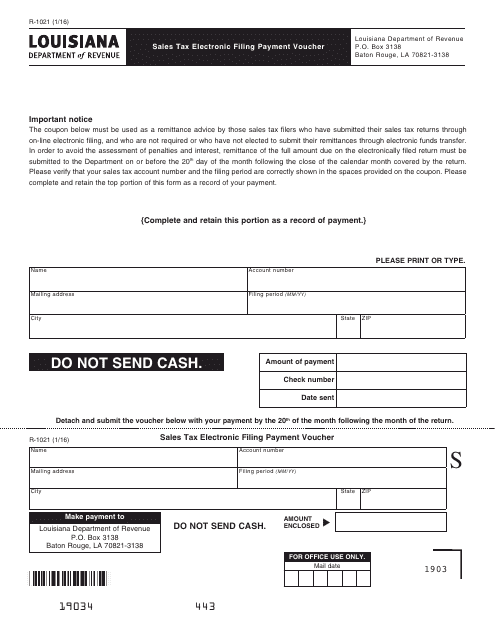

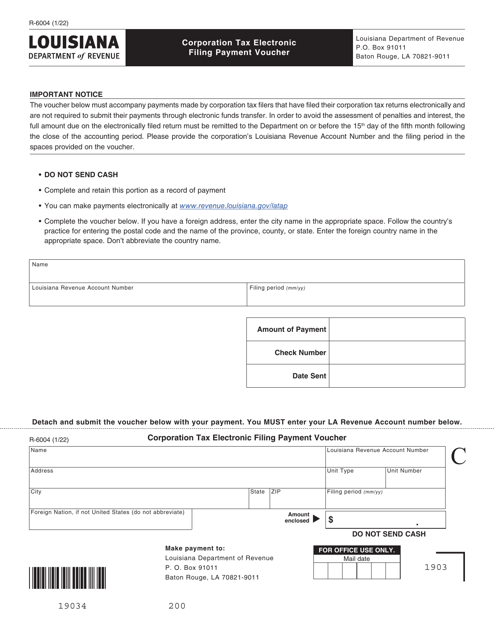

For example, consider the Form R-1021 Sales Tax Electronic Filing Payment Voucher for Louisiana. By using our electronic filing system, you can complete this form online and submit it electronically, eliminating the need for printing and mailing. Similarly, the IRS Form 1095-B Health Coverage can be securely filed and accessed through our electronic files platform.

Our electronic filing solution is not limited to tax forms. Take, for instance, the Form 4806 Electronic Signature Declaration for Annual State Equalization Reports for Michigan. With our system, you can easily complete and file this form online, saving time and resources. Similarly, the Form 40-151 Electronic Filing System for State Fund in Texas provides a convenient way to file important documents electronically.

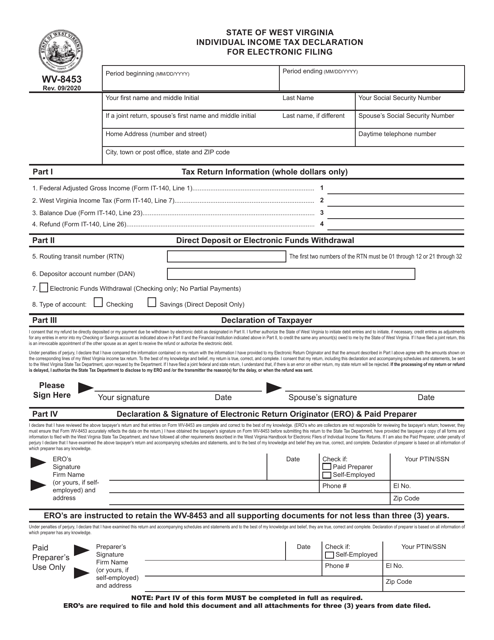

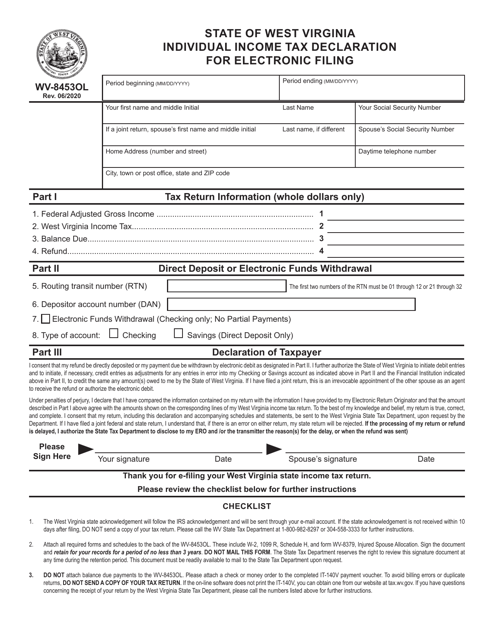

Don't forget about Form R-8453 (LA8453) Individual Income Tax Declaration for Electronic Filing in Louisiana. With our electronic files solution, you can securely submit this form online, eliminating the need for paper forms and mailing.

Experience the benefits of electronic filing with our user-friendly and secure electronic files system. Say goodbye to the hassles of paper documents and embrace the convenience and efficiency of electronic filing. Make the switch today and enjoy a more organized and environmentally friendly approach to managing your files.

Documents:

323

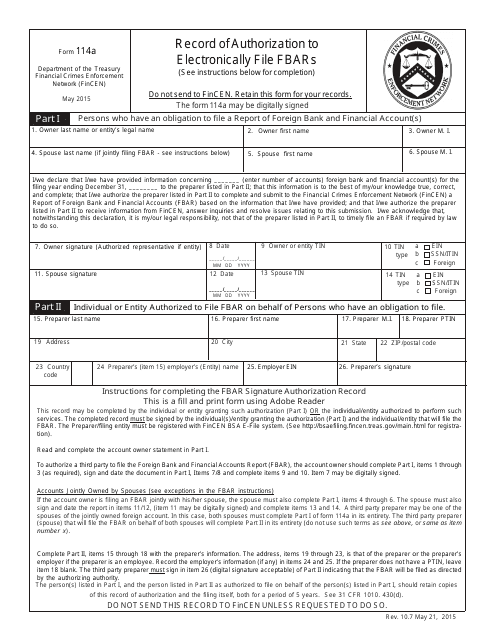

Use this document for releasing your authorization to an individual or organization to complete and file the FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). You can file using a third-party preparer.

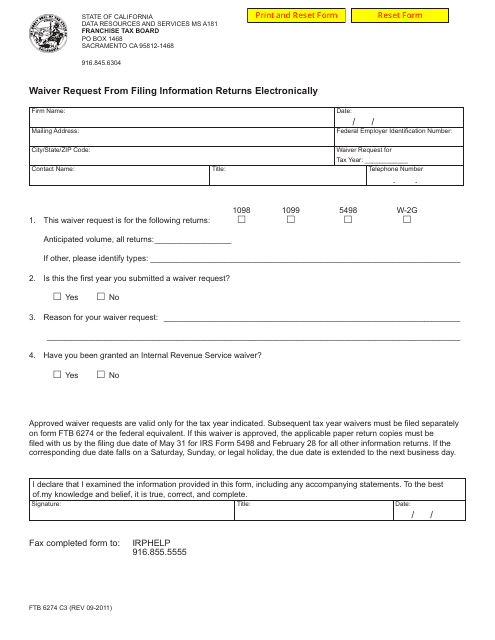

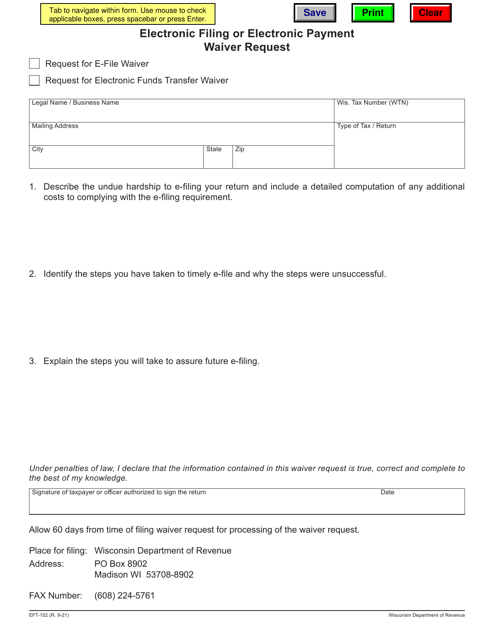

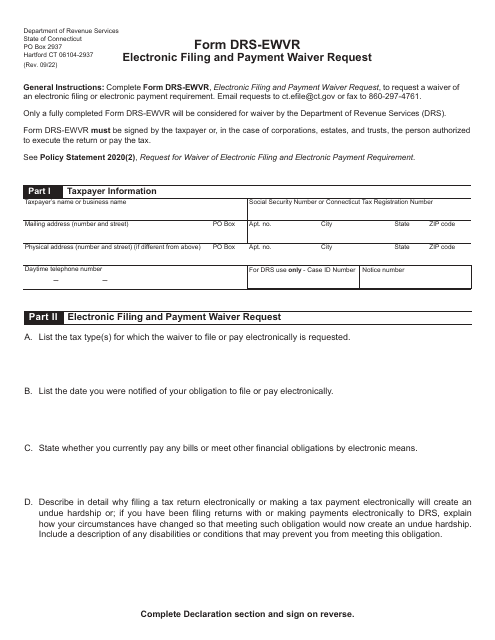

This form is used for requesting a waiver from filing information returns electronically in California.

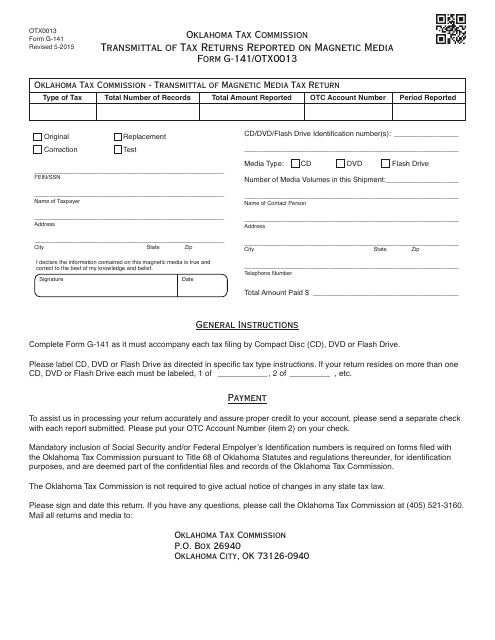

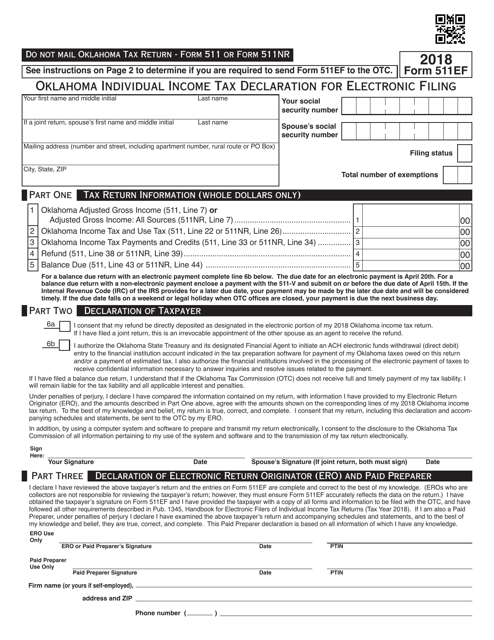

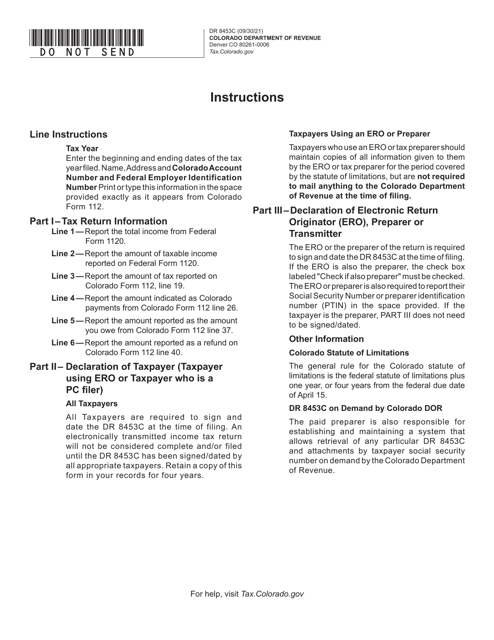

This document is used for transmitting tax returns reported on magnetic media to the Oklahoma Tax Commission (OTC).

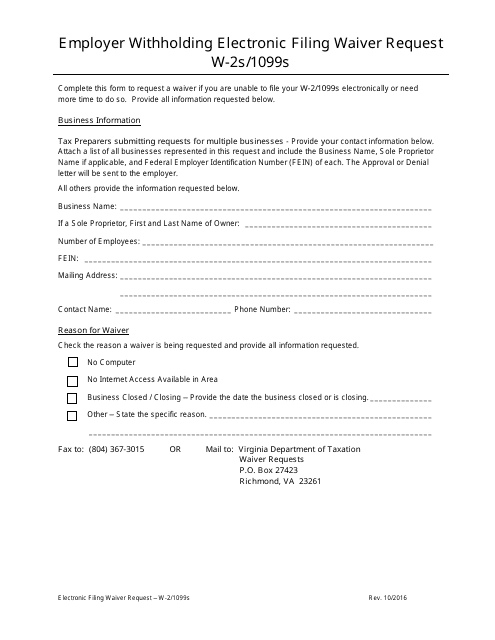

This form is used for employers in Virginia to request a waiver from electronic filing requirements for Form W-2S or 1099S.

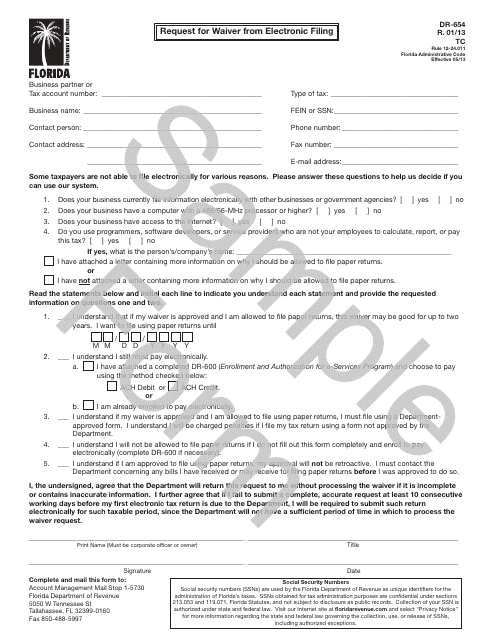

This form is used for requesting a waiver from electronic filing in the state of Florida.

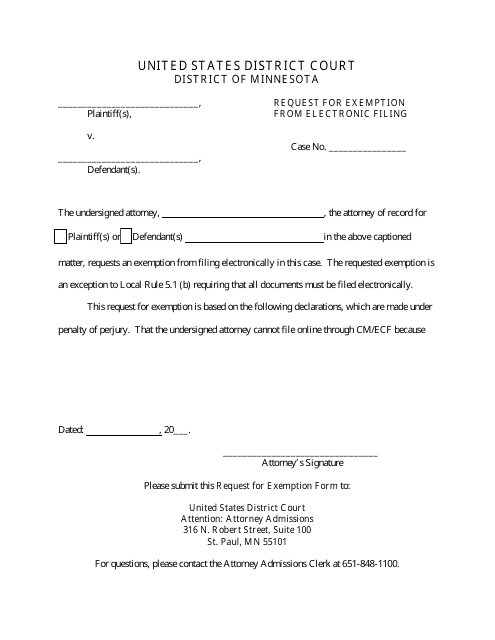

This document is a request for exemption from electronic filing in the state of Minnesota. It is used when an individual or business is unable to file their documents electronically and requires an exemption from this requirement.

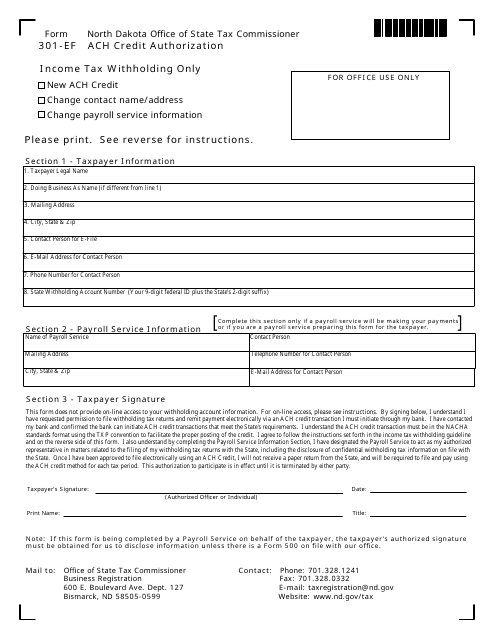

This form is used for applying for withholding and authorizing ACH credits in North Dakota.

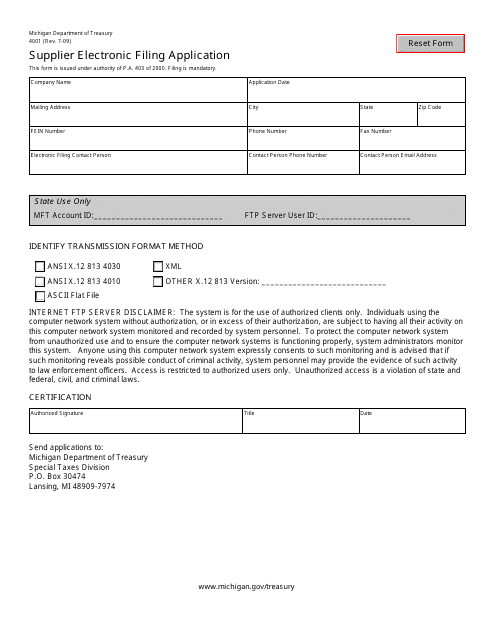

This Form is used for suppliers in Michigan to apply for electronic filing.

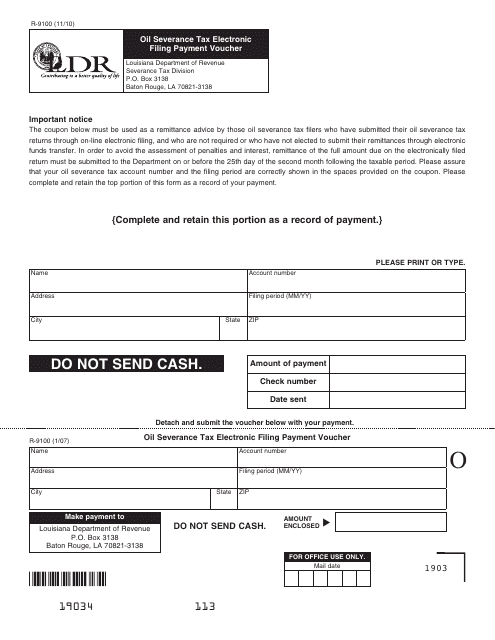

This form is used for making electronic payments related to the oil severance tax in Louisiana.

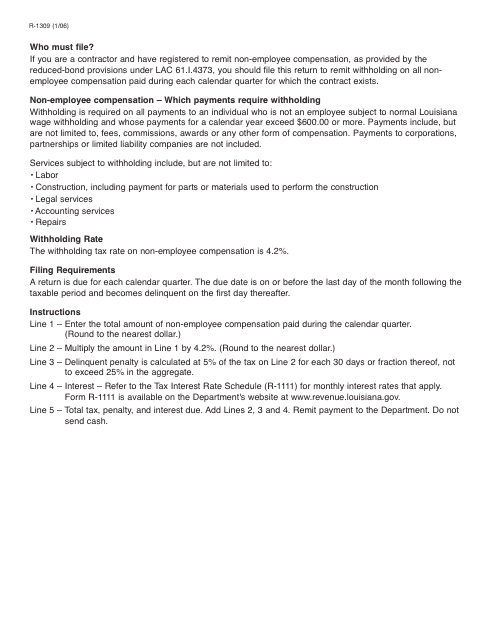

This document is used for reporting non-employee compensation in the state of Louisiana.

This form is used for electronically filing and making payments for sales tax in Louisiana.

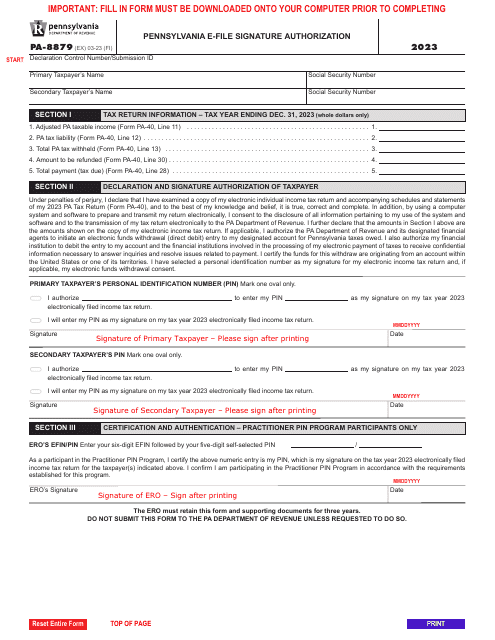

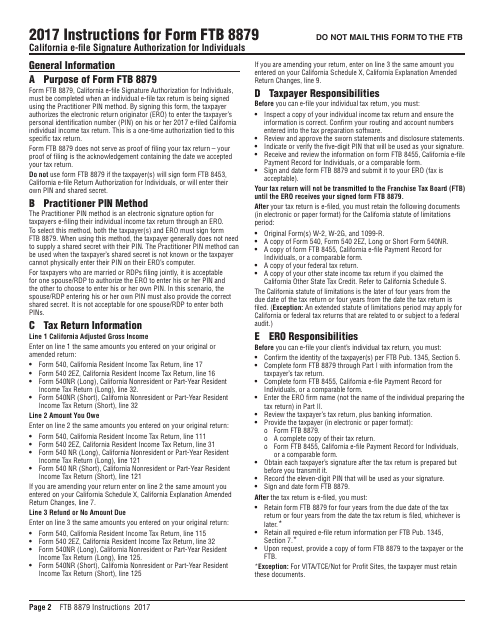

This document is used for authorizing electronic filing of tax returns for individuals in California. It provides instructions on how to complete Form FTB8879 for electronic signature authorization.

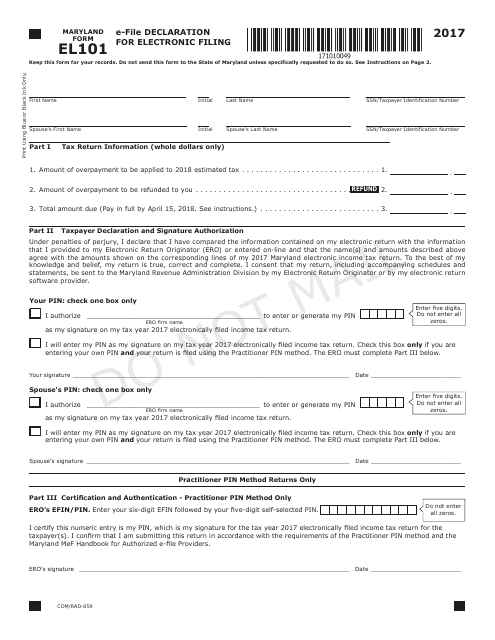

This form is used for declaring electronic filing in the state of Maryland. It is specifically for individuals who want to e-file their tax returns.

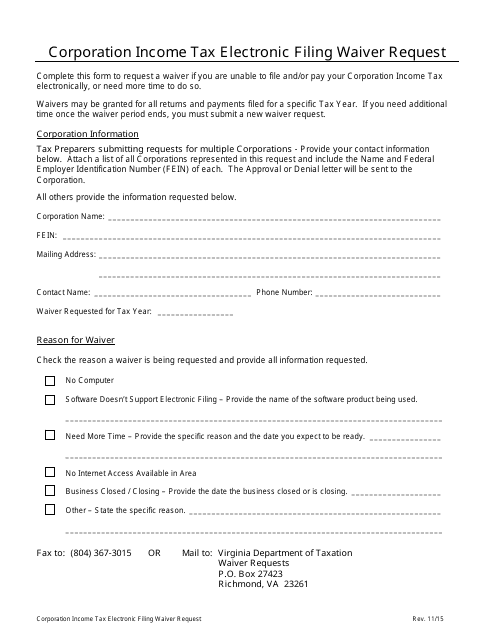

This document is used to request a waiver for electronic filing of corporation income tax in the state of Virginia.

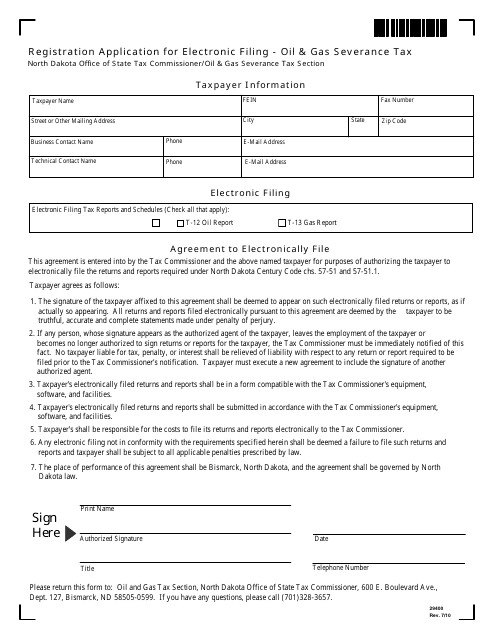

This Form is used for registering electronic filing of oil & gas severance tax in North Dakota.

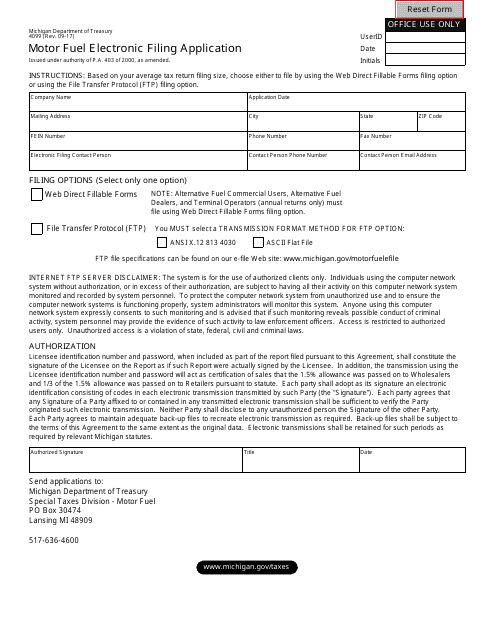

This form is used for electronically filing motor fuel applications in the state of Michigan.

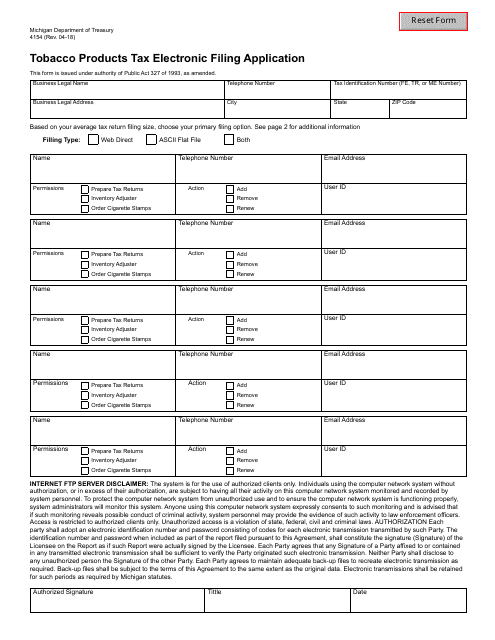

This form is used for electronic filing of tobacco products tax in the state of Michigan.

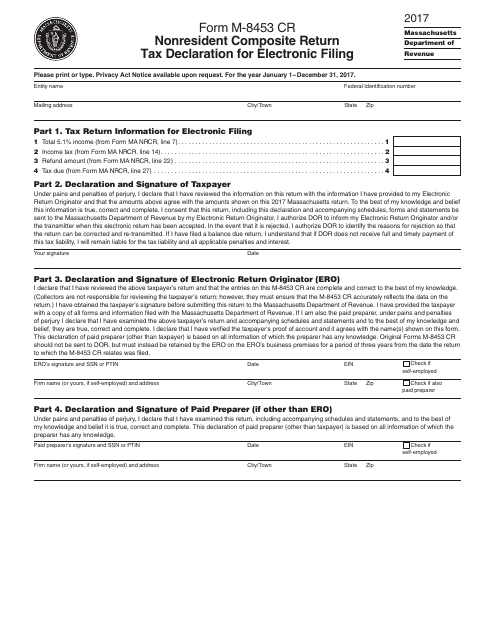

This Form is used for nonresident individuals in Massachusetts to declare their tax information for electronic filing.

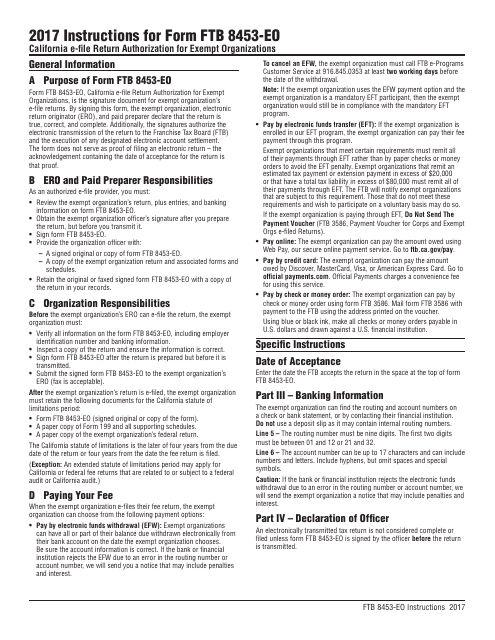

This document is used for authorized exempt organizations in California to electronically file their tax returns.

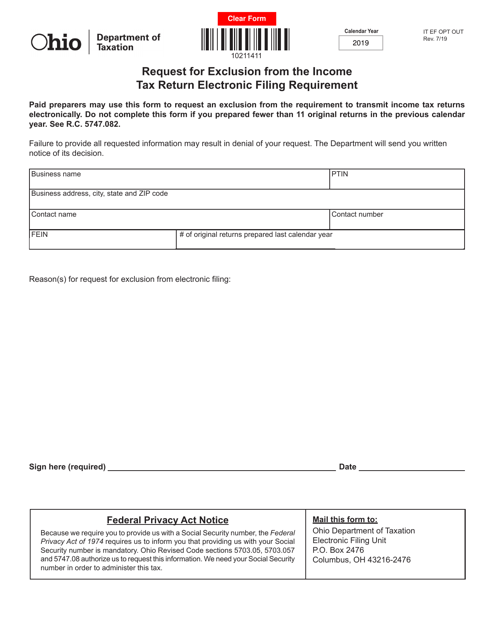

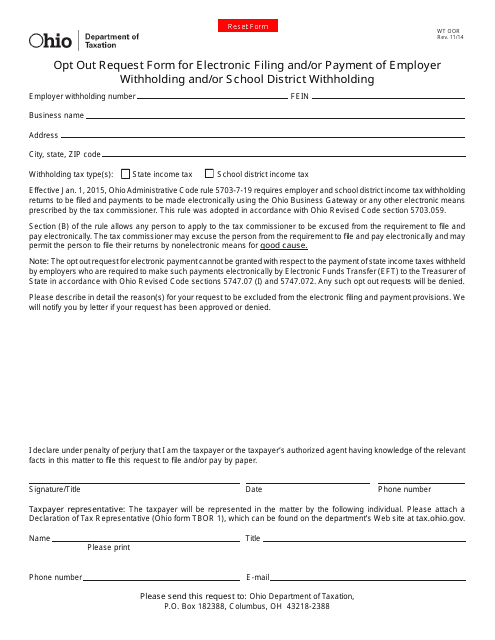

This form is used for requesting to opt out of electronic filing and/or payment of employer withholding and/or school district withholding in Ohio.

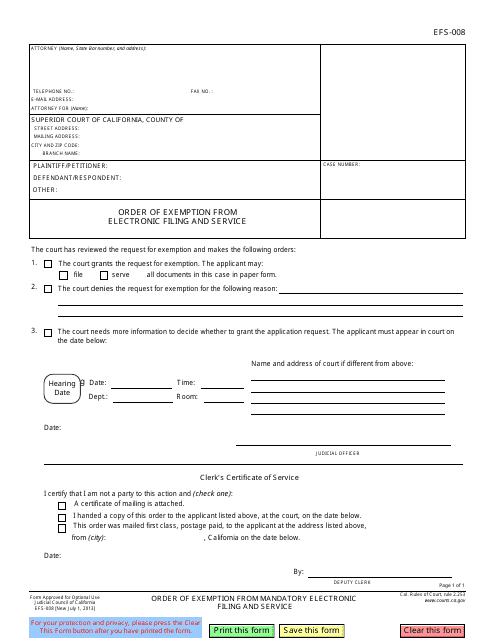

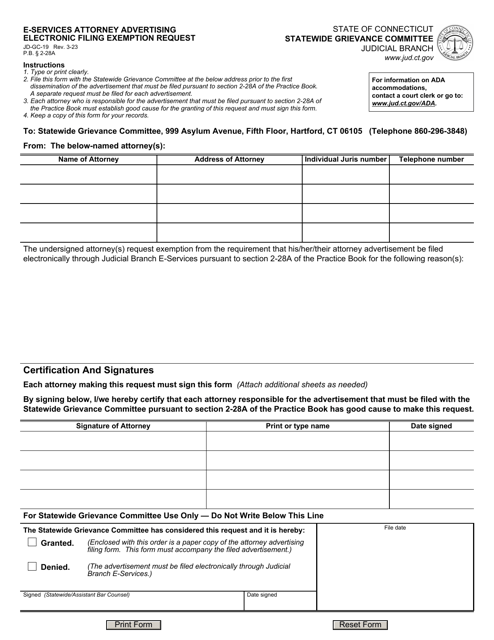

This Form is used for requesting an exemption from electronic filing and service in the state of California.

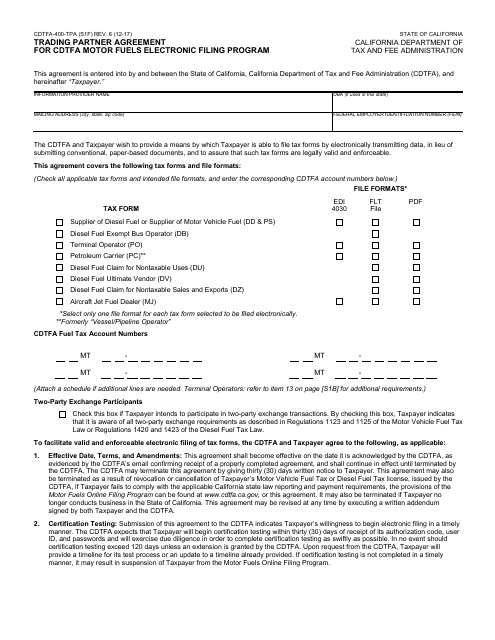

This form is used for creating a Trading Partner Agreement for the CDTFA Motor Fuels Electronic Filing Program in California.

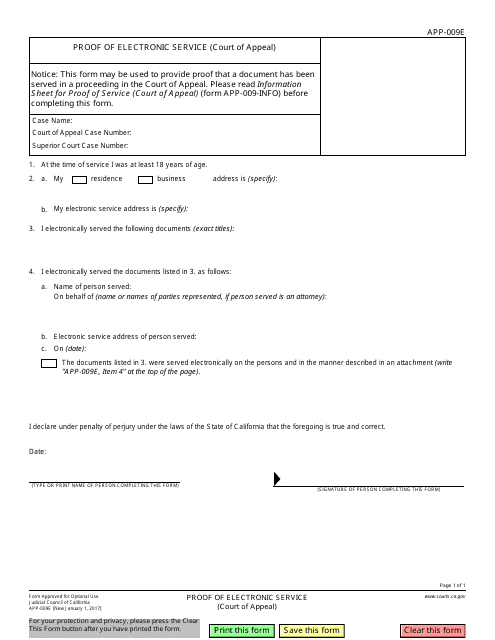

This form is used for providing proof of electronic service in California. It is used to confirm that a document has been served electronically to the other party involved in a legal case.

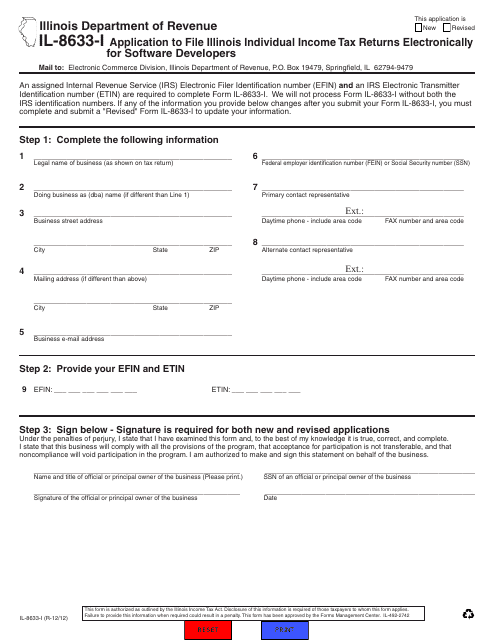

This Form is used for software developers in Illinois to apply for electronic filing of individual income tax returns.

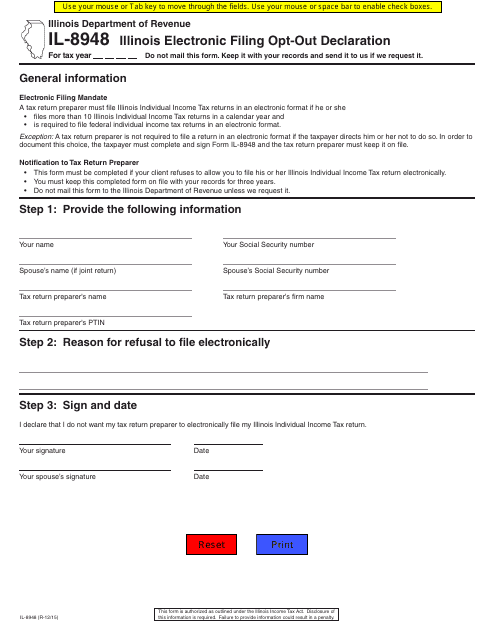

This form is used for residents of Illinois to opt out of electronic filing for their tax returns.

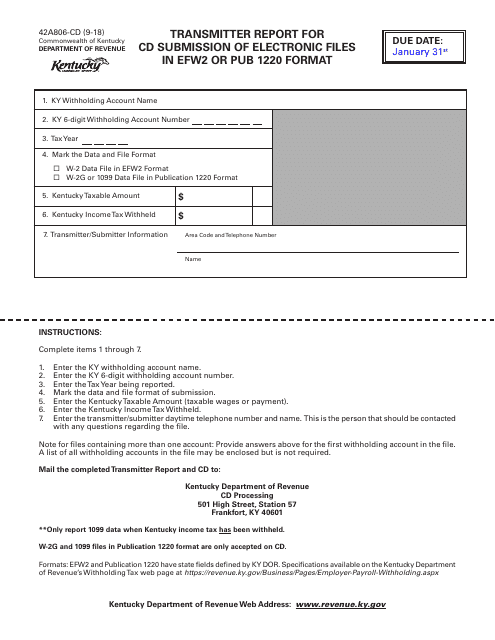

This document is used for submitting electronic files in EFW2 or Pub 1220 format for CD transmission in Kentucky.