Government Bonds Templates

Government Bonds, also known as government bond forms, are important financial instruments issued by the government to raise capital. These bonds serve as a means for the government to borrow money from investors with the promise of repayment along with periodic interest payments. Government bonds are considered low-risk investments, making them a popular choice for investors looking for stability and consistent returns.

These bonds come in various forms and are typically issued by government entities such as states, municipalities, and federal agencies. Whether you're an individual or an institutional investor, government bonds offer a range of benefits. They provide a safe and secure investment option, backed by the full faith and credit of the government entity issuing the bond.

Investing in government bonds offers a stable source of income, with regular interest payments. The interest rates on government bonds are typically competitive and can provide a predictable stream of income over the life of the bond. Additionally, government bonds are highly liquid, meaning they can be easily bought or sold in the secondary market.

Government bonds are also an essential tool for governments to finance infrastructure projects, fund social programs, or manage fiscal deficits. These bonds help governments raise capital without resorting to excessive borrowing, promoting economic stability and growth.

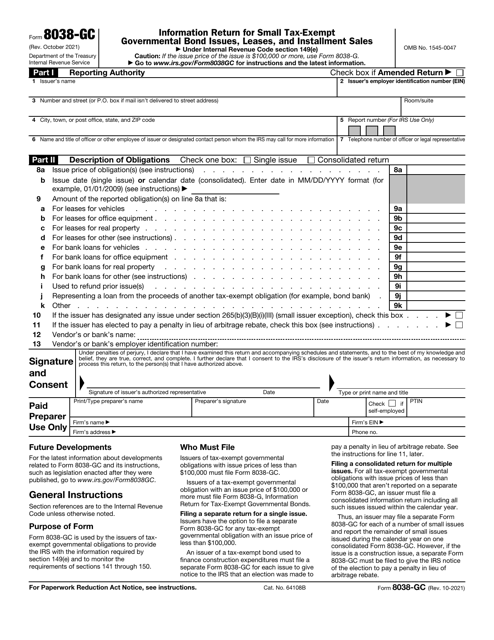

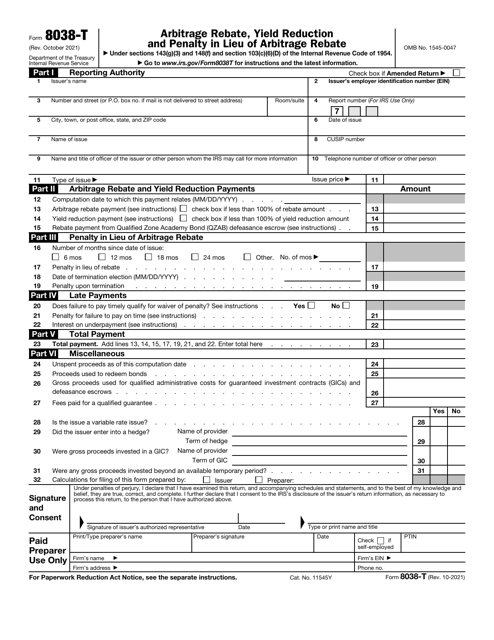

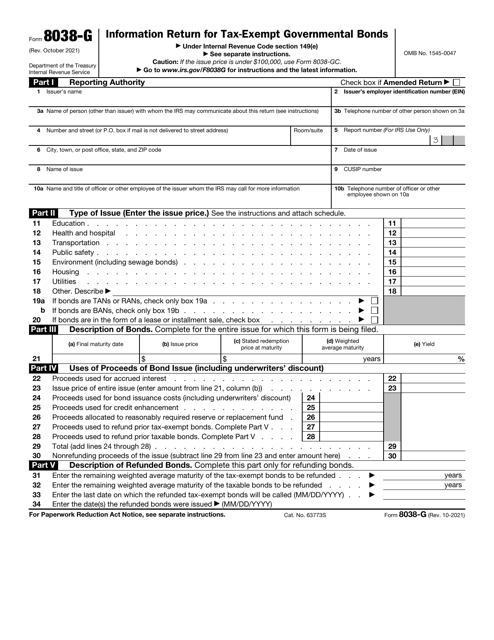

Whether you're an investor seeking a reliable and low-risk investment or a government entity looking to raise funds, government bonds offer a valuable avenue. Explore the various government bond options available, including IRS Form 8038-G Information Return for Tax-Exempt Governmental Bonds and Affidavit of Financial Responsibility - Government Bond - Wisconsin. Invest in government bonds and contribute to the growth and development of your country's economy.

Documents:

17

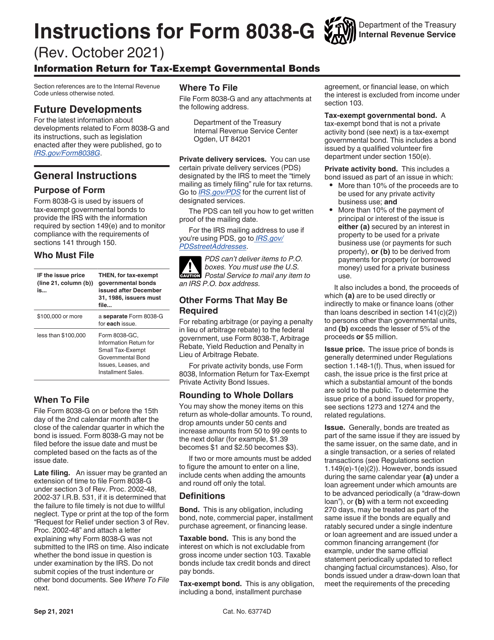

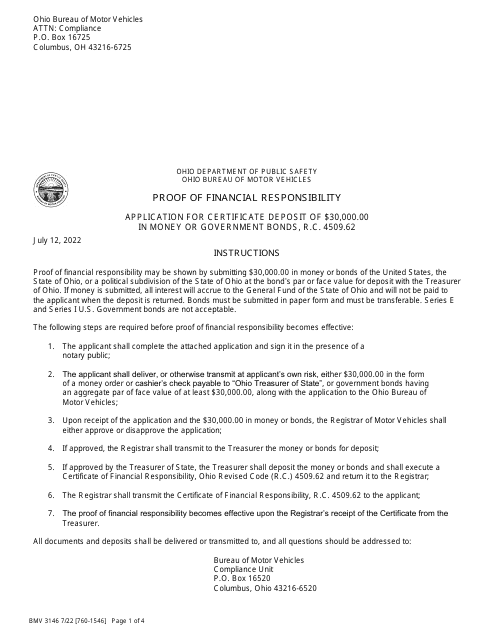

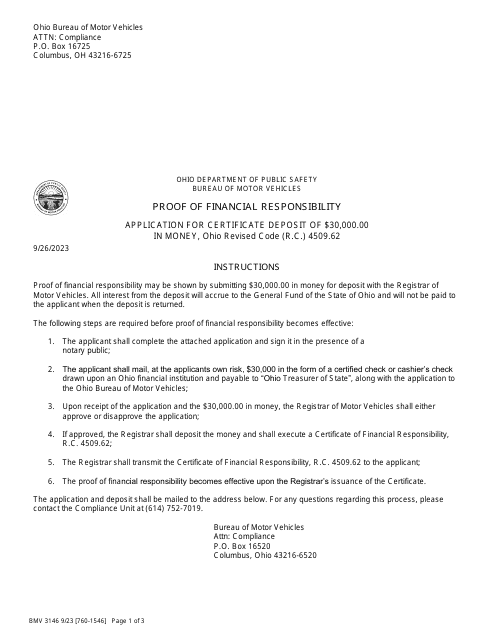

This form is used for applying to the Ohio DMV to deposit $30,000.00 in money or government bonds.

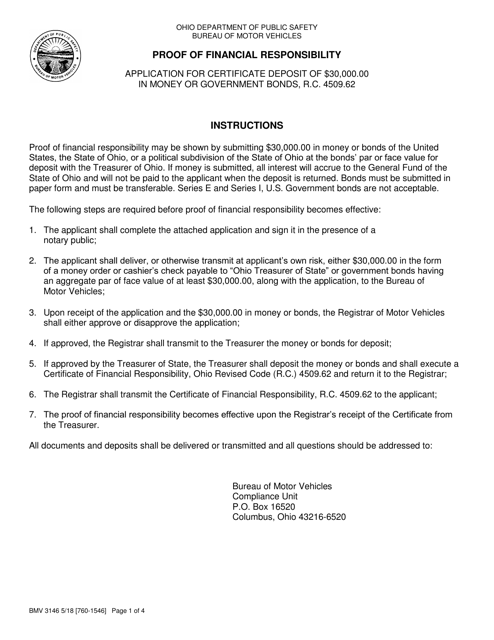

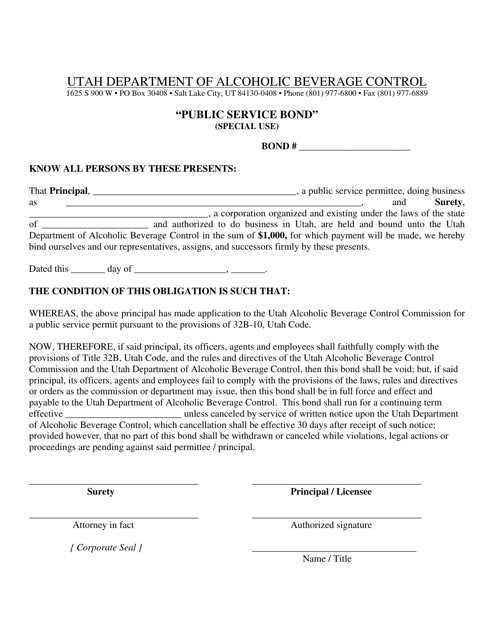

This document is a Public Service Bond specific to the state of Utah. It is used to ensure that individuals holding public service positions fulfill their obligations and responsibilities.

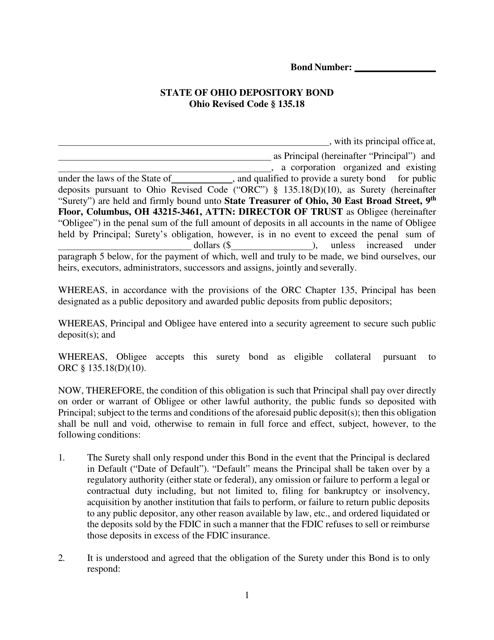

This document is a type of bond required by the state of Ohio. It is used to ensure that entities acting as depositories for public funds in Ohio are financially stable and capable of fulfilling their obligations.

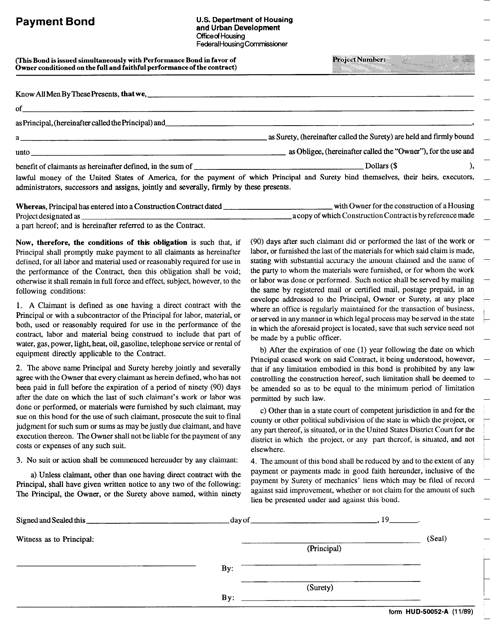

This form is used for submitting a payment bond to the U.S. Department of Housing and Urban Development (HUD). The payment bond ensures that contractors and suppliers will be paid for their services and materials used in HUD-funded construction projects.

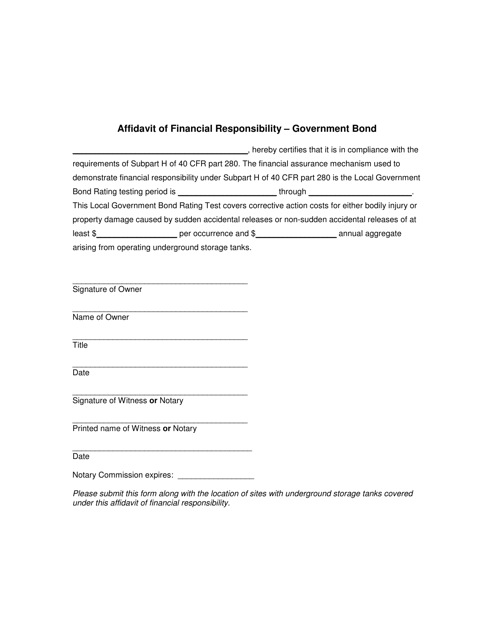

This document is used for individuals in Wisconsin to provide proof of financial responsibility by submitting a government bond.

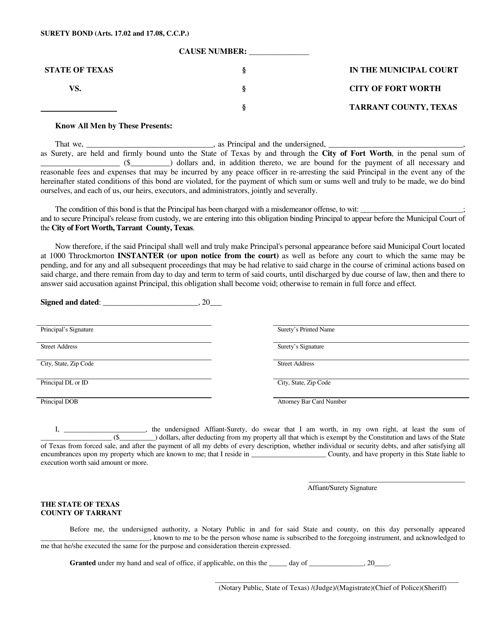

This document is a surety bond specific to the City of Fort Worth, Texas. It guarantees that certain obligations will be fulfilled, providing financial protection for the city and its residents.

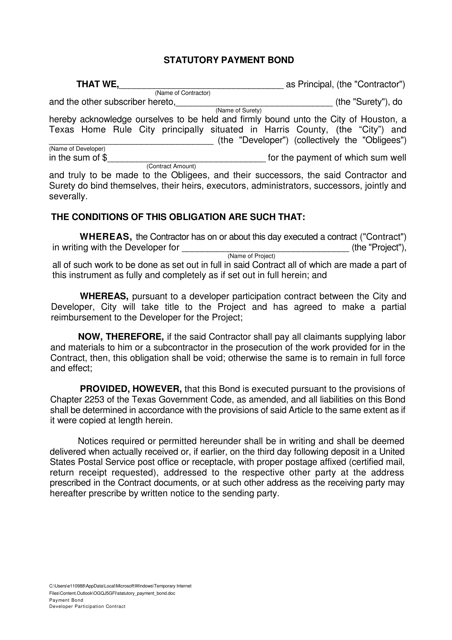

This document is a statutory payment bond specific to the City of Houston, Texas. It provides protection to subcontractors and suppliers in the event that the principal contractor fails to pay them for their work or supply of materials on a construction project.

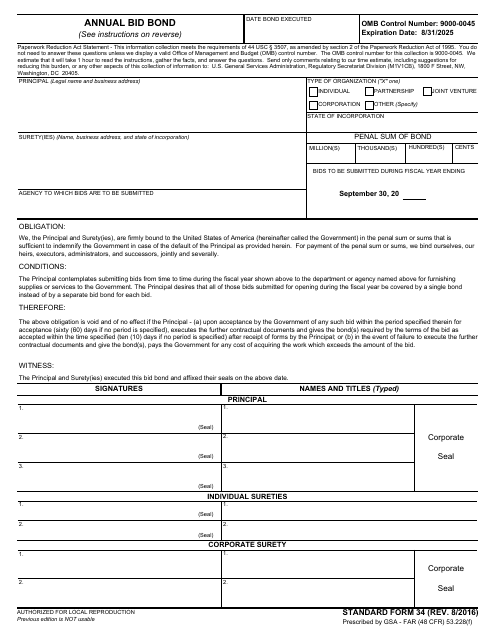

This Form is used for applying an annual bid bond. It is required for contractors who bid on government construction projects to ensure the project owner that they will enter into a contract if they are awarded the bid.

This form is used for applying to deposit $30,000.00 in money or government bonds in Ohio.