Income Source Templates

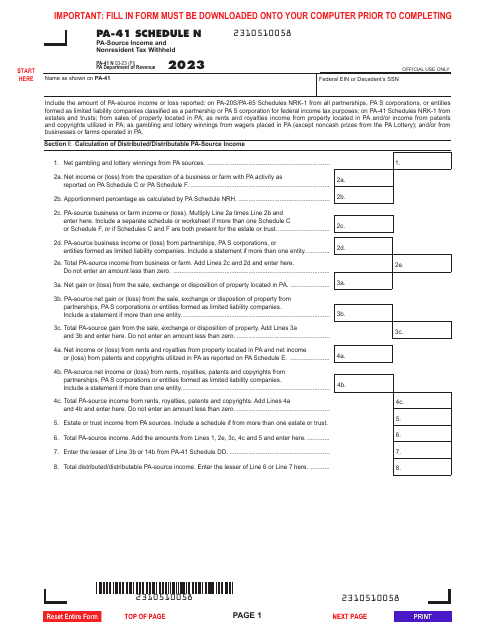

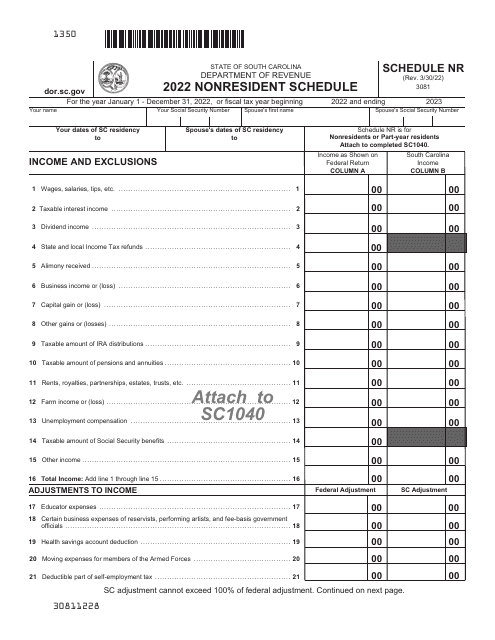

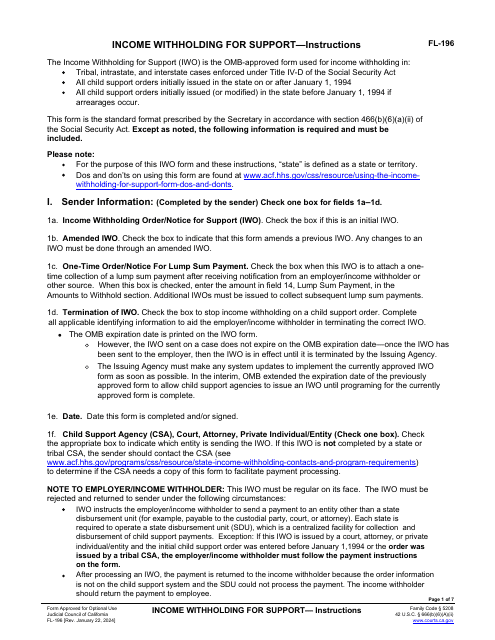

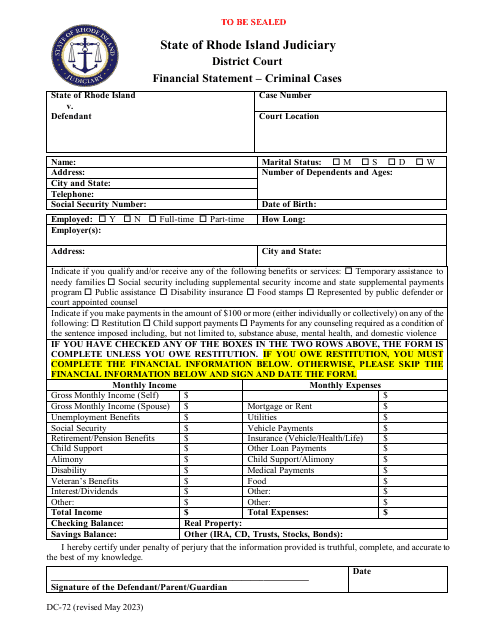

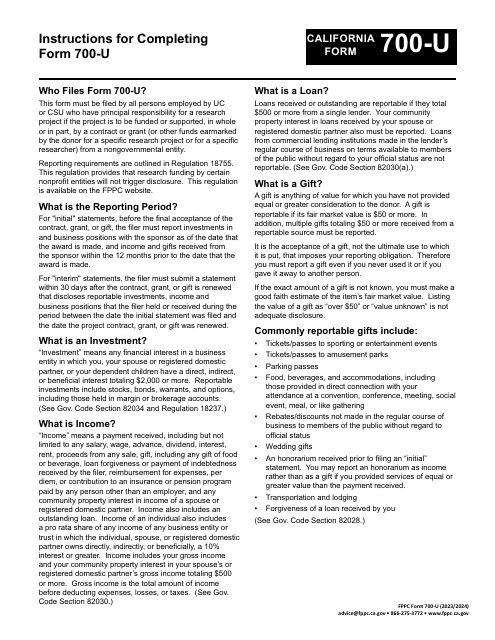

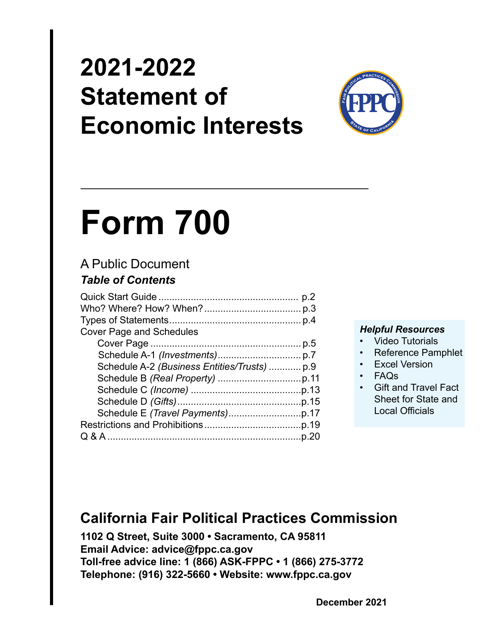

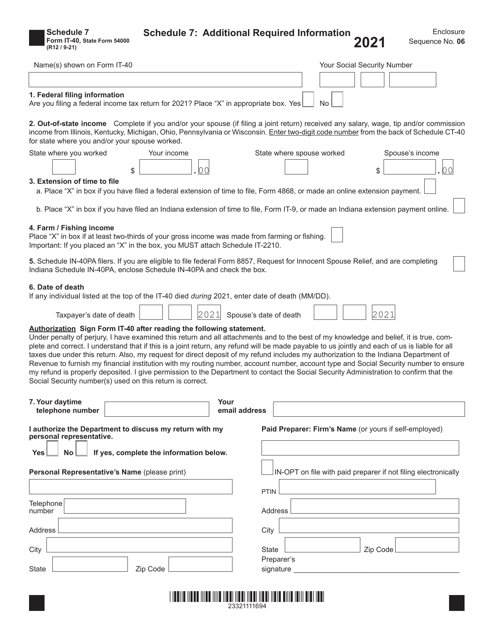

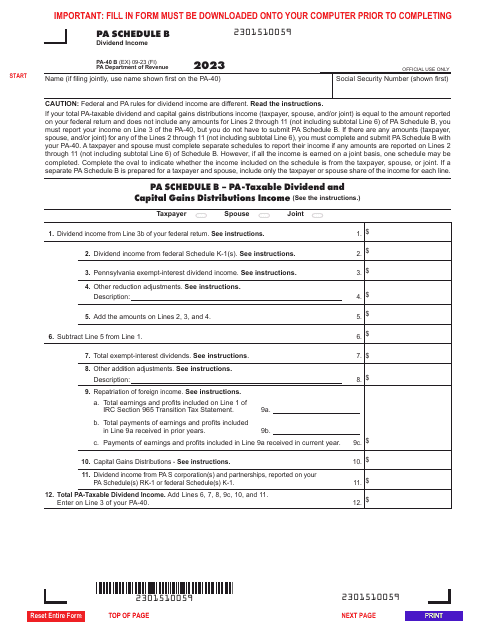

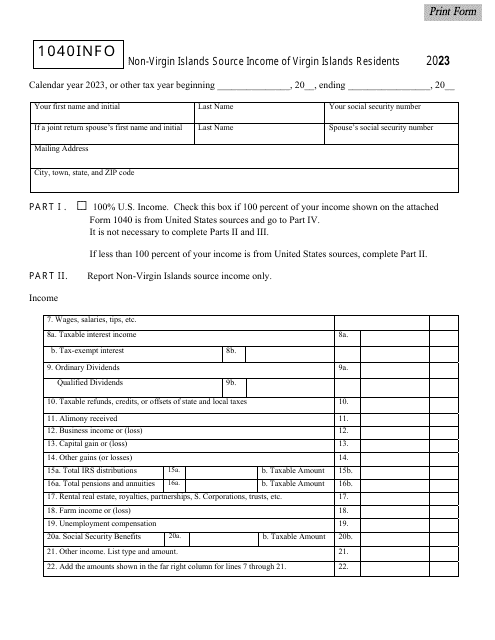

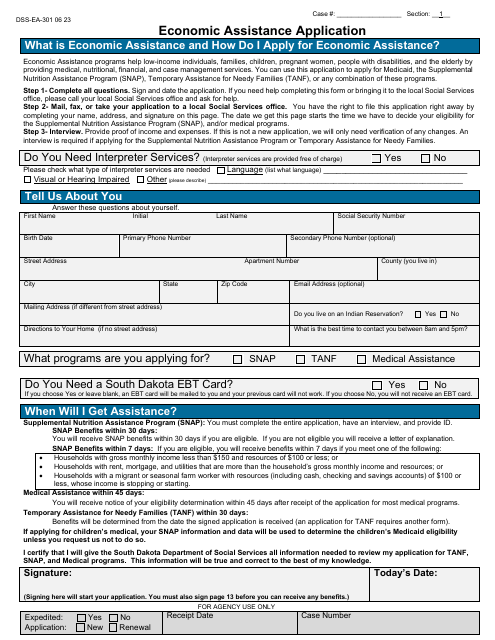

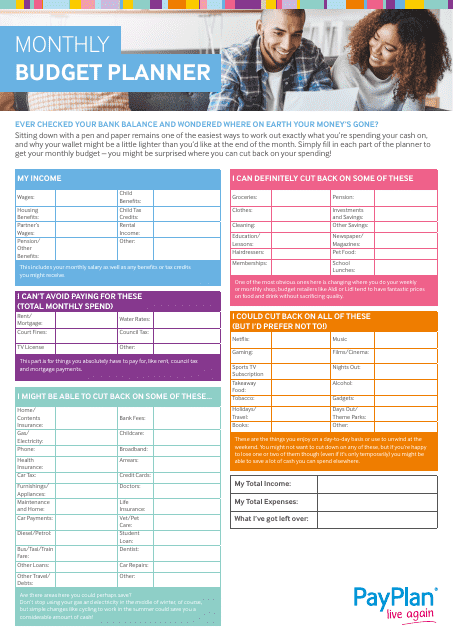

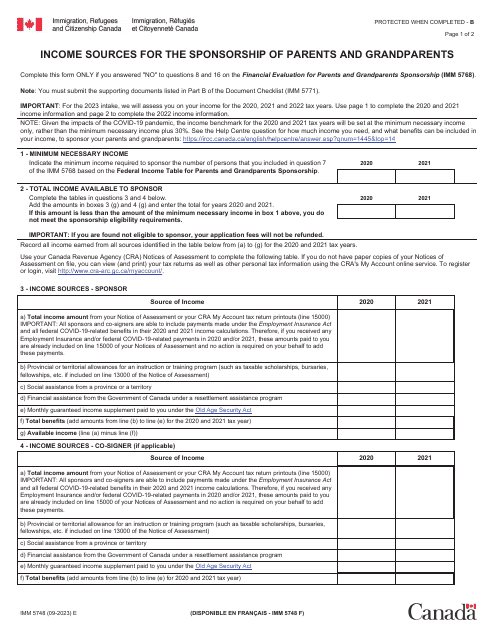

Are you looking for information about income sources or source income? We have a comprehensive collection of documents related to income source that can provide valuable insights and guidance. Our documents cover various forms and statements from different states, such as the Form DC-72 Financial Statement from Rhode Island, the FPPC Form 700 Statement of Economic Interests from California, and the Form IT-40 Additional Required Information from Indiana. We also offer resources like the Annual Income Worksheet from New Mexico, available in both English and Spanish, and the Form PA-40 Schedule B for reporting dividend income in Pennsylvania.

Whether you are an individual, a business owner, or a tax professional, having a clear understanding of your income sources is crucial for financial planning, tax compliance, and overall financial well-being. Our collection of income source documents can assist you in accurately reporting your income, ensuring that you comply with state-specific requirements, and optimizing your tax deductions and credits.

Explore our comprehensive collection of income source documents to stay informed and make informed financial decisions. With our wide range of resources, you can confidently navigate the complexities of income reporting and maximize your financial potential.

Documents:

37

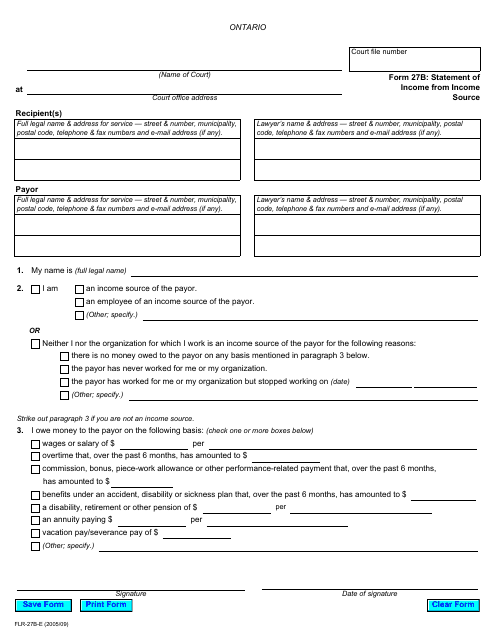

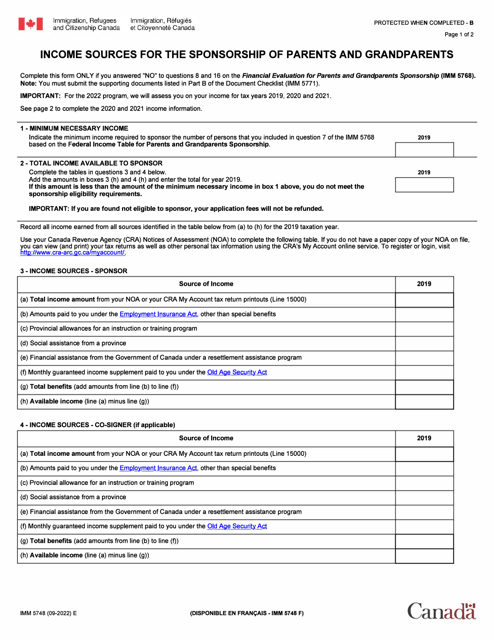

This document is used for reporting income from different sources in the province of Ontario, Canada. It is an essential form for tax filing purposes.

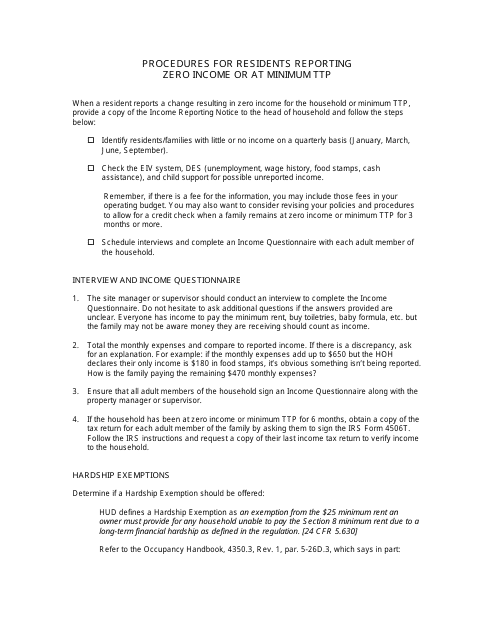

This form is used for conducting an interview and collecting income-related information in the state of Arizona.

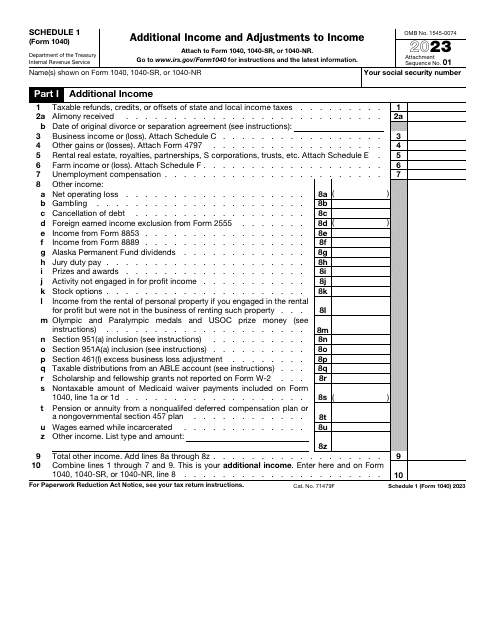

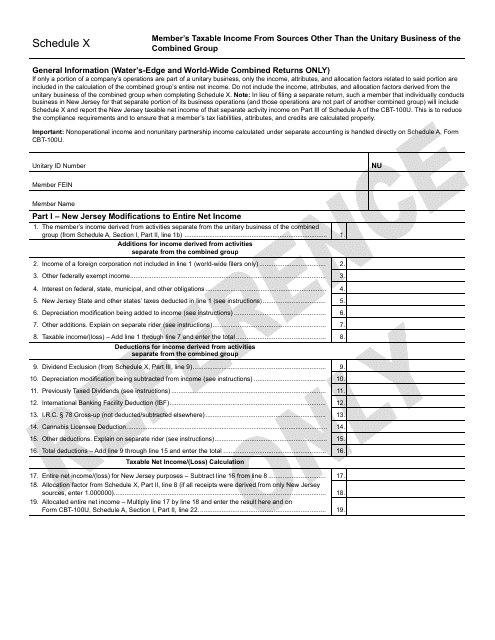

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

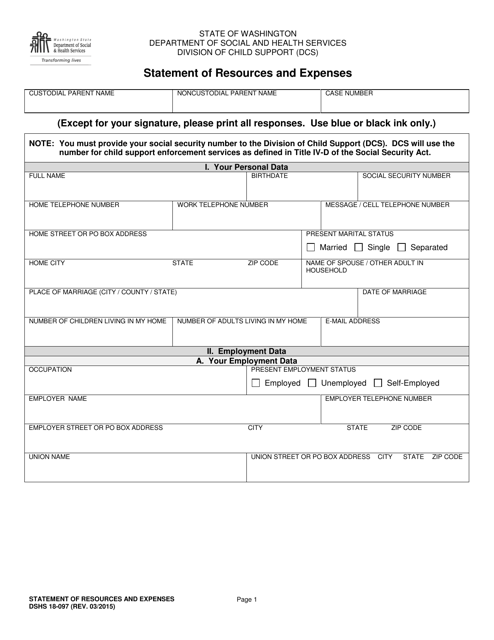

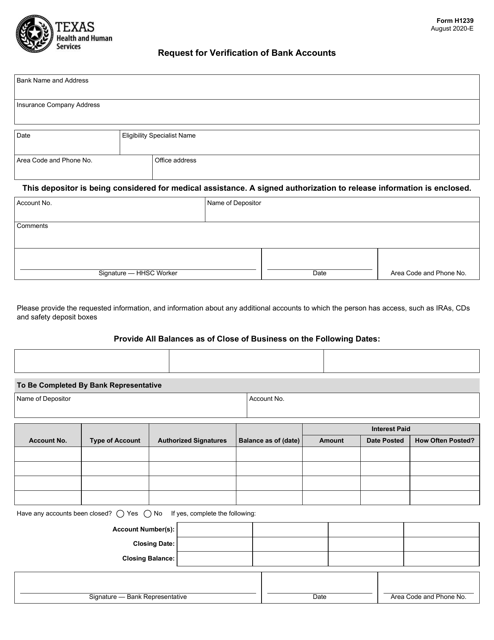

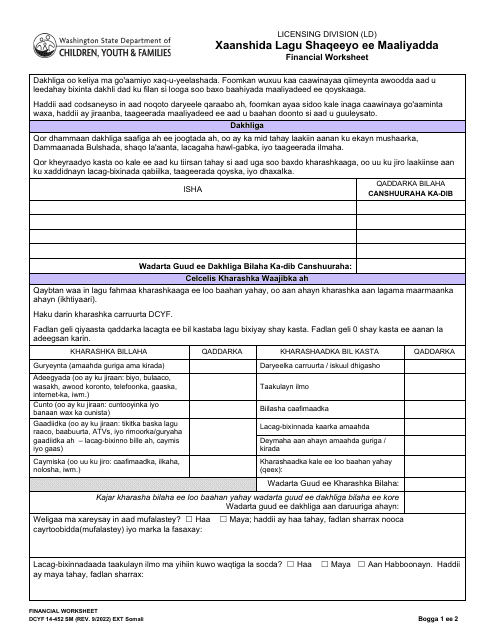

This form is used for reporting and documenting the resources and expenses of individuals residing in Washington state. It helps the Department of Social and Health Services (DSHS) assess eligibility for various programs and services.

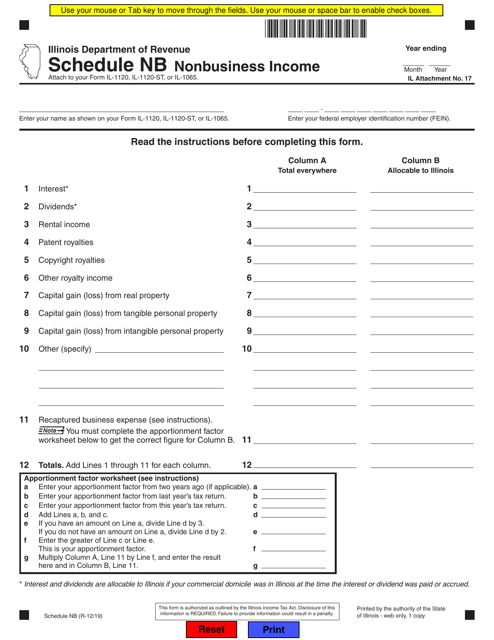

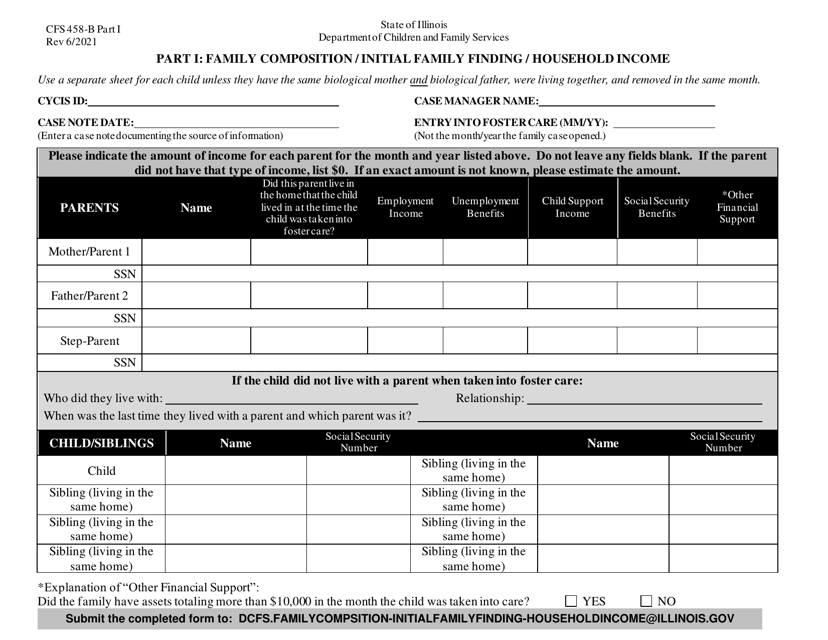

This document is for reporting nonbusiness income in the state of Illinois for individual taxpayers. It is used to schedule the income that is not derived from business activities.

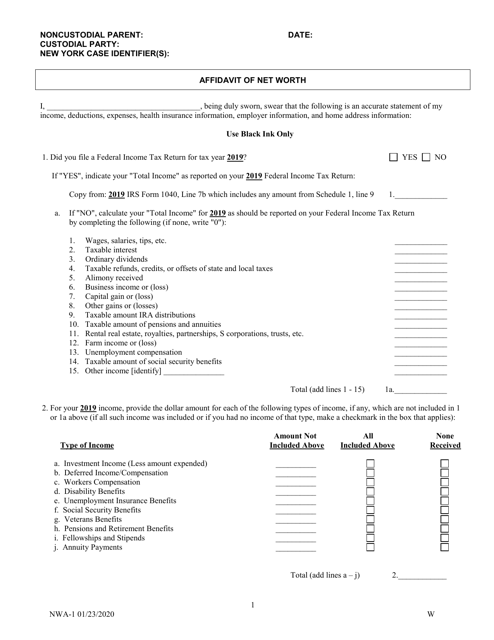

This form is used for submitting an affidavit that provides details about an individual's net worth. It is specific to New York state.

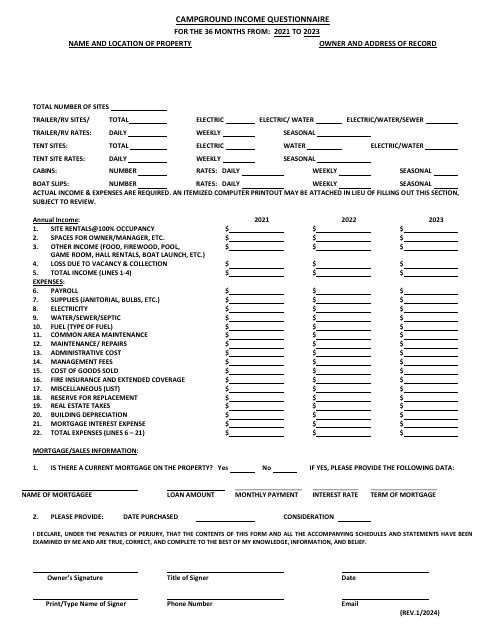

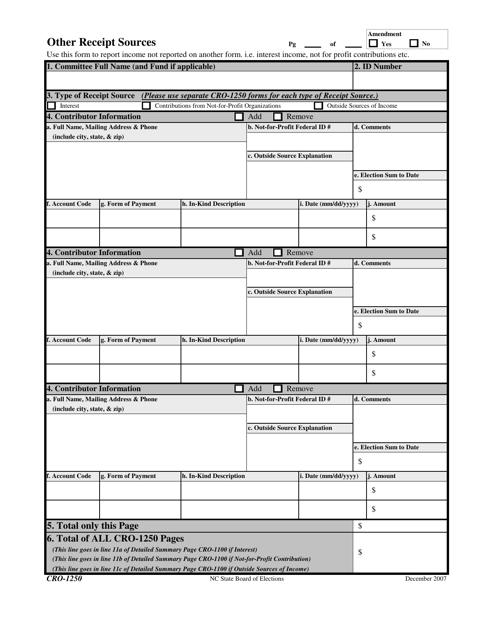

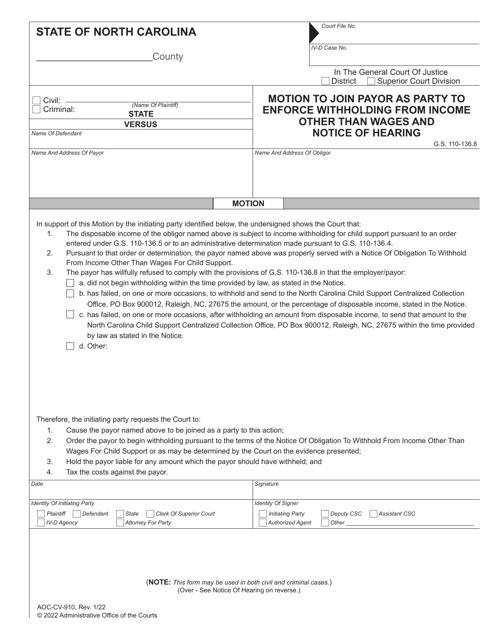

This Form is used for reporting other sources of revenue in North Carolina. It is used by businesses to provide details about income from sources other than regular sales or services.

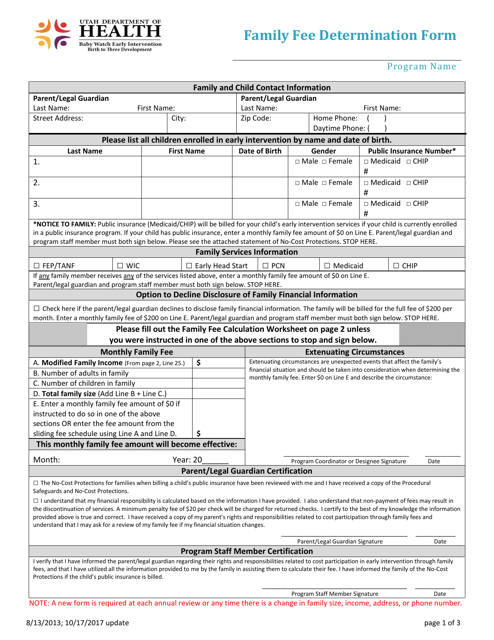

This form is used for determining the fees for family-related services in Utah.

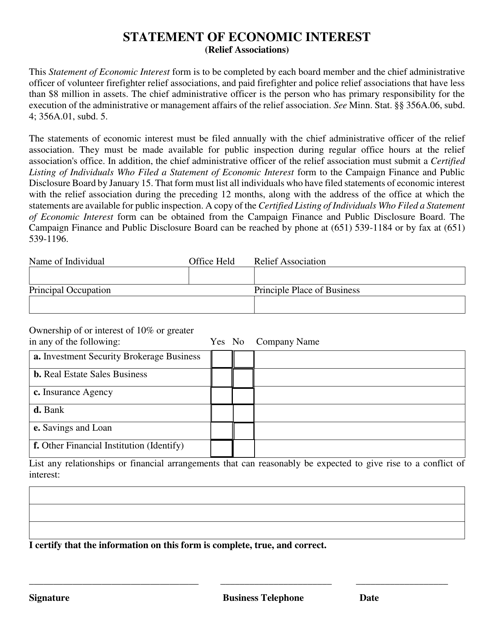

This document is used for reporting financial interests and potential conflicts of interest by individuals serving in public office or certain government positions in Minnesota.

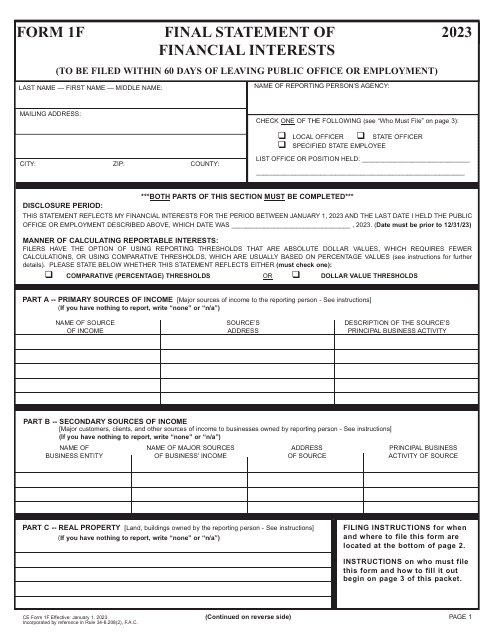

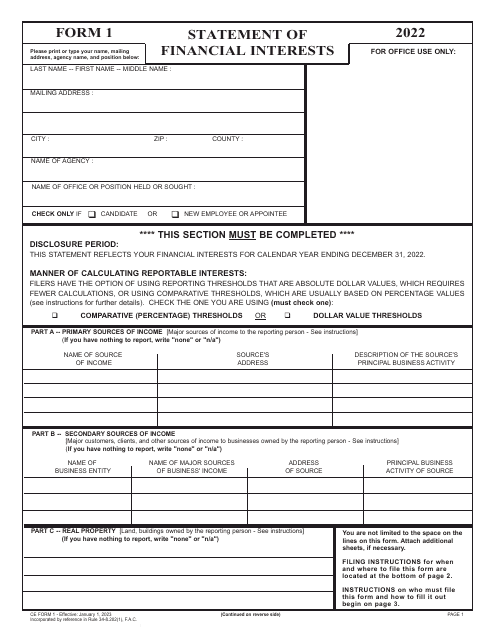

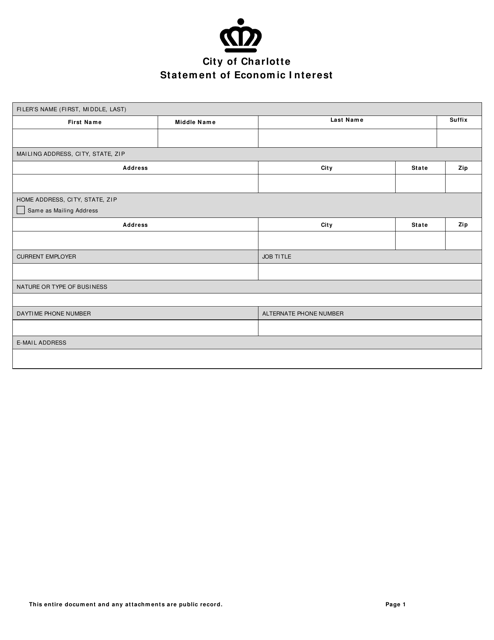

This document is used for reporting financial interests of individuals working for the City of Charlotte, North Carolina. It helps ensure transparency and prevent conflicts of interest.

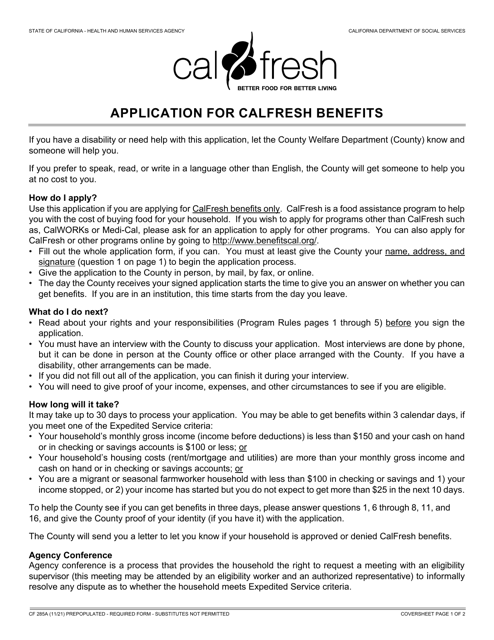

This form is used for applying for CalFresh benefits in California. CalFresh is a program that provides eligible low-income individuals and families with funds to purchase food.

This Form is used for reporting any financial interests or sources of income of public officials or employees in California. It helps ensure transparency and prevents conflicts of interest in government decision-making.

This form is used for providing additional required information for Form IT-40 in the state of Indiana.

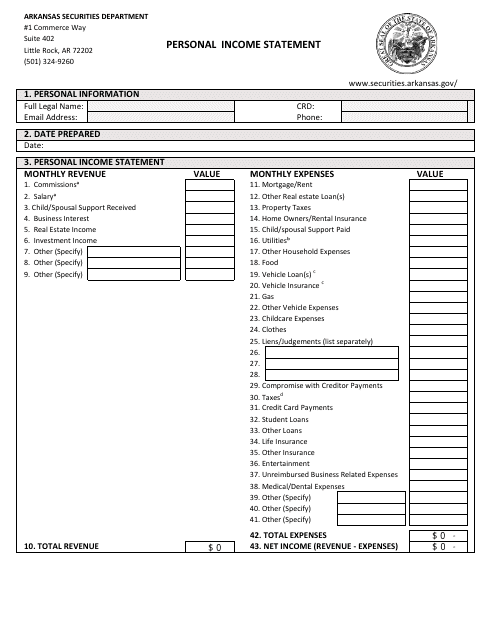

This document is used for keeping track of your personal income in the state of Arkansas. It helps you calculate your earnings and expenses to better manage your finances.

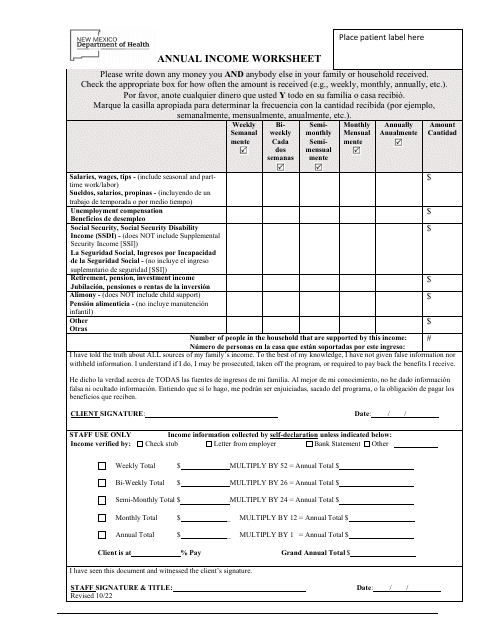

This document provides a worksheet for residents in New Mexico to calculate and record their annual income. It is available in both English and Spanish.