Income Eligibility Templates

Are you wondering if you qualify for certain benefits or programs based on your income? Look no further! Our income eligibility documentation provides you with the necessary tools and forms to determine your eligibility for a variety of programs. Whether you're applying for the Child and Adult CareFood ProgramMeal Benefit, Low-Income Home Energy Assistance Program, or need to verify your income for the Food AssistanceAccounting System, our collection of income eligibility forms has got you covered.

No need to stress about where to find the proper forms or how to complete them. With our income eligibility documentation, you can easily access the forms you need, complete them accurately, and ensure that you meet the income requirements for the program you're applying to. We offer a user-friendly platform that is designed to simplify the income eligibility process, making it convenient and hassle-free for you.

So, whether you're a California resident looking to determine your eligibility for the TB Program, an Arizona child care center applying for the Child and Adult Care Food Program Meal Benefit, or an Iowa resident seeking assistance through the Low-Income Home Energy Assistance Program, our income eligibility documentation will guide you through the process. Don't miss out on the benefits you may qualify for – explore our collection now and get one step closer to securing the assistance you deserve.

Documents:

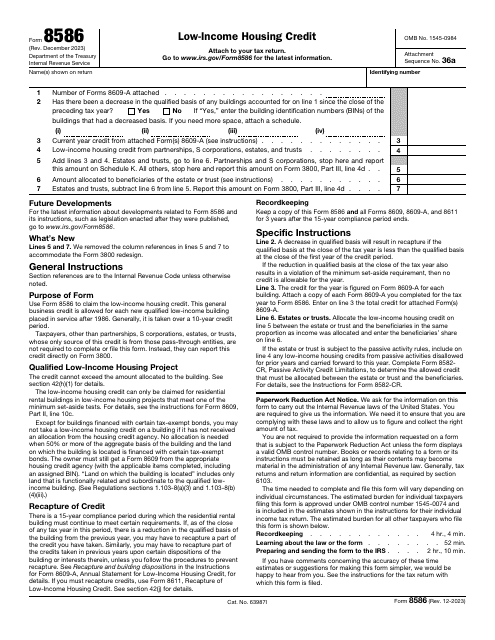

86

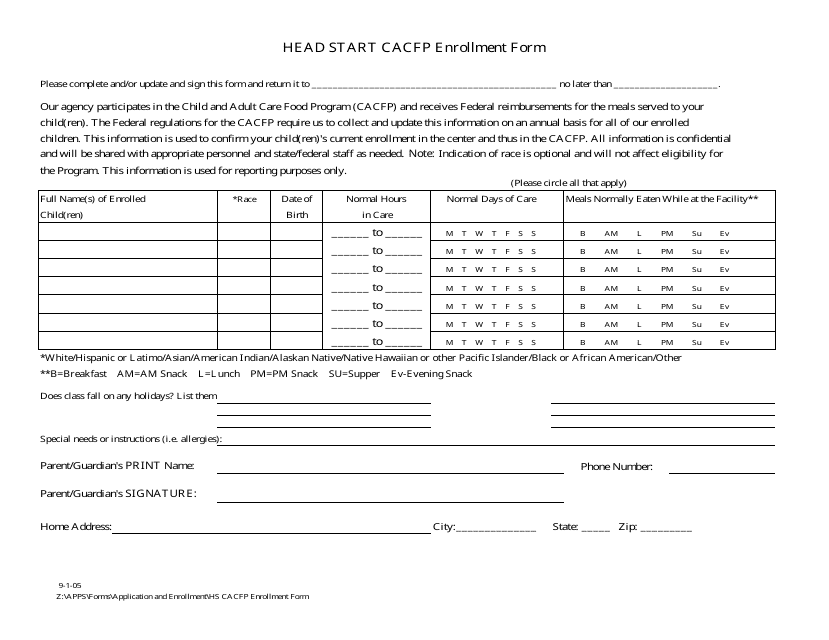

This Form is used for enrolling in the Head Start Child and Adult Care Food Program (CACFP).

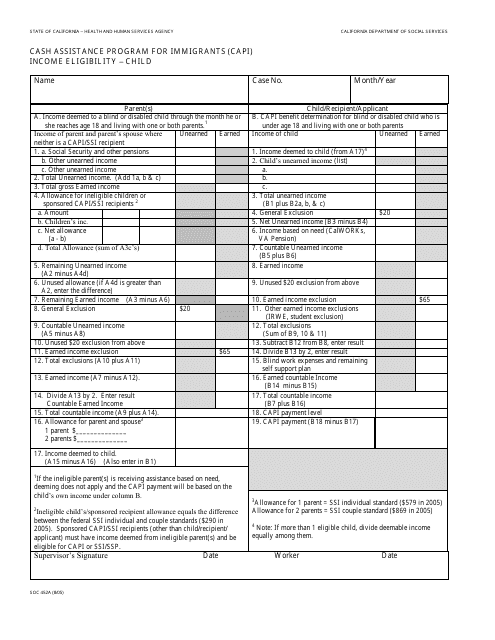

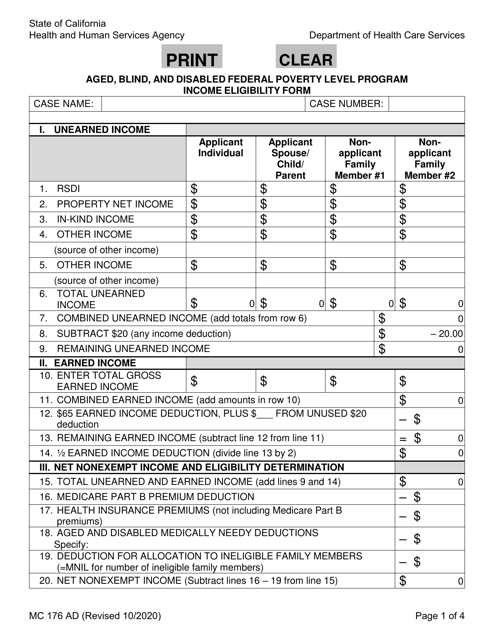

This Form is used for determining the income eligibility of children for the Cash Assistance Program for Immigrants (Capi) in California.

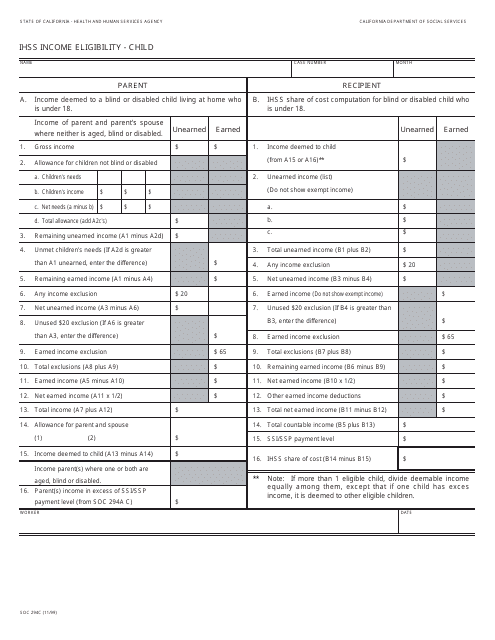

This Form is used for determining the income eligibility of children applying for the In-Home Supportive Services program in California.

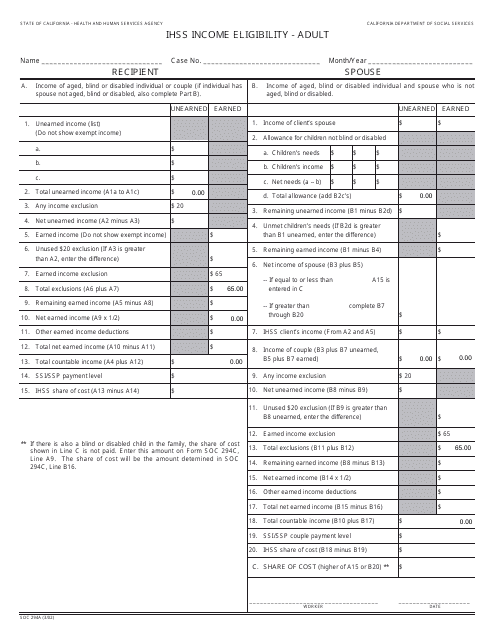

This form is used for determining the income eligibility of adults in California for the In-Home Supportive Services (IHSS) program.

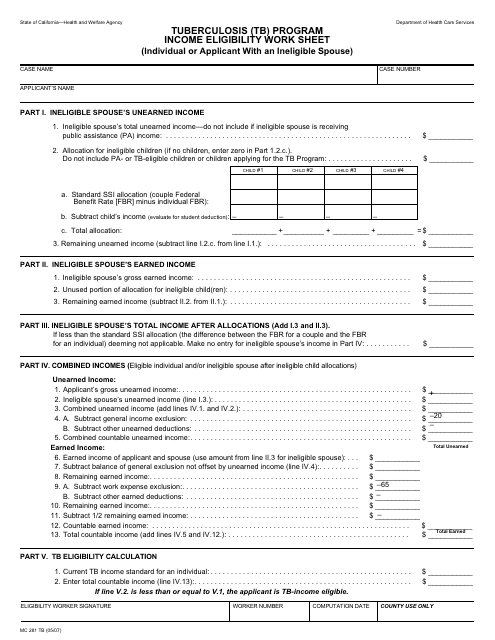

This form is used for determining income eligibility for the TB program in California.

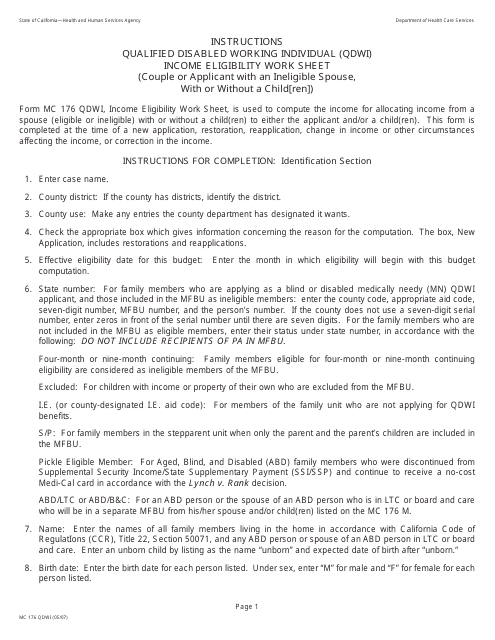

This form is used to determine income eligibility for the Qualified Disabled Working Individual (QDWI) program in California. It is specifically for couples or applicants with an ineligible spouse, with or without a child.

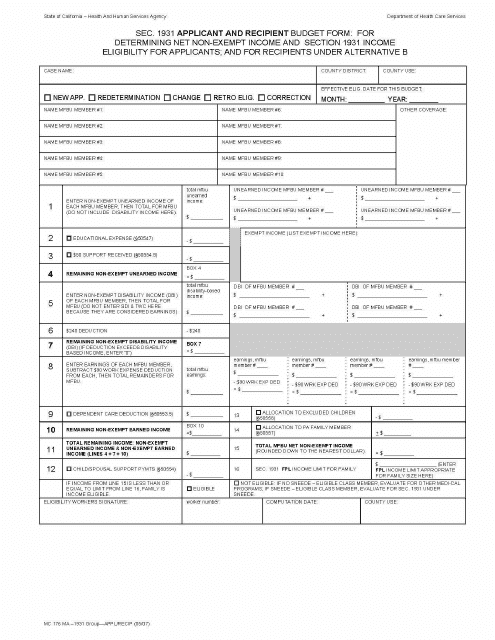

This form is used for determining net non-exempt income and section 1931 income eligibility for applicants and recipients under Alternative B in California.

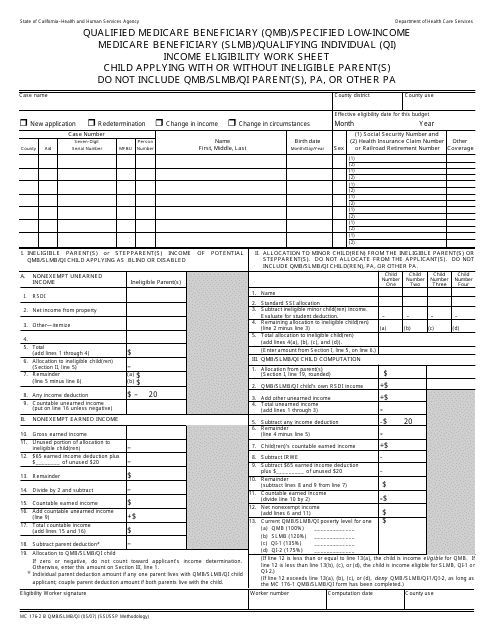

This Form is used for determining income eligibility for children applying for the QMB/SLMB/QI program in California, whether they have an ineligible parent or not.

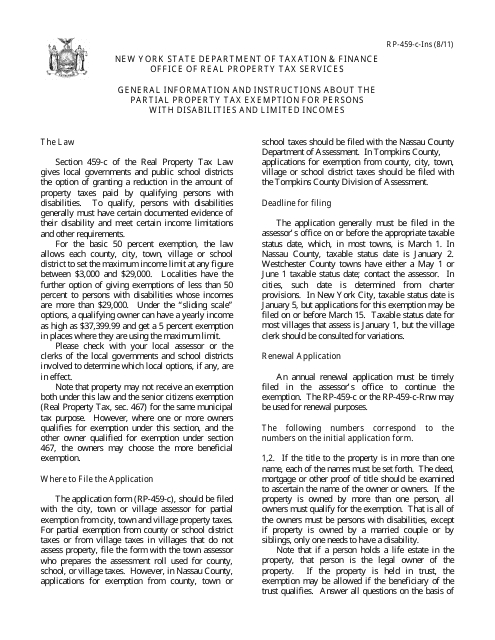

This Form is used for claiming a partial property tax exemption in New York for individuals with disabilities and limited incomes. It provides instructions on how to apply for the exemption and the documentation required.

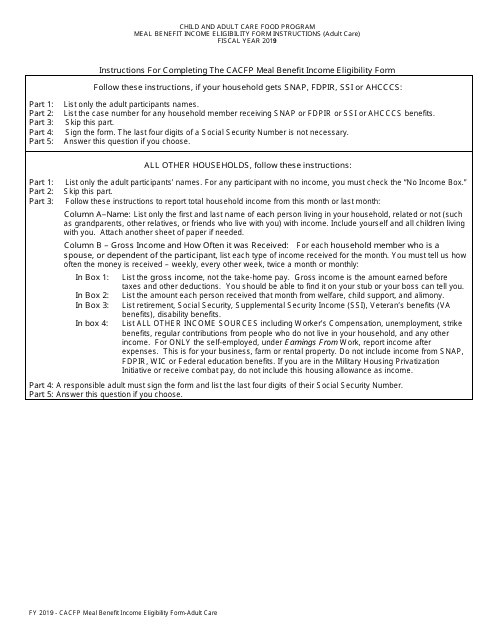

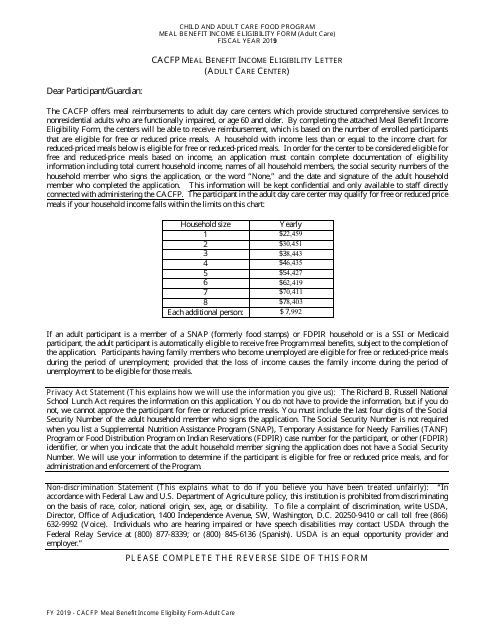

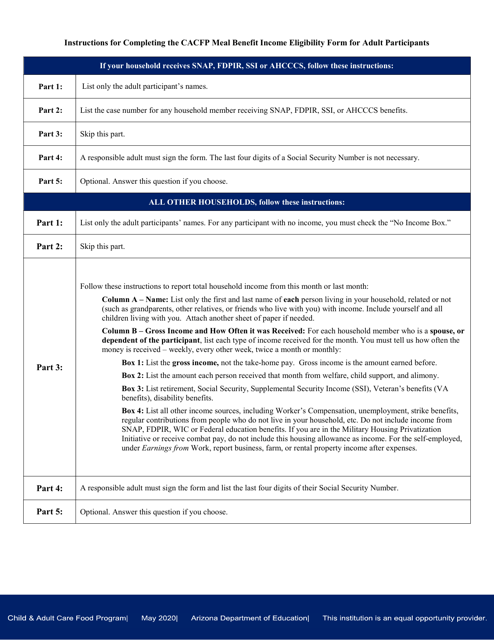

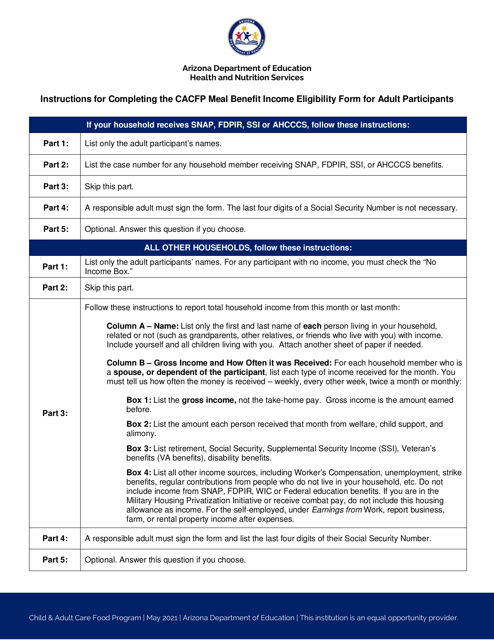

This form is used to determine income eligibility for adults participating in the CACFP meal benefit program. It provides instructions on how to accurately complete the form and submit it for review. This document is essential for determining if adults qualify for subsidized meals through the CACFP program.

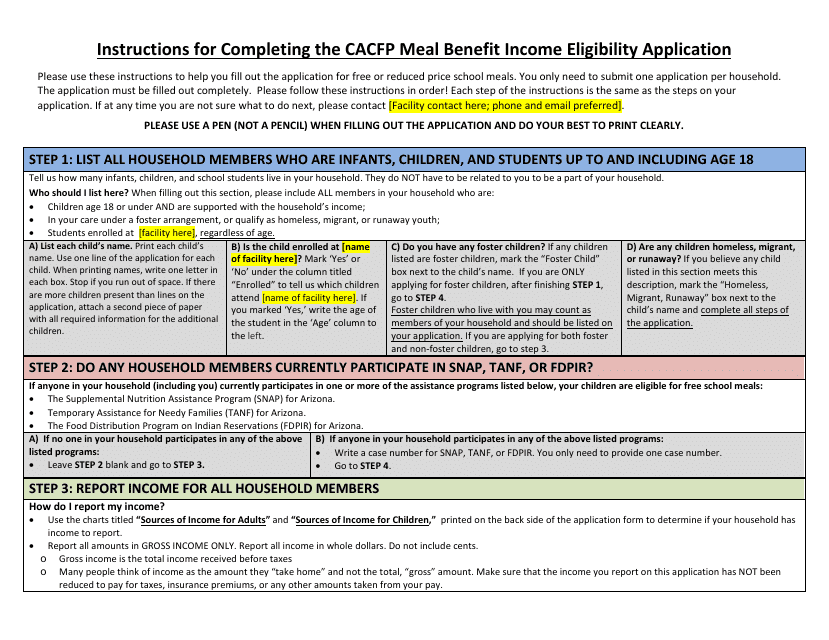

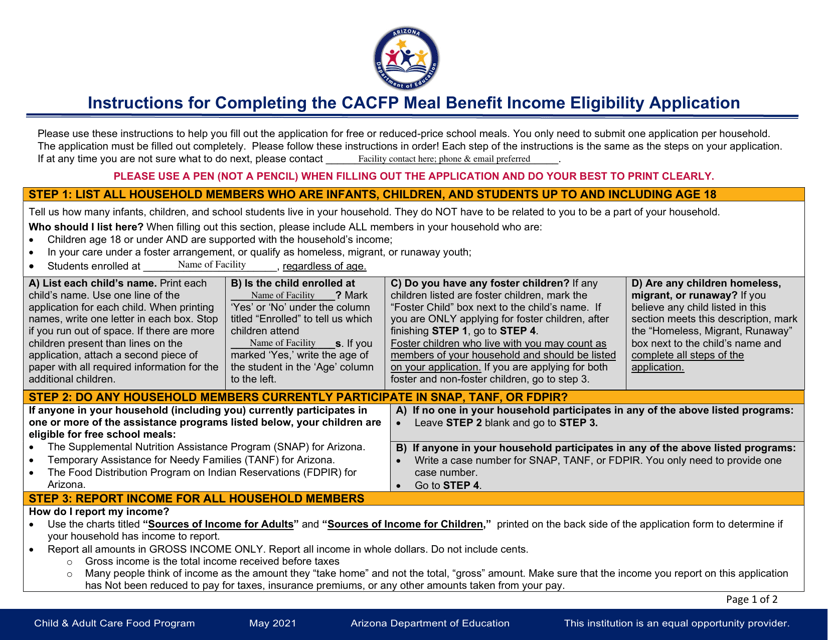

This form is used for applying for income eligibility for the Child and Adult Care Food Program (CACFP) in Arizona. It provides instructions on how to complete the form and determine if you qualify for meal benefits.

This document is used for determining the income eligibility of adults participating in the Child and Adult Care Food Program to receive meal benefits.

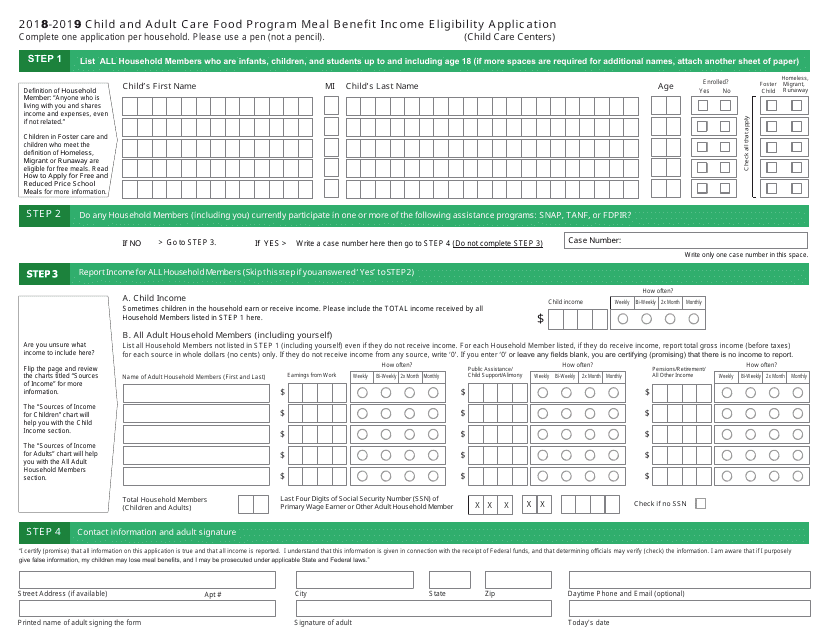

This type of document is a form used in Arizona to apply for income eligibility for the Child and Adult Care Food Program meal benefits.

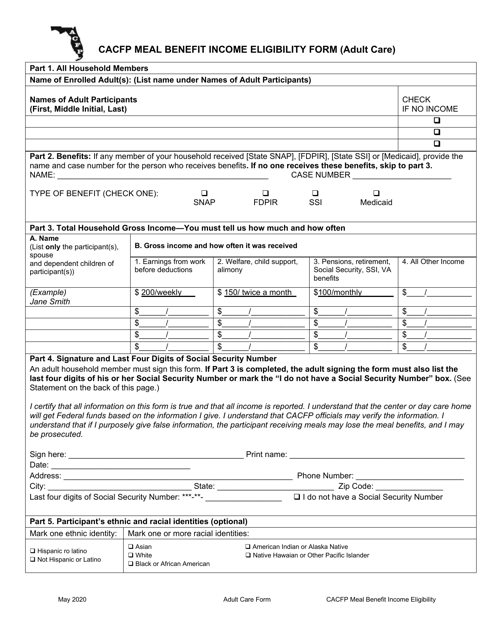

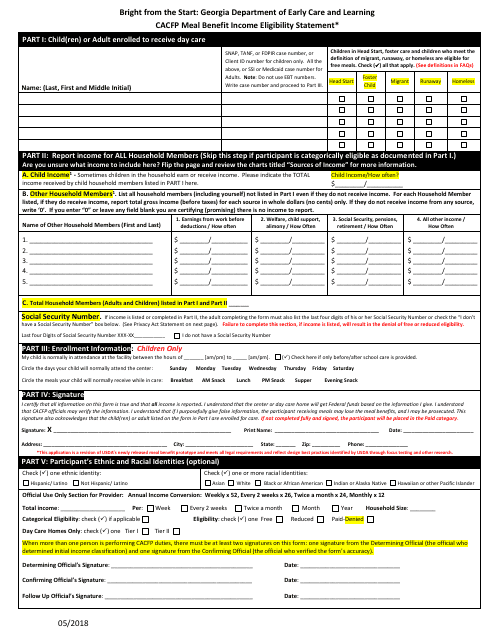

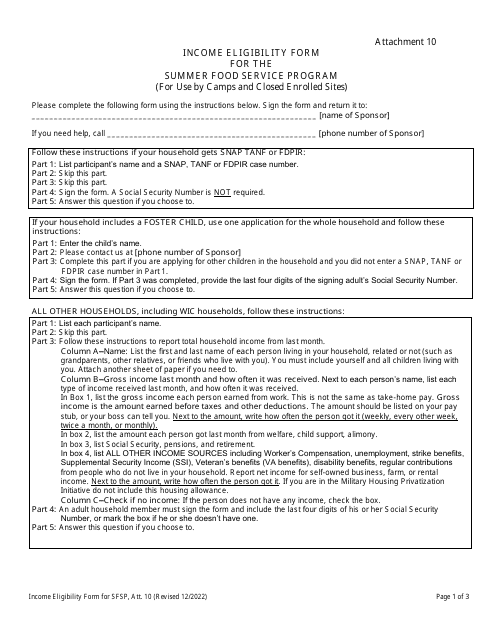

This form is used for determining income eligibility for the Child and Adult Care Food Program (CACFP) in Georgia.

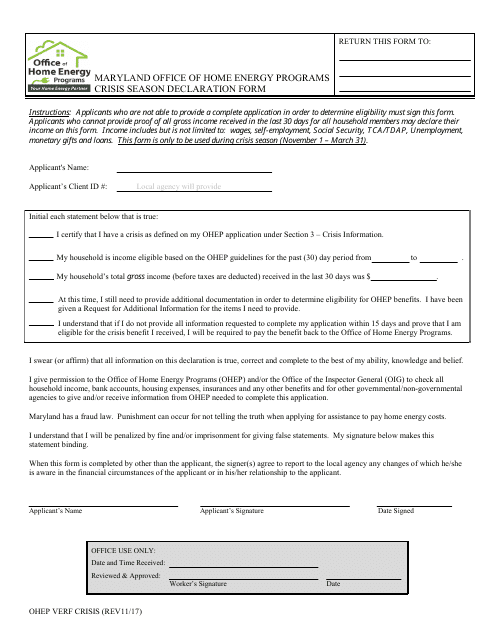

This Form is used for declaring a crisis season in the Office of Home Energy Programs in Maryland.

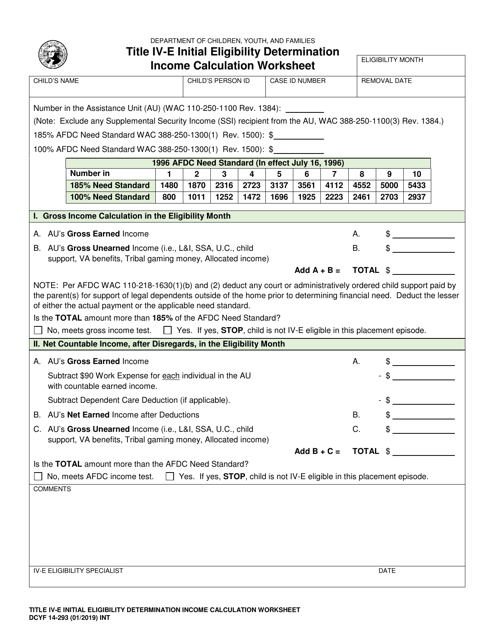

This document is used for calculating income eligibility for Title IV-E assistance in Washington. It is a worksheet provided by the DCYF (Department of Children, Youth, and Families).

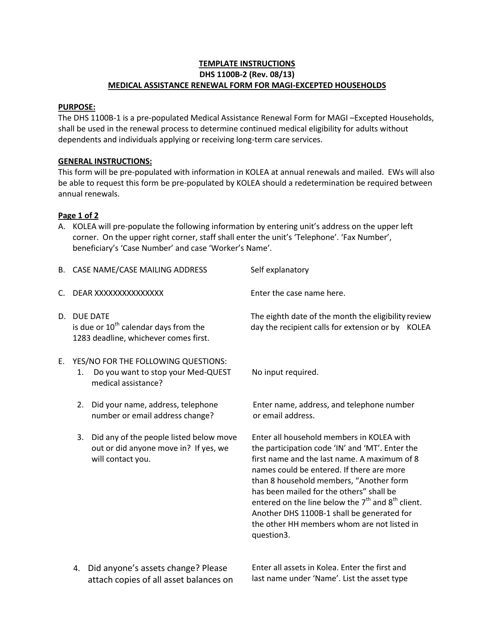

This Form is used for renewing medical assistance for Magi-Excepted Households in Hawaii. It provides instructions for completing the renewal form DHS1100B-2.

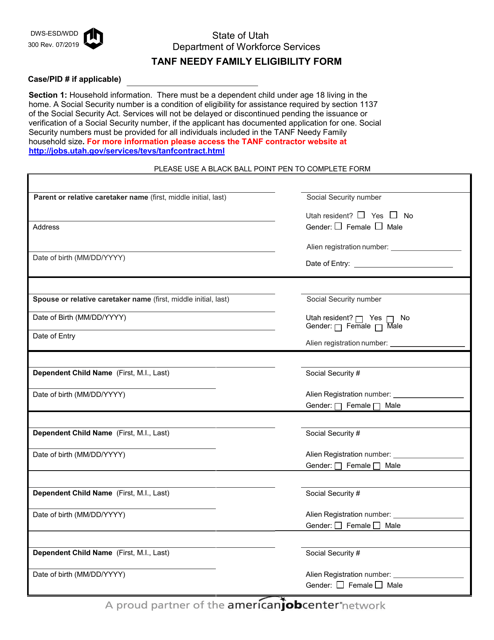

This form is used for determining eligibility for the TANF (Temporary Assistance for Needy Families) program in Utah.

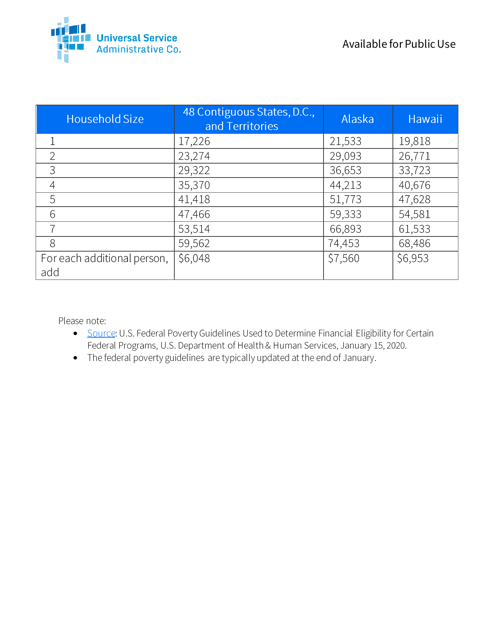

This document provides the Federal Poverty Guidelines for eligibility in the Lifeline program administered by USAC.

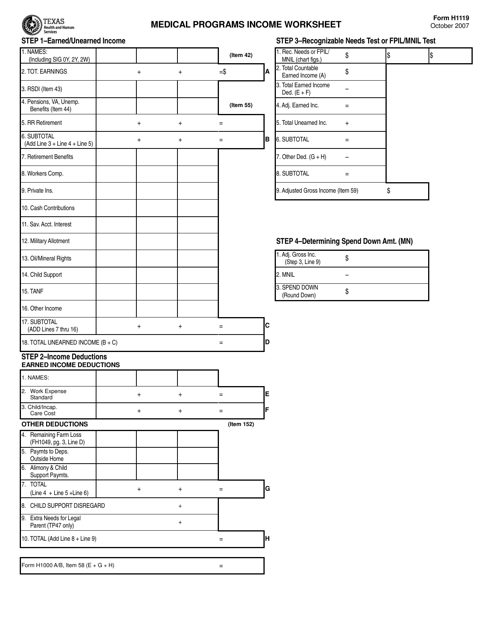

This form is used to calculate income for medical programs in Texas. It helps determine eligibility for Medicaid and other healthcare assistance programs.

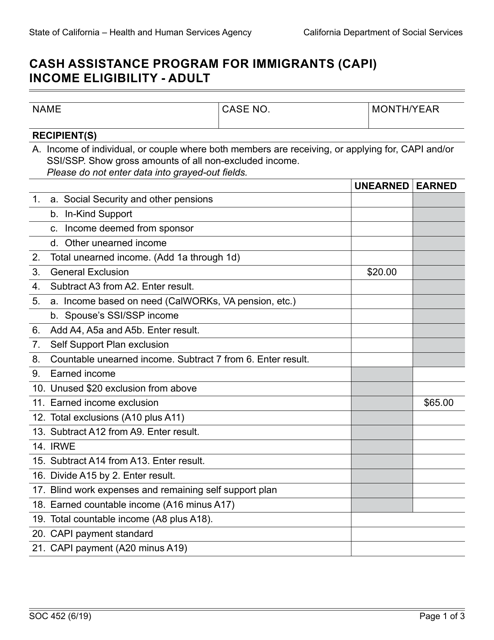

This form is used for determining income eligibility for the Cash Assistance Program for Immigrants (CAPI) in California for adults.

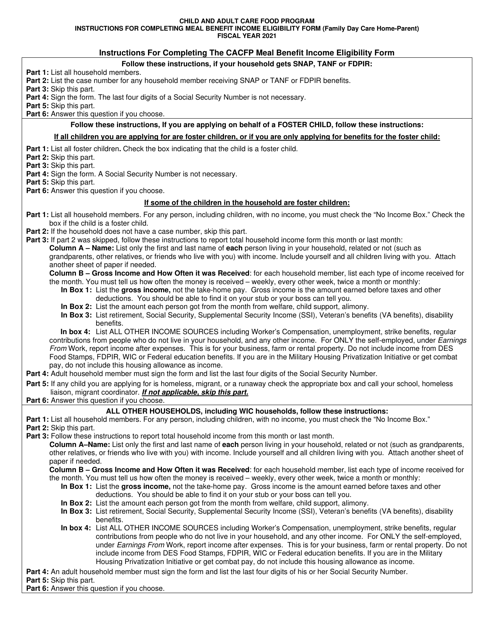

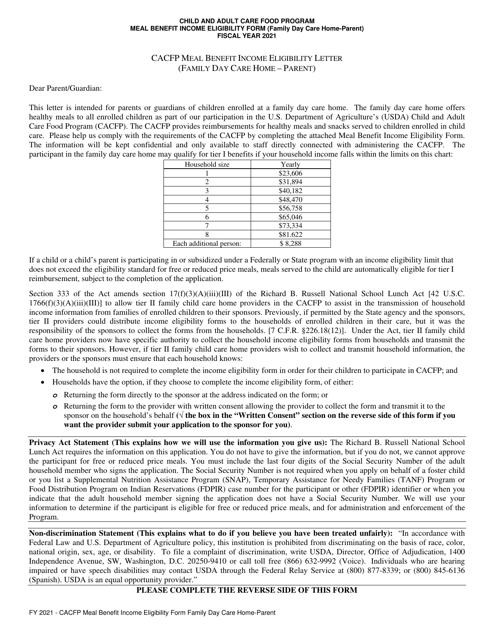

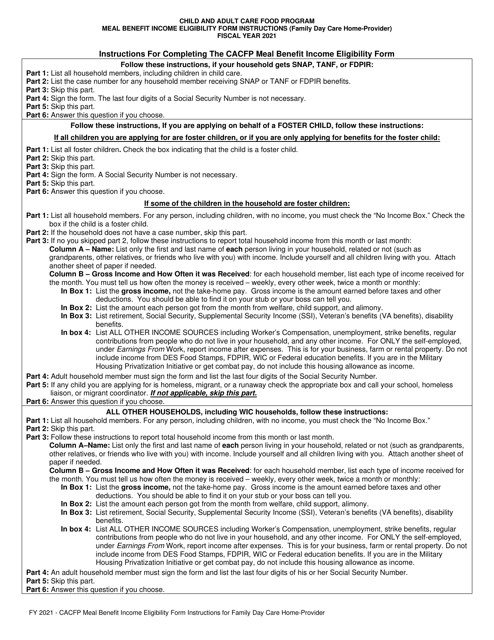

This document is used for determining the income eligibility of families in Arizona who participate in the Child and Adult Care Food Program (CACFP) at family day care homes. It provides instructions on how to fill out the form for determining the meal benefits for eligible families.

This form is used for determining the income eligibility of families of children in family day care homes for the Child and Adult Care Food Program (CACFP) in Arizona.

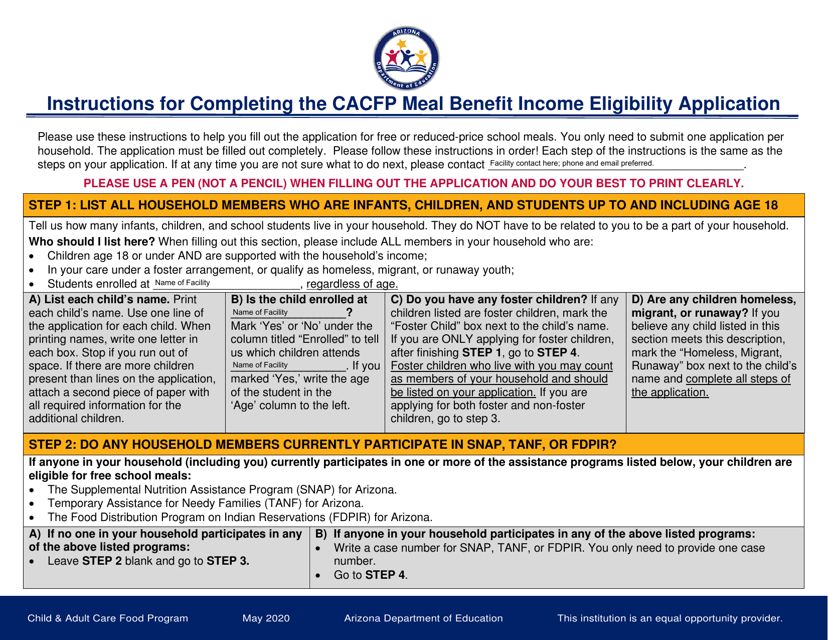

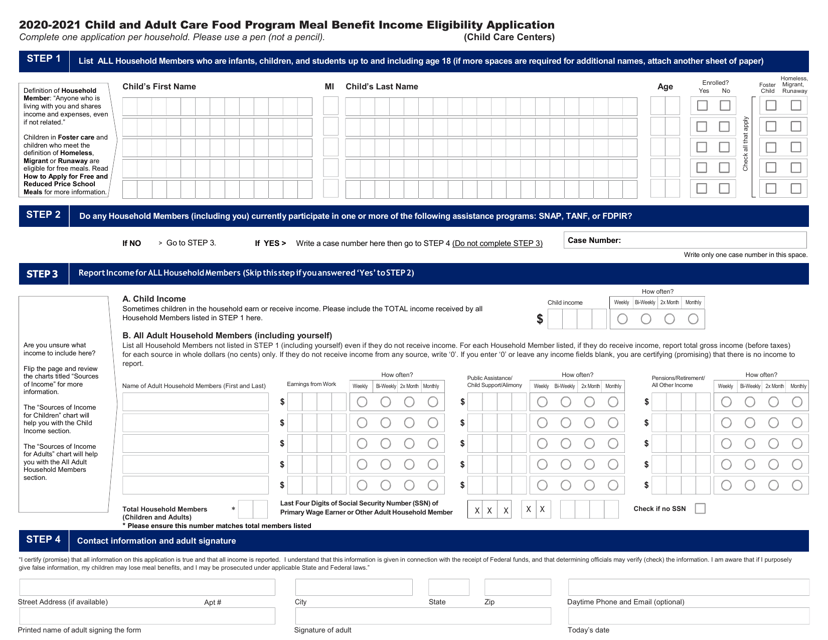

This document provides instructions for completing the application to determine income eligibility for the Child and Adult Care Food Program in Arizona. It ensures that individuals meet the requirements to receive meal benefits.

This form is used for applying for the CACFP meal benefit program in Arizona. It helps determine if an individual or family is eligible based on their income.

This document provides instructions for the CACFP Meal Benefit Income Eligibility Form for Family Day Care Home Providers in Arizona. It helps providers determine the eligibility of their meals for reimbursement under the CACFP program.

This form is used for determining meal benefit income eligibility for adult participants in Arizona. It provides instructions on how to fill out the form and gather the necessary information.

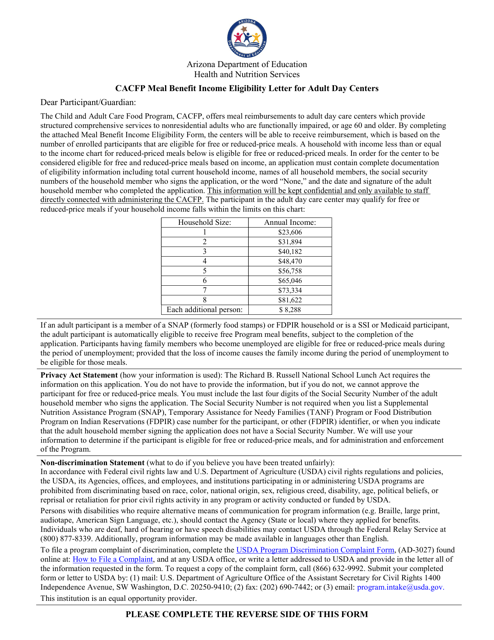

This document is used to determine the income eligibility of adult day centers participating in the CACFP meal benefit program in Arizona. It provides information on whether the center qualifies for meal benefits based on the income of the individuals they serve.

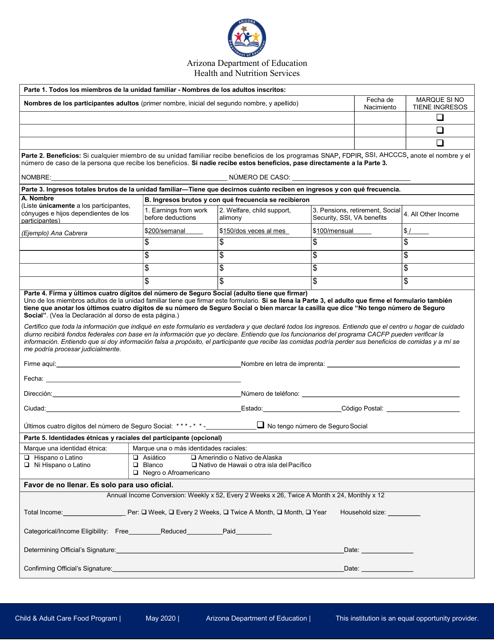

This document is used for determining the income eligibility for meal benefits in Arizona. It is available in Spanish.

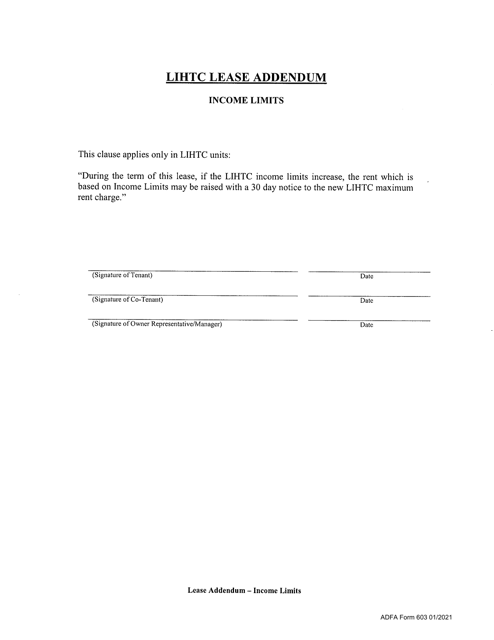

This document is a form used for adding an income limit provision to a Low-Income Housing Tax Credit (LIHTC) lease in Arkansas. It helps ensure that tenants meet the income requirements for affordable housing.

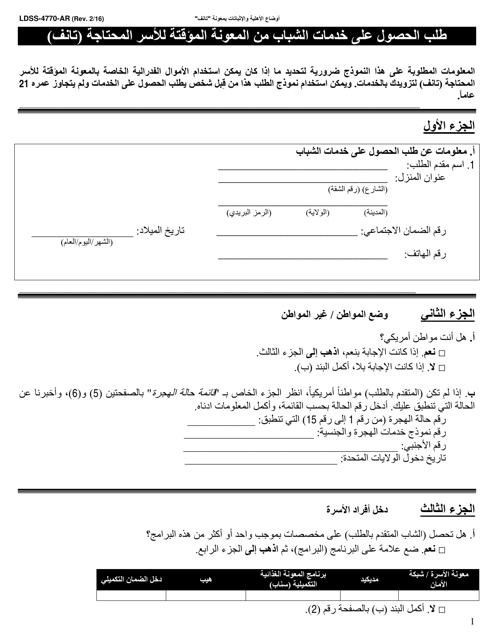

This form is used for applying for TANF Youth Services in New York. It is available in both English and Arabic languages.