Supplemental Income Templates

Are you looking to boost your income and supplement your current earnings? Look no further! We have a wide range of resources and documents available to help you in your quest for supplemental income. Whether you're looking for a part-time job, a gig economy opportunity, or additional ways to generate revenue, our collection of documents is here to support you.

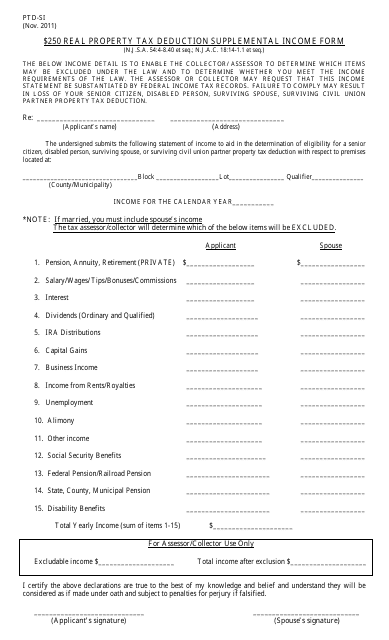

Our extensive selection of resources includes the Supplemental Income Form PTD-SI 250 Real PropertyTax Deduction Supplemental Income Form from New Jersey. This document provides valuable information on how to report your supplemental income for tax purposes, ensuring that you stay compliant with state regulations.

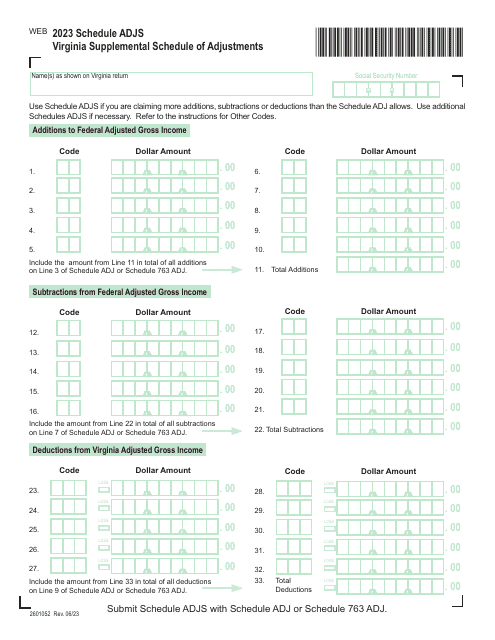

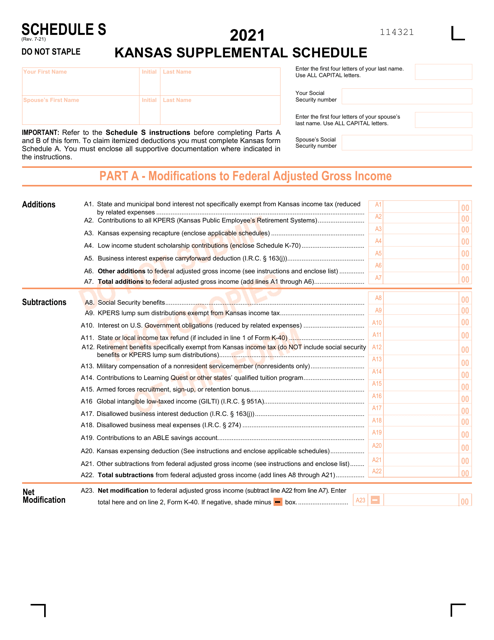

If you're in Virginia, you'll find the Schedule ADJS Supplemental Schedule of Income document helpful. This schedule allows you to accurately track and report any additional income you earn, ensuring that you don't miss out on potential deductions and credits.

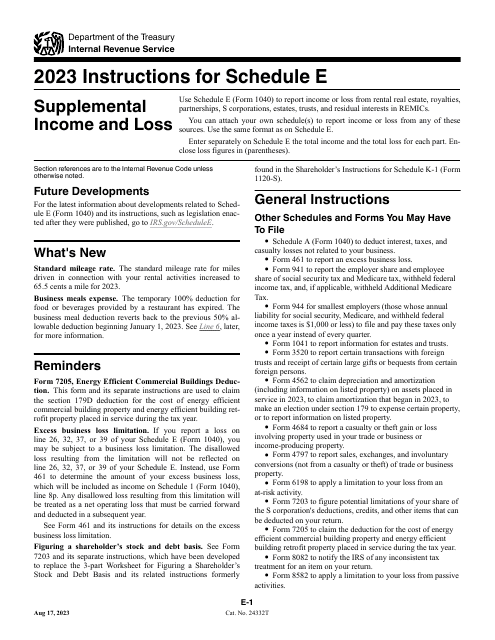

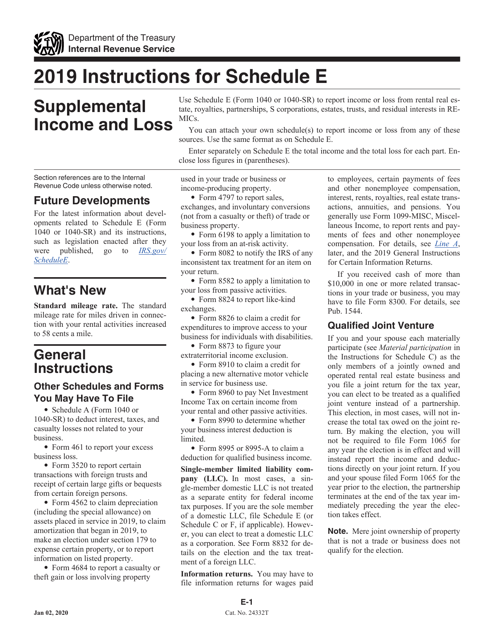

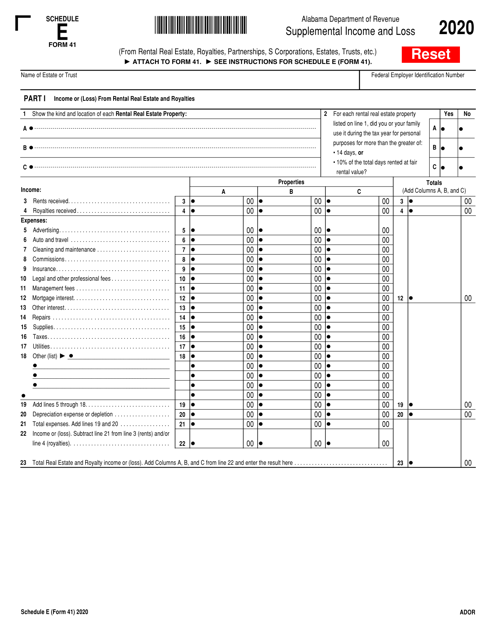

For those in the US, the IRS Form 1040 (1040-SR) Schedule E Supplemental Income and Loss document is a crucial tool in reporting extra income sources. This form assists in calculating your taxable supplemental income and any associated losses, maximizing your potential tax benefits.

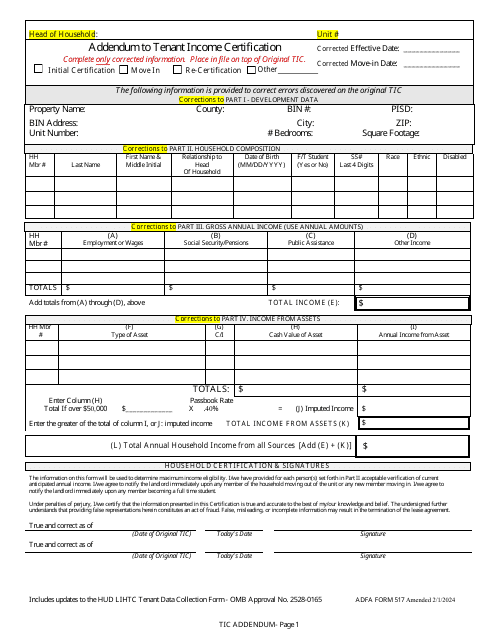

Local to Arkansas? Look no further than the ADFA Form 517 Addendum to Tenant Income Certification document. This document is designed for tenants who receive supplemental income and provides a supplementary certification to ensure accurate reporting.

Supplemental income isn't just for individuals; businesses, too, can benefit. That's why we've included the Schedule E RECONCILIATION Total Supplemental Income and (Loss) - Draft document from Massachusetts. This tool allows businesses to reconcile their total supplemental income and any associated losses, ensuring accurate financial reporting.

At Templateroller.com, we understand the importance of additional income in today's challenging economic climate. Our comprehensive collection of documents, including income supplements and alternative earning opportunities, is here to support you on your journey. Don't miss out on the potential of supplemental income - explore our resources today!

Documents:

18

This form is used for reporting supplemental income for the Real Property Tax Deduction in New Jersey.

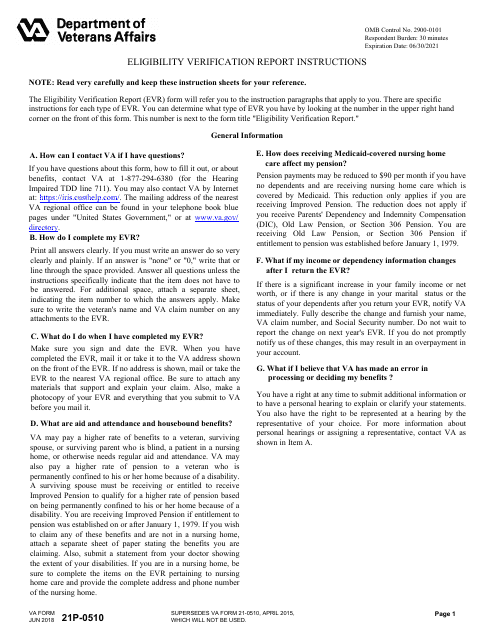

This form is used for verifying eligibility for improved pension benefits. It provides instructions on how to complete VA Form 21P-0510.

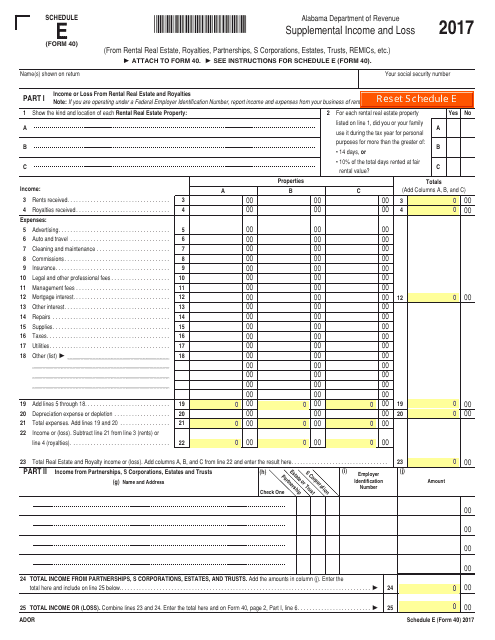

This Form is used for reporting supplemental income and loss in the state of Alabama.

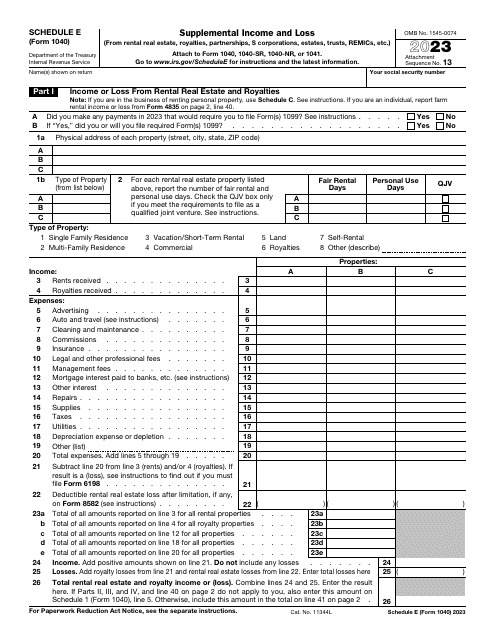

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

This Form is used for reporting supplemental income and loss on your individual tax return. It is an attachment to Form 1040 or 1040-SR.

This Form is used for reporting supplemental income and losses in Alabama.

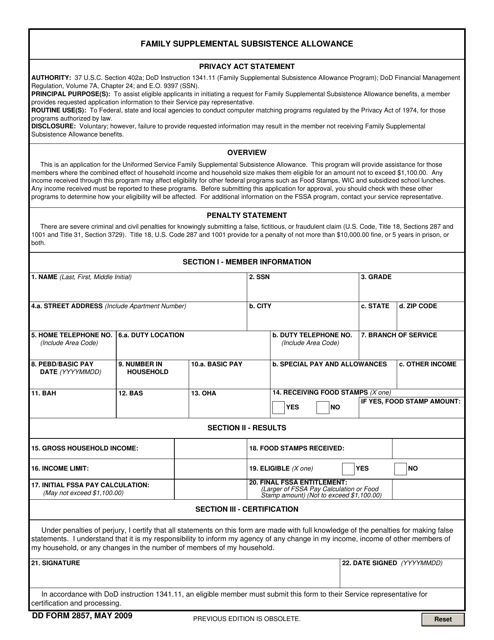

This document is used for applying for the Family Supplemental Subsistence Allowance program. It helps military families receive additional financial assistance to meet their basic needs.