Partner Shares Templates

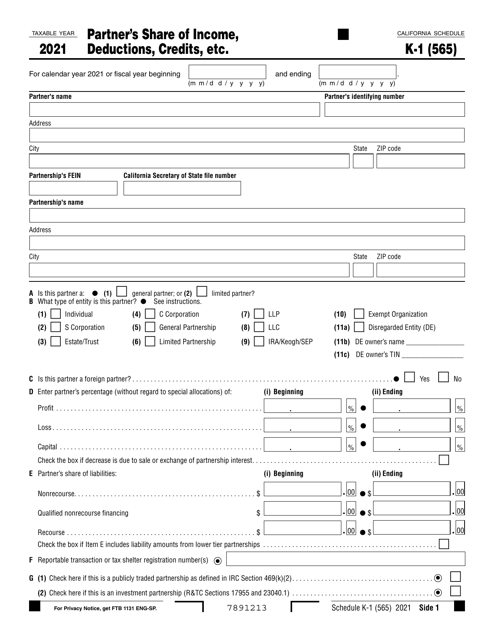

Partner Shares (also known as Partners Share or Partnerships Share) is a collection of documents that provide detailed information about the distribution of income, deductions, adjustments, and credits among partners in various business partnerships. These documents serve as a comprehensive record of each partner's share of profits, losses, and tax liabilities.

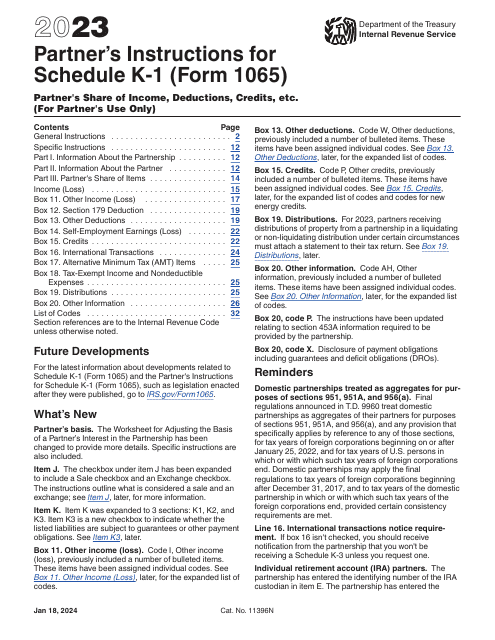

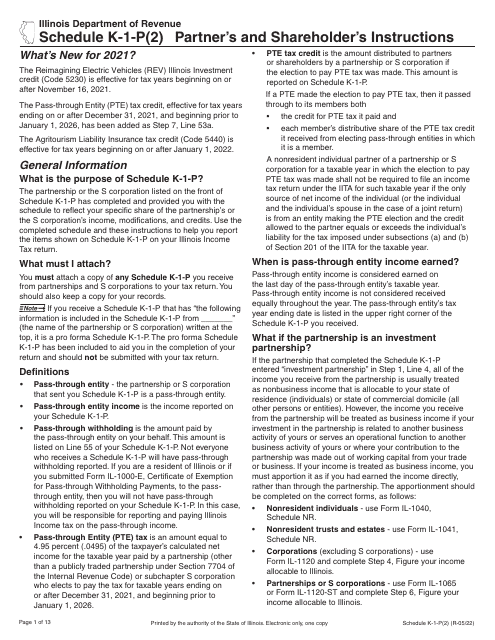

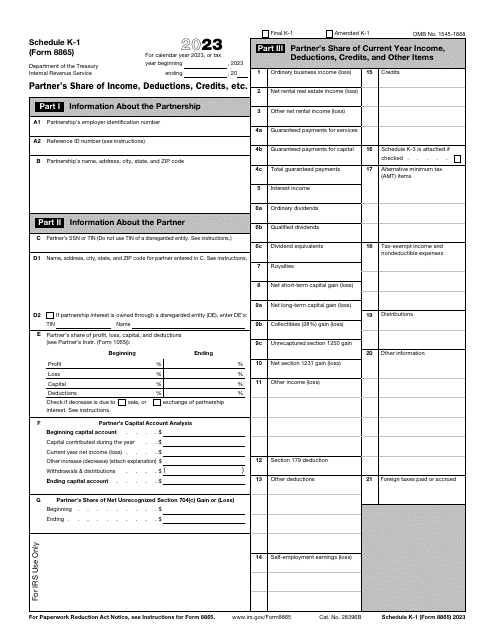

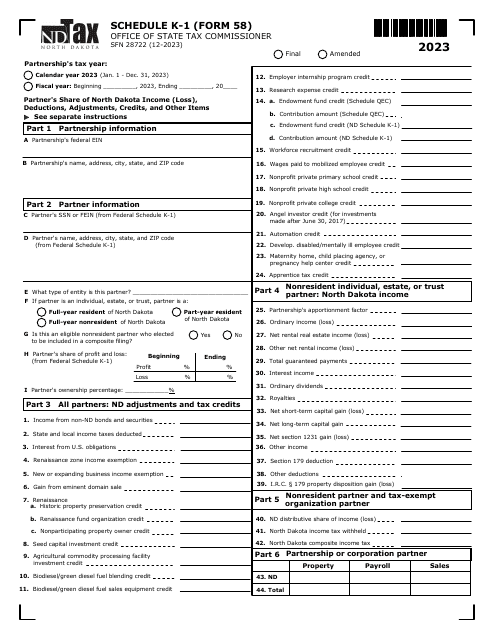

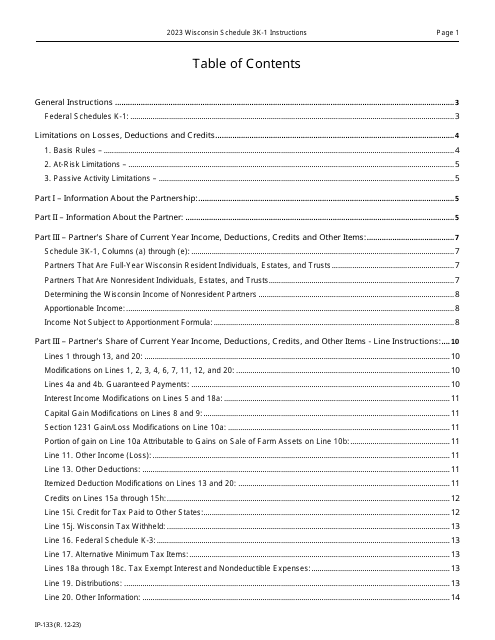

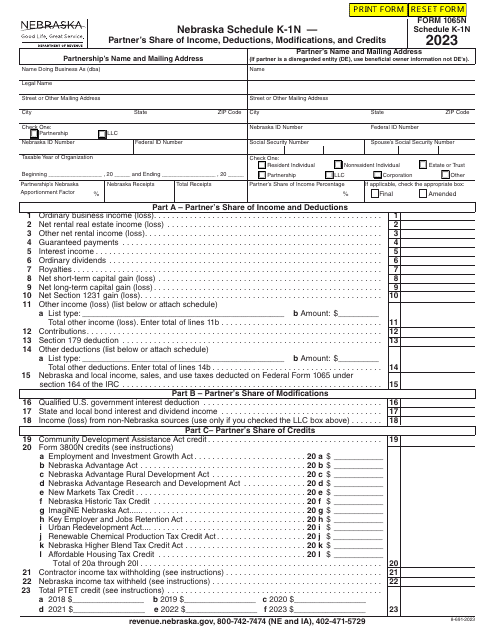

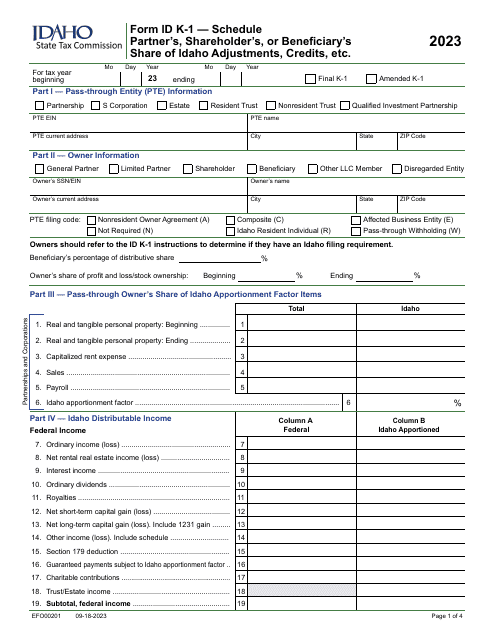

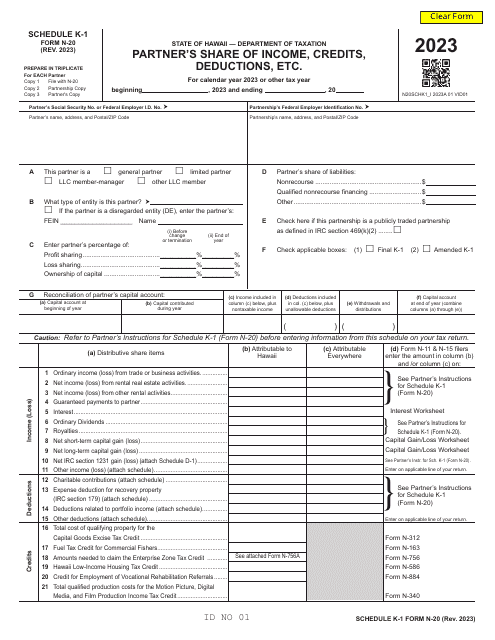

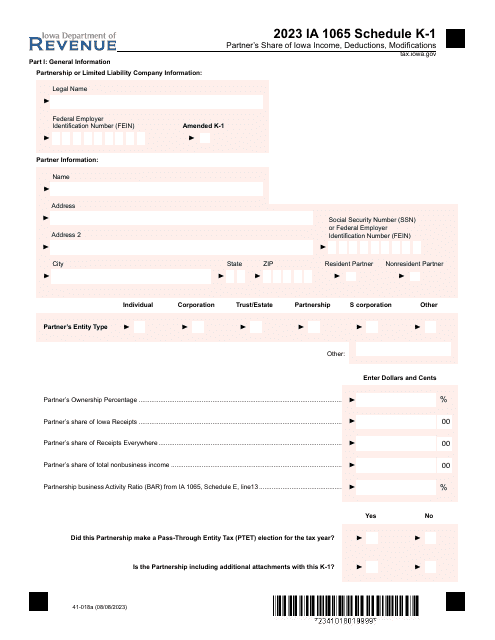

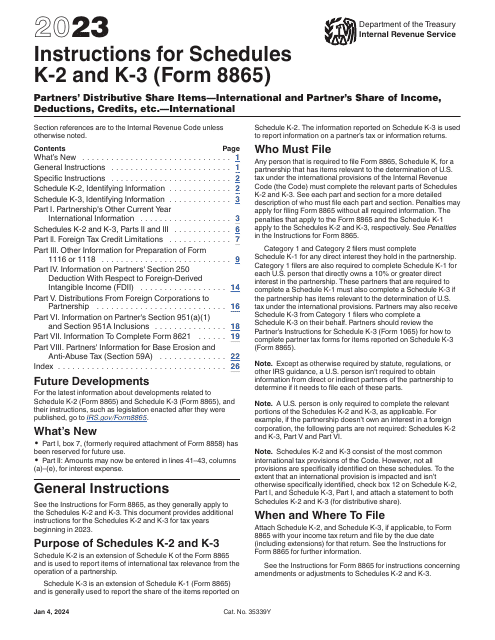

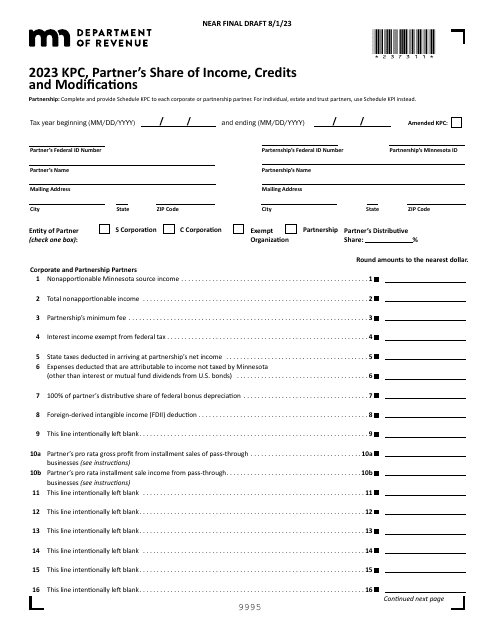

Within the Partner Shares document group, you can find various forms and schedules such as the Form D-403 NC K-1 Partner's Share of North Carolina Income, Adjustments, and Credits in North Carolina, IRS Form 8865 Schedule K-1 Partner's Share of Income, Deductions, Credits, Etc., and IRS Form 8865 Schedule K-3 Partner's Share of Income, Deductions, Credits, Etc. for international partnerships. Additionally, you may come across the Form ID K-1 (EFO00201) Partner's, Shareholder's or Beneficiary's Share of Idaho Adjustments, Credits, Etc., serving the purpose of reporting partner shares in Idaho.

These partner share documents are crucial for partners in understanding their individual financial responsibilities and tax obligations within the partnership. They provide an accurate breakdown of the partnership's financial activities and assist in ensuring compliance with tax regulations. By analyzing these documents, partners can make informed business decisions, allocate resources effectively, and accurately report their share of income, deductions, and credits.

Whether you are a partner in a local or international partnership or operating within a specific state, the Partner Shares document group is vital for maintaining accurate financial records and meeting your tax obligations. Understanding your partner share allows for transparent and fair distribution of profits and losses, ensuring the partnership operates smoothly and efficiently.

Disclaimer: This text is for informational purposes only and should not be considered legal, financial, or tax advice. It is always recommended to consult with a qualified professional for personalized guidance regarding your specific partnership and tax situation.

Documents:

42

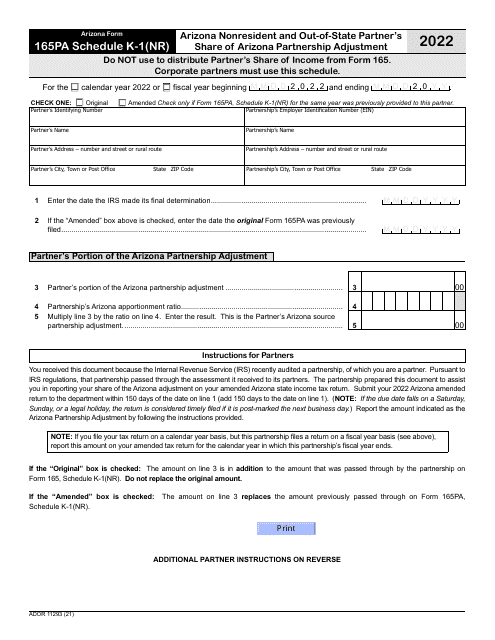

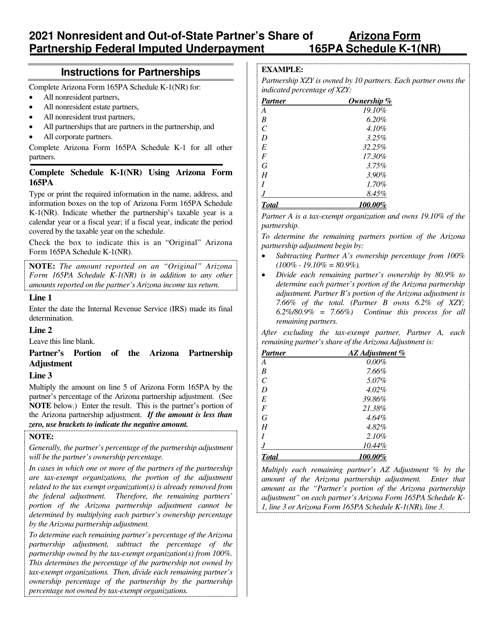

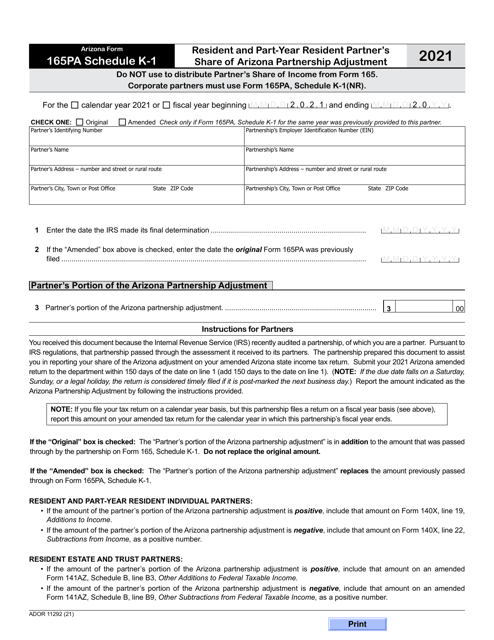

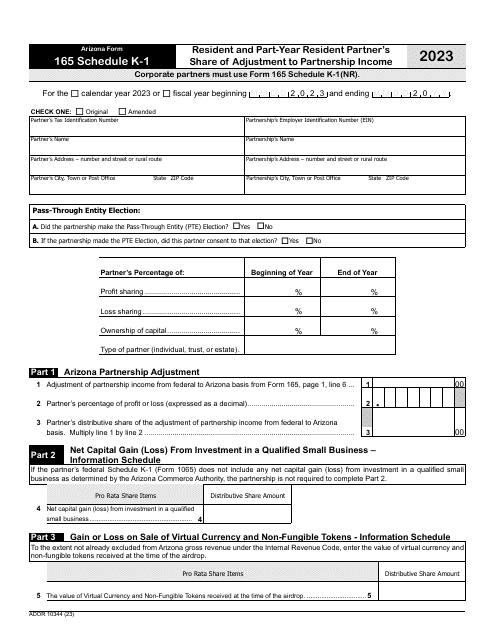

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

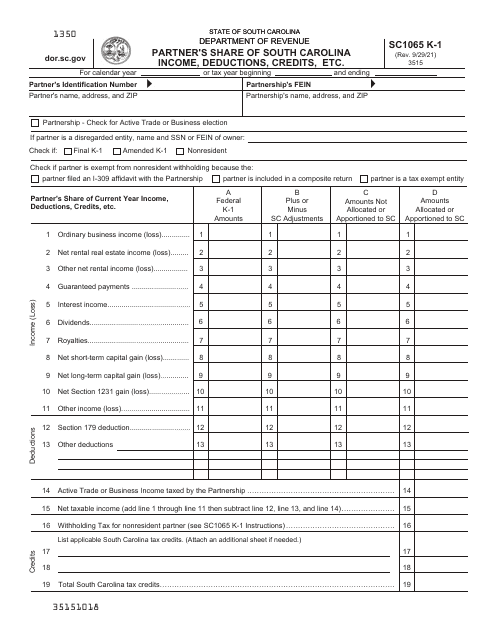

Form SC1065 K-1 Partner's Share of South Carolina Income, Deductions, Credits, Etc. - South Carolina

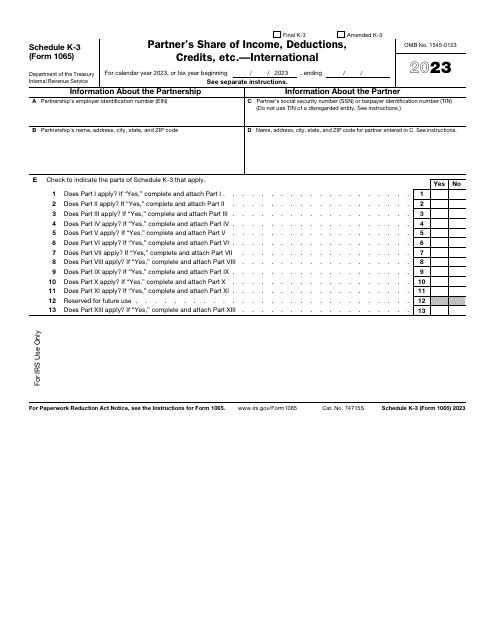

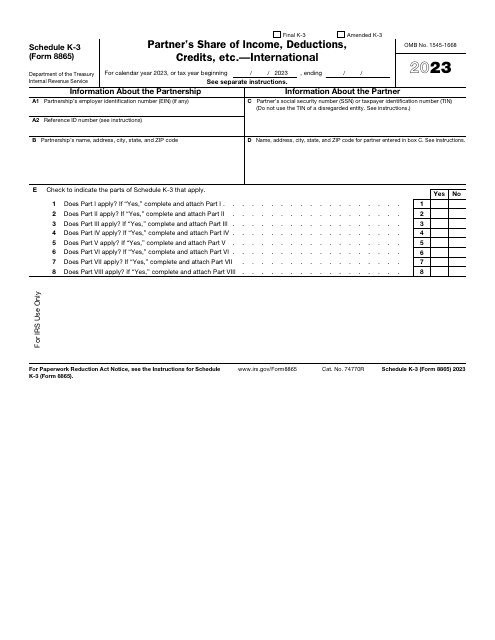

This is a fiscal IRS form designed to specify a partner's distributive share of various items that have international tax relevance.

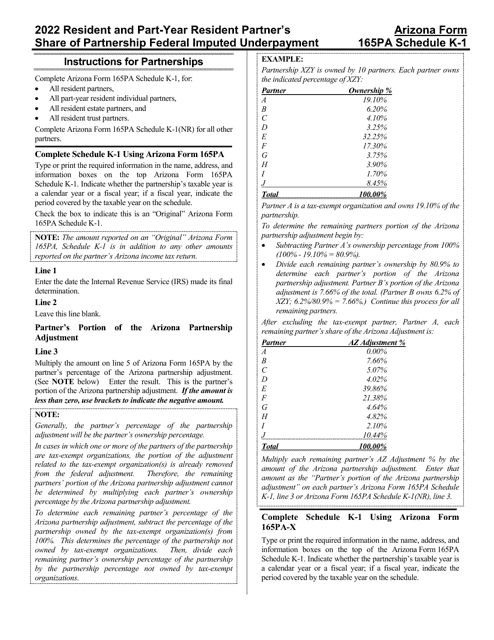

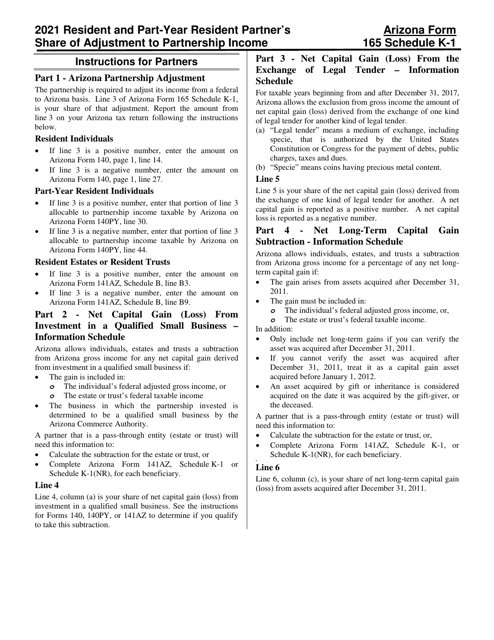

This Form is used for reporting a resident or part-year resident partner's share of Arizona Partnership Adjustment on Schedule K-1.