Schedule Cf Templates

The Schedule CF, also known as the CF Inventory of Stamps and Cigarettes and Little Cigars on Hand, is a crucial document for businesses in the tobacco industry. This document serves as a way for businesses to keep track of their inventory of stamps, cigarettes, and little cigars. It is mandatory for businesses in Illinois, Wisconsin, and other states to accurately complete and file their Schedule CF forms to comply with the respective regulations.

The Schedule CF is an essential tool for businesses to manage their inventory and ensure compliance with state laws and regulations. This document helps businesses maintain accurate records of their stock of stamps, cigarettes, and little cigars, enabling them to handle tax reporting, inventory control, and compliance procedures efficiently.

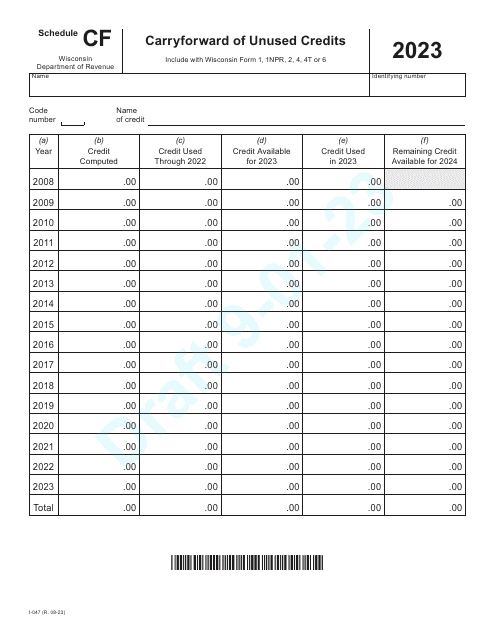

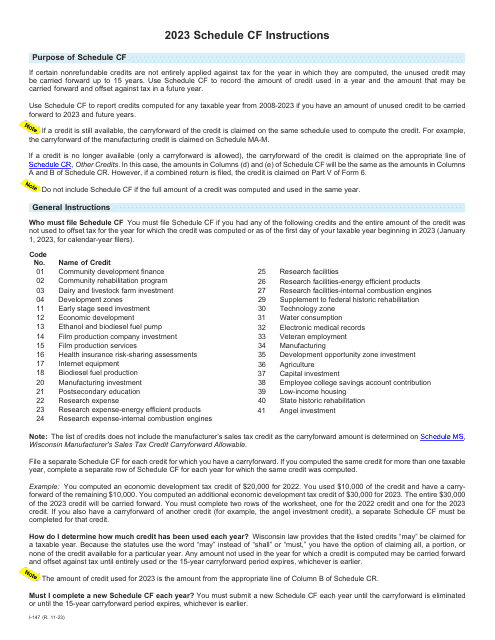

Furthermore, the Schedule CF allows businesses to carry forward any unused credits, as indicated in the Form I-047 Schedule CF Carryforward of Unused Credits used in Wisconsin. By completing this form, businesses can benefit from the ability to carry over any unused credits to future tax periods.

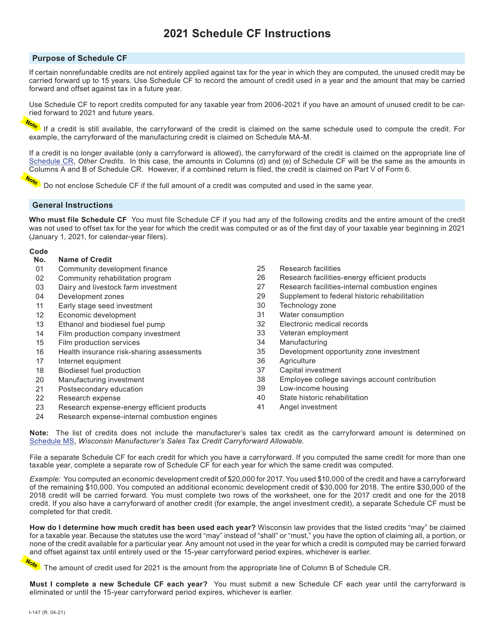

To ensure proper completion of the Schedule CF, businesses should refer to the detailed instructions provided by state authorities. For example, Wisconsin offers detailed instructions for completing the Form I-047 Schedule CF Carryforward of Unused Credits.

Overall, the Schedule CF serves as a vital document for businesses in the tobacco industry, allowing them to accurately track and report their inventory of stamps, cigarettes, and little cigars while also providing the opportunity to carry forward any unused credits. By staying compliant with state regulations and keeping accurate records, businesses can successfully manage their operations and tax obligations.

Documents:

7

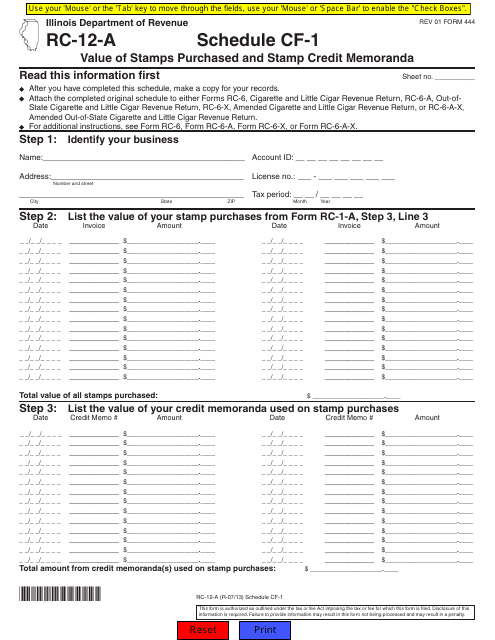

This form is used to report the value of stamps purchased and stamp credit memoranda in the state of Illinois.

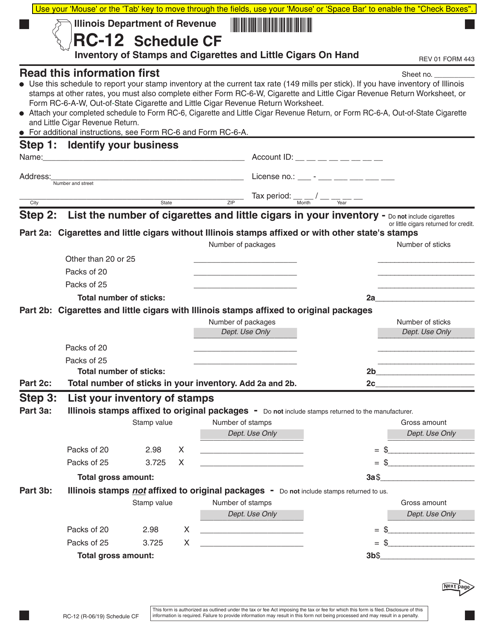

Form RC-12 (443) Schedule CF Inventory of Stamps and Cigarettes and Little Cigars on Hand - Illinois

This document is used for reporting the inventory of stamps, cigarettes, and little cigars that a person or business in Illinois has on hand.

This Form is used for carrying forward unused tax credits in the state of Wisconsin. It provides instructions on how to report and claim these credits from previous years.