Mobility Tax Templates

If you're a New York nonresident individual partner or employer, it's important to understand your obligations when it comes to the Metropolitan Commuter Transportation Mobility Tax (MCTMT). This tax, also known as mobility tax, is a levy imposed by the state of New York to fund public transportation services in certain regions.

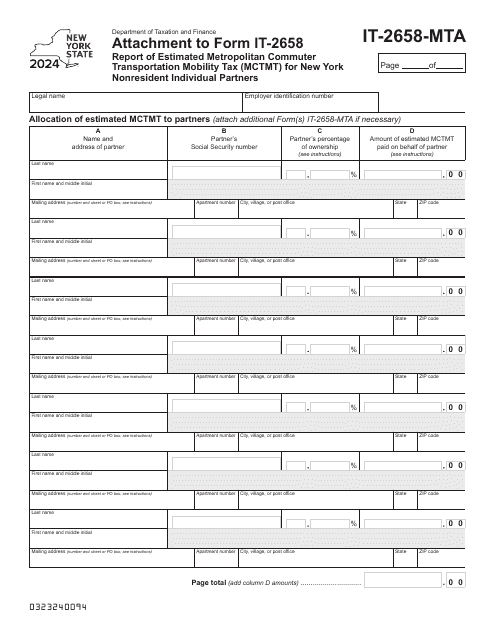

To comply with the MCTMT requirements, nonresident individual partners must submit Form IT-2658-MTA, also referred to as the "Report of Estimated Metropolitan Commuter Transportation Mobility Tax." This form allows you to report and pay your estimated MCTMT liability. By accurately completing this form, you ensure that you contribute your fair share to support the transportation infrastructure.

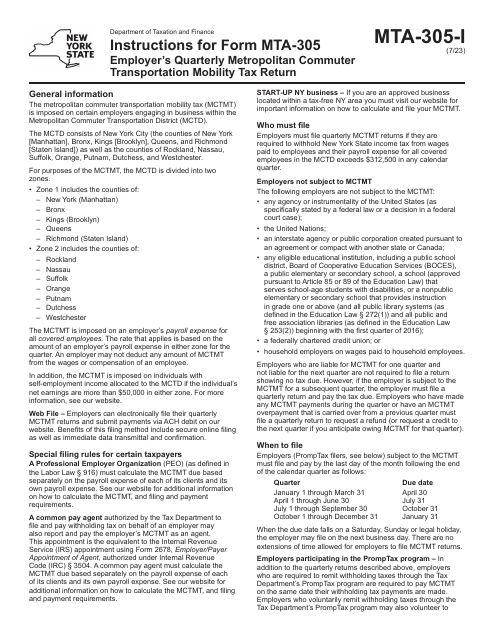

Similarly, employers in New York have their own obligations related to the MCTMT. They must file Form MTA-305, the "Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return." This return enables employers to report and remit the MCTMT on behalf of their employees.

Understanding and navigating the MCTMT requirements can be complex, which is why it's vital to familiarize yourself with the comprehensive instructions provided by the state. These instructions guide taxpayers through the process of completing the relevant forms, ensuring accurate reporting, and avoiding potential penalties.

By staying informed about the MCTMT and fulfilling your obligations, you demonstrate your commitment to supporting the public transportation system in the designated regions. Keep up to date with any changes in legislation or reporting requirements to remain compliant and contribute to the mobility tax program effectively.

Documents:

5