Tax Lien Templates

Are you in need of information about tax liens and how they work? Look no further! Our comprehensive collection of tax lien documents will provide you with all the details you need to understand the process. Whether you are a taxpayer looking to apply for a certificate of tax liens and other charges, a property owner interested in participating in a tax lien auction or sale, or simply seeking instructions on how to file a notice of tax lien or release, our documents have got you covered.

Our tax lien documents cover a wide range of topics and procedures, ensuring that you have access to the information you need, regardless of your specific circumstances. Need to know how to redeem a tax lien? We have forms and instructions for that too! Our collection includes resources from various states across the country, including Charles County, Maryland, Alabama, Vermont, Texas, and Massachusetts.

Explore our tax lien document collection today and gain a better understanding of how tax liens work, how to navigate the process, and how to protect your interests. With our comprehensive and easy-to-use resources, you'll have all the information you need at your fingertips. Don't let tax liens become a source of confusion or stress - let our documents guide you through the process seamlessly and efficiently.

Let us assist you with all your tax lien needs. Browse our collection today and take the first step towards becoming informed and empowered.

Documents:

23

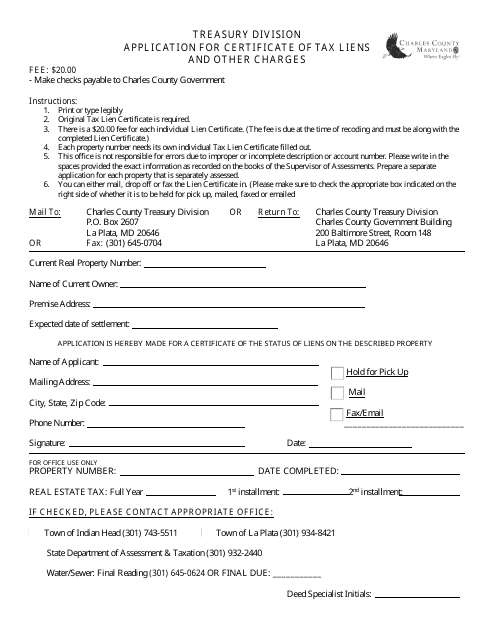

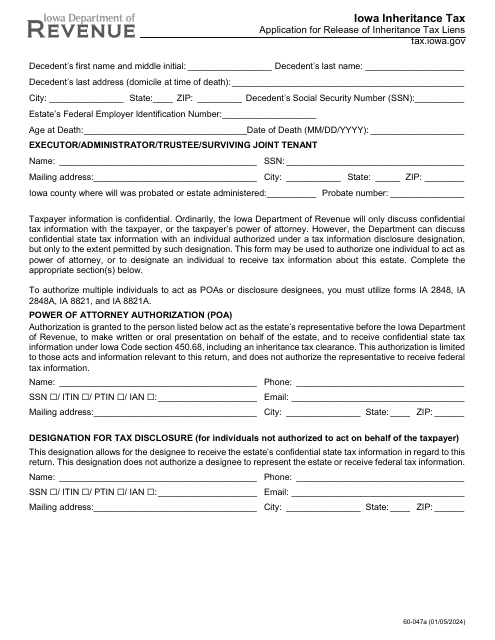

This document is used for applying for a certificate of tax liens and other charges in Charles County, Maryland. It is necessary for individuals or businesses who owe unpaid taxes or other outstanding charges to the county. The certificate serves as proof of the outstanding debts and is often required in real estate transactions or loan applications.

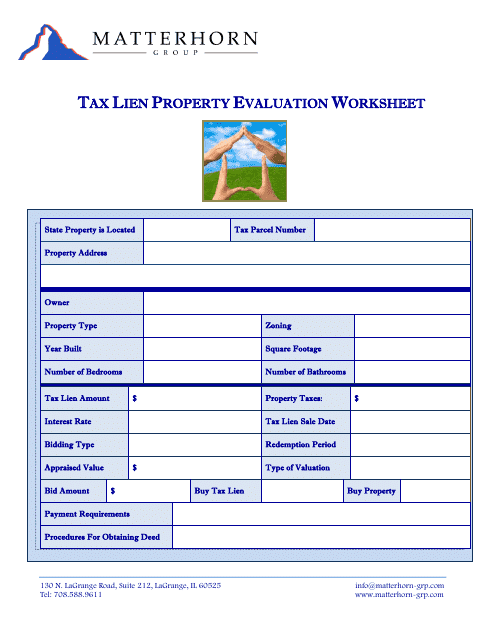

This document is a template used to evaluate tax lien properties. It is designed to be used by the Matterhorn Group.

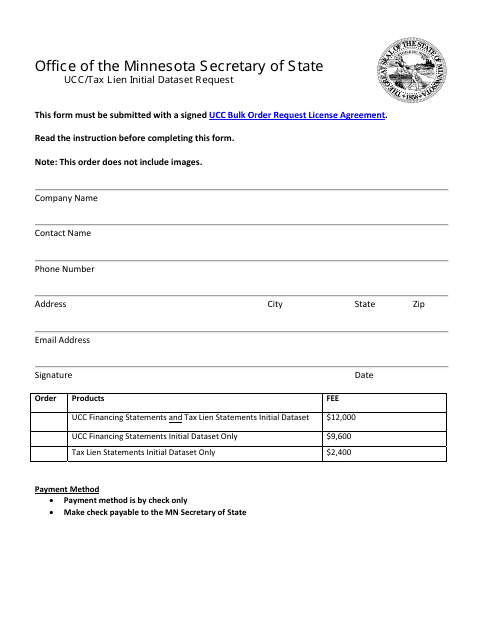

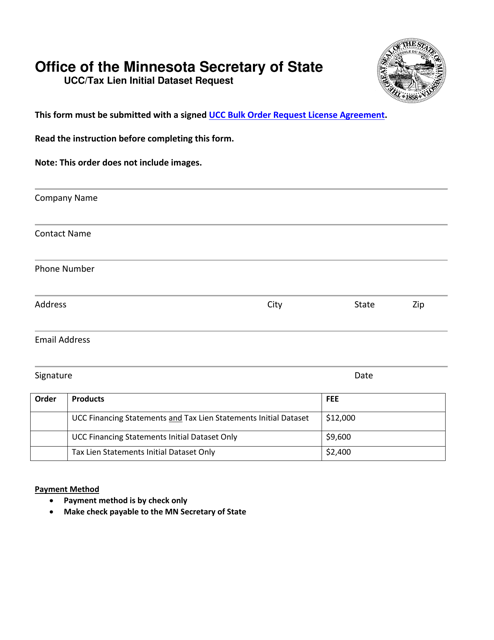

This type of document is a formal request form used in Minnesota to initiate the process of acquiring UCC and Tax Lien datasets.

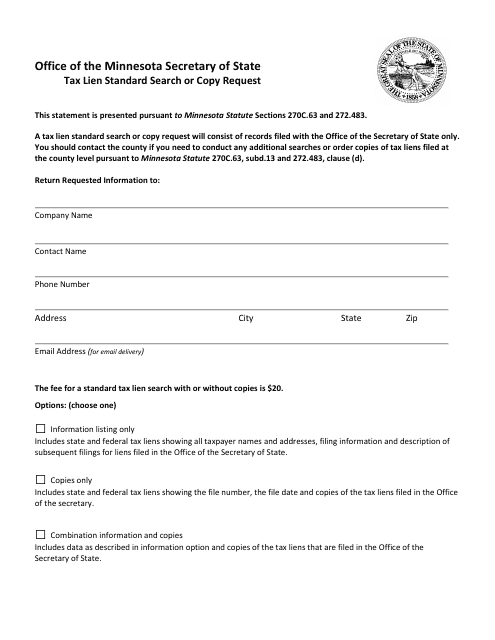

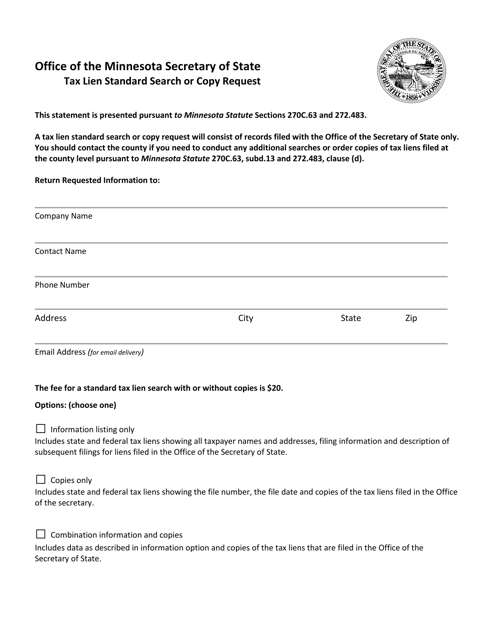

This type of document is used to request a standard search or copy of tax lien information in Minnesota.

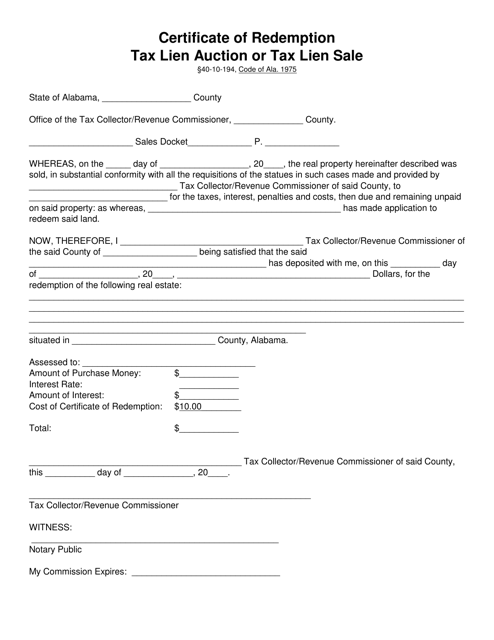

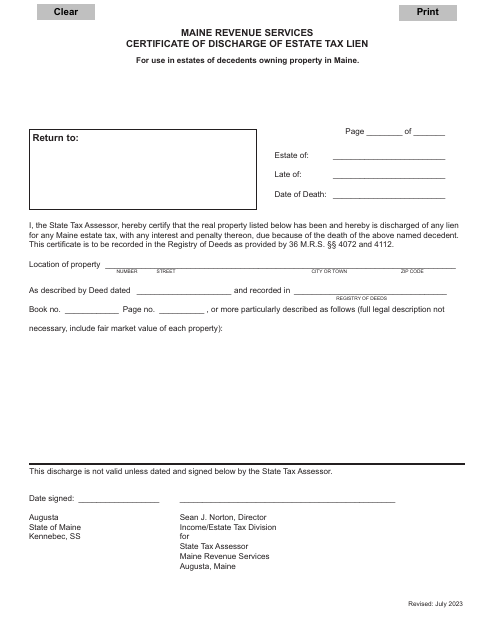

This type of document is used for certifying the redemption of a tax lien in Alabama after an auction or sale has taken place. It confirms that the property owner has paid the required amount to redeem the tax lien and regain ownership of the property.

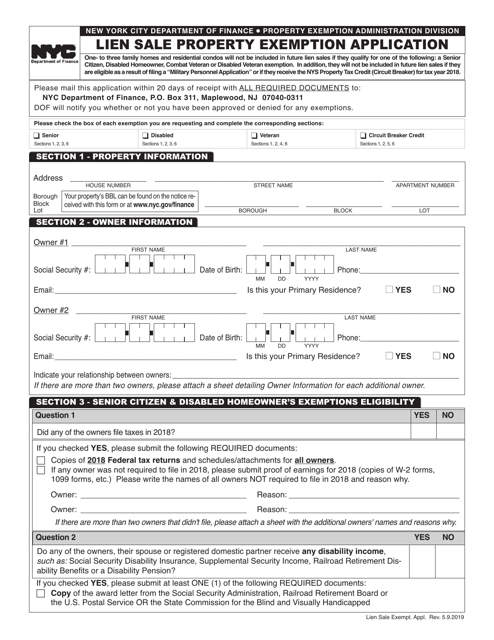

This document is for applying for an exemption on a property being sold through a lien sale in New York City.

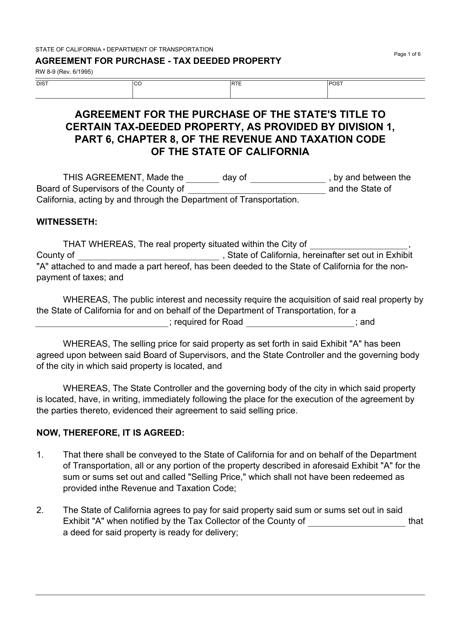

This form is used for creating an agreement for the purchase of a tax deeded property in California.

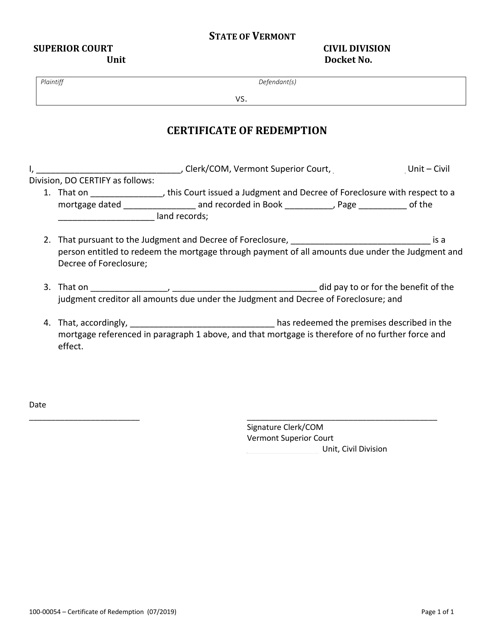

This form is used for the process of redeeming a property in the state of Vermont.

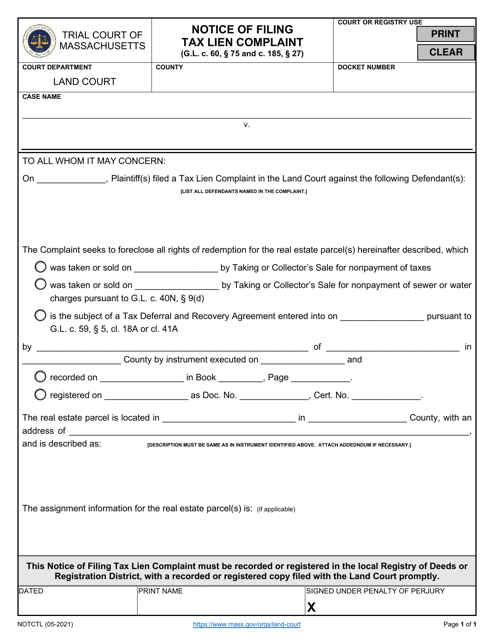

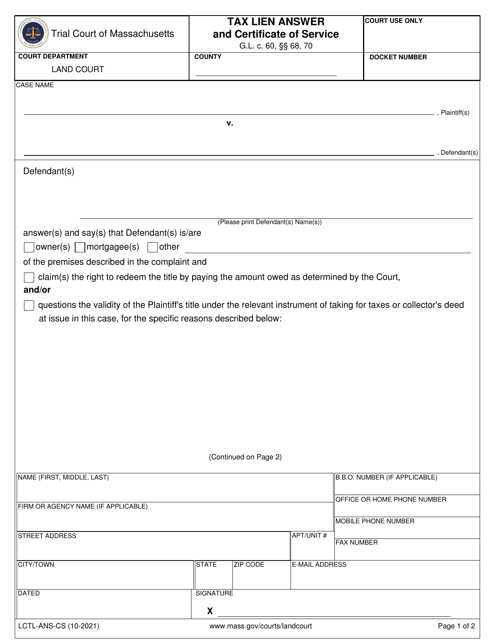

This form is used for filing a tax lien complaint in Massachusetts. It notifies the taxpayer that a lien has been filed against them for unpaid taxes.

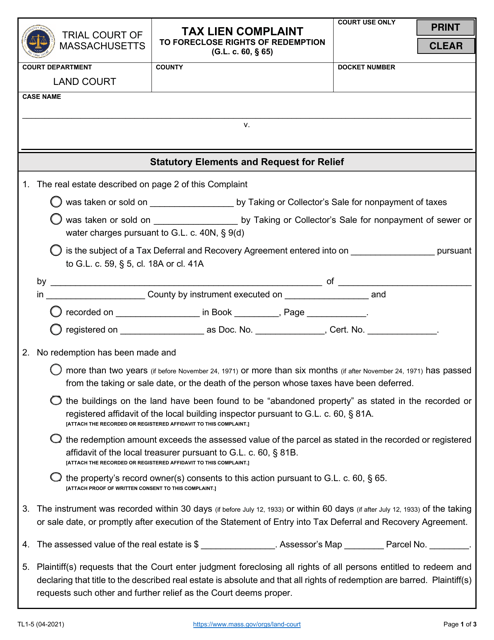

This form is used for filing a tax lien complaint to foreclose the rights of redemption in Massachusetts.

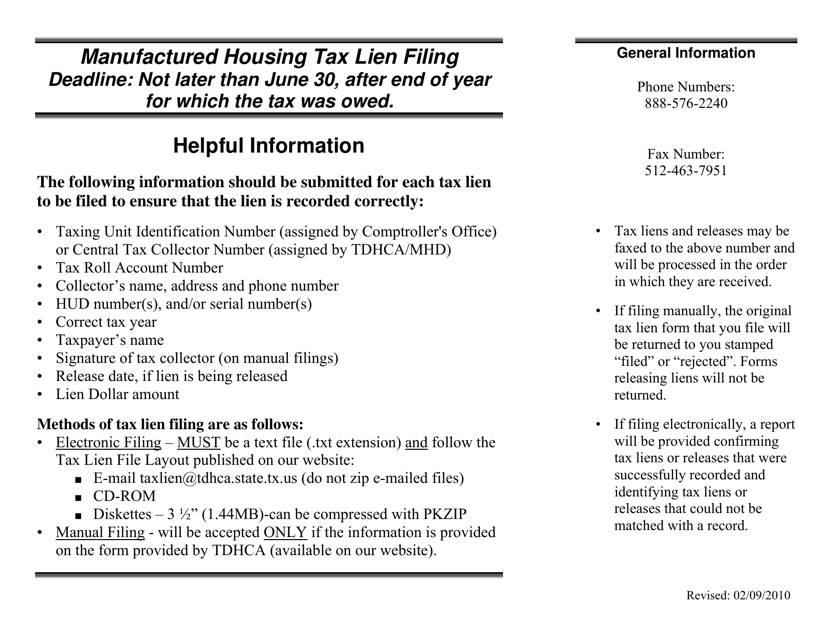

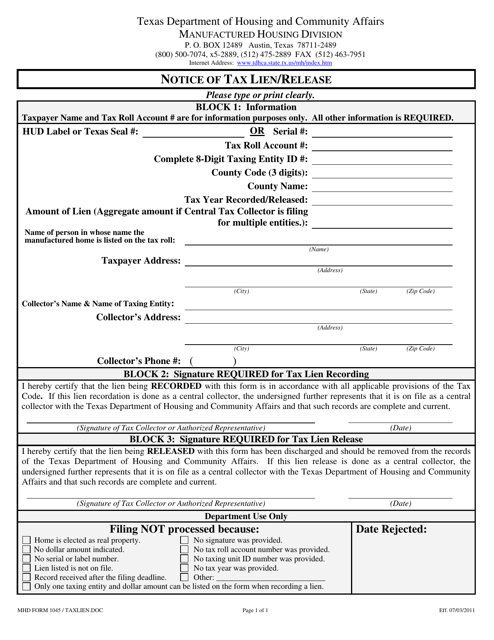

This document is used for filing a notice of tax lien or release in the state of Texas for MHD Form 1045. It provides instructions on how to properly complete and submit the form.

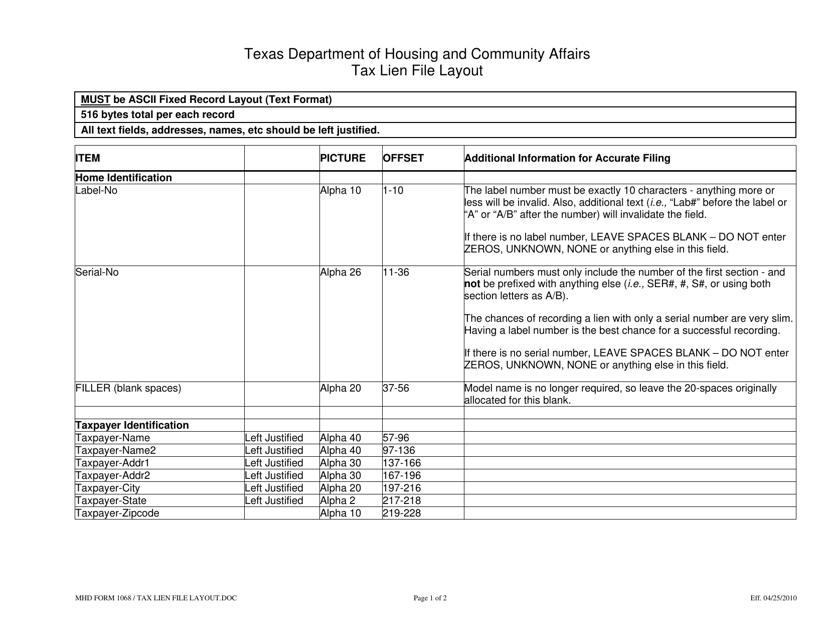

This document provides an example layout of the MHD Form 1068 Manufactured Housing Tax Lien in Texas. It is used to help individuals understand how to properly fill out and organize their tax lien information for manufactured housing.

This type of document is used for notifying taxpayers in Texas about a tax lien or a release of tax lien.

This form is used for requesting a standard tax lien search or copy in Minnesota. It is necessary for certain financial and legal purposes.

This document is a request for the initial dataset of UCC (Uniform Commercial Code) and tax lien records in Minnesota. It is used to gather information related to UCC filings and tax liens in the state.

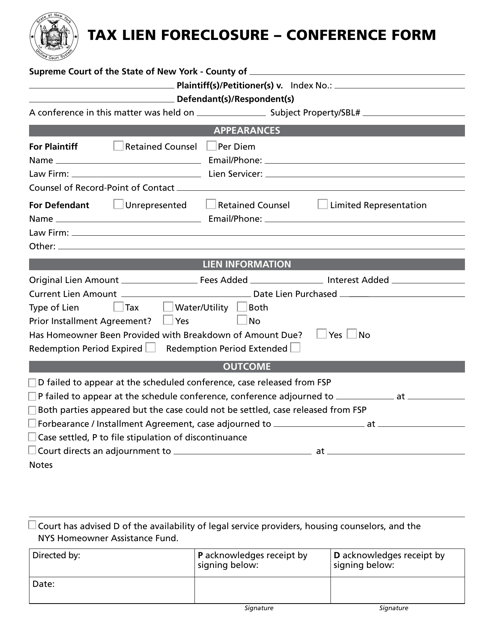

This form is used for organizing a conference related to tax lien foreclosure in New York.

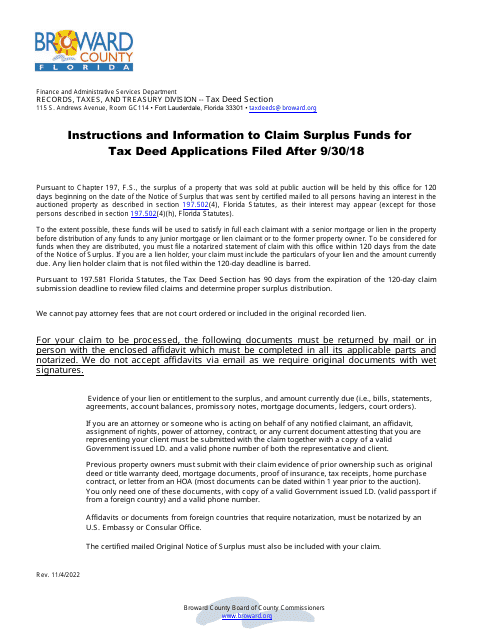

This document is used to claim the surplus proceeds from a tax deed sale in Broward County, Florida. If the sale of a property through a tax deed auction results in more money than is owed in taxes, this form allows individuals to request the excess funds.