IRS Appeals Templates

Are you dissatisfied with a decision made by the Internal Revenue Service (IRS)? Do you believe that you have valid grounds to appeal the decision? You're in luck! Our website is dedicated to providing you with all the information you need about IRS appeals.

The IRS appeals process allows taxpayers to challenge decisions made by the IRS that they believe are incorrect or unfair. Whether you want to dispute an audit, challenge a denial of a refund, or appeal a penalty, the IRS appeals process provides a platform for taxpayers to present their case.

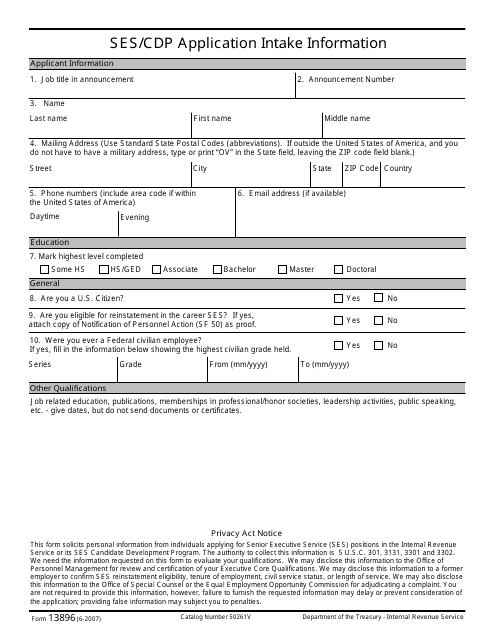

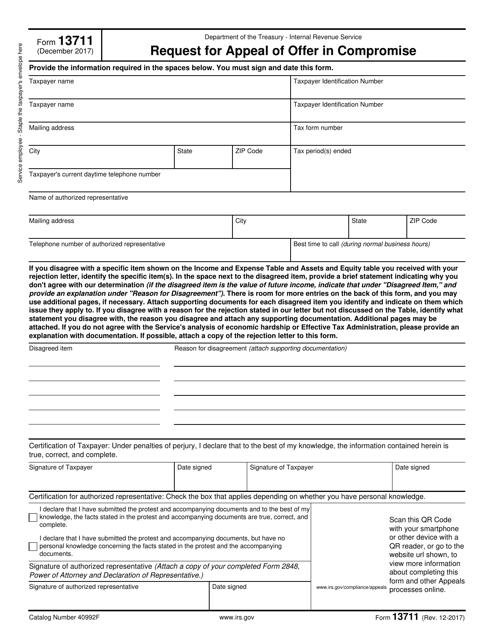

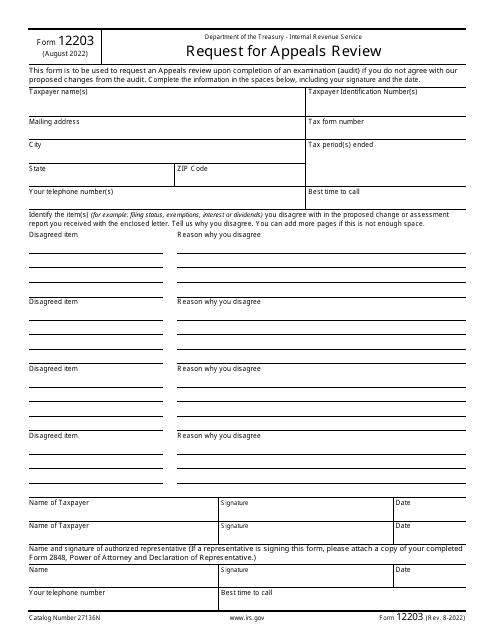

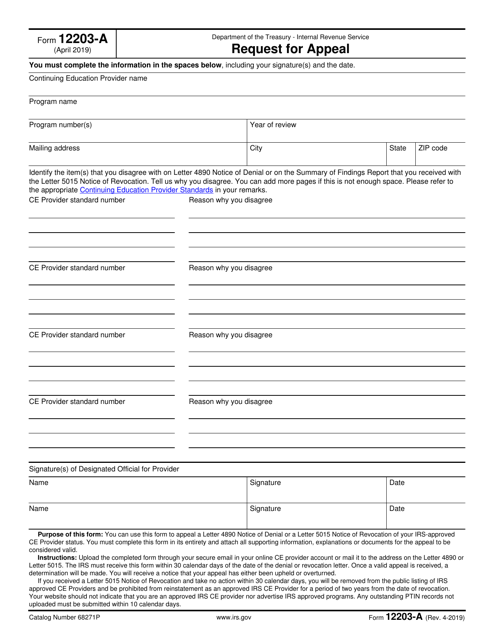

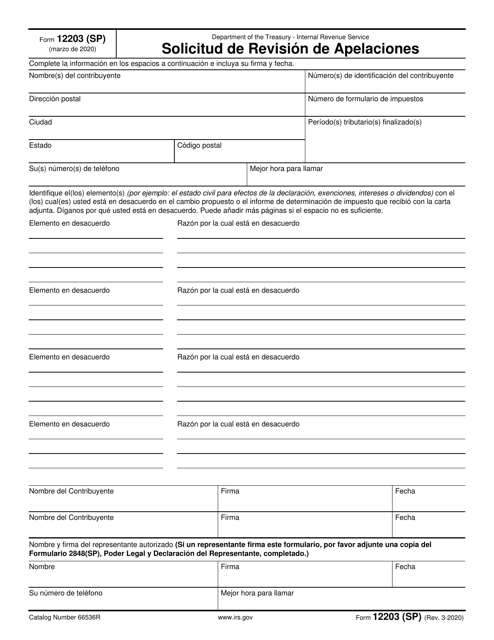

At our website, you will find a comprehensive collection of documents related to IRS appeals. Our extensive library includes forms such as IRS Form 13896 Ses/Cdp Application Intake Information, IRS Form 13711 Request for Appeal of Offer in Compromise, IRS Form 12203 Request for Appeals Review, and IRS Form 12203-A Request for Appeal. Additionally, we offer resources in multiple languages, such as the IRS Formulario 12203 (SP) Solicitud De Revision De Apelaciones in Spanish.

Whether you prefer to handle your IRS appeal independently or seek professional assistance, our website is here to guide you every step of the way. We provide detailed information on how tofill out each form correctly and what supporting documentation may be required. We also offer tips and strategies to increase your chances of a successful appeal.

Don't let a decision by the IRS go unchallenged. Visit our website today and access our comprehensive collection of documents and resources on IRS appeals. Take control of your tax situation and exercise your right to appeal!

Documents:

5

This form is used for applying for a Ses/Cdp Application Intake with the IRS.

This type of document is an IRS Form used for requesting a review of appeals in Spanish language.