Payment Extension Templates

Are you in need of more time to make your payment? Our payment extension services can help you with that. Whether you refer to it as a payment extension, extension payment, or extension payments, we have the solution for you.

At Templateroller.com, we understand that unforeseen circumstances can arise that may prevent you from making your payment by the original due date. That's why we offer a range of options to provide you with the extra time you need.

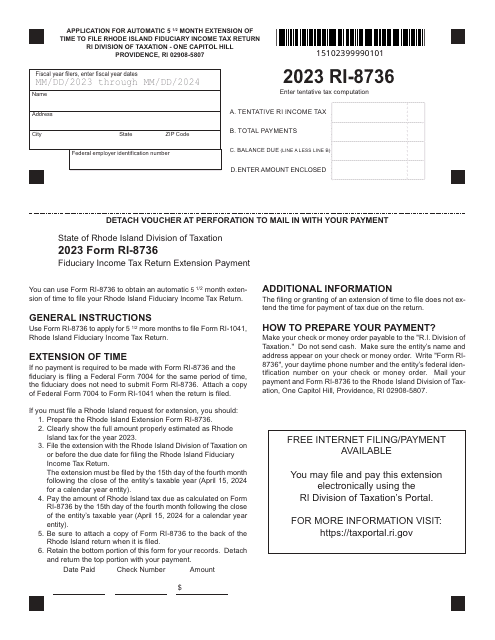

Our payment extension program allows you to request additional time to make your payment, ensuring that you can fulfill your financial obligations without the stress of late fees or penalties. We work with various government agencies, including Rhode Island, Arkansas, Illinois, Maryland, and Nevada, to offer you the flexibility you need.

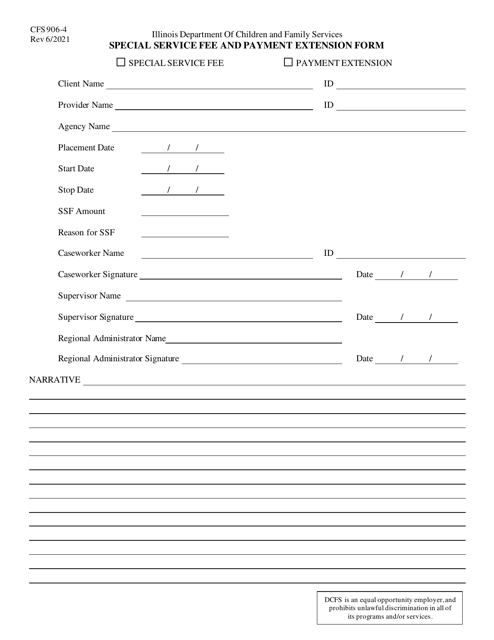

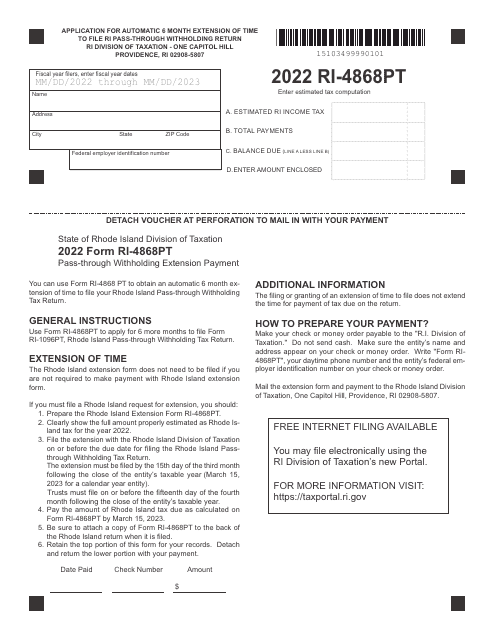

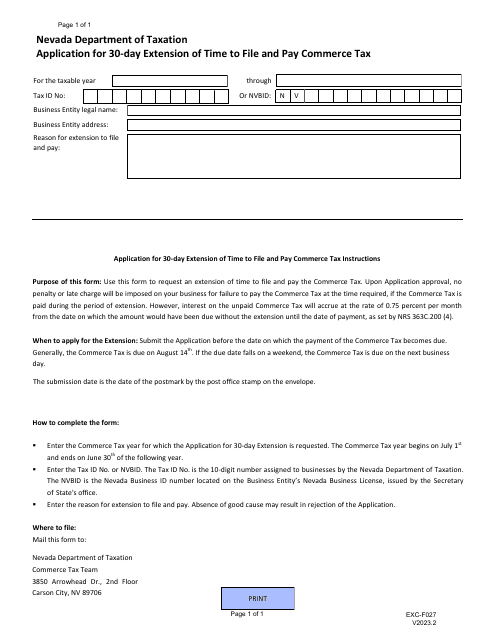

For example, if you are a resident of Rhode Island, you may be familiar with Form RI-4868PT Pass-Through Withholding Extension Payment. Similarly, Arkansas offers Additional (One Time) Payment(S) for those in need of an extension. In Illinois, you can use Form CFS906-4 Special Service Fee and Payment Extension Form to request additional time. The Child Care Scholarship Program in Maryland provides Form DOC.422.40 Provider Payment Extension Request for families with children turning 13. Lastly, Nevada allows businesses to apply for a 30-day extension of time to file and pay Commerce Tax through Form EXC-F027.

No matter which state you reside in, our payment extension services provide you with a seamless process to request additional time for your payment. Don't let unexpected circumstances cause unnecessary stress. Contact us today to learn more about our payment extension options and ensure that you have the time you need to fulfill your financial obligations.

Documents:

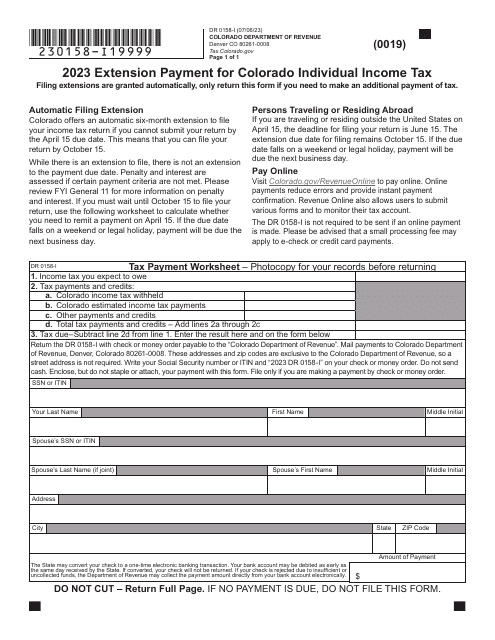

19

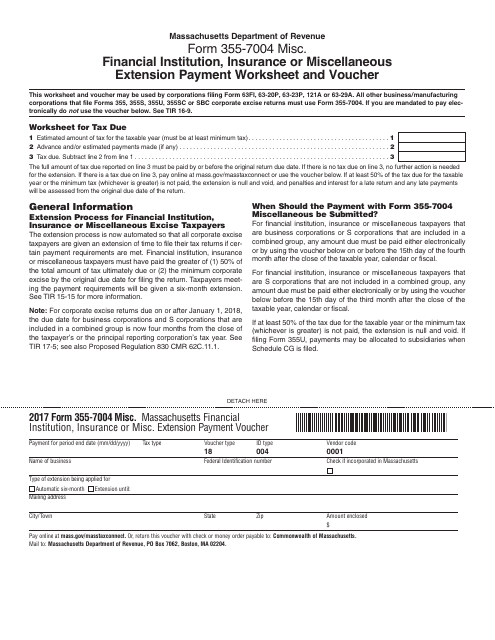

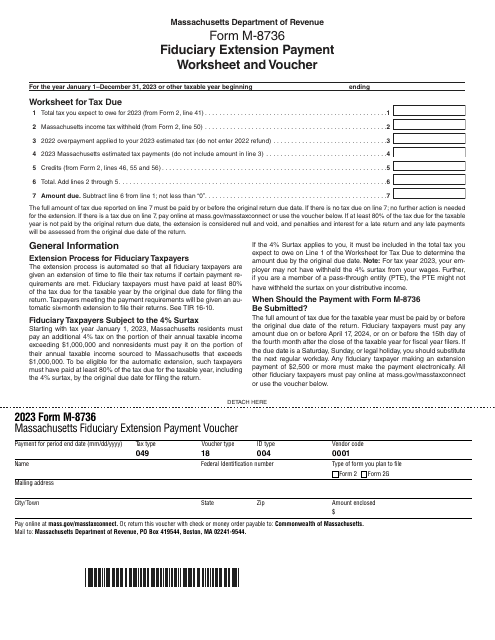

This form is used for making extension payments for financial institutions, insurance companies, or other miscellaneous entities in Massachusetts. It serves as a worksheet and voucher for making the payment.

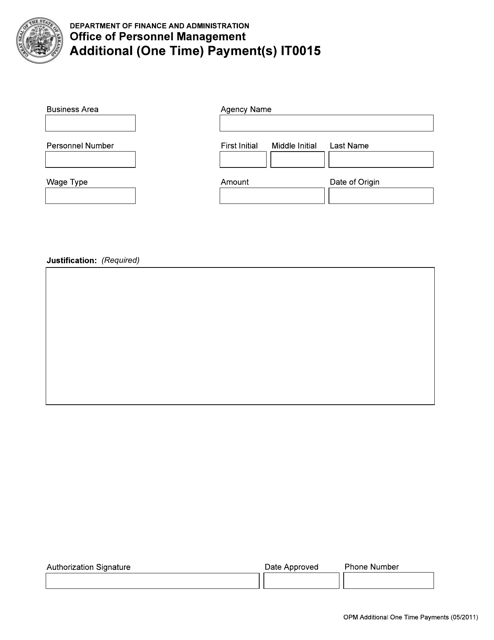

This document is used for making additional one-time payments in the state of Arkansas.

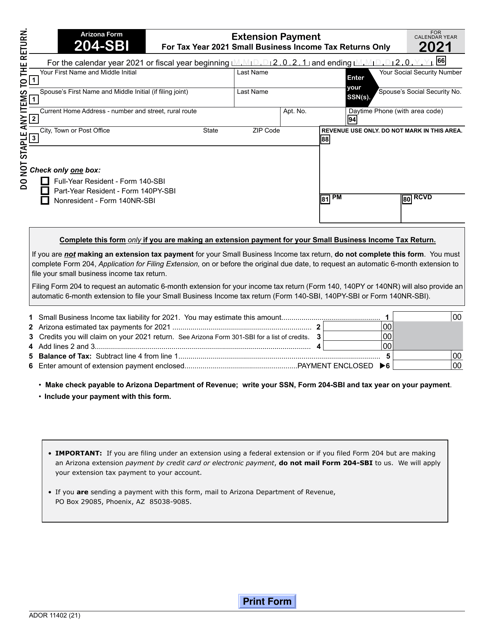

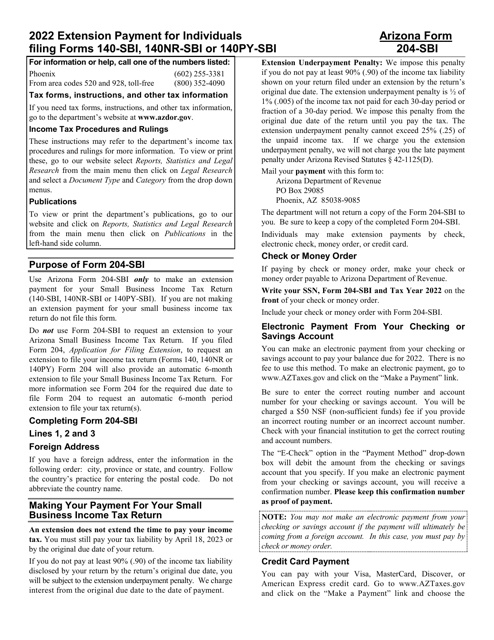

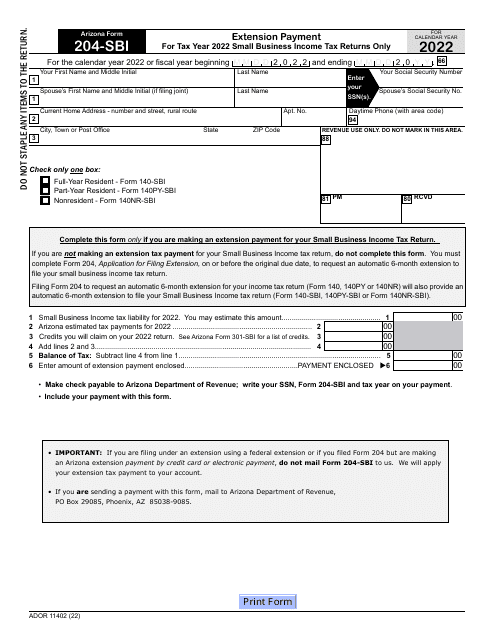

This form is used for making extension payments for small business income tax returns in Arizona.

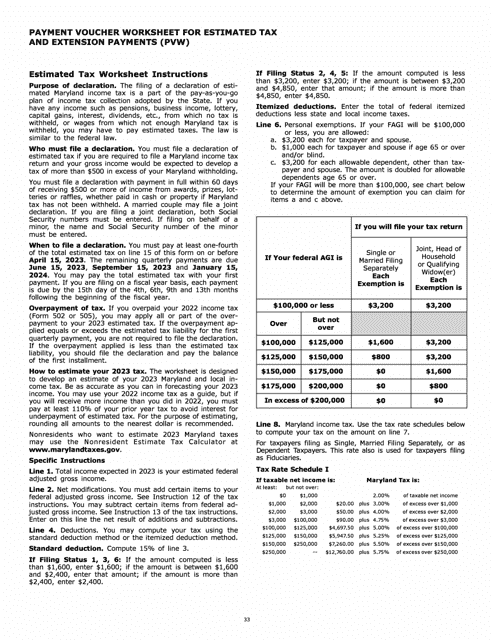

This form is used for making estimated tax and extension payments in the state of Maryland. It serves as a worksheet for recording payment details.

This form is used for making extension payments for small business income tax returns in Arizona. It provides instructions on how to properly complete and submit Form 204-SBI, ADOR11402.