Alcohol Tax Templates

Are you aware of the taxes associated with the production and sale of alcoholic beverages? In the United States, Canada, and other countries, the government imposes an alcohol tax to help regulate the consumption of these beverages and generate revenue. This tax contributes to various aspects of society, from funding public services to promoting public health.

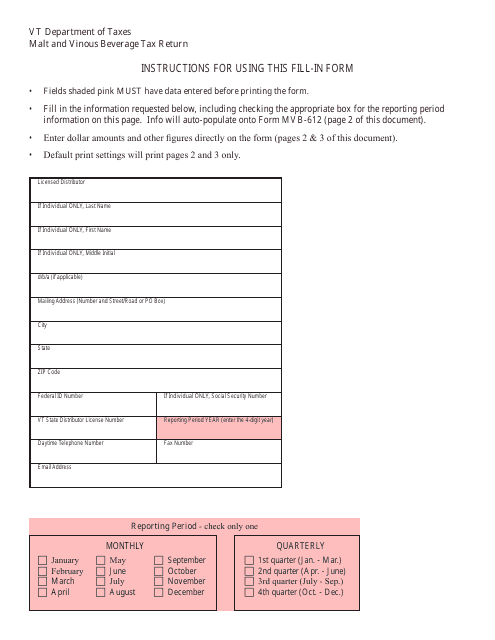

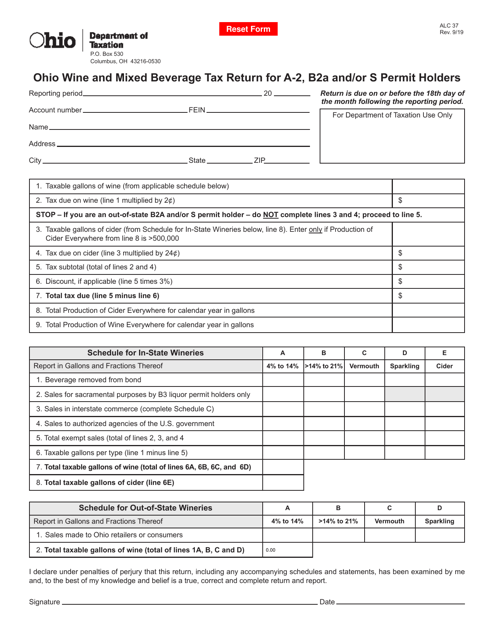

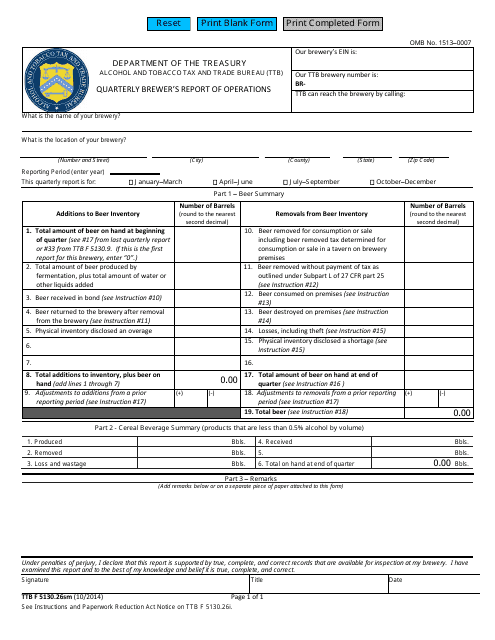

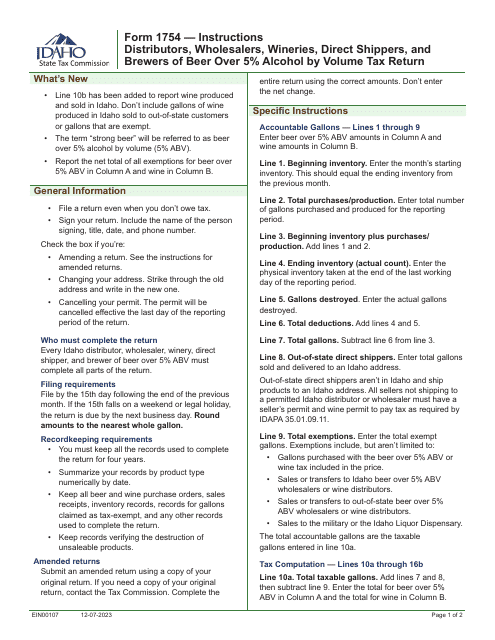

Alcohol tax, also known as alcohol taxes or alcohol tax forms, is a crucial component of the government's financial structure. It ensures that the production and sale of alcoholic beverages are properly regulated. Alcohol tax forms, such as Form R-46 Schedule M-N Alcohol Beverage Tax in New Jersey or TTB Form 5130.26SM Quarterly Brewer's Report of Operations, are essential documents for businesses involved in the production and distribution of alcoholic beverages.

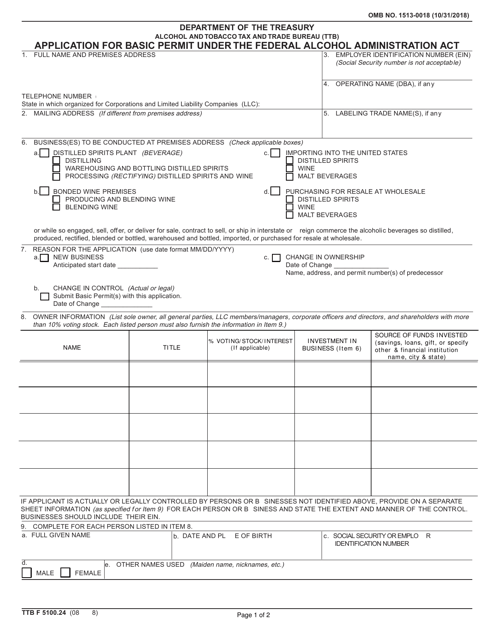

For those looking to start a business in the alcohol industry, TTB Form 5100.24 Application for Basic Permit Under the Federal Alcohol Administration Act is a significant document. It guides entrepreneurs through the permit application process and helps ensure compliance with federal regulations.

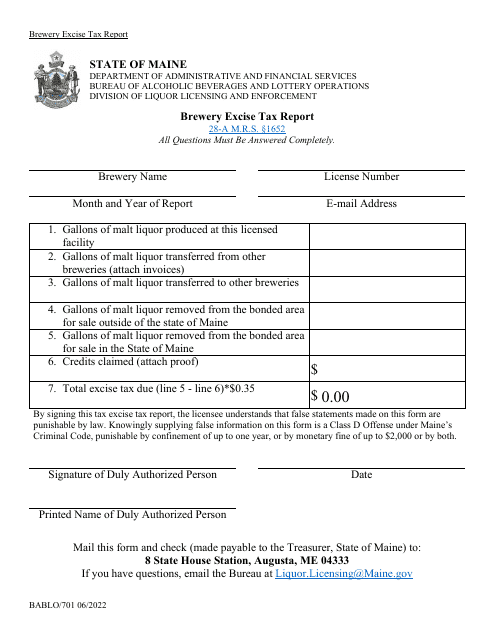

States like Maine require the submission of Form BABLO/701 Brewery Excise Tax Report to calculate and report the amount of excise tax owed. This document helps maintain transparency in the tax system and assists in regulating the production and sale of alcoholic beverages within the state.

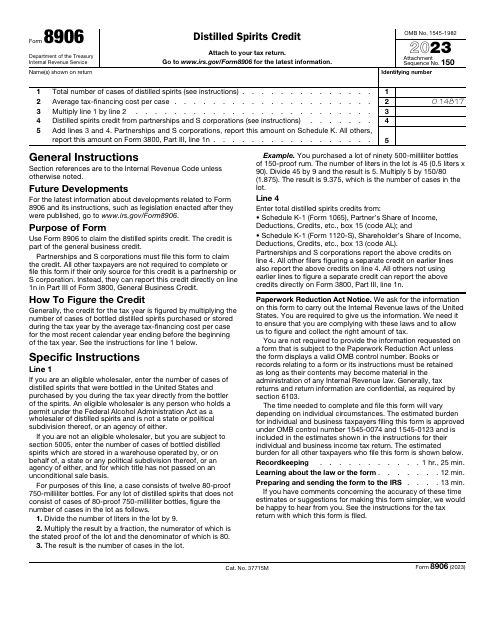

Furthermore, the Internal Revenue Service (IRS) requires businesses to fill out Form 8906 Distilled Spirits Credit to claim tax credits for the production of distilled spirits. This document helps businesses in the alcohol industry reduce their overall tax liability.

Whether you are a business owner in the alcohol industry or an individual interested in understanding the taxation structure, familiarizing yourself with these alcohol tax forms is essential. Understanding and complying with the alcohol tax regulations ensures a fair and transparent financial system while supporting the government's efforts to maintain a healthy and responsible consumption of alcoholic beverages.

Please note that specific alcohol tax forms and regulations may vary by jurisdiction. It is crucial to consult with the appropriate governmental agencies or legal professionals for the most up-to-date information.

Documents:

31

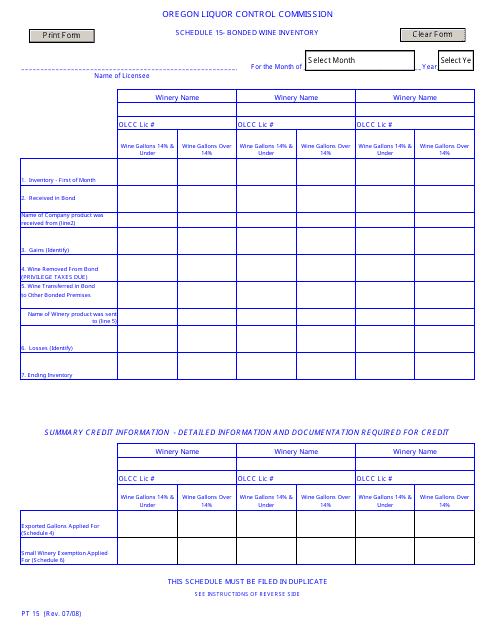

This form is used for reporting the bonded wine inventory in Oregon.

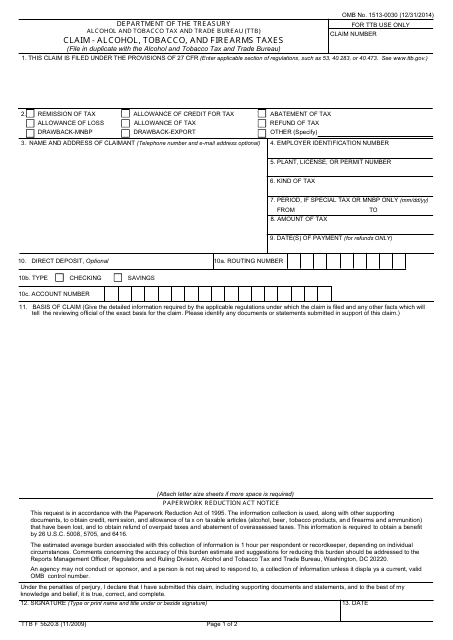

This form is used for claiming refunds for alcohol, tobacco, and firearms taxes in the United States.

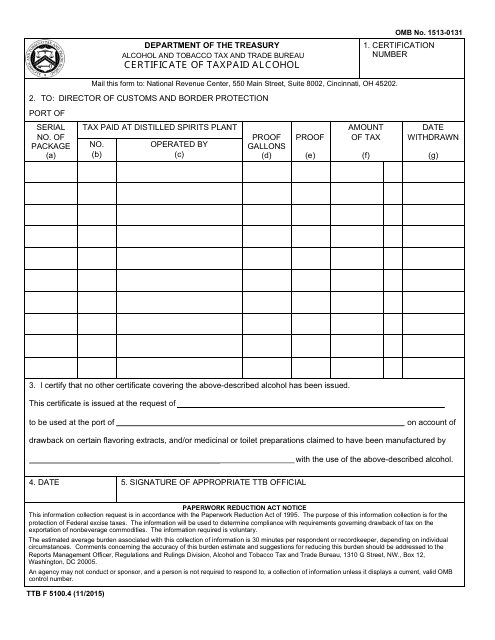

This form is used for obtaining a certificate for alcohol on which taxes have been paid.

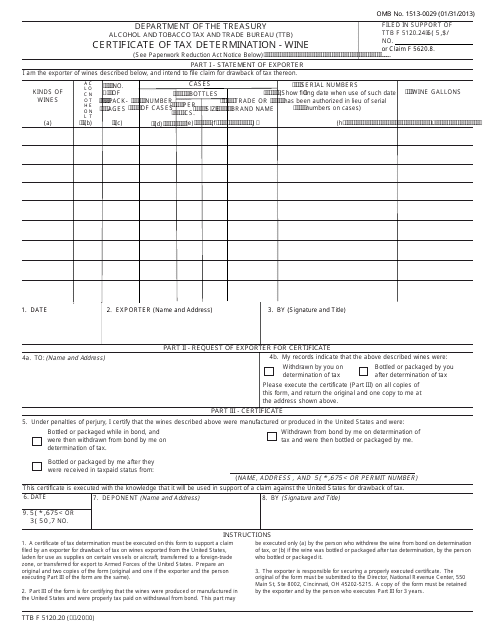

This TTB Form is used for obtaining a Certificate of Tax Determination for wine. It helps to determine the tax liability for wine producers and importers.

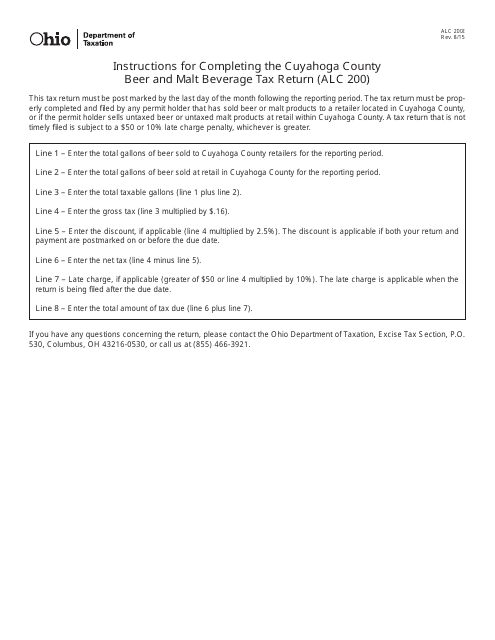

This Form is used for reporting and paying the beer and malt beverage tax in Cuyahoga County, Ohio. Beer distributors and retailers are required to fill out this form and submit it along with the corresponding payment to the county tax department. The form provides instructions on how to complete it accurately and where to send it.

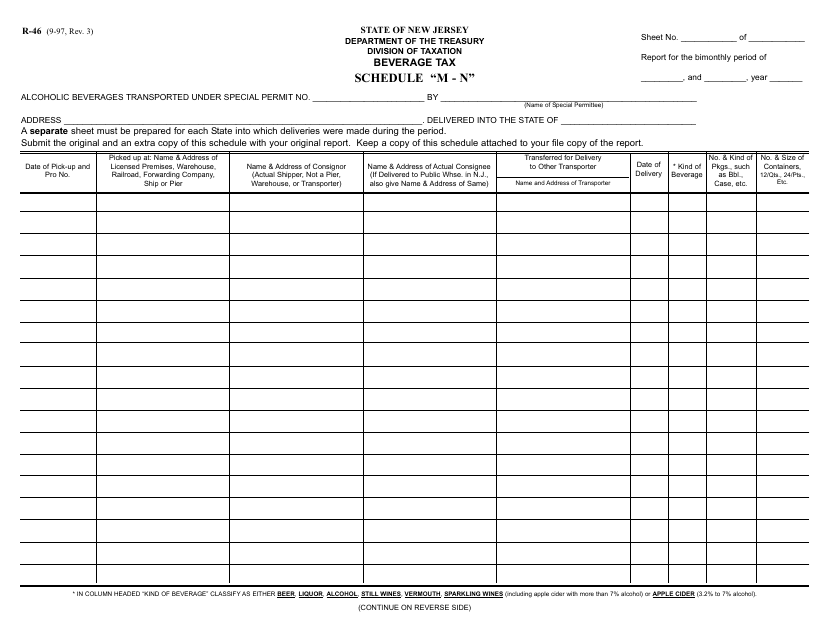

This form is used for reporting and paying alcohol beverage taxes in the state of New Jersey. It is specifically for Schedule M-N.

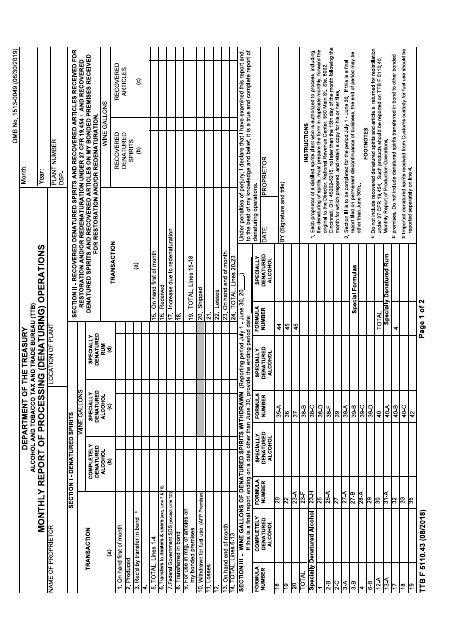

This form is used for reporting monthly processing (denaturing) operations.

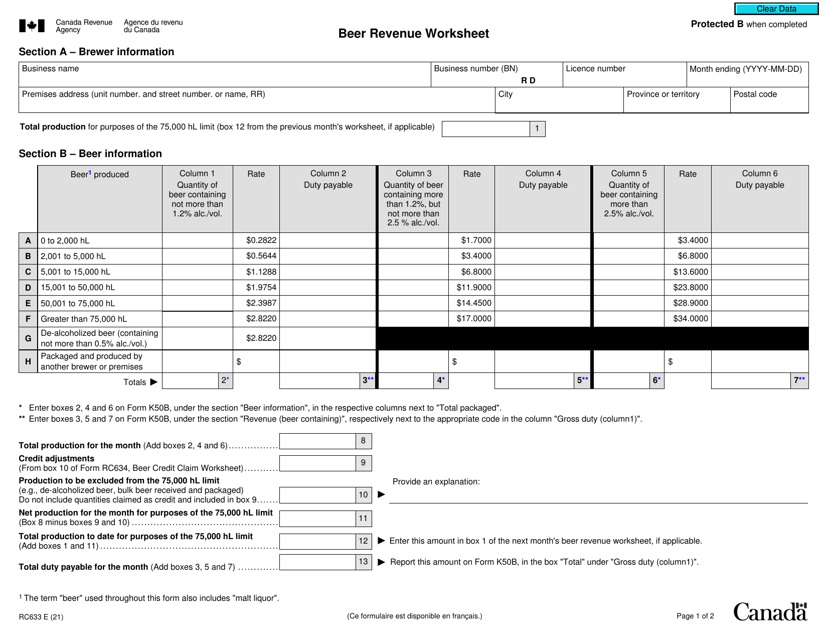

This Form is used for brewers to report their quarterly operations to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

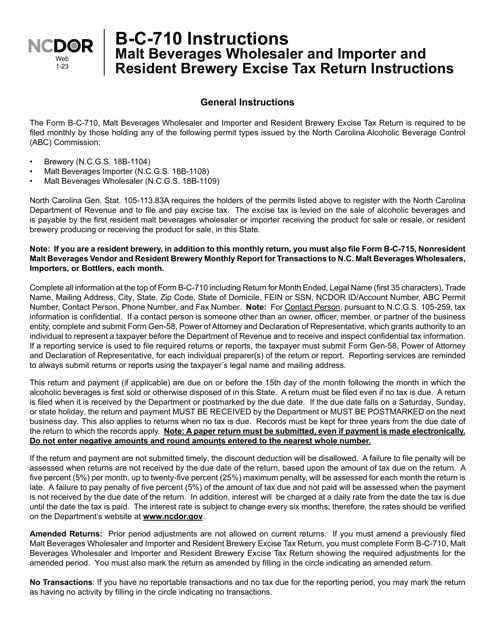

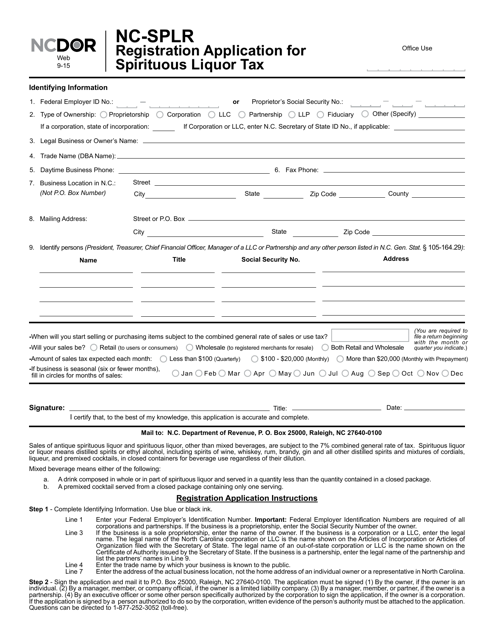

This form is used for registering and applying for the Spirituous Liquor Tax in the state of North Carolina.

This form is used for applying for a basic permit under the Federal Alcohol Administration Act. It is necessary for businesses involved in the production or importation of alcohol to obtain this permit.

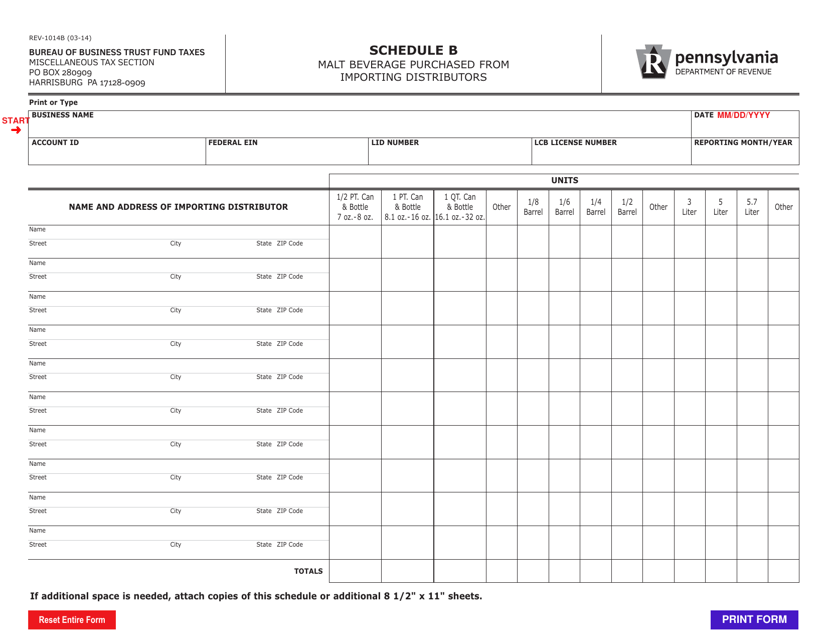

This form is used for reporting the purchase of malt beverages from an importing distributor located in Pennsylvania.

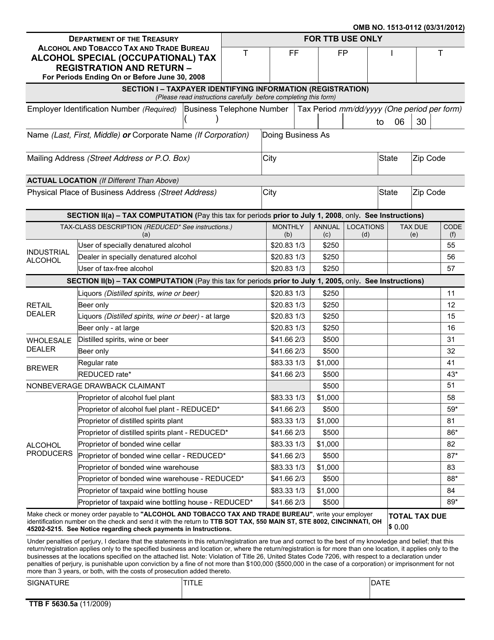

This form is used for registering and reporting the occupational tax for alcohol businesses for periods ending on or before June 30, 2008.

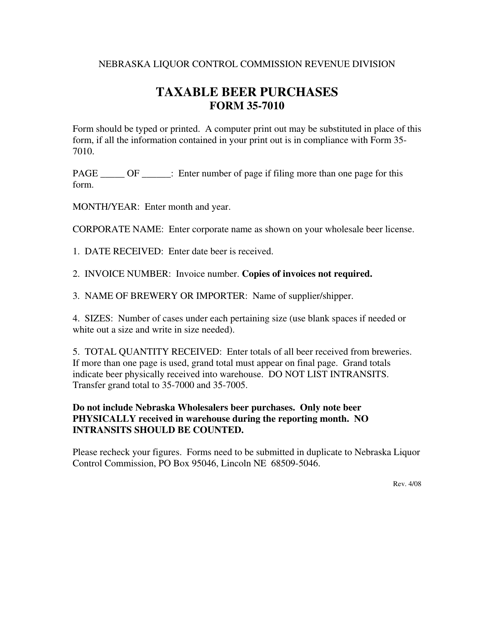

This Form is used for reporting taxable beer purchases in the state of Nebraska. It provides instructions on how to accurately fill out and submit the form to the appropriate tax authority.

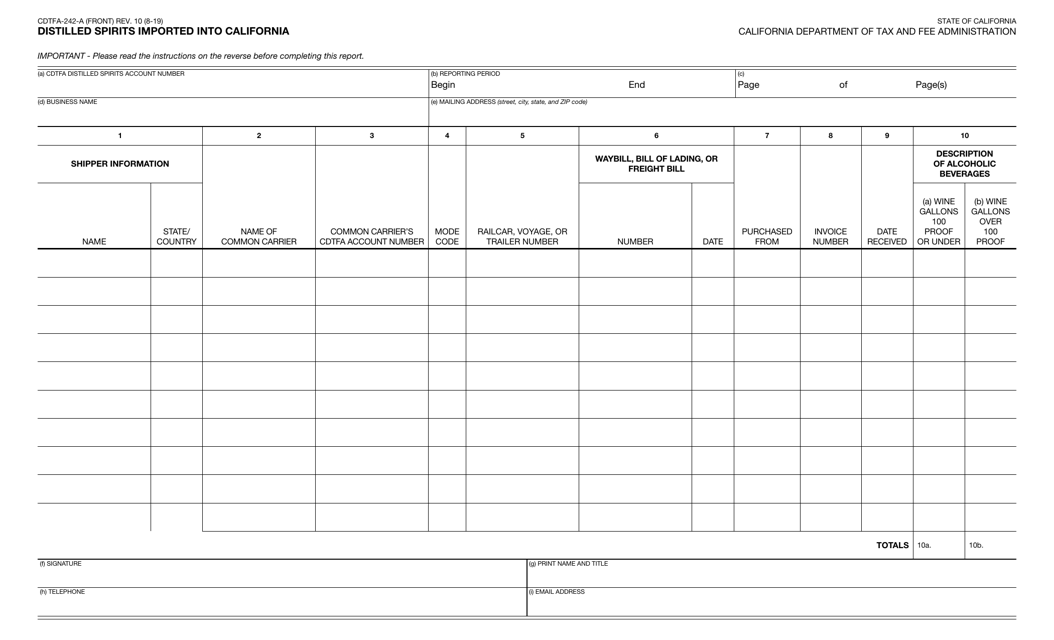

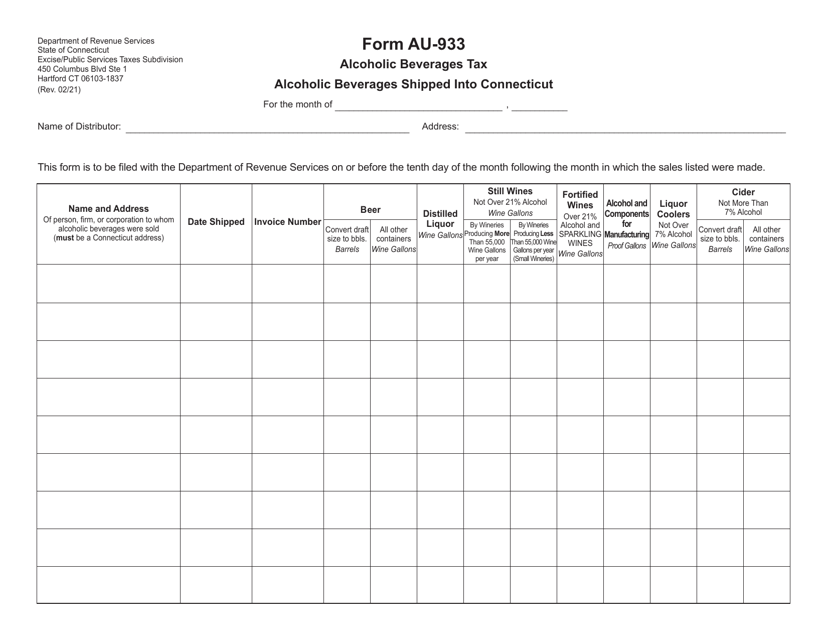

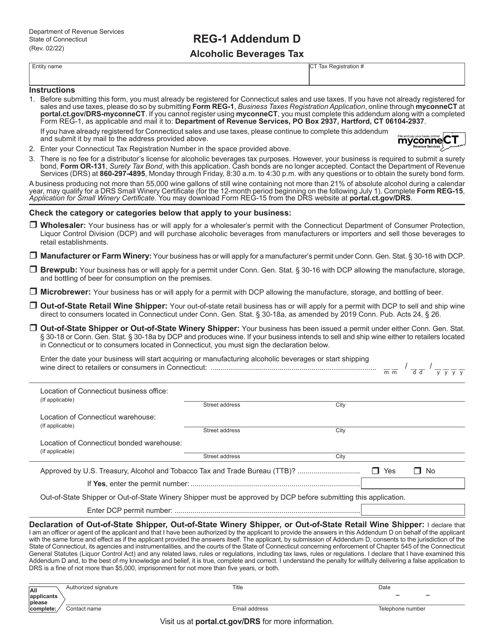

This form is used for reporting and paying taxes on alcoholic beverages that are shipped into Connecticut.

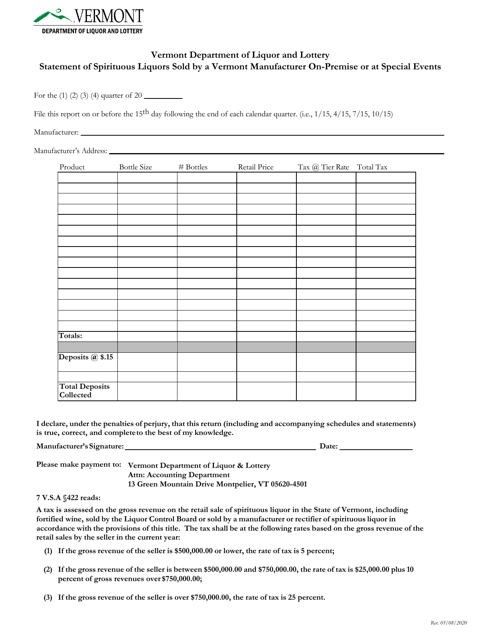

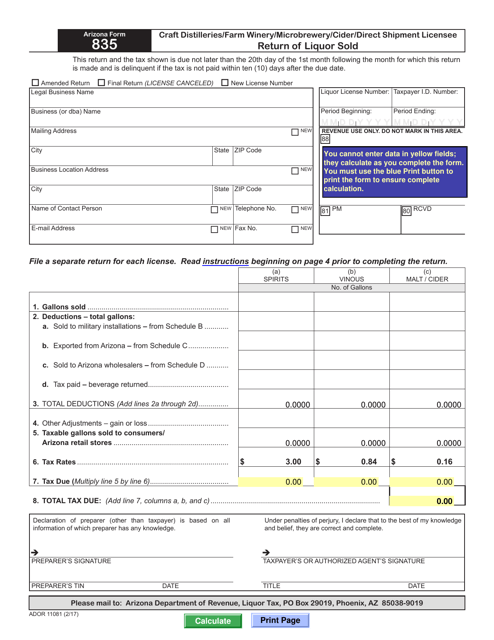

This document is used for reporting and paying taxes on liquor sold by craft distilleries, farm wineries, microbreweries, cider producers, and direct shipment licensees in Arizona.

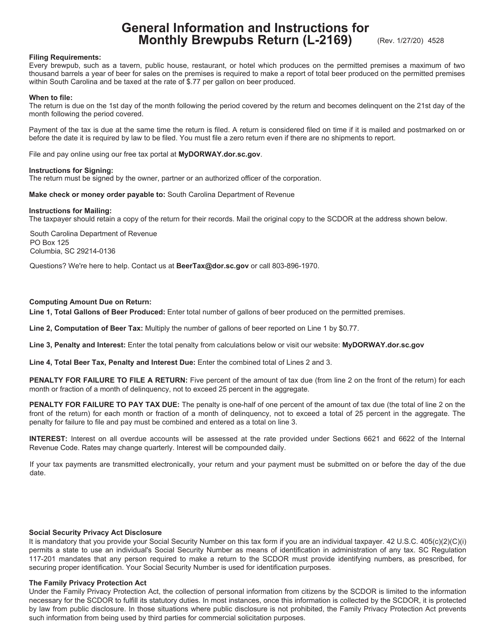

This document provides instructions for completing and filing the Monthly Brewpubs Return form in South Carolina. It includes guidelines on how to report income, expenses, and other necessary information for brewpub businesses on a monthly basis.

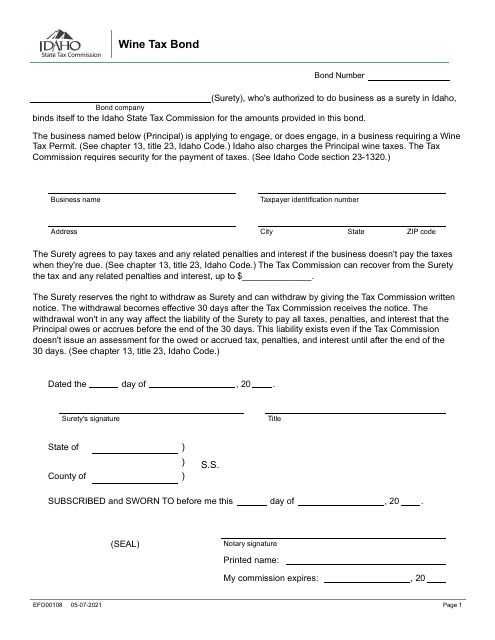

This Form is used for obtaining a Wine Tax Bond in Idaho.

This Form is used for reporting brewery excise taxes in the state of Maine. It is required for breweries to accurately report and pay their excise tax obligations.

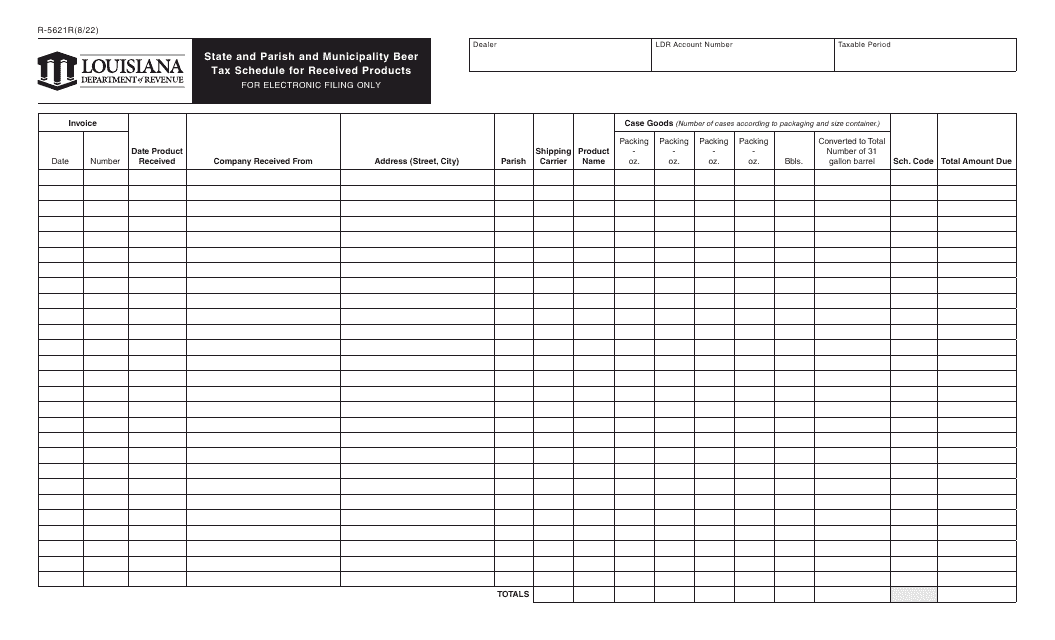

This form is used for reporting and calculating beer taxes for received products in the state of Louisiana, including state, parish, and municipality taxes.