Corporate Income Templates

Welcome to our webpage on corporate income, also known as corporation income. Here, you will find a comprehensive collection of documents and resources related to filing and managing corporate income or franchise tax returns for various states in the USA.

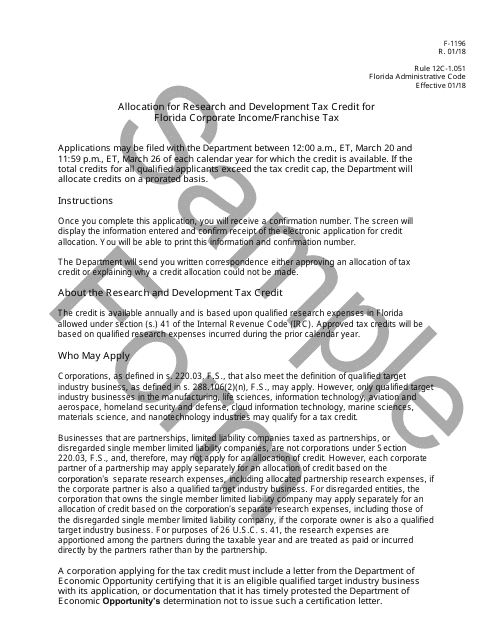

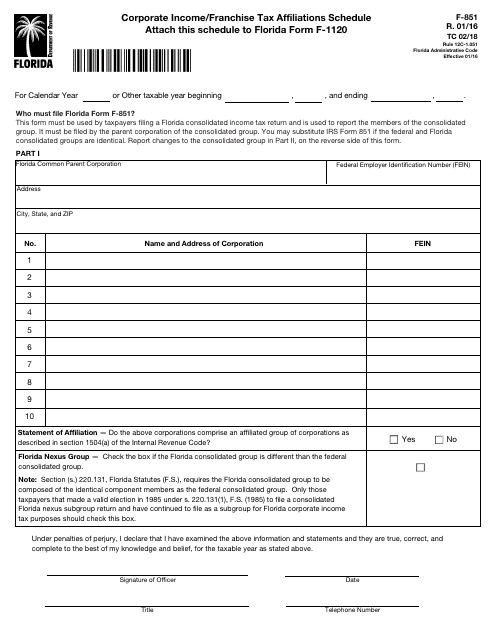

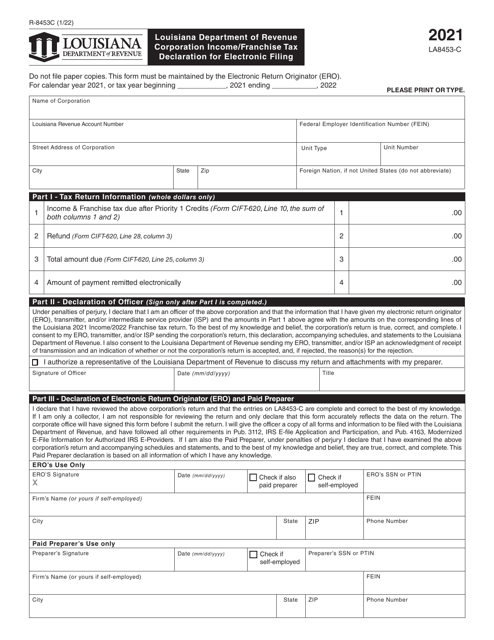

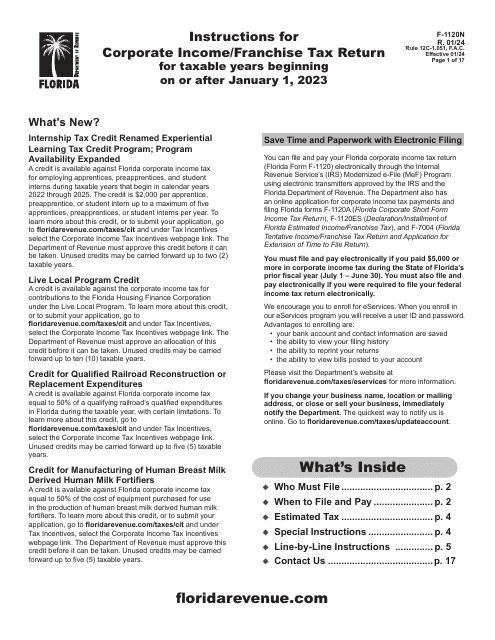

Our collection includes a wide range of documents, such as the Sample Form F-1196 for allocating the Research and Development Tax Credit for Florida Corporate Income/Franchise Tax, the Form F-1120 Schedule F-851 for the Corporate Income/Franchise Tax Affiliations Schedule in Florida, and the Form R-8453C for the Corporation Income/Franchise Tax Declaration for Electronic Filing in Louisiana.

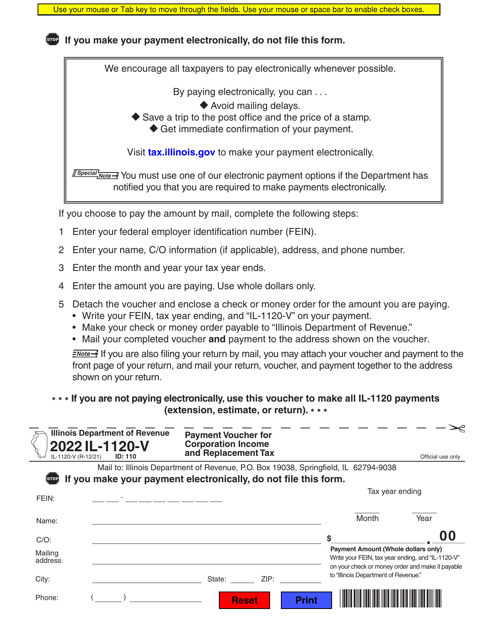

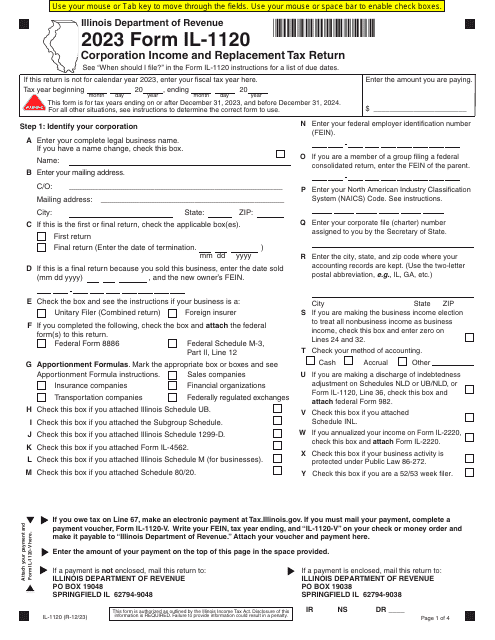

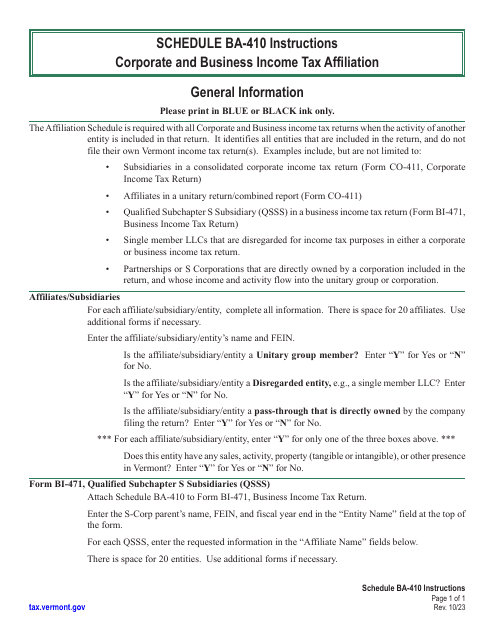

For those in Illinois, we provide the Form IL-1120 for the Corporation Income and Replacement Tax Return, while in Vermont, we have the Instructions for Schedule BA-410 for Vermont Corporate and Business Income Tax Affiliation.

Our webpage serves as a one-stop destination for all your corporate income needs, providing step-by-step instructions, downloadable forms, and valuable resources to help you navigate the complex world of corporate income taxation. Whether you are a business owner, tax professional, or simply looking for information on corporate income taxes, our comprehensive collection of documents will help you stay compliant and make informed decisions.

Documents:

10

This form is used for allocating the research and development tax credit for Florida corporate income/franchise tax in the state of Florida.

This Form is used for reporting corporate income and franchise tax affiliations in the state of Florida.

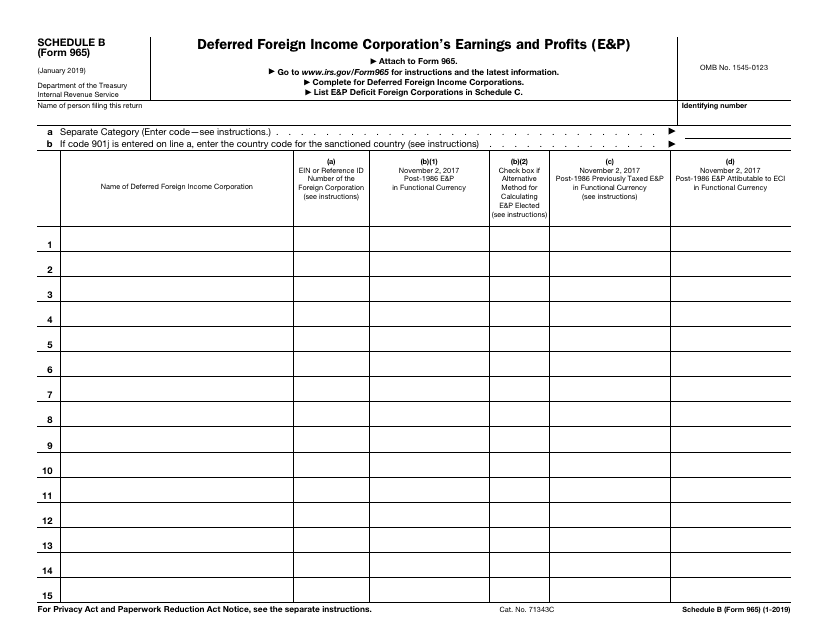

This Form is used for reporting the deferred foreign income and the earnings and profits of a foreign corporation.

This document is used for electronic filing of corporation income and franchise tax in Louisiana.