Petroleum Products Templates

Are you looking for information on petroleum products? Look no further! Our website is your one-stop resource for all things related to petroleum products. Whether you are interested in learning about the various types of petroleum products, their uses and applications, or the latest trends and developments in the industry, we have got you covered.

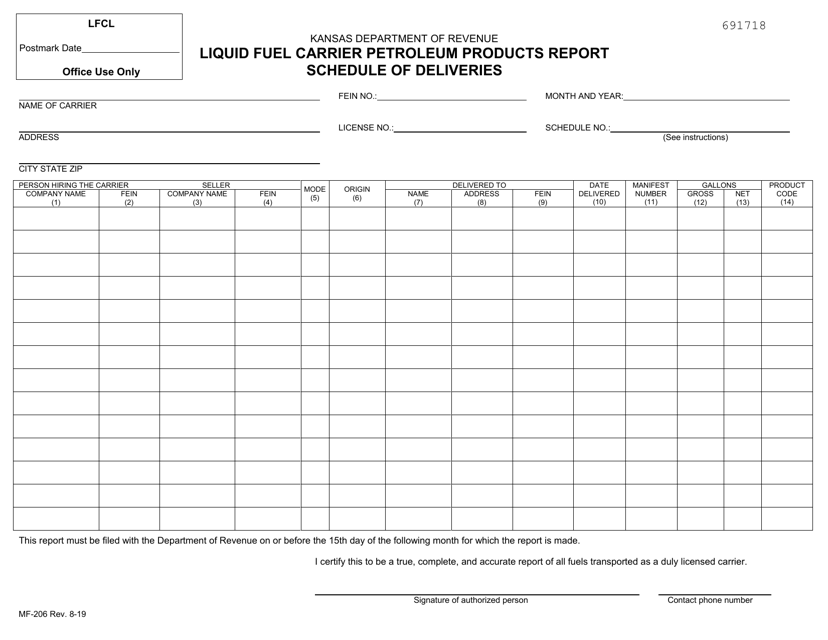

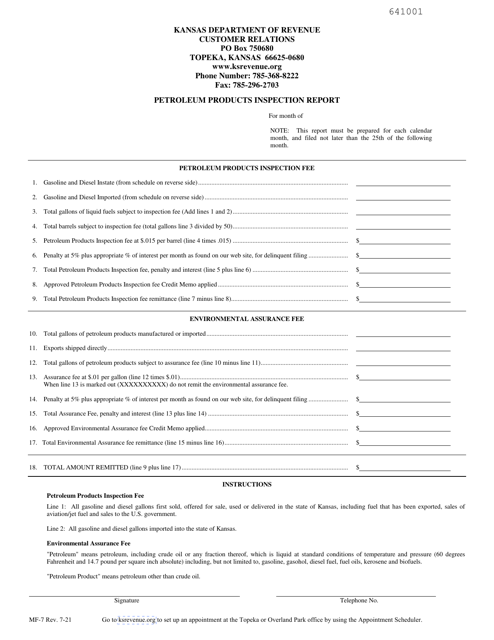

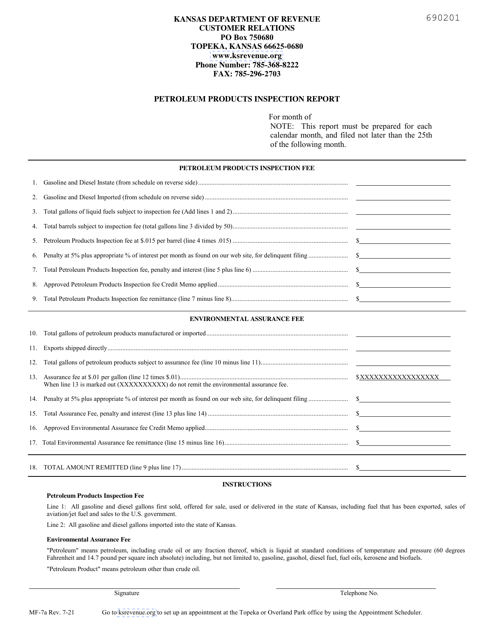

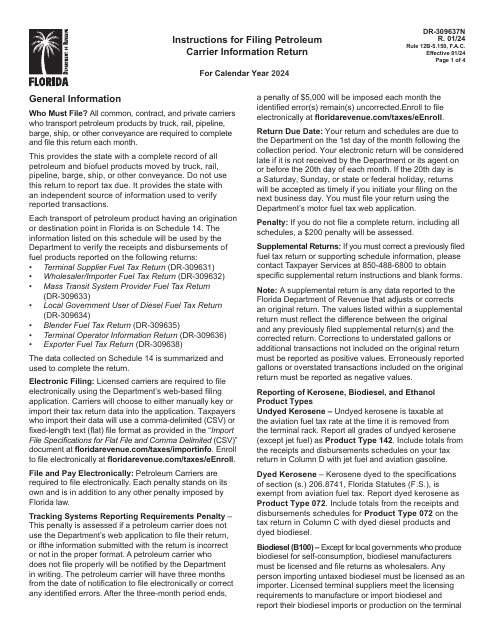

Our vast collection of documents on petroleum products covers a wide range of topics. From reports on the schedule of deliveries and monthly abstracts of issues to tax returns and permit applications, we have compiled a comprehensive collection of documents that are essential for anyone involved in the petroleum industry.

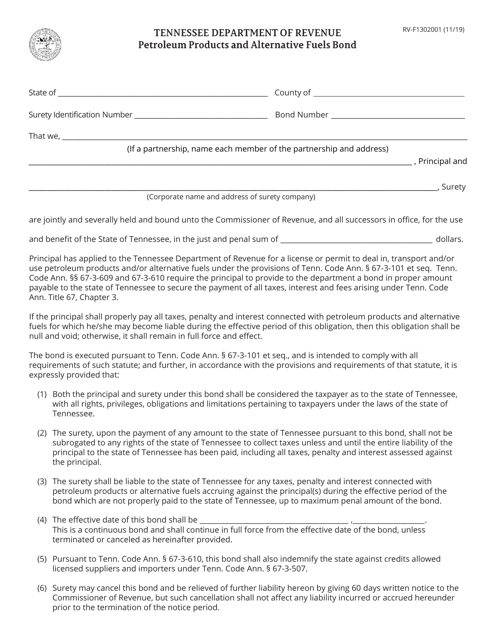

Discover the latest industry standards and regulations with our collection of documents. Stay up to date with the Form PPT-10 Petroleum Products Gross Receipts Tax Return for New Jersey or the Application for Permit to Install, Repair, Modify, Close or Remove Underground Storage Tanks for Petroleum Products or Hazardous Substances in Montana.

Whether you are a business owner, a researcher, or simply curious about petroleum products, our collection of documents will provide you with the information you need. Our user-friendly interface allows you to easily navigate and access the documents you are interested in.

So, why wait? Explore our collection of documents on petroleum products today and stay informed about this important industry.

Documents:

65

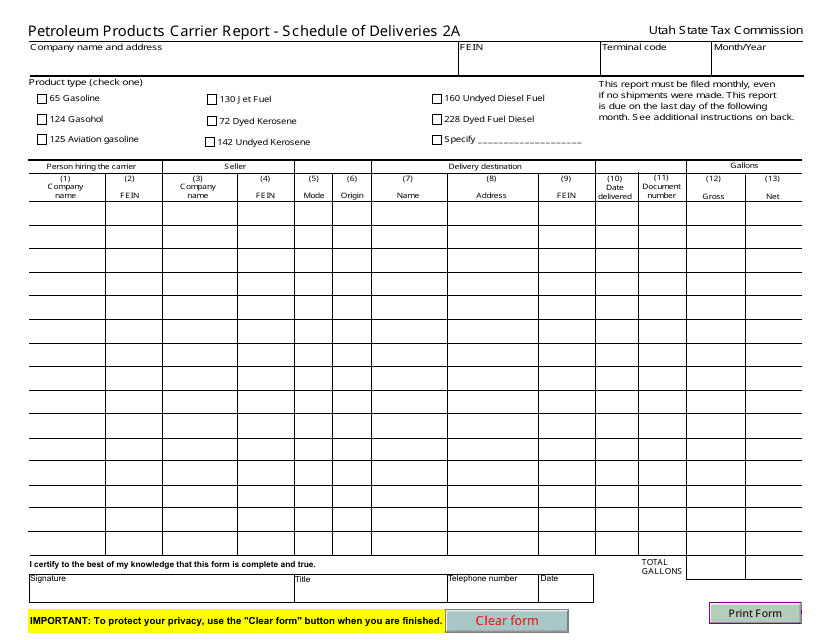

This document is a report that provides a schedule of petroleum product deliveries in Utah.

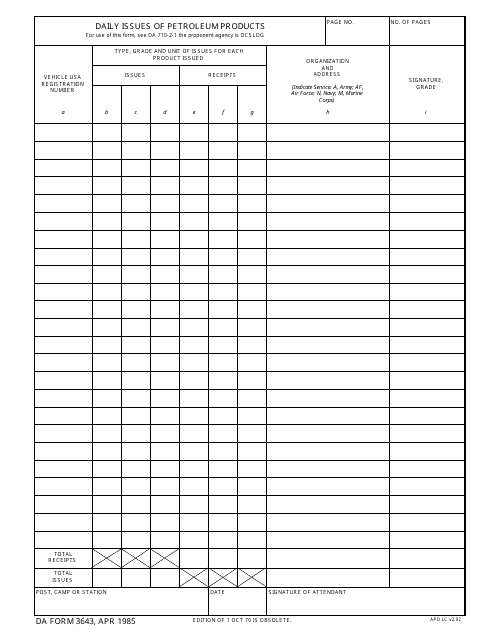

This is a form used for recording of receipts and issues of petroleum products from and to U.S. Army vehicles.

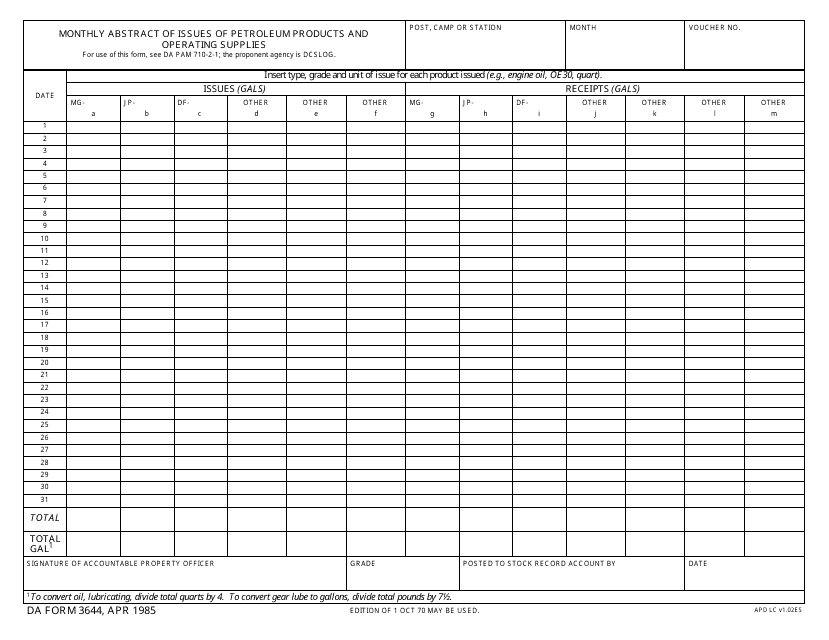

This is an Army form used for recording monthly issues and receipts of fuel and operating supplies.

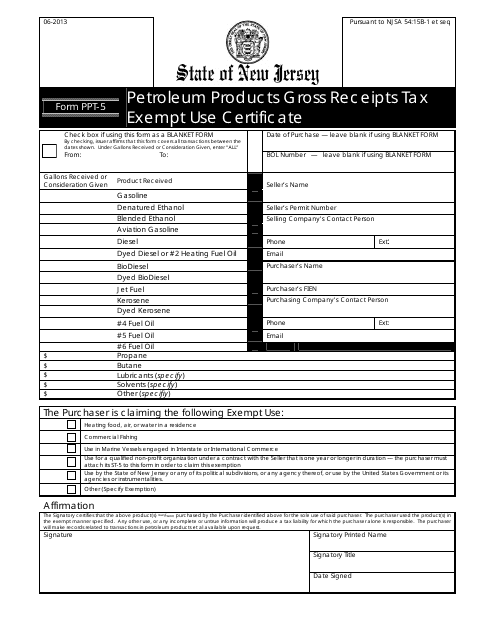

This Form is used for applying for an exemption from the gross receipts tax on the use of petroleum products in New Jersey.

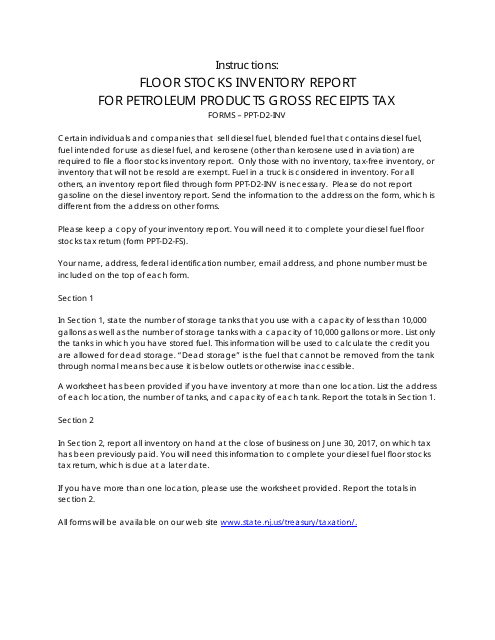

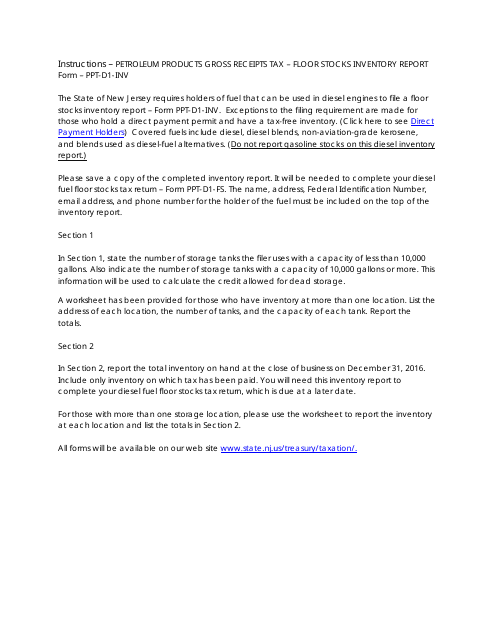

This document provides instructions for completing Form PPT-D2-INV, which is used to report floor stocks inventory for petroleum products gross receipts tax in New Jersey.

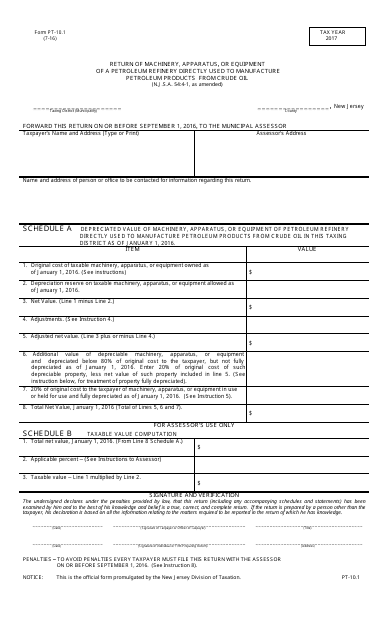

This form is used for reporting machinery, apparatus, or equipment used in petroleum refineries in New Jersey for manufacturing petroleum products from crude oil.

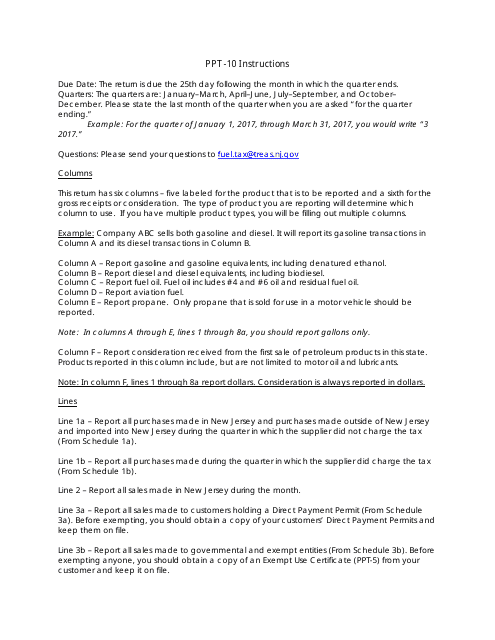

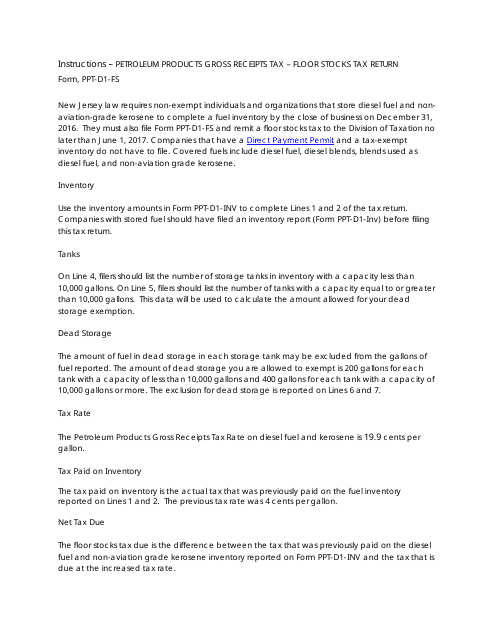

This Form is used for filing the Petroleum Products Gross Receipts Tax Return in the state of New Jersey. It provides instructions on how to accurately report and calculate the tax owed on petroleum products.

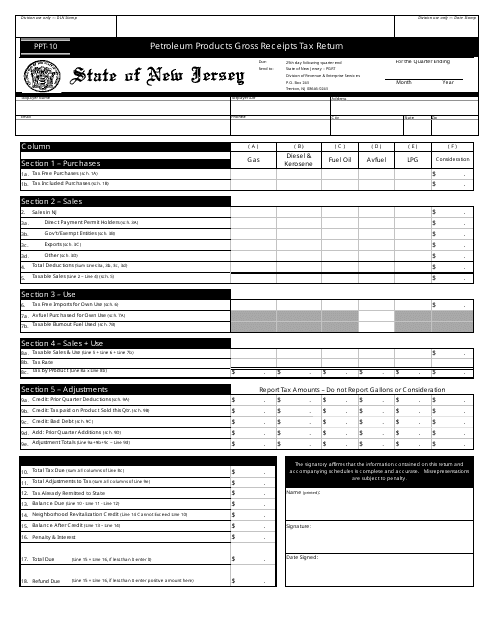

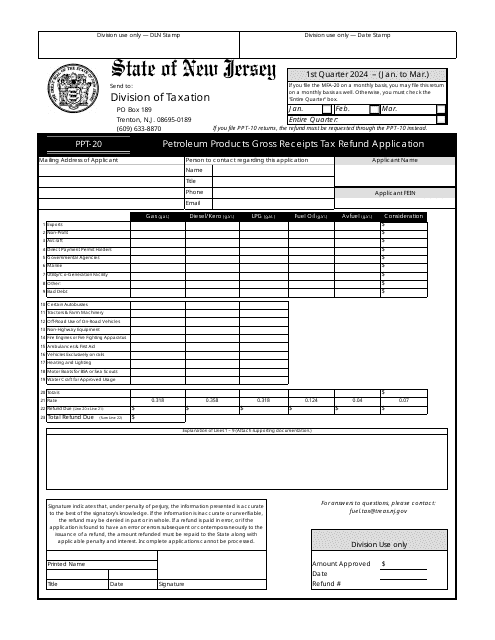

This Form is used for reporting and paying the Petroleum Products Gross Receipts Tax in the state of New Jersey.

This Form is used for reporting floor stocks inventory of petroleum products for the purpose of calculating the gross receipts tax in New Jersey.

This form is used for reporting and paying the Petroleum Products Gross Receipts Tax (Floor Stocks Tax) in New Jersey. It provides instructions on how to correctly fill out and submit the tax return.

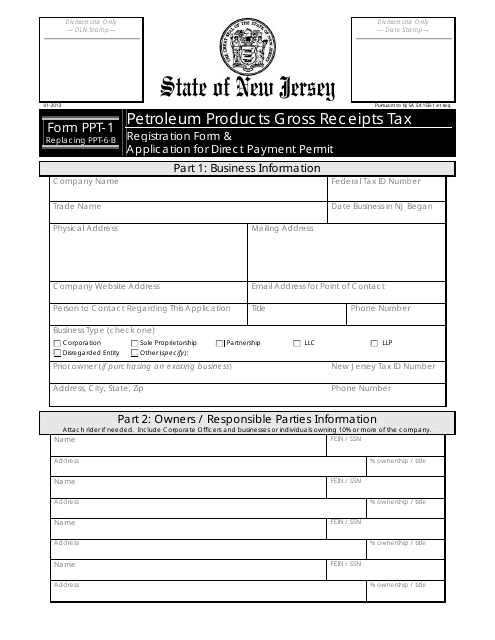

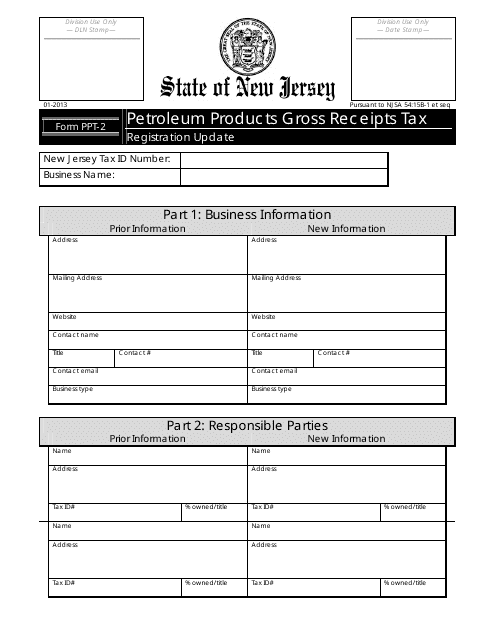

This form is used for updating the registration information for the Petroleum Products Gross Receipts Tax in New Jersey.

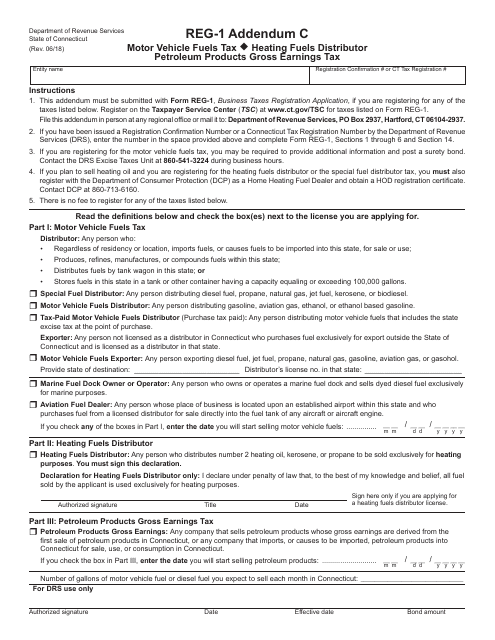

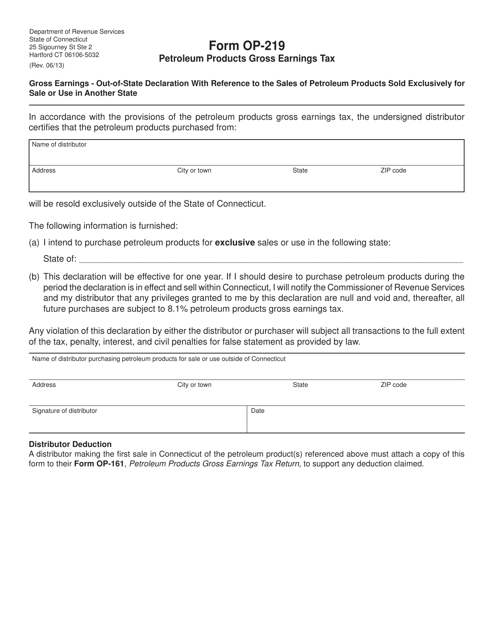

This type of document is an addendum form for reporting motor vehicle fuels tax, heating fuels distributor tax, and petroleum products gross earnings tax in Connecticut.

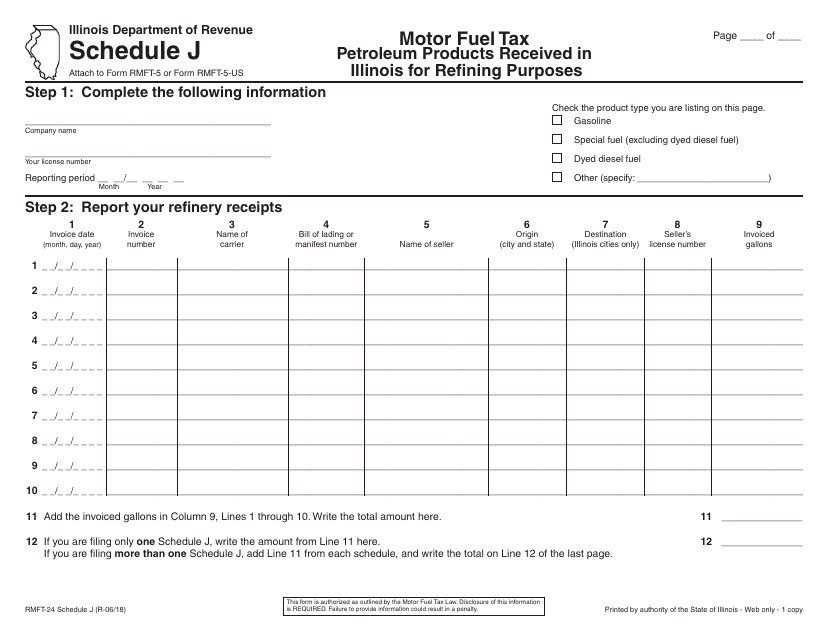

This form is used in Illinois to report the quantity of petroleum products received for refining purposes.

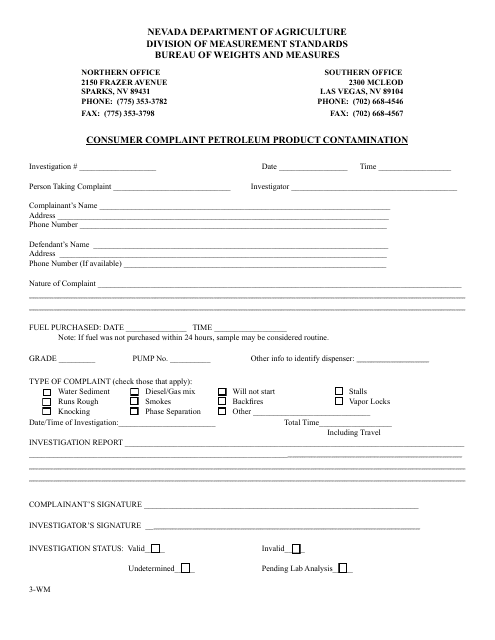

This form is used for filing a consumer complaint regarding petroleum product contamination in Nevada. It is specifically for residents who have experienced issues with the quality or safety of petroleum products they have purchased.

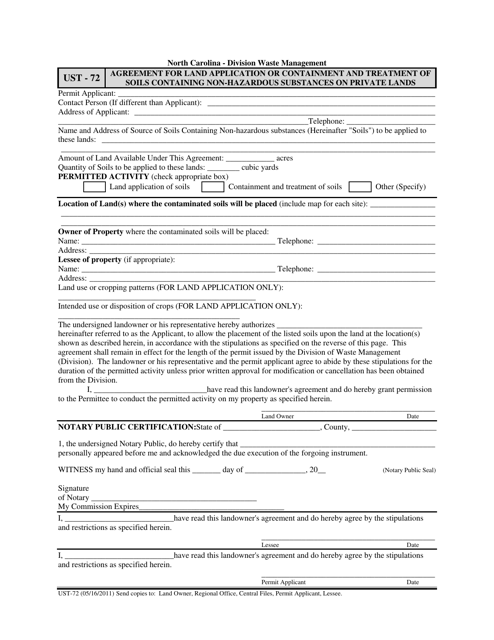

This form is used for agreement regarding the land application, containment, and treatment of soils containing petroleum products on private lands in North Carolina.

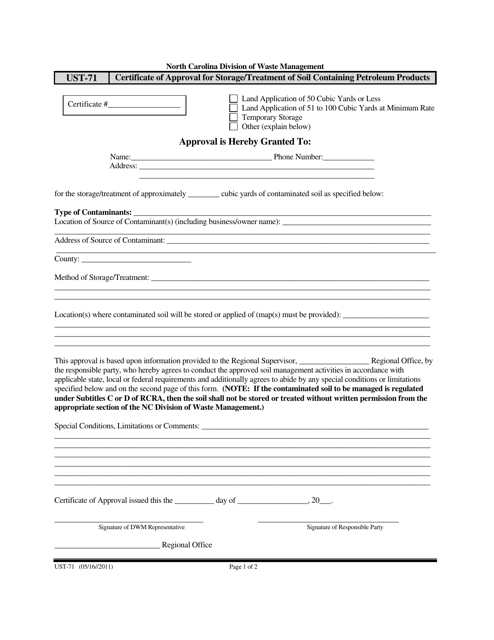

This form is used for obtaining a certificate of approval in North Carolina for the storage or treatment of soil containing petroleum products.

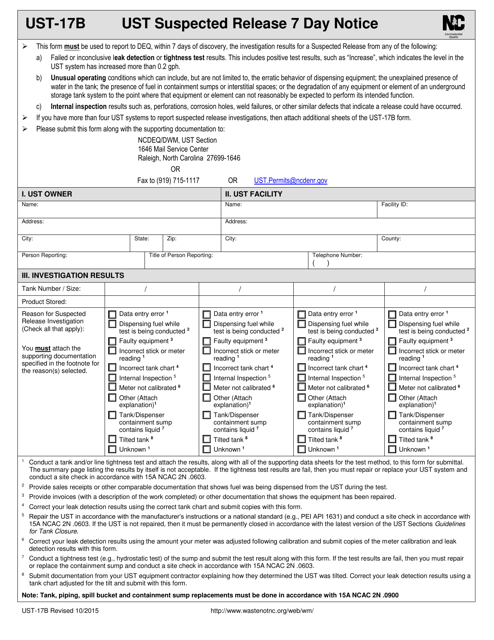

This Form is used for reporting a suspected release of hazardous substances in North Carolina within 7 days.

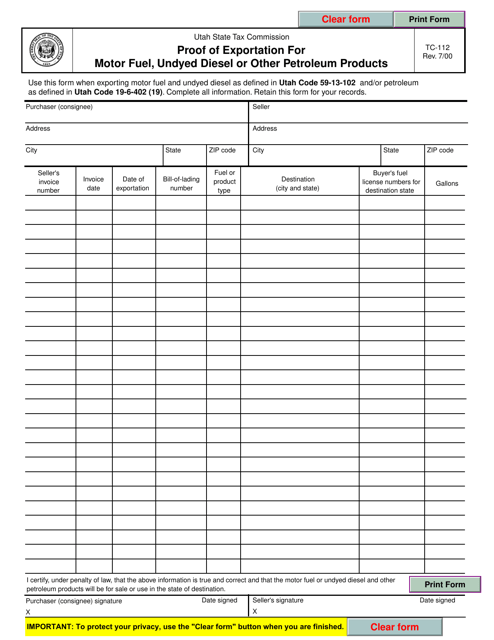

This form is used for providing proof of exportation for motor fuel, undyed diesel, or other petroleum products in the state of Utah. It is required to demonstrate that these products have been exported out of the state.

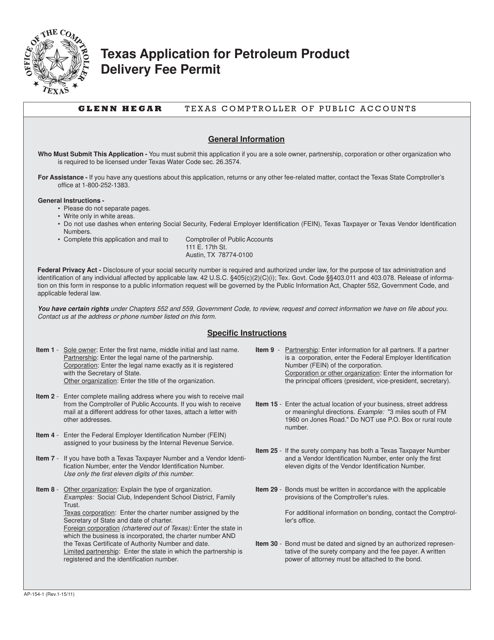

This Form is used for applying for a permit to deliver petroleum products in Texas. It helps regulate the transportation and distribution of petroleum products in the state.

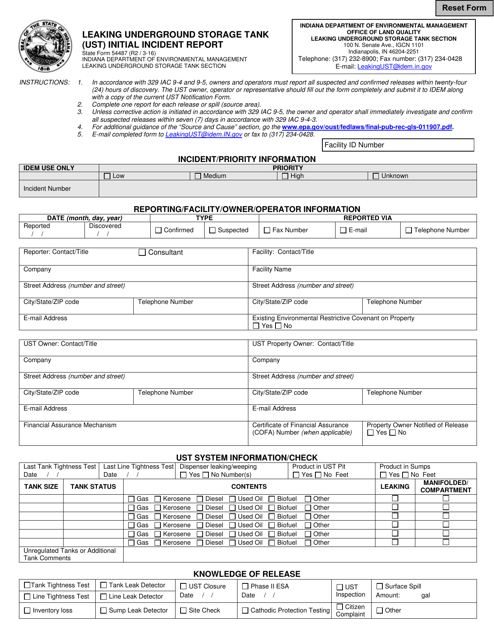

This form is used for reporting the initial incident of a leaking underground storage tank (UST) in the state of Indiana.

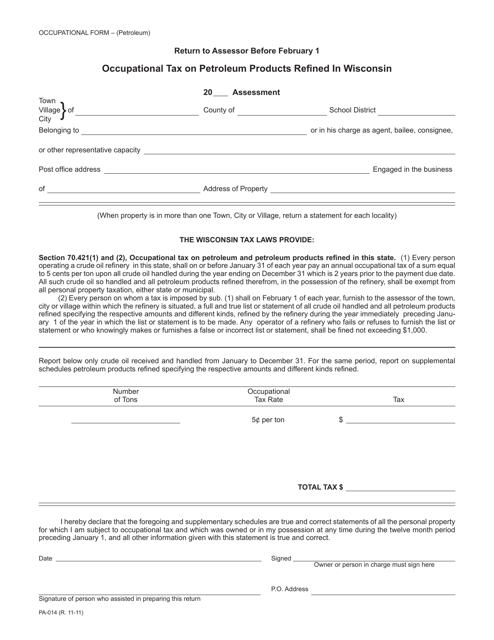

This Form is used for reporting and paying the occupational tax on petroleum products that have been refined in Wisconsin.

This form is used for reporting and calculating the gross earnings tax on petroleum products in the state of Connecticut.

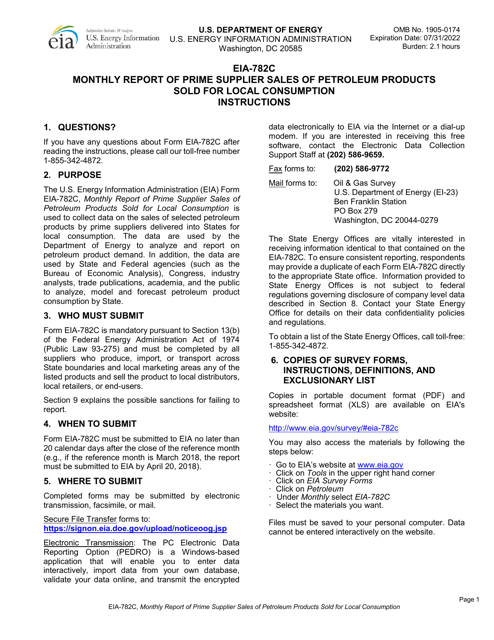

This Form is used for reporting monthly sales of petroleum products by prime suppliers for local consumption.

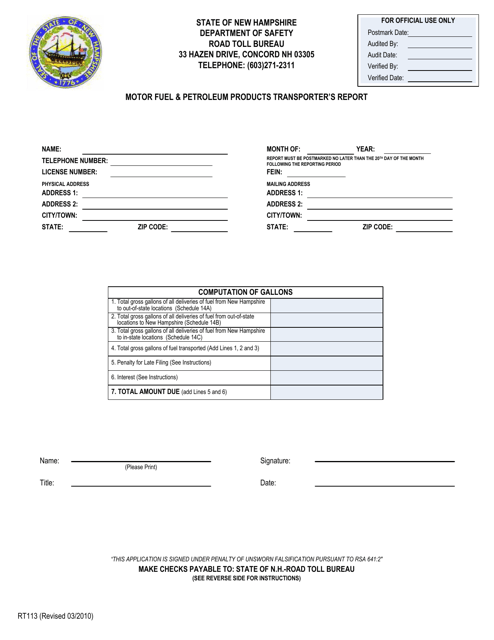

This form is used for reporting the transportation of motor fuel and petroleum products in the state of New Hampshire.

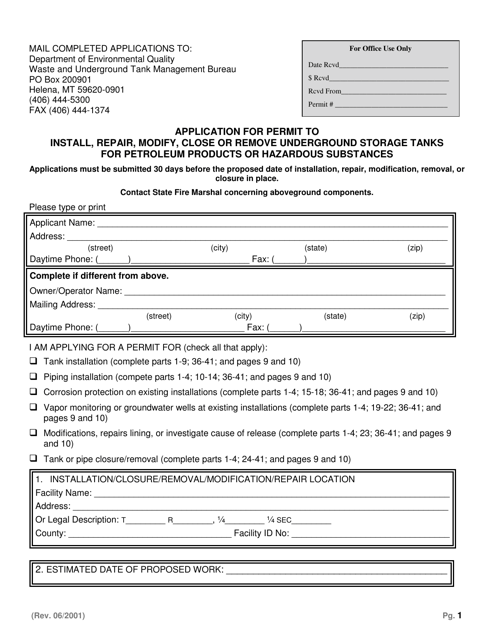

This type of document is used in Montana for obtaining a permit to install, repair, modify, close, or remove underground storage tanks for petroleum products or hazardous substances.