Household Income Templates

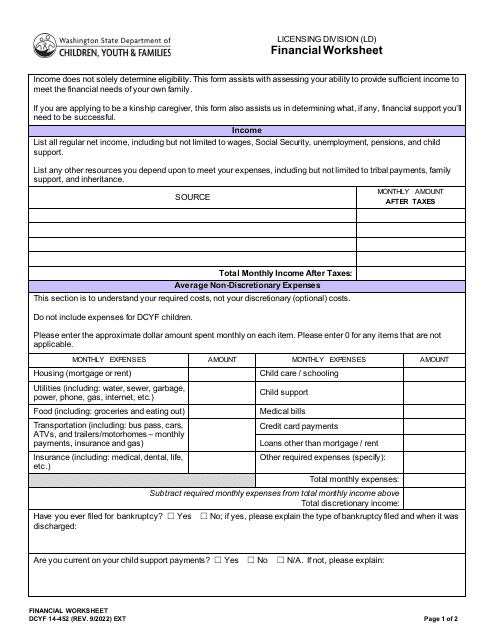

Are you curious to know more about household income? Look no further! This collection of documents is a comprehensive resource that covers various aspects of household income. Whether you need to calculate a capital loss to add back in household income or declare self-sufficiency, these documents will guide you through the process.

If you reside in Minnesota, you can find the Worksheet for Calculating a Capital Loss to Add Back in Household Income, a helpful tool that ensures accuracy in your financial calculations. For individuals in California, the Lower Income Households Family Household Income Reporting Worksheet (Form BOE-267-L-A) provides a clear framework for reporting household income. Meanwhile, in Oregon, the Oregon Lifeline Household Worksheet (Form FMFM951ENG) assists residents in determining their eligibility for the lifeline program based on their household income.

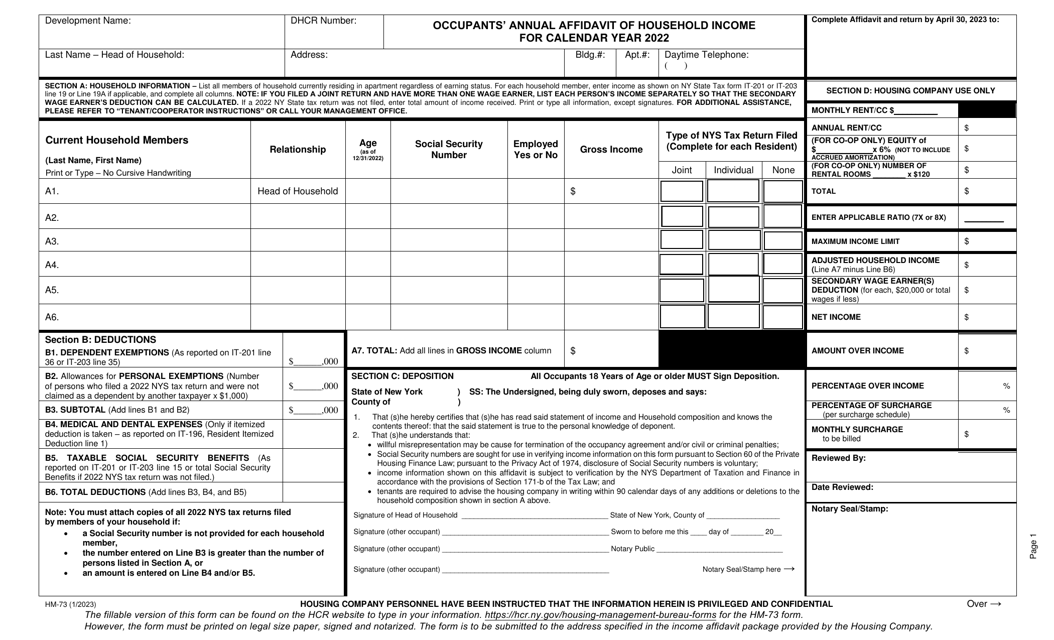

New York residents can benefit from the Occupants' Annual Affidavit of Household Income (Form HM-73), which plays a crucial role in determining eligibility for various assistance programs. Finally, if you are looking for a comprehensive document that encompasses the declaration of self-sufficiency, the USCIS Form I-944 is perfect for you.

From calculating capital losses to reporting household income, this collection of documents offers valuable resources for individuals and families in a variety of circumstances. Whether you're seeking financial assistance or need to provide accurate income information, these documents will facilitate the process.

Documents:

35

This document provides information on the income levels and poverty rates in the United States. It offers insights into the financial well-being of individuals and families in the country.

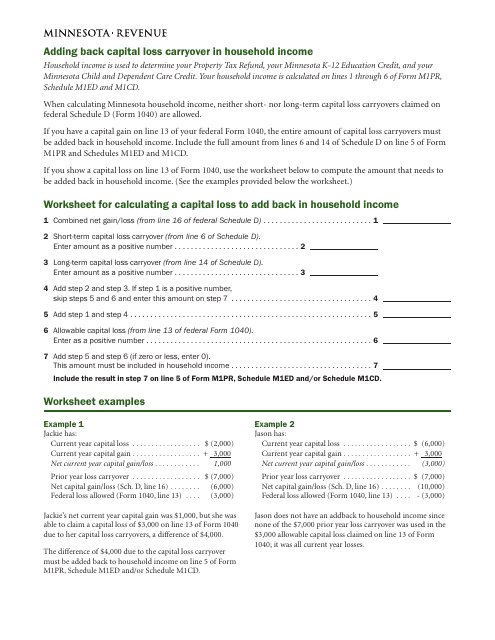

This worksheet is used in Minnesota to calculate a capital loss that needs to be added back to your household income for tax purposes. It helps in determining the amount of capital loss that can be deducted from your income tax return.

This form is used for requesting additional information related to the CalFresh program in California.

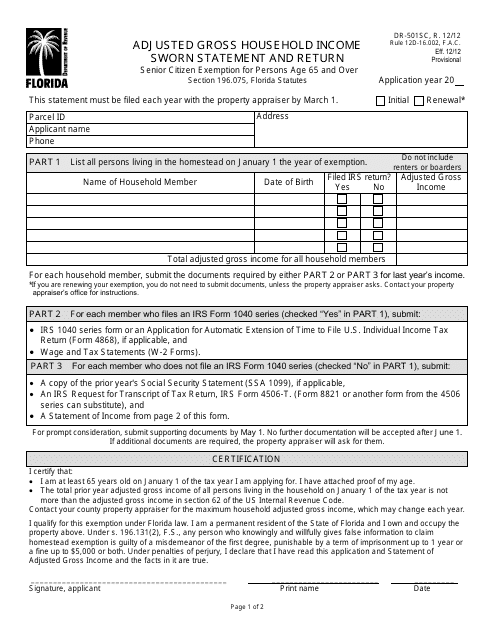

This form is used for reporting the adjusted gross household income in Florida and is required to be accompanied by a sworn statement.

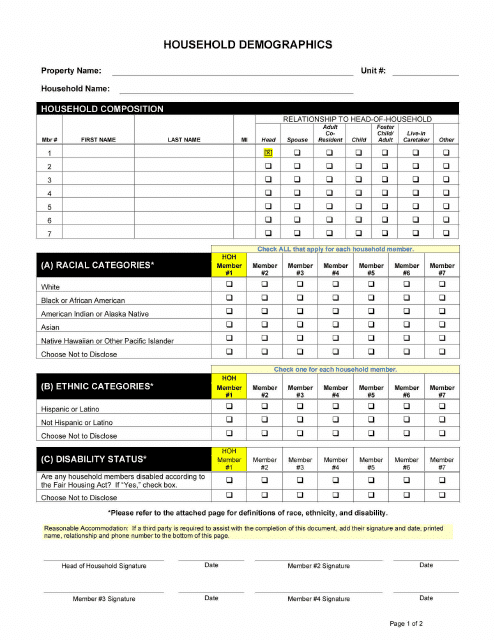

This form is used to gather information about the demographics of households in the state of Arizona. It helps in understanding the characteristics and composition of households in Arizona.

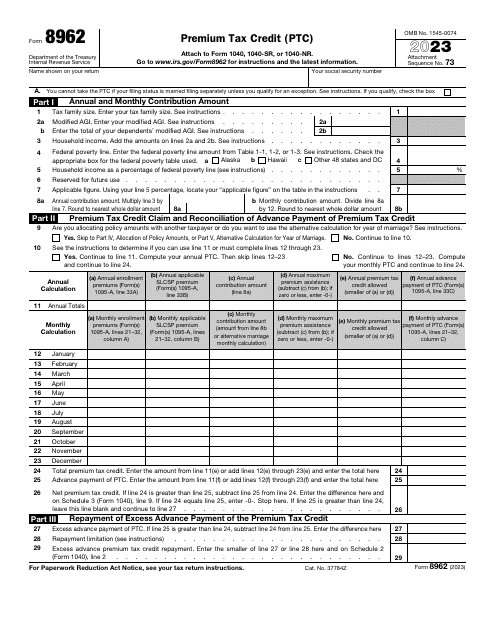

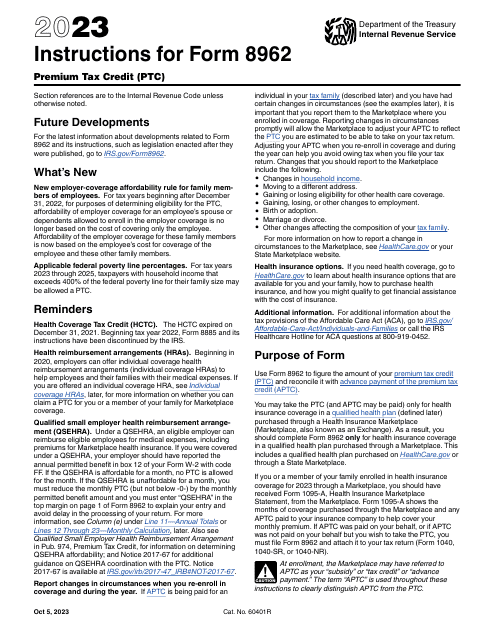

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.

This document provides information about the income levels and poverty rates in the United States. It includes data on the distribution of income and the prevalence of poverty across different demographic groups.

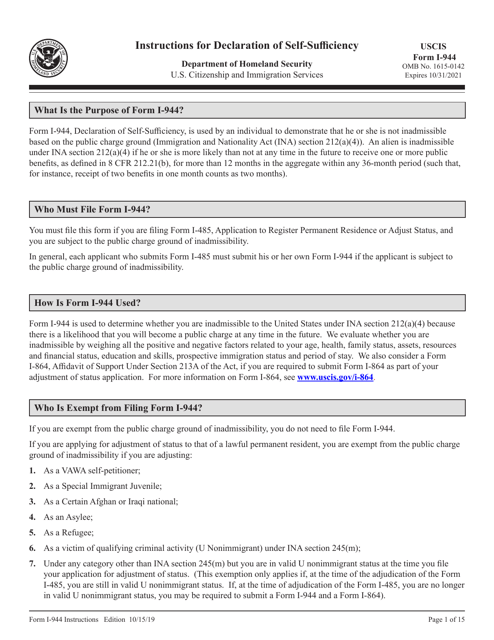

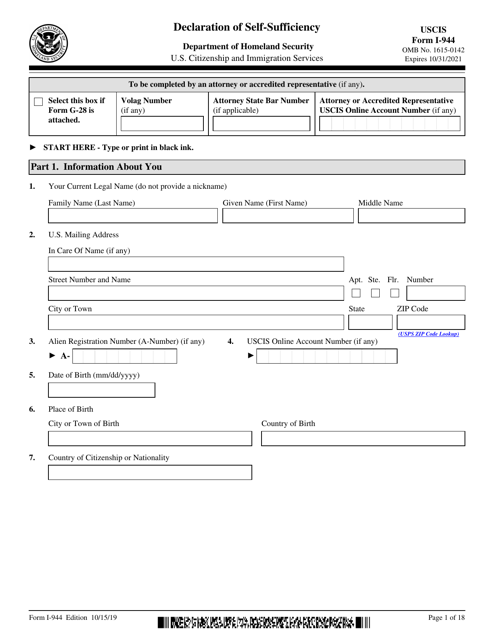

This document provides instructions for completing USCIS Form I-944, which is the Declaration of Self-sufficiency. This form is used for assessing an immigrant's ability to support themselves financially and avoid becoming a public burden in the United States. It requires detailed information on the applicant's income, assets, liabilities, and use of public benefits.

This form is used for declaring self-sufficiency to the United States Citizenship and Immigration Services (USCIS).

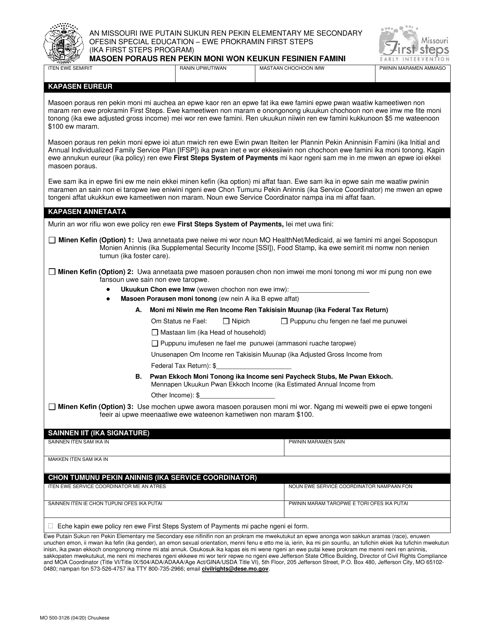

This form is used for providing financial information for family cost participation in Missouri. It is specifically designed for the Chuukese community.

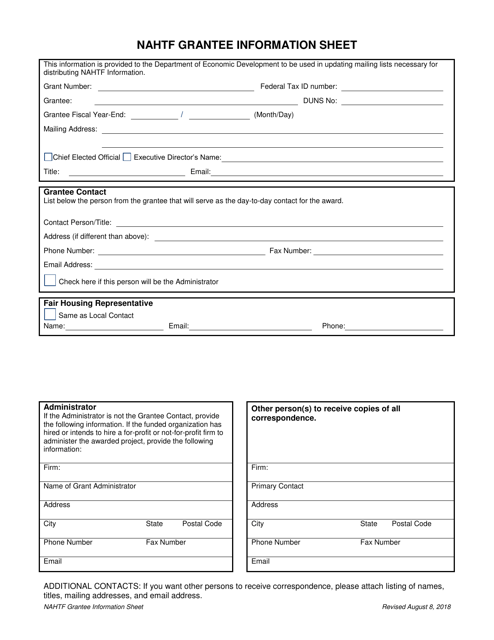

This document is for gathering information about grant recipients in Nebraska. It provides details about the organization or individual receiving the grant.

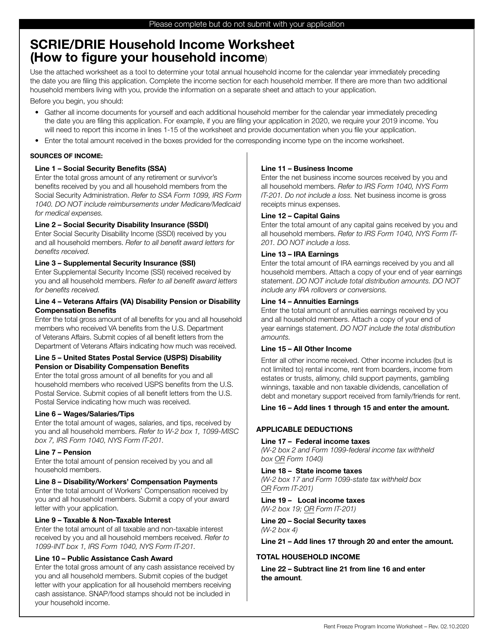

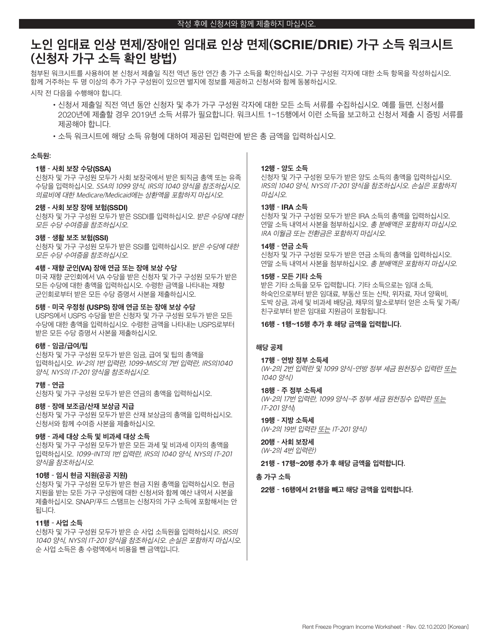

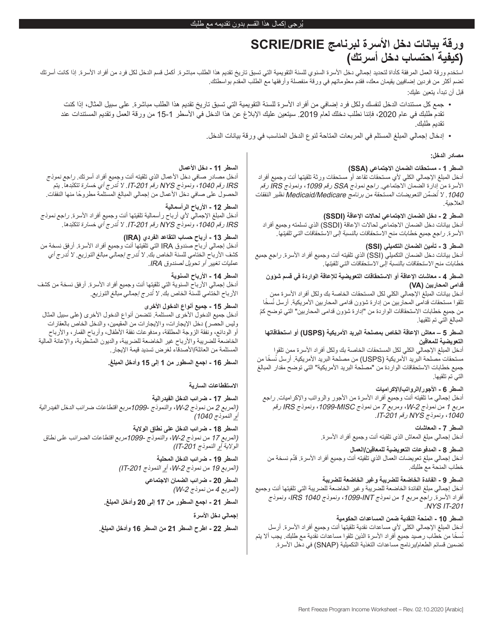

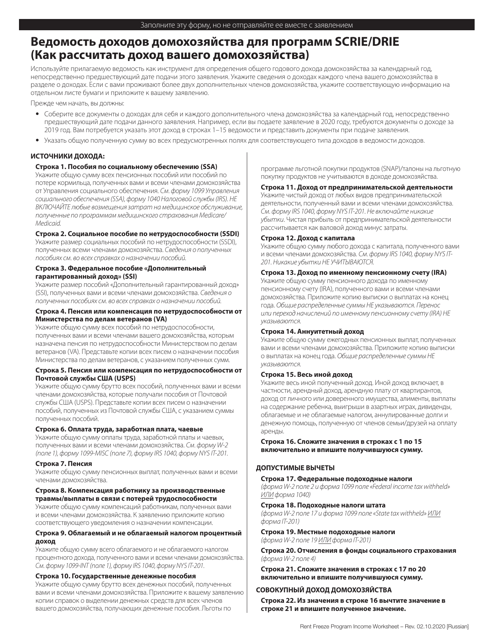

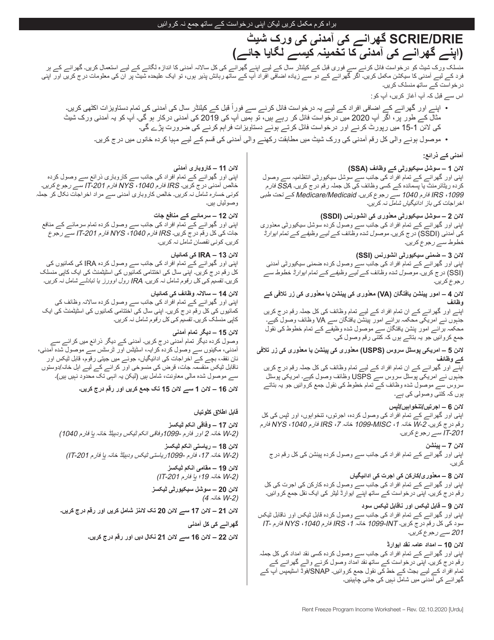

This document is a Household Income Worksheet specifically designed for the residents of New York City. It helps individuals and families in New York City to calculate and track their household income.

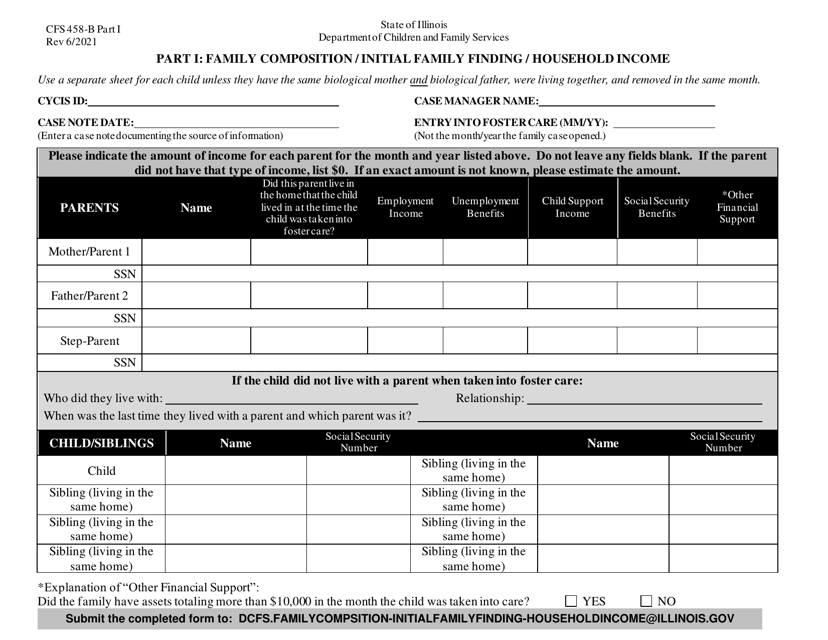

This Form is used for reporting information about a family to the Department of Housing and Urban Development (HUD).

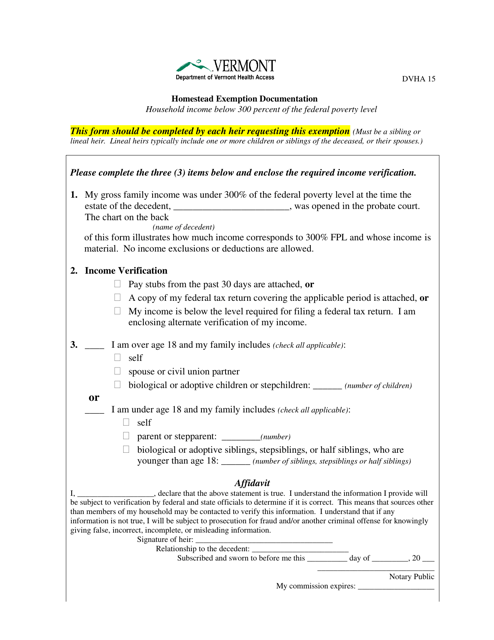

This form is used for applying for a Homestead Exemption in Vermont if your household income is below 300 percent of the Federal Poverty Level.

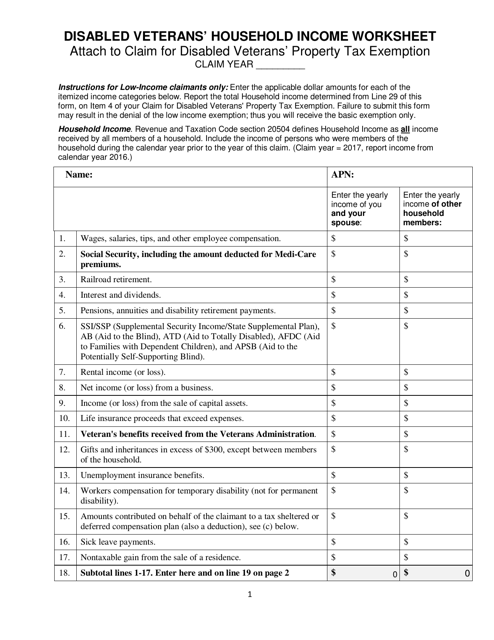

This document is a worksheet used by disabled veterans in Santa Cruz County, California to calculate their household income.

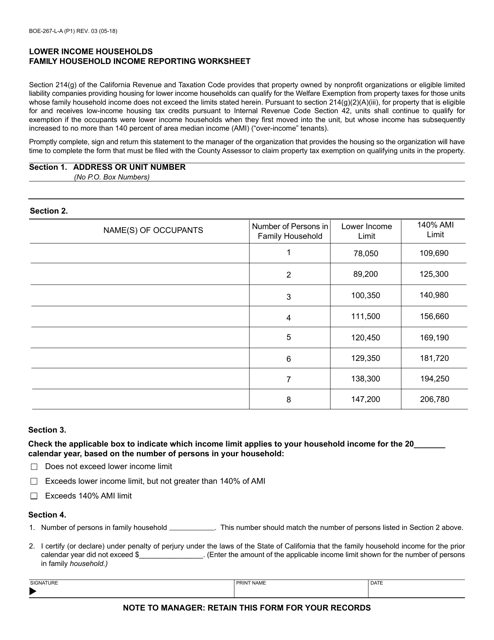

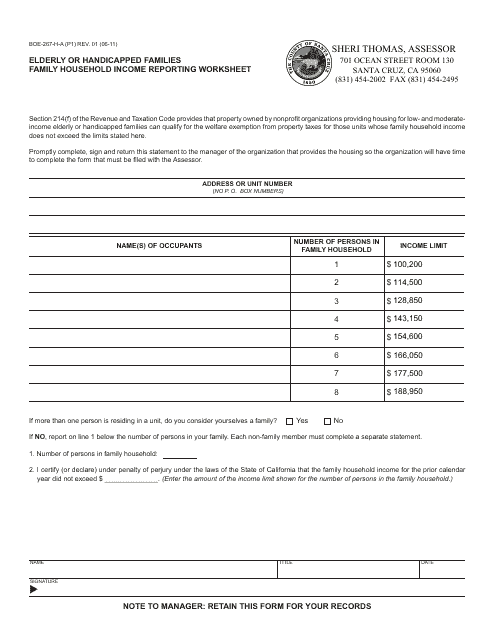

This Form is used for reporting family household income for lower income households in California.

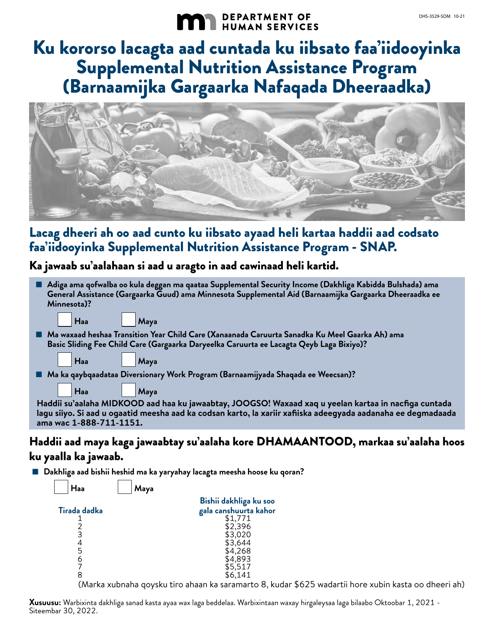

This document is used for applying for Supplemental Nutrition Assistance Program (SNAP) benefits in Minnesota. It is specifically designed for Somali speakers.

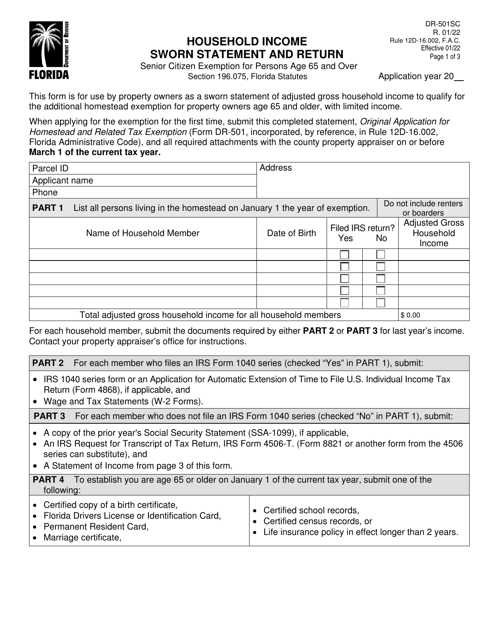

This form is used for senior citizens in Florida who want to apply for a tax exemption for persons aged 65 and over. It requires a sworn statement and return of household income.

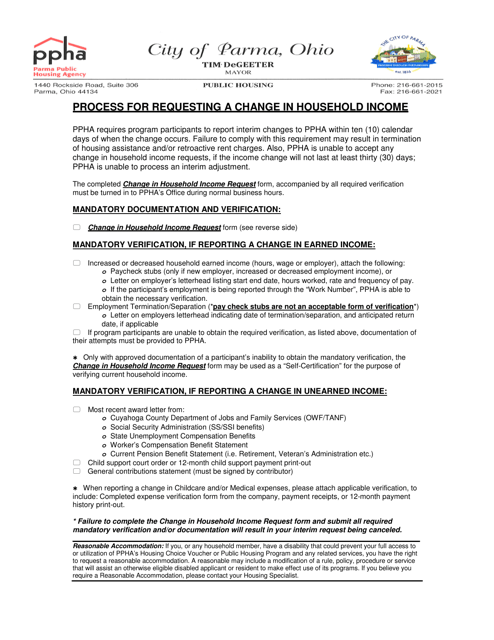

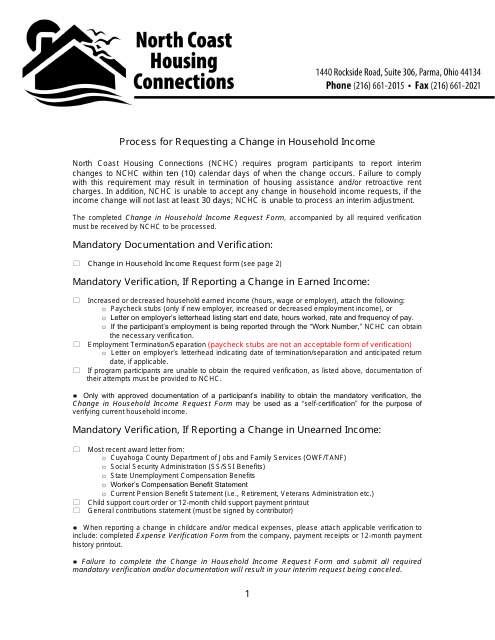

This form is used for requesting a change in household income in the City of Parma, Ohio.

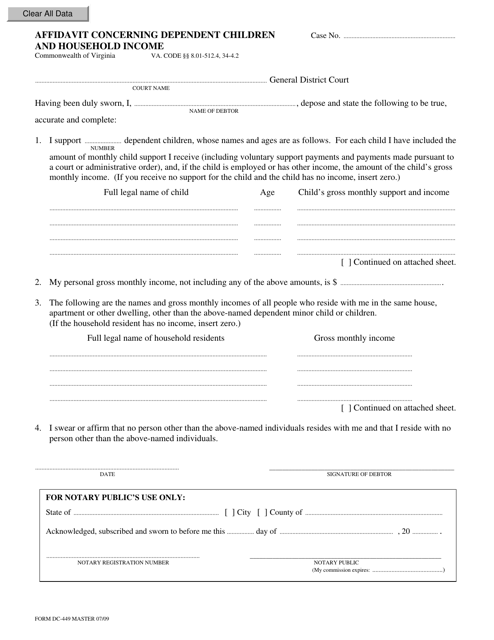

This form is used for filing an affidavit in Virginia to provide information about dependent children and household income.

Instructions for Form DC-449 Affidavit Concerning Dependant Children and Household Income - Virginia

This Form is used for providing an affidavit concerning dependent children and household income in the state of Virginia. It is used to gather information about the financial support and care provided to dependent children and the household income to determine eligibility for certain benefits or programs.

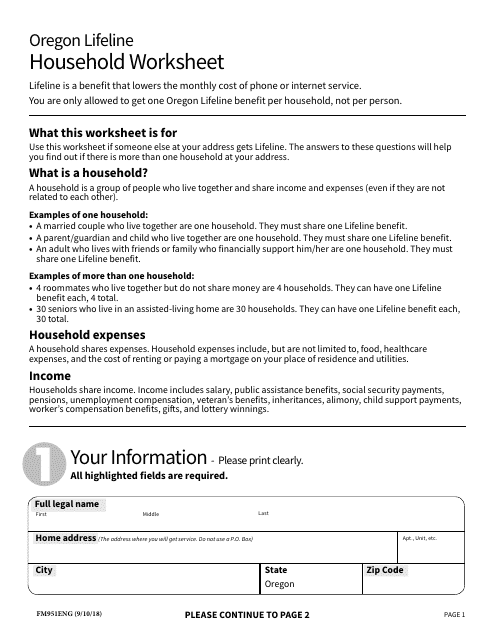

This form is used for the Oregon Lifeline program to determine eligibility for discounted phone and internet service for low-income households in Oregon.

This form is used for the occupants of a household in New York to provide an annual affidavit of their income. It is used to determine eligibility for certain programs or benefits.

This form is used for reporting the household income of elderly or handicapped families living in Santa Cruz County, California.

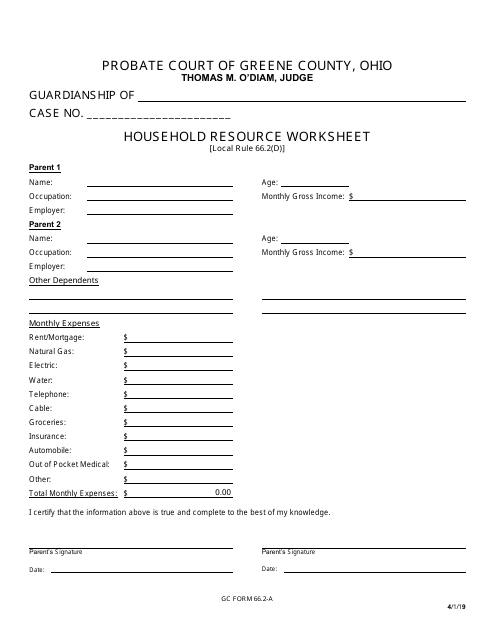

This Form is used for determining household resources in Greene County, Ohio.