Tax Intercept Templates

Are you struggling to collect overdue taxes from individuals or businesses? Look no further – our tax intercept services are here to help.

Our tax intercept program allows government agencies and municipalities to collect outstanding debts by intercepting state income tax refunds. With the click of a button, you can significantly improve your collection efforts and recoup the funds you are owed.

Our system is efficient and convenient, making it easier than ever to recover the money that is rightfully yours. Through our tax intercept program, we work with states across the country to ensure that individuals and businesses who owe you money understand the consequences of non-payment.

Gone are the days of frustrating and time-consuming collection efforts. Our tax intercept program streamlines the process, allowing you to focus on what matters most – serving the needs of your community.

No matter the size or scope of your tax intercept needs, our program is customizable to fit your unique requirements. From small municipalities to large government agencies, we have the expertise and technology to make the intercept process seamless.

Don't let overdue taxes drain your resources and impact the services you provide. Our tax intercept services offer a cost-effective solution to maximize your revenue and minimize the burden on your staff.

Don't leave money on the table – contact us today to learn more about our tax intercept services and how we can help you recover what you are owed.

Documents:

5

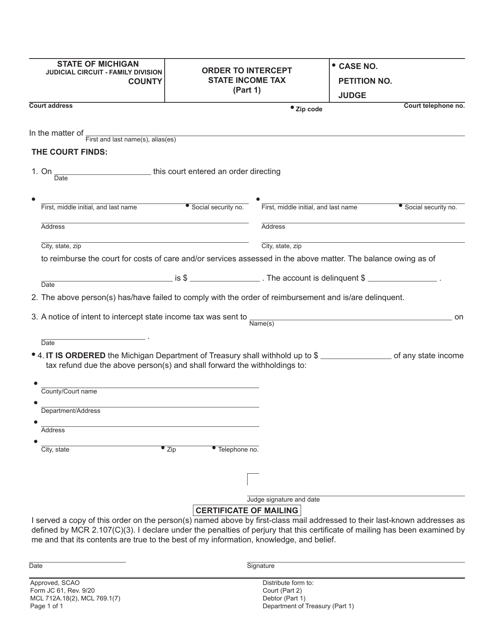

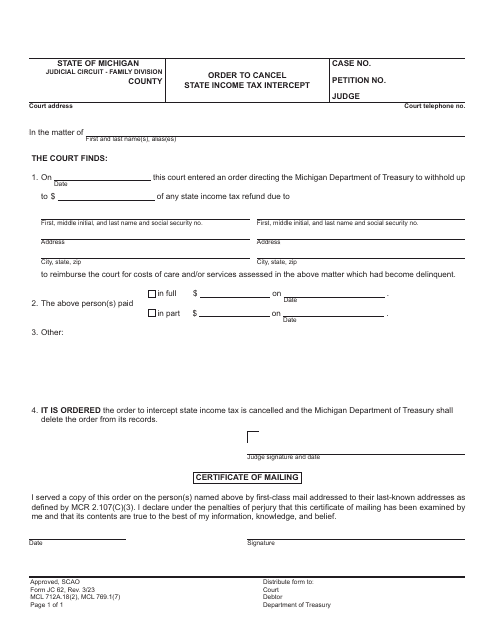

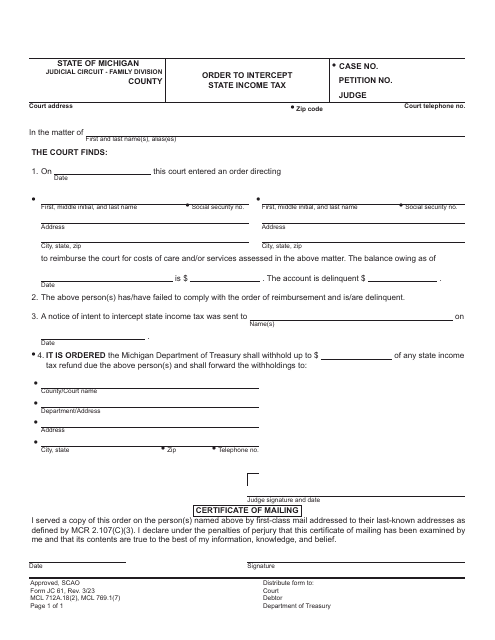

This form is used for requesting an order to intercept state income tax in the state of Michigan. It allows for the collection of unpaid debts through the interception of income tax refunds.

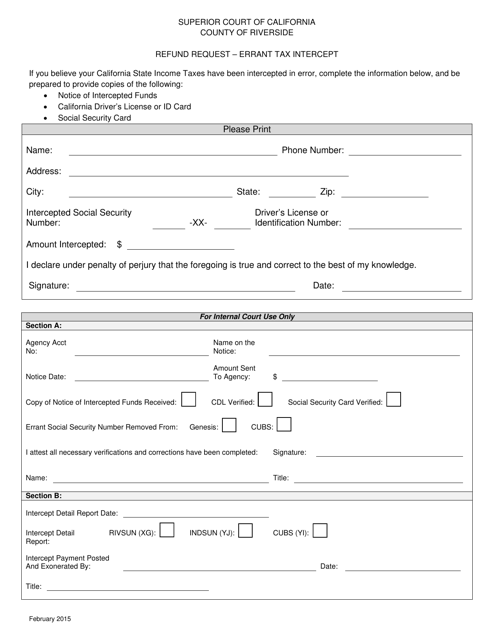

This document is used for submitting a refund request for an erroneous tax intercept in Riverside County, California.