Resort Property Templates

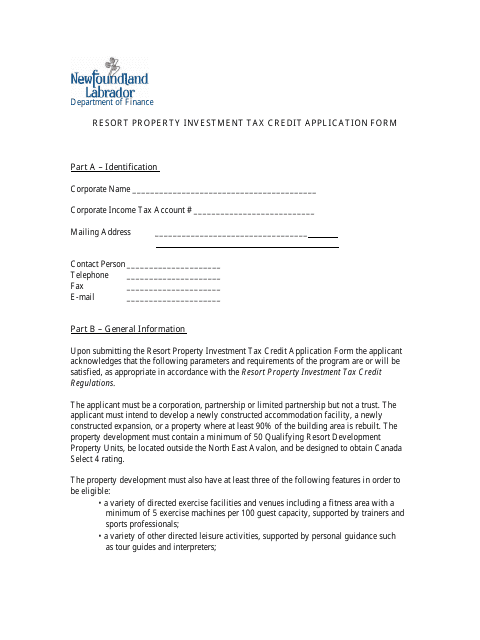

Are you looking to invest in a resort property? The resort property investment tax credit application form is here to help you navigate the process. This document, provided by the government of Newfoundland and Labrador in Canada, is specifically designed for individuals interested in claiming the resort property investment tax credit.

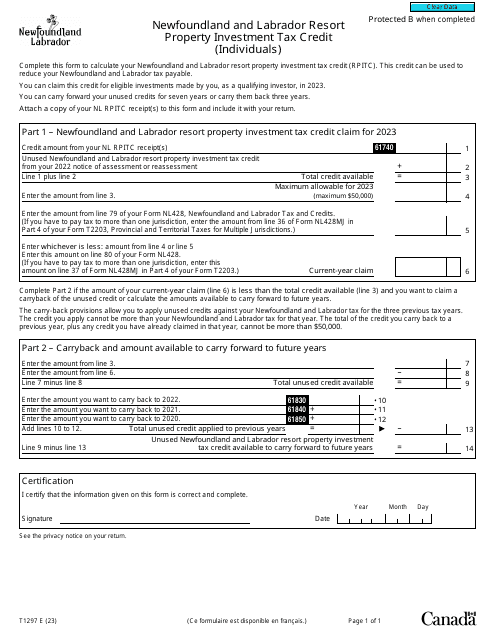

Also known as Form T1297, this form is an essential tool for individuals looking to take advantage of the tax benefits associated with investing in resort properties in Newfoundland and Labrador. Whether you're a seasoned investor or new to the world of real estate, this document provides the necessary information and guidelines to help you successfully complete your tax credit application.

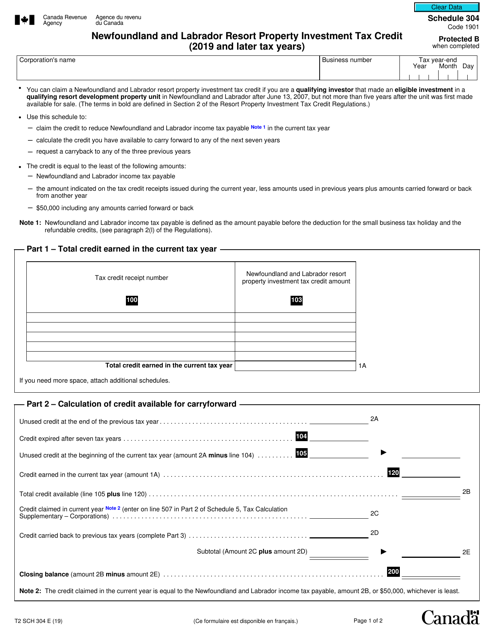

In addition to Form T1297, the government of Newfoundland and Labrador provides an alternative version known as Form T2 Schedule 304. This document is specifically designed for individuals claiming the resort property investment tax credit for the 2019 tax year and beyond.

With the resort property investment tax credit application form, you can maximize your tax savings while investing in the lucrative world of resort properties. Don't miss out on this incredible opportunity to grow your wealth and diversify your investment portfolio.

Please note that the provided example documents are for illustrative purposes only. For the most up-to-date and accurate information, please refer to the official government documents or consult with a tax professional. Start your resort property investment journey today and take advantage of the resort property investment tax credit.

Documents:

7

This Form is used for applying for the Resort Property Investment Tax Credit in Newfoundland and Labrador, Canada.