Tax Forms for Trusts Templates

Are you looking for tax forms specifically designed for trusts? Look no further! Our comprehensive collection of tax forms for trusts provides everything you need to fulfill your legal obligations and ensure compliance with the tax laws.

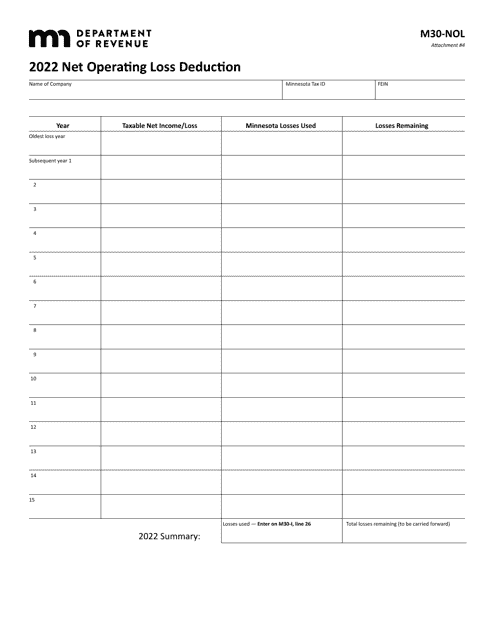

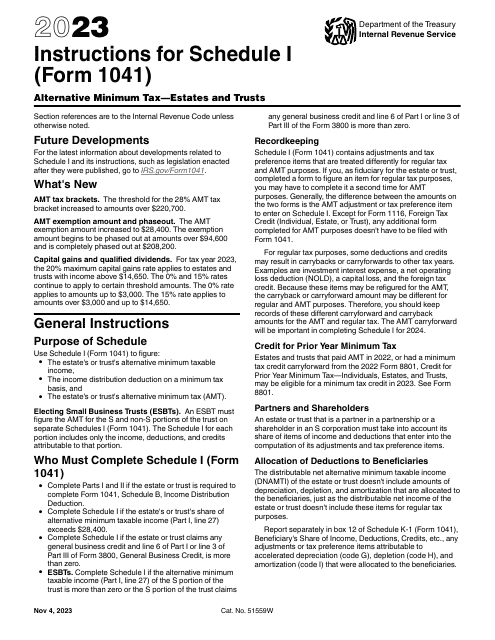

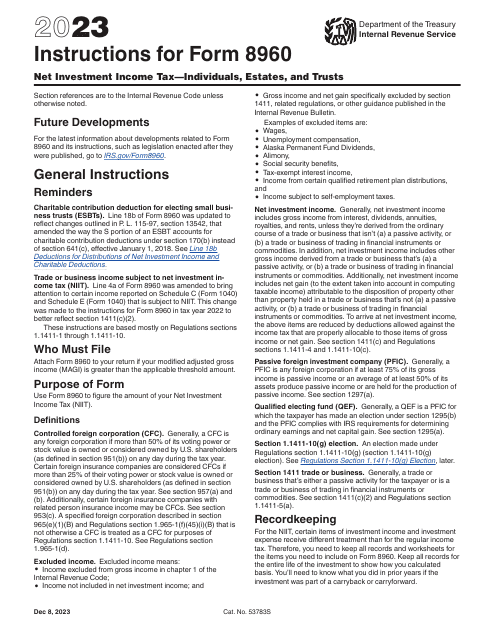

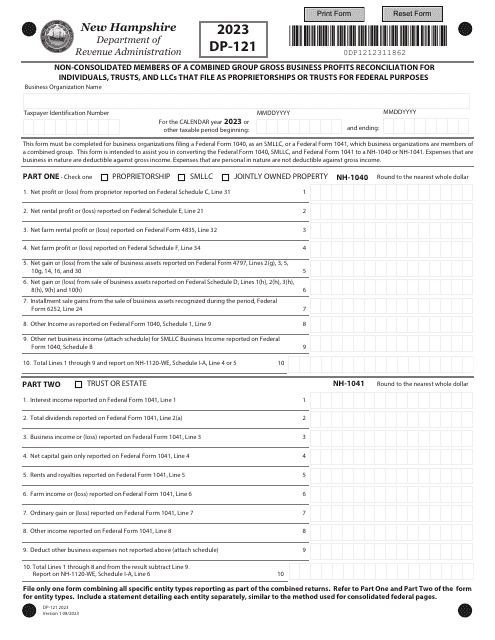

From Form M30-NOL Net Operating Loss Deduction in Minnesota to Form DP-121 Non-consolidated Members of a Combined Group Gross Business Profits Reconciliation in New Hampshire, our tax forms cover a wide range of situations and jurisdictions.

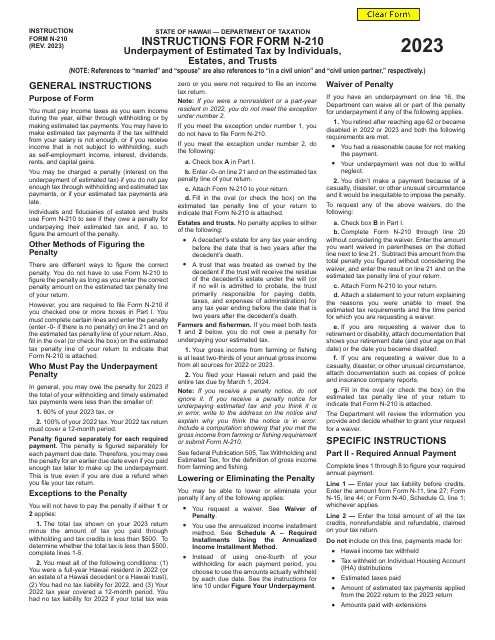

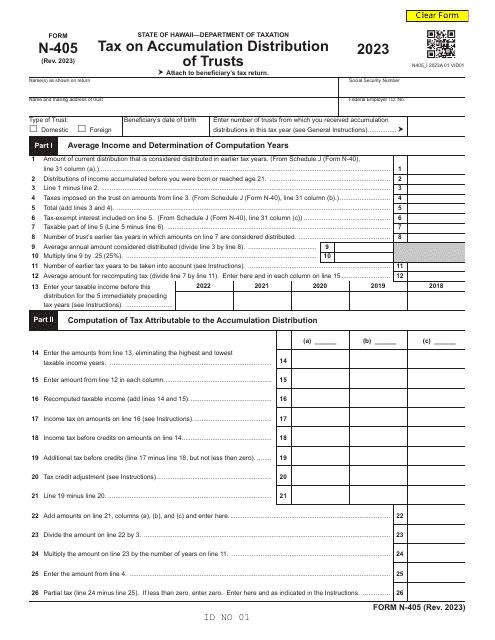

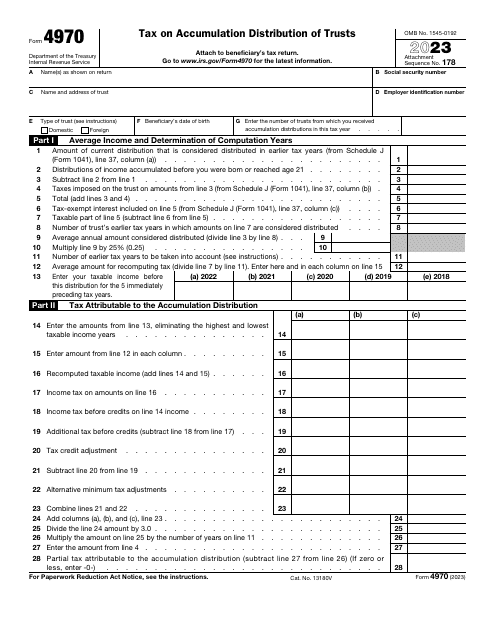

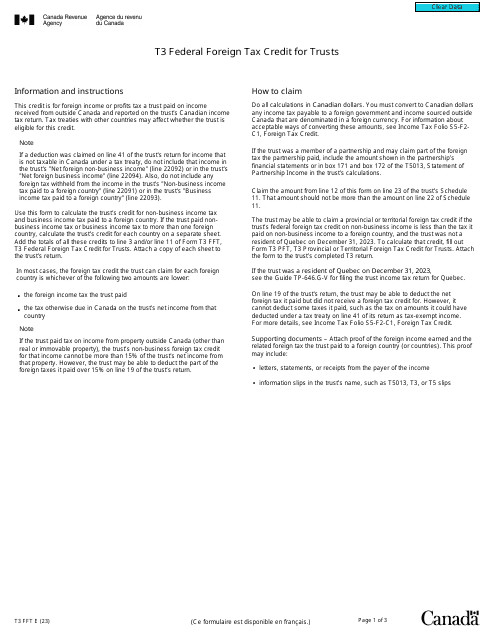

Whether you need to file for Alternative Minimum Tax, report underpayment of estimated tax, or calculate the tax on accumulation distribution, our collection has got you covered. Trusts can be complex entities, but our user-friendly instructions and forms will simplify the process for you.

Don't let tax season stress you out. Take advantage of our easy-to-use tax forms for trusts and stay on top of your tax obligations. Trust us to keep your trust taxes in order!

Documents:

8