Debt Repayment Templates

Are you drowning in debt? Is your financial situation causing you stress and anxiety? It's time to take control of your financial future and start your journey towards debt freedom. Our debt repayment solutions are designed to help individuals and businesses like yours regain their financial stability and eliminate the burden of debt.

Our comprehensive collection of resources and templates offer practical assistance in managing your debt repayment journey. From debt dispute letter templates to wage assignment transmittal forms, we have all the tools you need to navigate the complex world of debt repayment.

Also known as debt management documents, our diverse range of resources cater to different needs and situations. Whether you're an individual struggling with credit card debt or a business owner trying to manage multiple loans, our debt repayment documents can provide clear guidance and assistance.

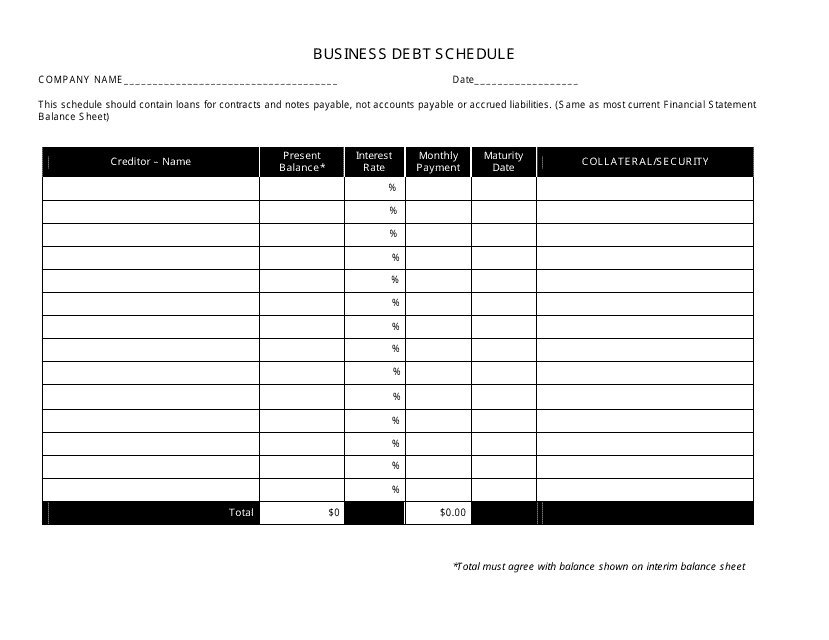

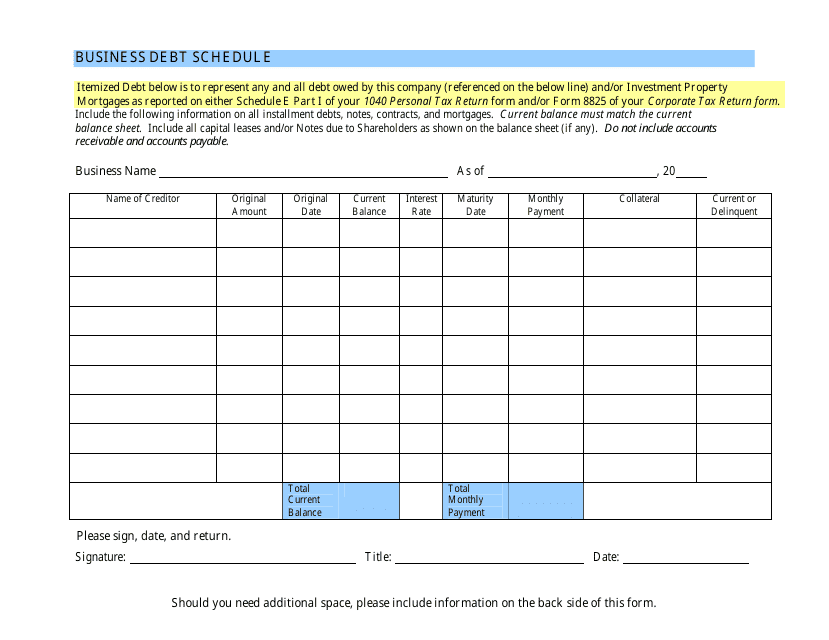

Take advantage of our Business Debt Schedule Template, a valuable tool for organizing and tracking your business debts. This template offers a straightforward approach to managing your repayments, ensuring you stay on top of your financial obligations.

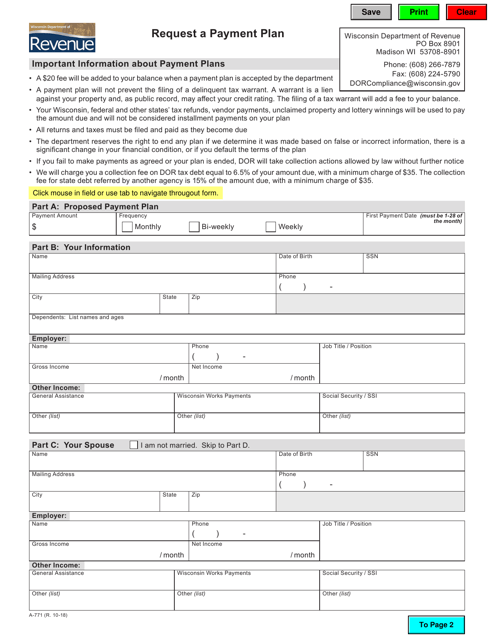

If you're facing challenges in negotiating a payment plan with your creditors, our Form A-771 Request a Payment Plan - Wisconsin can help. This document provides a formal request that outlines your financial situation and proposes a realistic payment plan that suits your needs.

Sometimes, mistakes happen, and you may find yourself facing an overpayment recovery request. In such cases, our Form SSA-632-BK Request for Waiver of Overpayment Recovery can assist you in seeking a waiver for the overpayment.

At debtrepaymentsolutions.com, we understand that every situation is unique, which is why we offer a wide range of resources to cater to diverse needs. Our goal is to equip you with the knowledge and the tools you need to achieve a debt-free future.

Take the first step towards financial freedom today by exploring our debt repayment solutions. Say goodbye to sleepless nights and constant worry, and hello to a brighter, debt-free future.

Documents:

54

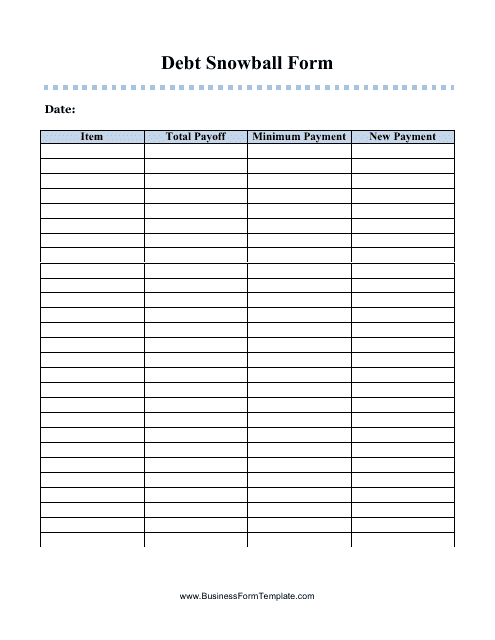

This form is used for organizing and managing your debt repayment strategy using the debt snowball method.

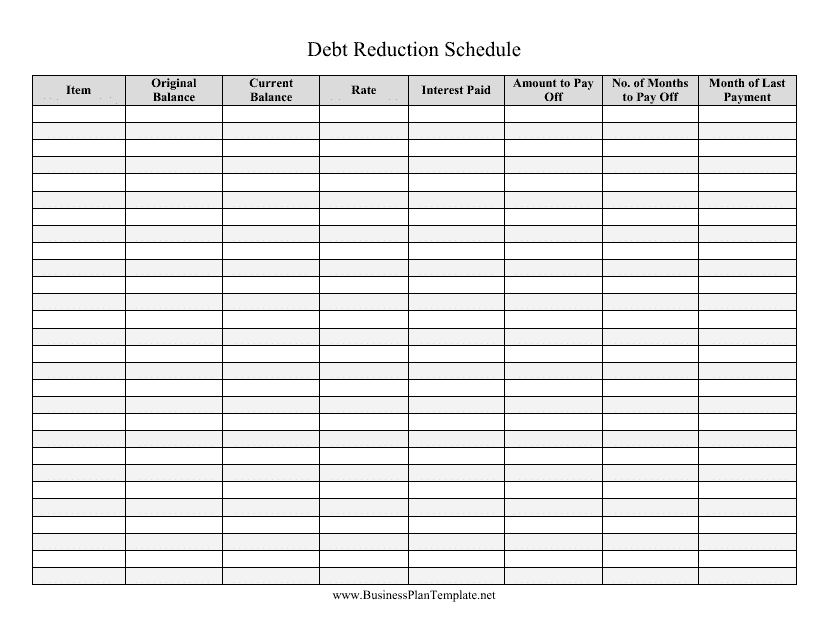

This document is a template that helps in creating a schedule for reducing debt. It can be customized to fit individual financial situations and goals.

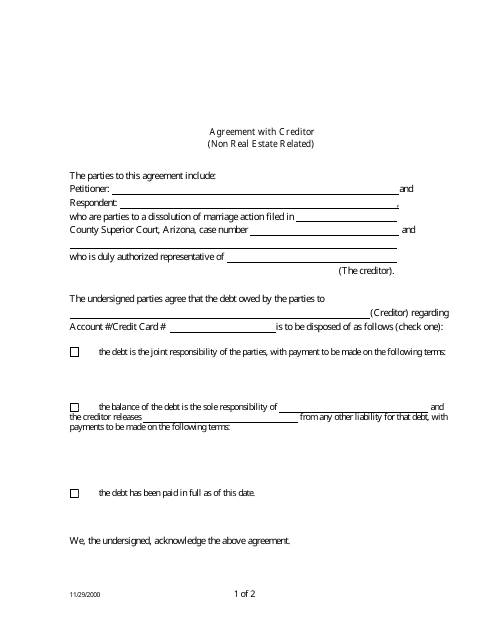

This document is a template used in Arizona for creating an agreement with a creditor that is not related to real estate. It helps in formalizing terms and conditions between the parties involved.

This type of document is a template that helps you manage and track your debts. It provides a structured format for organizing your debt information, including balances, interest rates, and payment schedules. Using a debt worksheet template can help you create a repayment plan and keep track of your progress towards becoming debt-free.

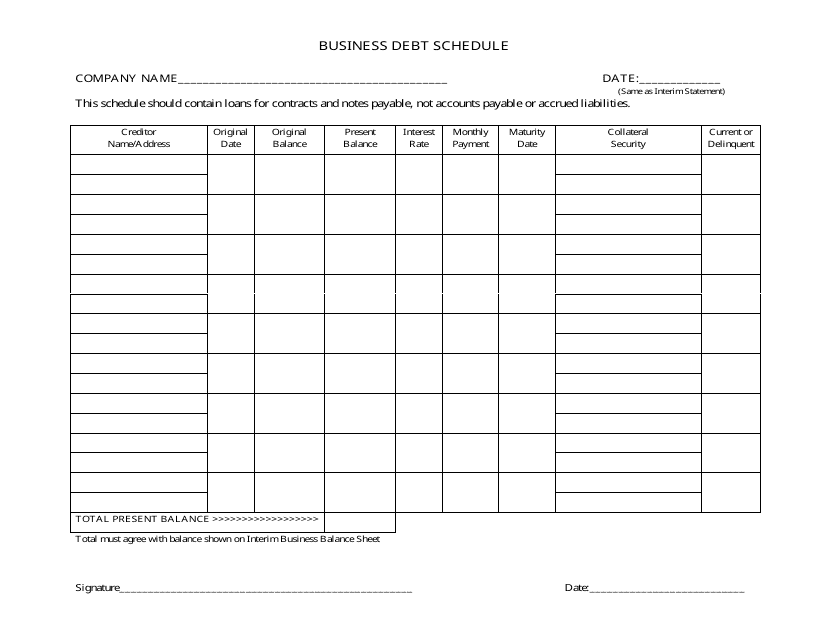

This document provides a template for creating a schedule of business debts. It is designed in a black and white format for easy printing and use.

This document is a template that helps businesses organize and track their debt schedule. It provides a varicolored format for easy visualization.

This document helps businesses organize and track their debts. It provides a template for listing the details of each debt, such as the amount owed, interest rate, and repayment terms. By using this template, businesses can better manage their debt obligations and make informed financial decisions.

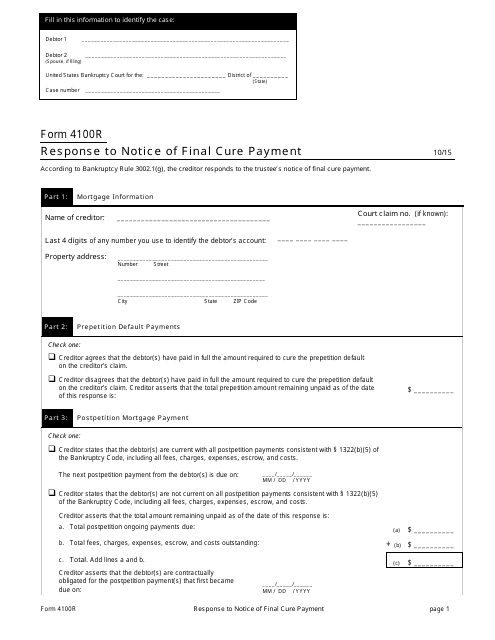

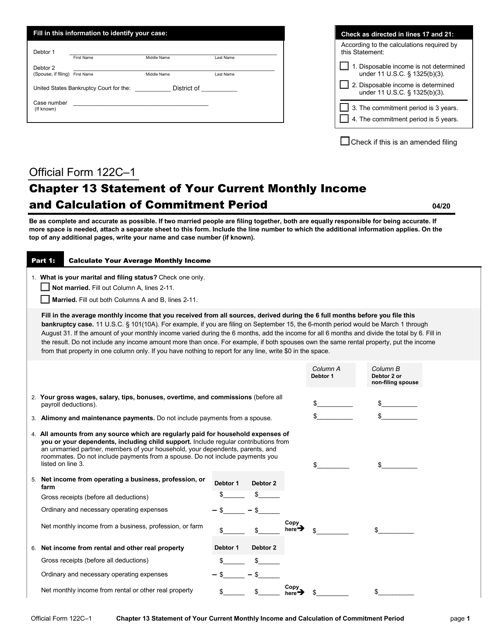

This Form is used for submitting a response to a Notice of Final Cure Payment. It is important to complete and submit this form to finalize the payment process.

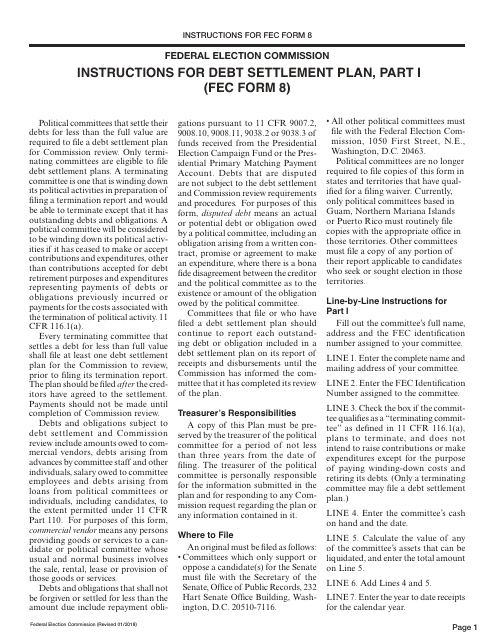

This document provides instructions for completing the FEC Form 8 Debt Settlement Plan.

This form is used for applying for an installment agreement in Illinois for state taxes.

This application form is used in Michigan to request an order regarding a payment plan or discharge of arrears. It helps individuals seeking to manage and resolve outstanding debts through a structured payment plan.

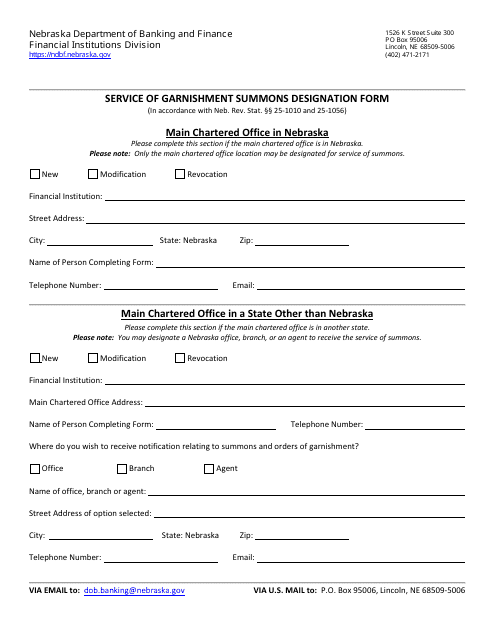

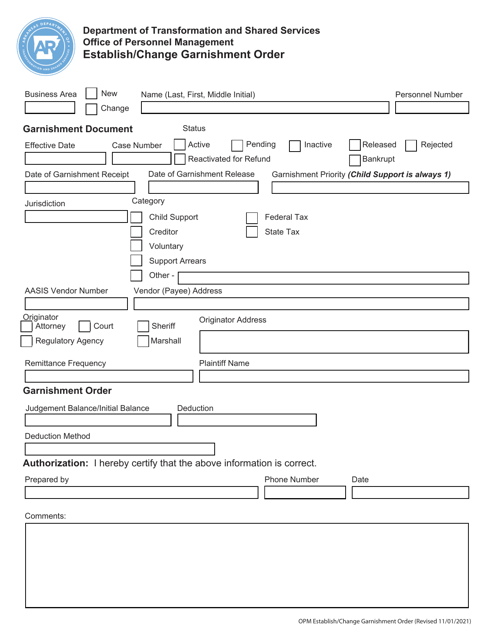

This document is used for designating the service of a garnishment summons in Nebraska.

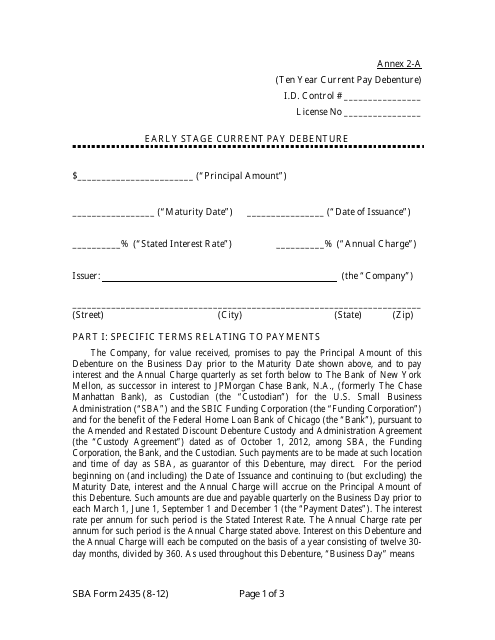

This document is used for applying for an early stage current pay debenture with the Small Business Administration (SBA).

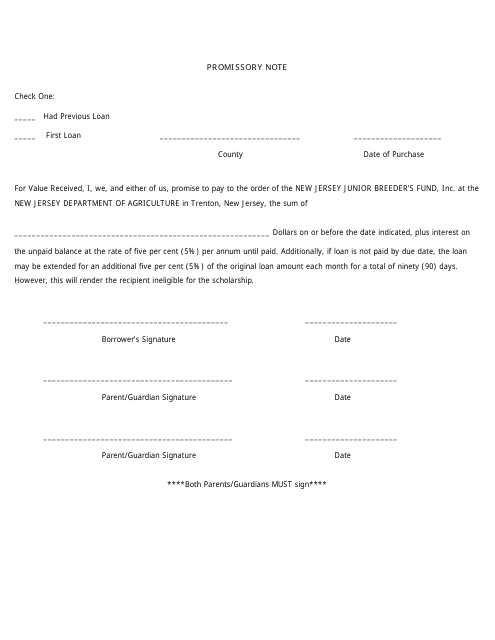

This type of document, known as a Promissory Note, is commonly used in New Jersey. It is a legal agreement that outlines the terms and conditions of a loan or debt. The note contains information such as the amount borrowed, the repayment schedule, and any interest involved. It serves as a written promise to repay the borrowed amount according to the agreed terms.

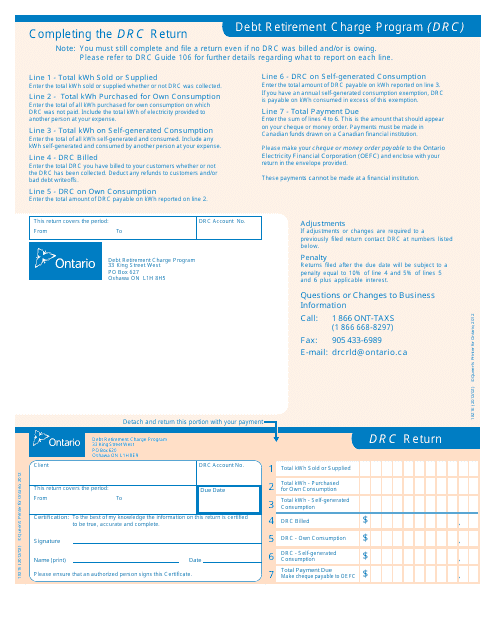

This form is used for filing the Debt Retirement Charge (DRC) return in Ontario, Canada. It is used by businesses to report and remit the DRC amount collected from their customers. The Debt Retirement Charge is a fee that was implemented to help pay off the stranded debt from the former Ontario Hydro. It is applicable to electricity consumed in Ontario.

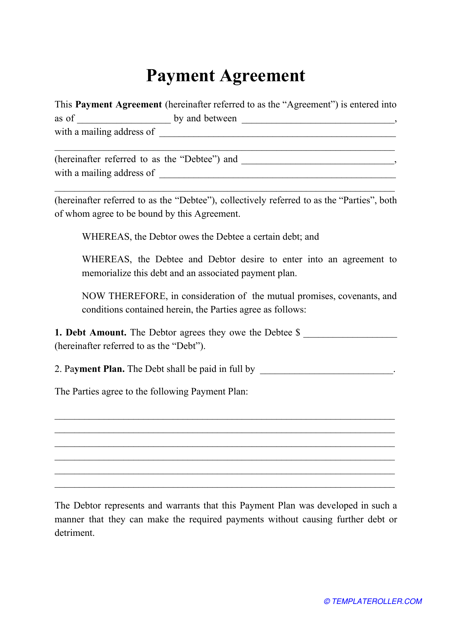

This legal contract is signed by a lender and a borrower and specifies the conditions of the payment, the details of the loan, interest rates, and payment periods.

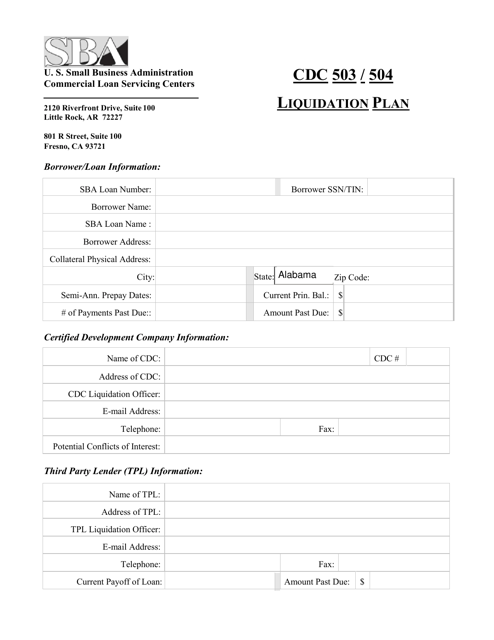

This document is a Liquidation Plan used by the CDC (Centers for Disease Control and Prevention). It outlines the process for liquidating assets or dissolving the organization.

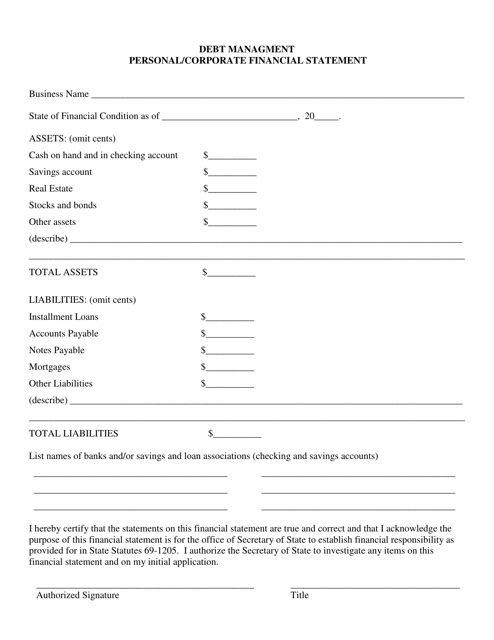

This document is used for managing personal or corporate debt by providing a financial statement in Nebraska. It helps individuals or businesses to track their income, expenses, and overall financial position.

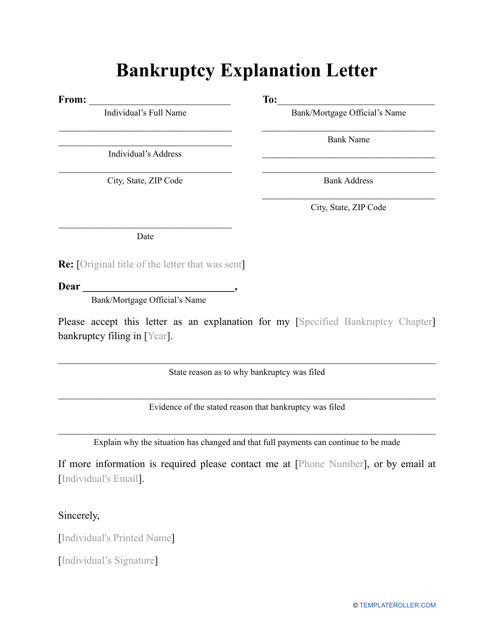

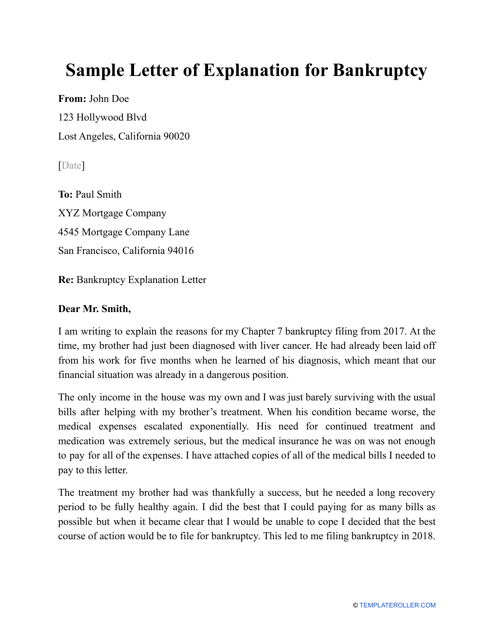

Use this letter template to explain why you had to file for bankruptcy when you are applying for a loan with a financial lender.

This letter serves as a statement from the borrower for the potential lender that clarifies why they had to file for bankruptcy in the past.

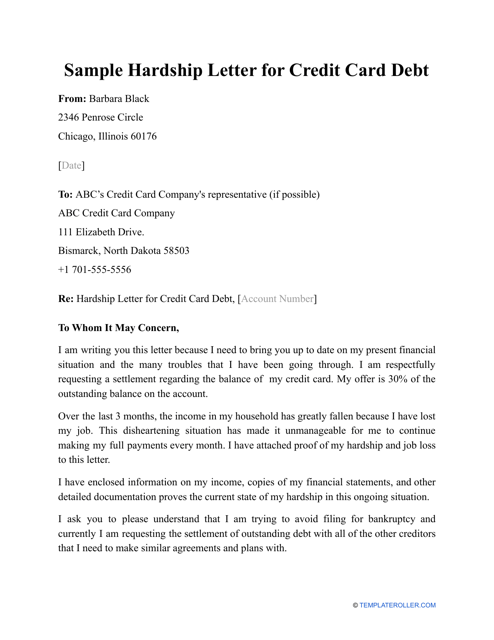

Owners of credit cards can reduce their debt by submitting a Hardship Letter explaining their situation to their credit card company.

This type of debt settlement letter is used by filers who want to decrease the debt on their credit card.

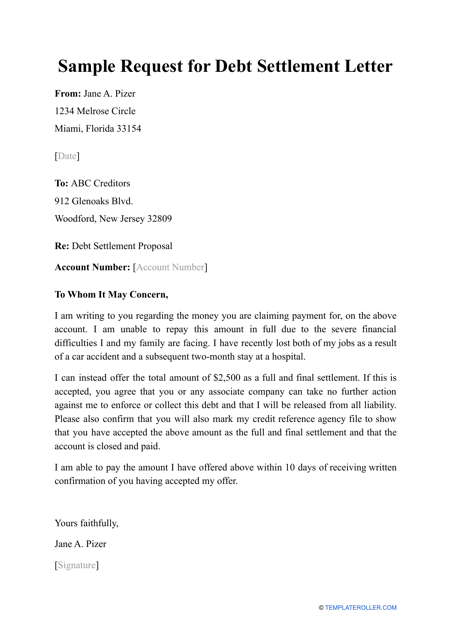

This document's purpose is to help a debtor decrease their debt or change the terms of paying it back in order to make it easier for them.

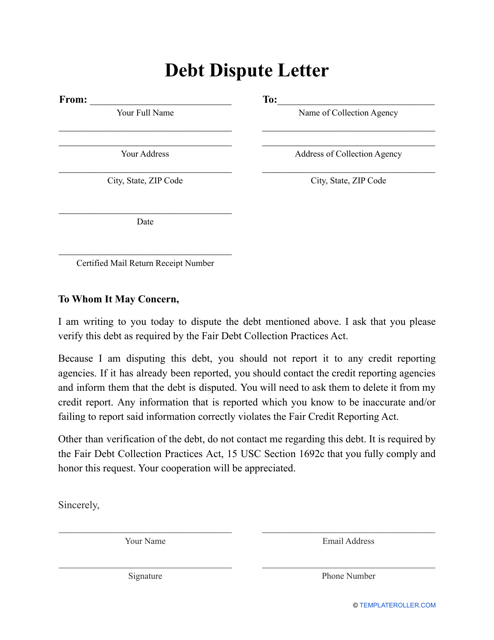

This letter serves as a refusal to accept debt and is written in response to a collector's notice.

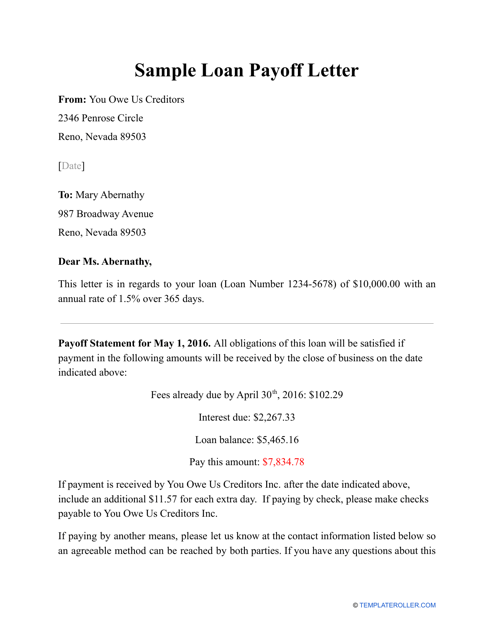

Check out this sample before drafting your own Loan Payoff Letter.

This form is used to request a payment plan in the state of Wisconsin. It allows individuals to make installment payments for certain obligations, such as taxes or fines.

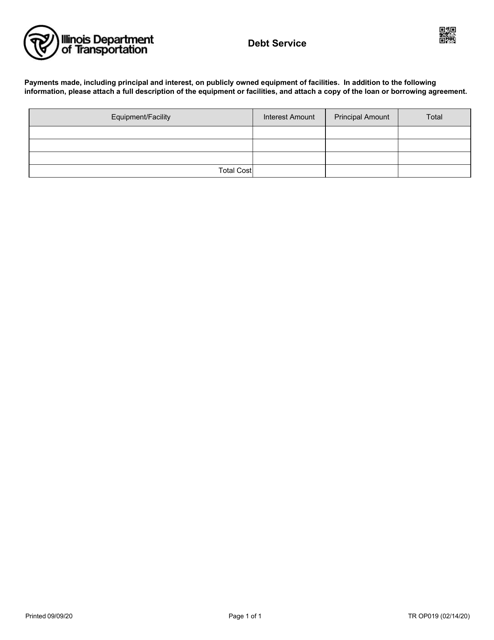

This form is used for reporting debt service in the state of Illinois. It helps individuals and businesses track their debt payments and stay organized financially.

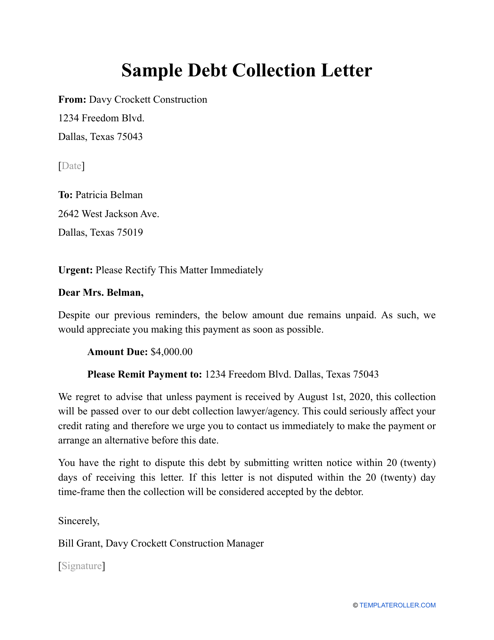

A lender can preparer this financial statement and send it to a borrower with the request for them to handle an unpaid debt.

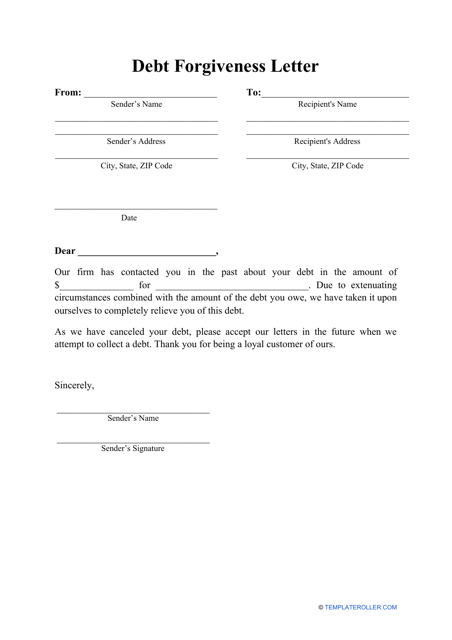

This letter informs the recipient that they no longer have to pay the money owed to their creditor.

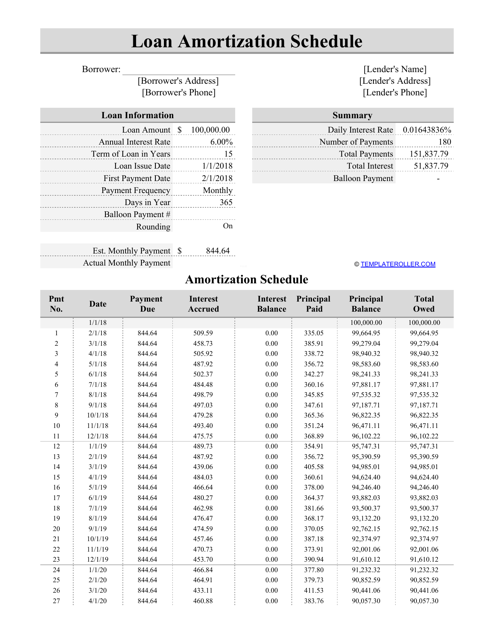

An individual can use this spreadsheet to outline payments for a loan, to calculate the money that goes towards the lender and to the interest until the borrower has paid off the entire amount of a loan.

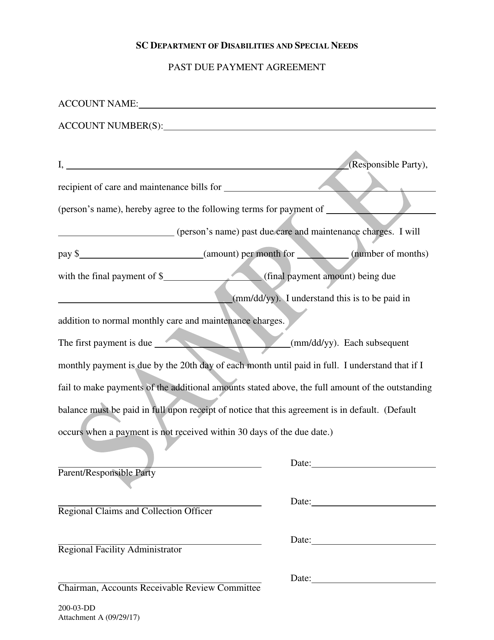

This document is a sample past due payment agreement for the state of South Carolina. It provides a template for outlining the terms and conditions of a payment plan for overdue payments.

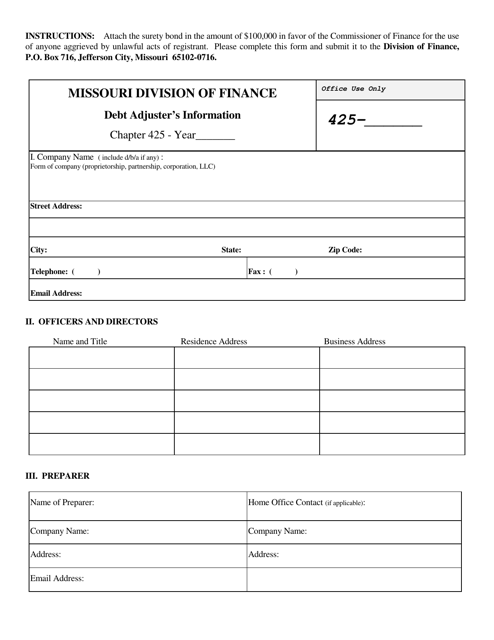

This document provides information about debt adjusters in the state of Missouri.

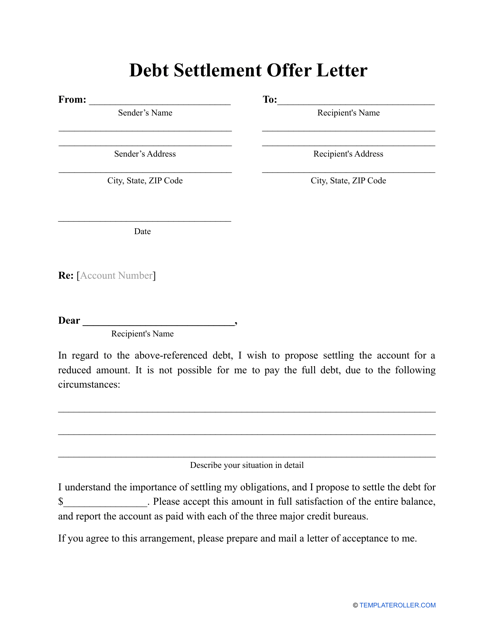

A debtor may use a letter such as this and send it to a creditor with the suggestion to pay back a portion of an outstanding debt.

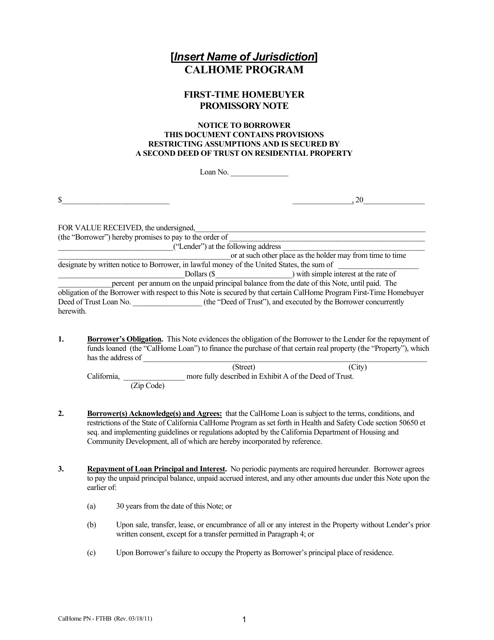

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

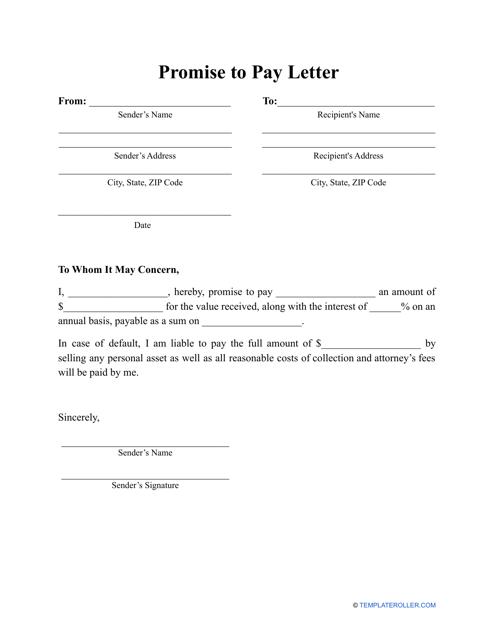

Use this type of written Promissory Note to promise to repay a debt by an agreed date.

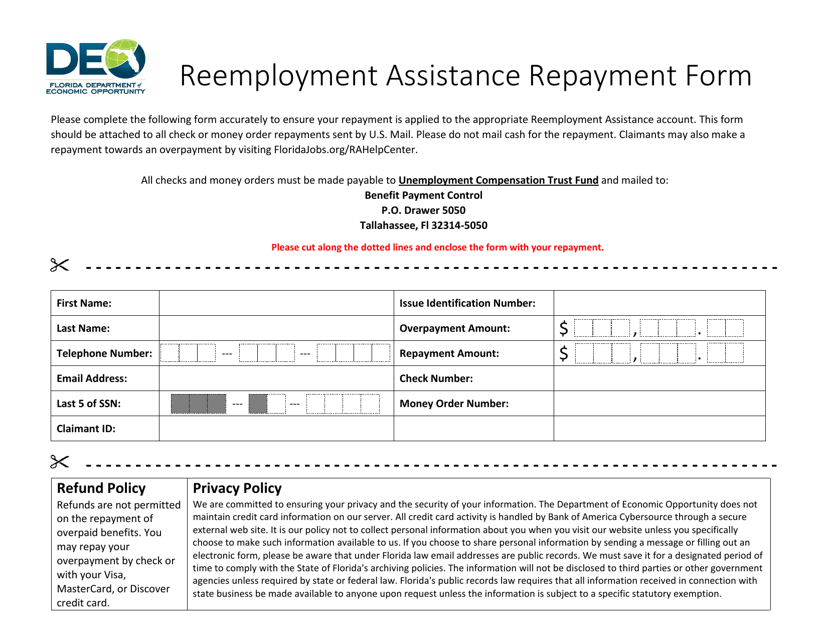

This Form is used for repaying reemployment assistance benefits in the state of Florida.

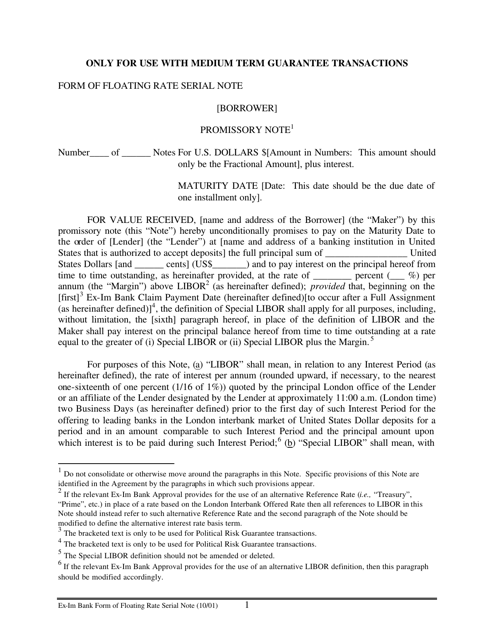

This form of document is used for issuing floating rate serial notes, which are financial instruments with interest rates that adjust periodically based on market conditions.

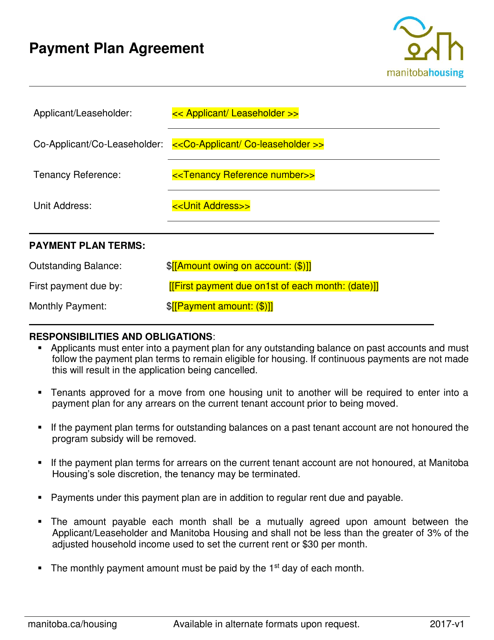

This type of document is used for creating a legal agreement between parties in Manitoba, Canada for a payment plan.