Related Entity Templates

Are you looking for information about related entities? Our webpage provides valuable resources on this topic, also known as related entity documentation or related entity forms. Whether you are a business owner, taxpayer, or professional accountant, understanding the concept of related entities is crucial for accurate financial reporting and compliance with tax regulations.

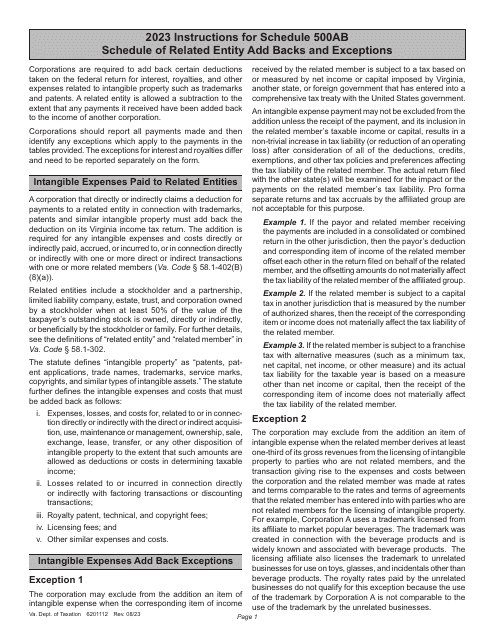

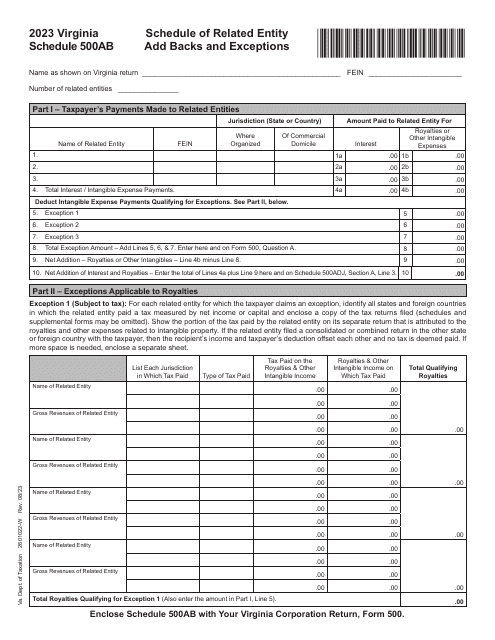

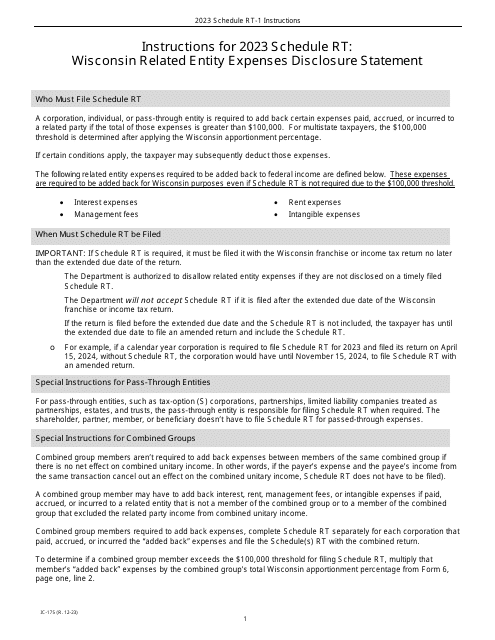

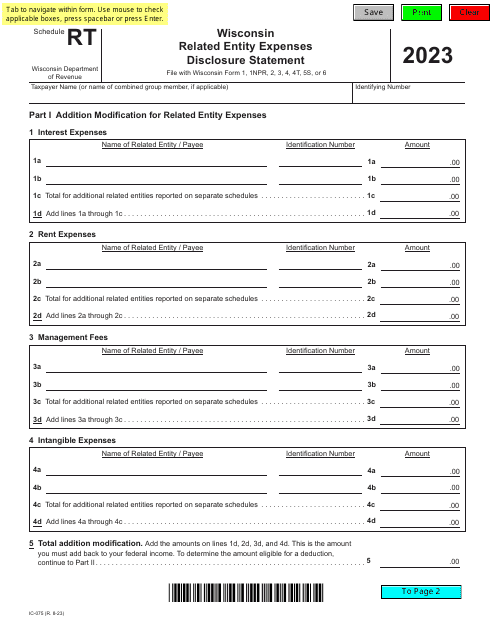

Our collection of documents includes instructions and forms specific to various jurisdictions, such as Virginia and Wisconsin. For example, you can find the Instructions for Schedule 500AB Schedule of Related Entity Add Backs and Exceptions in Virginia, which guides you through reporting related entity transactions and exceptions. Similarly, the Instructions for Form IC-075 Schedule RT Wisconsin Related Entity Expenses Disclosure Statement in Wisconsin provide guidance on disclosing expenses related to entities in that state.

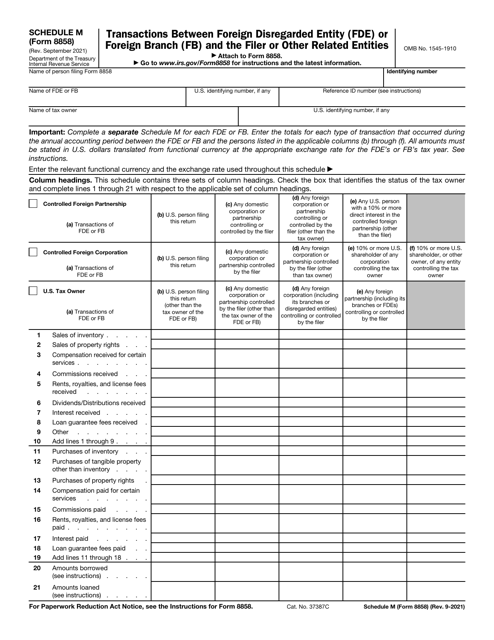

In addition, our document repository covers the IRS Form 8858 Schedule M, which details transactions between foreign disregarded entities (FDE) or foreign branches (FB) and the filer or other related entities. This form is essential for individuals and businesses that engage in transactions with foreign entities.

Whether you are looking for instructions, schedules, or disclosure statements related to entities, our website offers a comprehensive collection of documents to meet your specific needs. Stay informed, compliant, and make well-informed decisions with our valuable resources on related entities. Explore our comprehensive collection today.