Surplus Lines Broker Templates

Are you looking for information on surplus lines brokers? As a surplus lines broker, you play a crucial role in the insurance industry by facilitating the placement of insurance coverage in the surplus lines market. This market provides insurance coverage for risks that traditional insurance carriers are unable or unwilling to insure.

Surplus lines brokers, also known as surplus line brokers, act as intermediaries between insured individuals or businesses and insurers that specialize in providing coverage for unique or hard-to-place risks. These brokers work with insured individuals or businesses to identify their insurance needs and then find suitable coverage from surplus lines insurers.

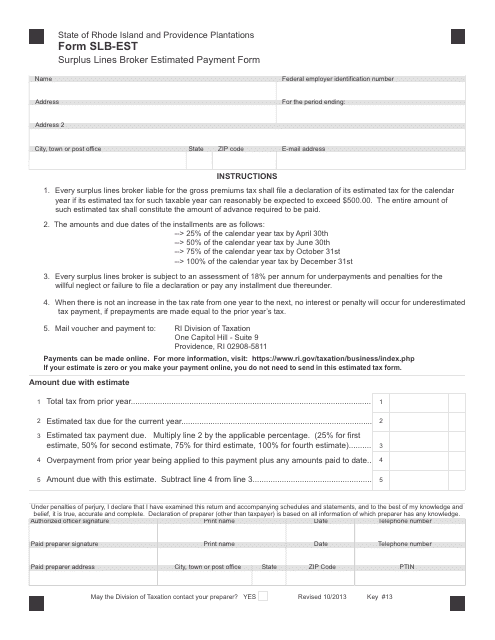

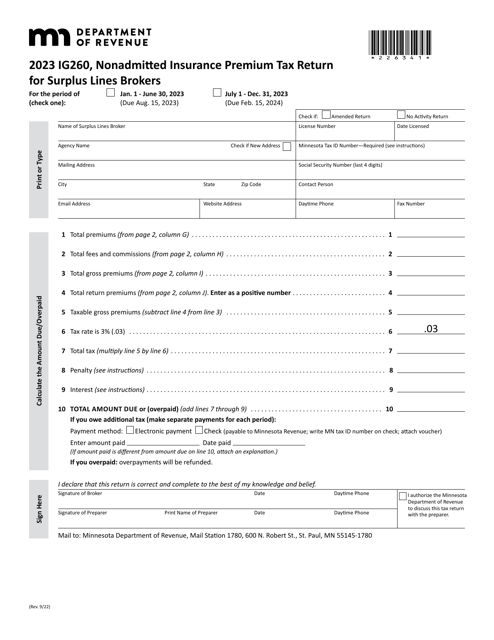

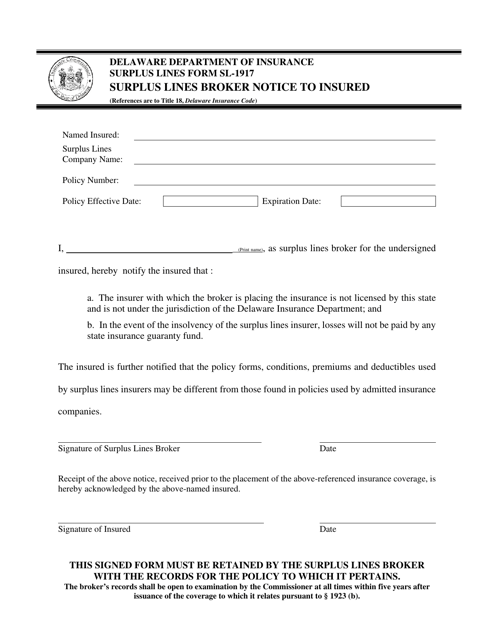

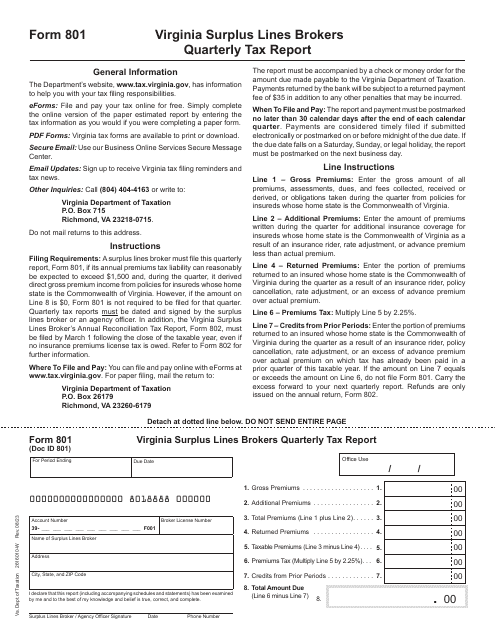

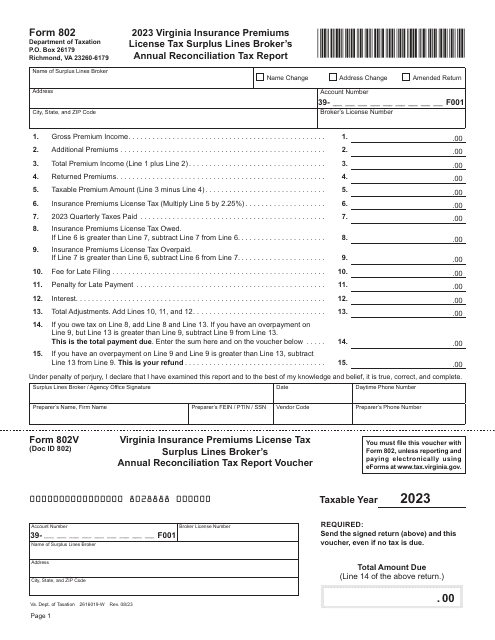

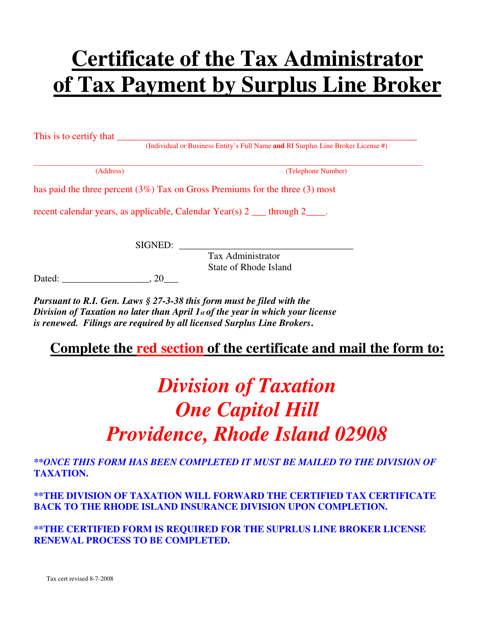

Surplus lines brokers are regulated by individual states, and each state may have its own set of requirements for licensing and operating as a surplus lines broker. To ensure compliance with state regulations, surplus lines brokers may need to complete various forms and applications such as the Form IG260 Nonadmitted Insurance Premium Tax Return for Surplus Lines Brokers in Minnesota or the Form SL-1917 Surplus Lines Broker Notice to Insured in Delaware.

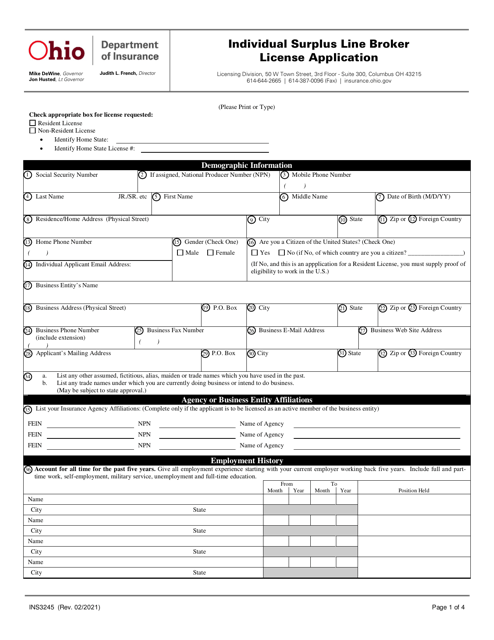

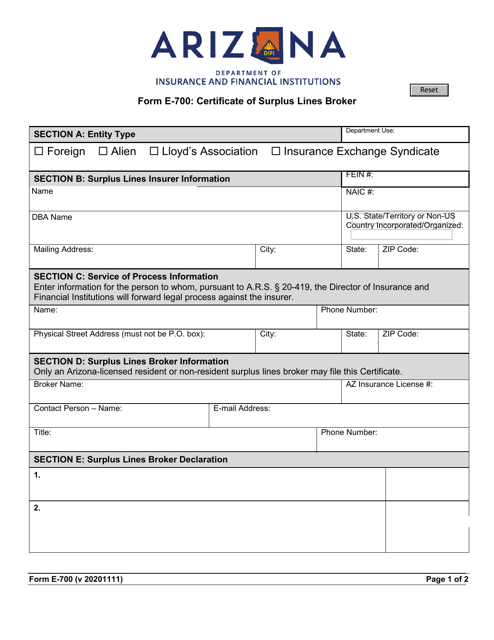

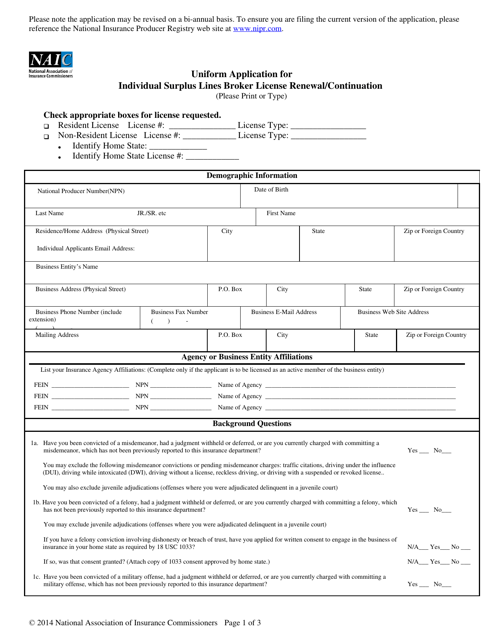

In addition to licensing and regulatory requirements, surplus lines brokers may also need to submit documents such as the Form E-700 Certificate of Surplus Lines Broker in Arizona or the Uniform Application for Individual Surplus Lines Broker License Renewal/Continuation. These documents help ensure that surplus lines brokers meet the necessary qualifications and maintain their compliance with state regulations.

As a surplus lines broker, you provide a valuable service to insured individuals and businesses who may not be able to find coverage through traditional insurance channels. By accessing the surplus lines market, you can offer insurance solutions tailored to meet the unique needs of your clients.

Whether you are just starting your career as a surplus lines broker or have years of experience in the industry, having access to reliable resources and documents is essential. Our collection of surplus lines broker documents, also referred to as surplus lines brokers templates, provides you with the necessary tools to navigate the regulatory landscape and meet the requirements of different states.

With our surplus lines broker documents, you can streamline your operations, ensure compliance with state regulations, and provide top-notch service to your clients. We understand the unique challenges that surplus lines brokers face, and our goal is to provide you with the resources and support you need to succeed.

Invest in your success as a surplus lines broker by accessing our comprehensive collection of surplus lines broker documents. Stay up to date with the changing regulatory landscape, simplify your administrative tasks, and focus on what you do best - connecting insured individuals and businesses with the insurance coverage they need.

Documents:

21

This form is used for surplus lines brokers in Rhode Island to make estimated payments.

This form is used for brokers in Delaware to provide a notice to insured individuals regarding surplus lines insurance policies.

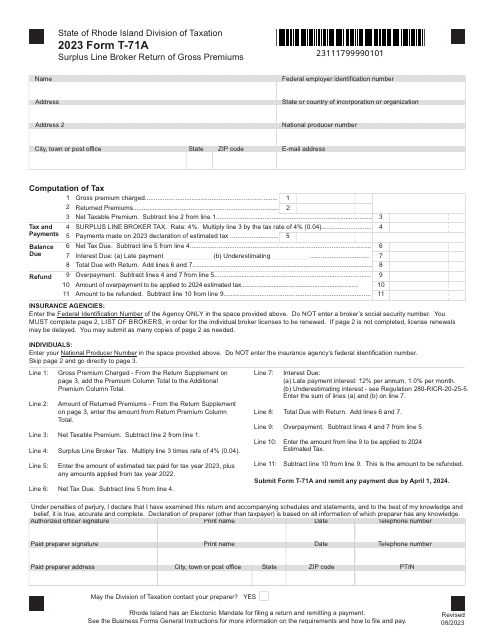

This document certifies that a surplus line broker in Rhode Island has made the required tax payment to the Tax Administrator.

This Form is used for obtaining a Certificate of Surplus Lines Broker in Arizona.

This form is used for renewing or continuing an individual surplus lines broker license.