Provincial Tax Credits Templates

Provincial Tax Credits: Maximize Your Tax Savings

Welcome to our comprehensive collection of provincial tax credits, also known as provincial tax credit. These tax incentives are designed to help individuals and businesses reduce their tax liability and maximize their savings. Our website is your go-to resource for all things related to provincial tax credits.

Whether you are a resident of Prince Edward Island, Canada or any other province or territory, you can find all the information and resources you need to take full advantage of the available provincial tax credits. Our user-friendly platform provides easy access to various forms and applications, such as the Provincial Tax Credit Application for Prince Edward Island, Canada.

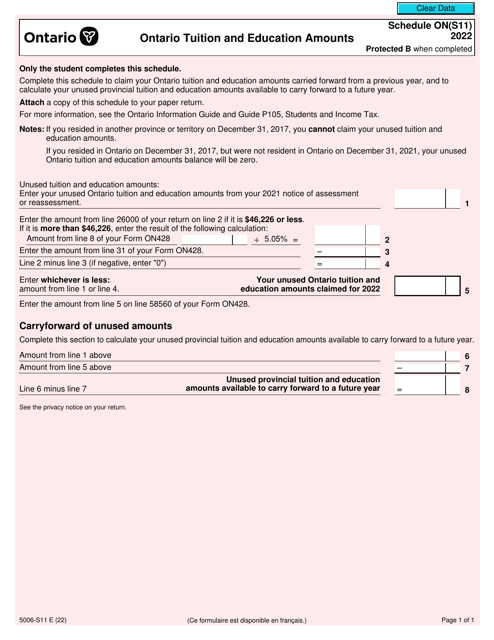

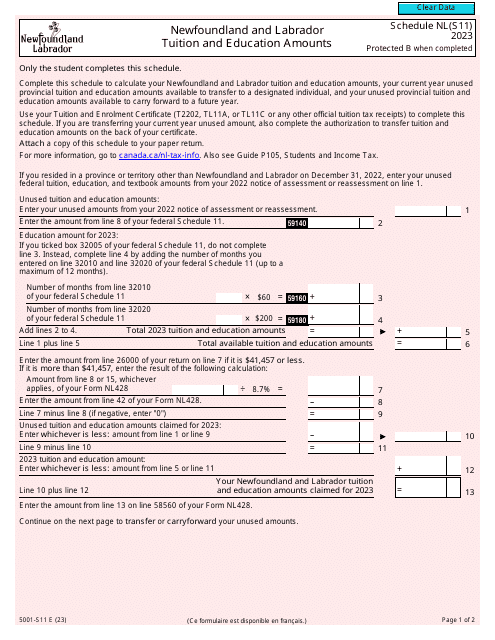

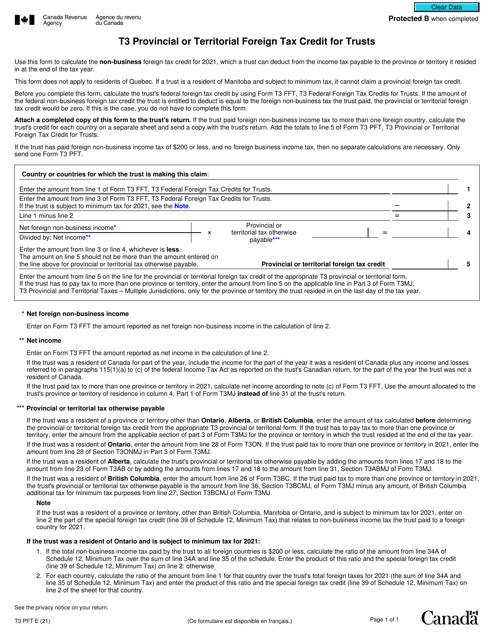

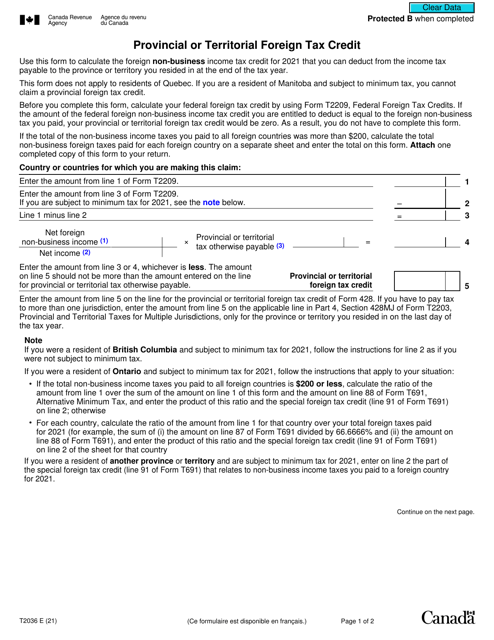

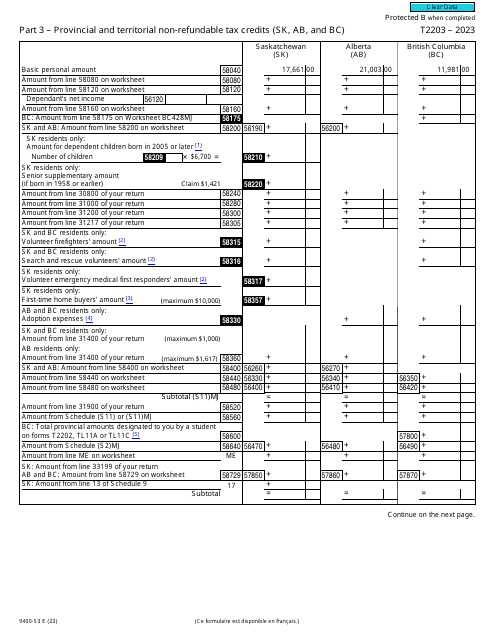

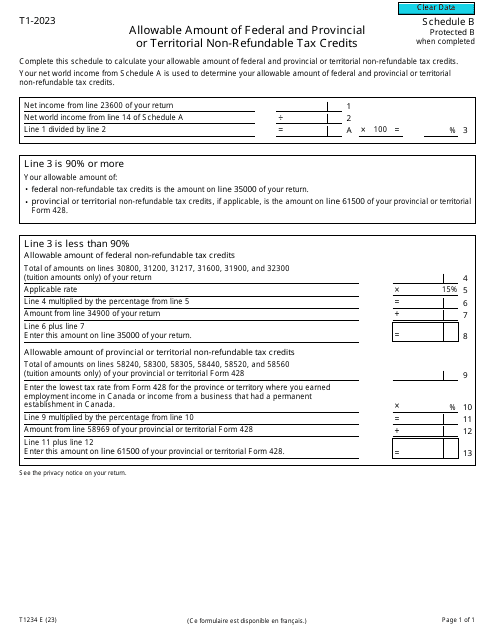

Navigating through the complex tax landscape can be overwhelming, but our website simplifies the process by offering a wide range of forms that cater to different tax situations. For example, you can find Form T3PFT for claiming the Provincial or Territorial Foreign Tax Credit, or Form T2203 (9400-S3) for the Part 3 Provincial and Territorial Non-refundable Tax Credits in provinces like Saskatchewan, Alberta, and British Columbia.

Not only do we provide the necessary forms, but our website also offers helpful resources and guidance to ensure you understand the eligibility criteria, application process, and any specific requirements associated with each provincial tax credit. We strive to empower individuals and businesses in maximizing their tax savings and ultimately boosting their financial well-being.

Explore our provincial tax credits collection today and unlock the potential savings available to you. From personal tax returns to business expenses, you'll find valuable information and convenient access to the documentation needed to claim the provincial tax credits you deserve.

Documents:

10

This document is used for applying for provincial tax credits in Prince Edward Island, Canada. It is used to claim potential tax deductions and benefits specific to the province.