Large Prints Templates

Documents:

397

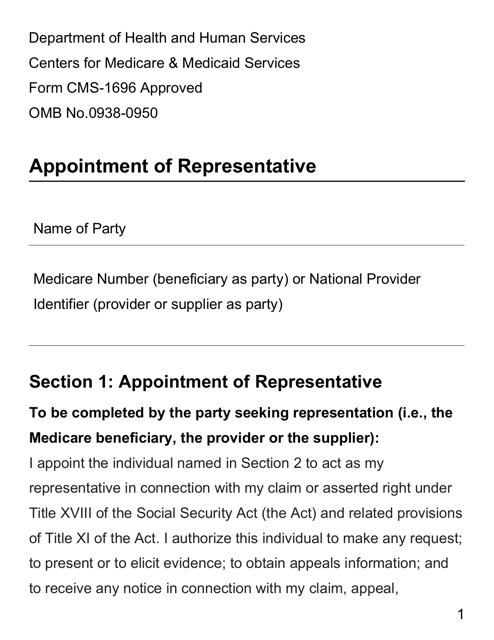

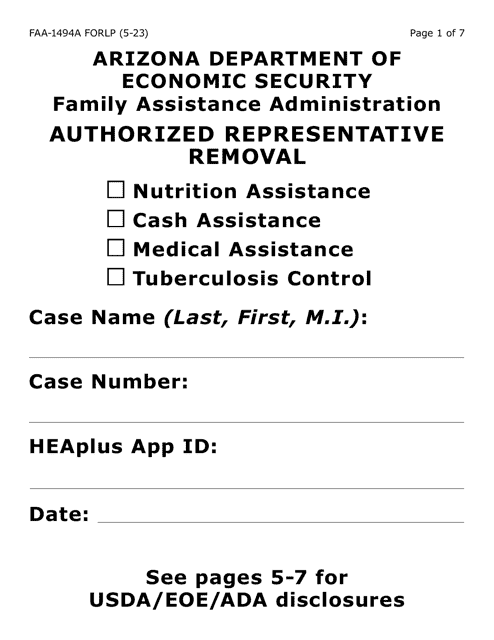

This form is used for appointing a representative for individuals who prefer large print format.

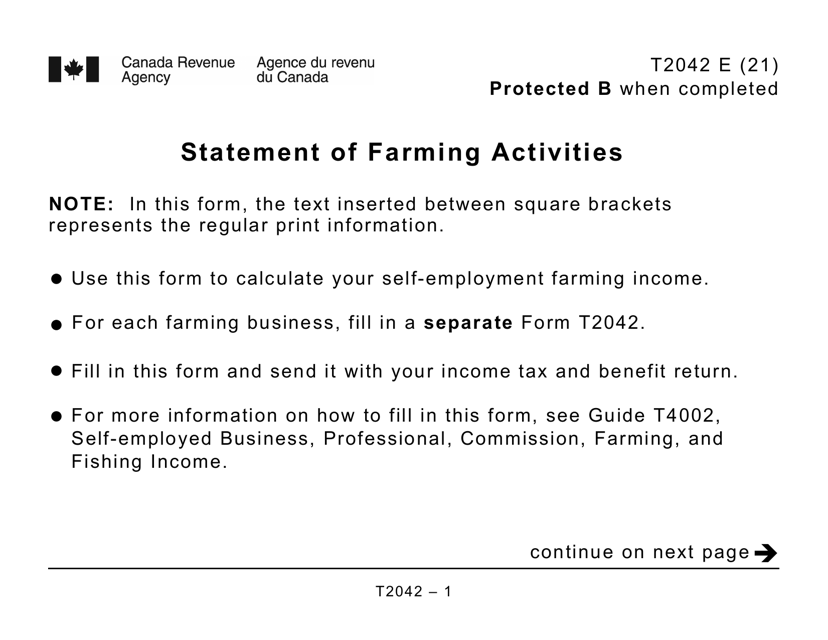

This form is used by Canadian farmers to report their farming activities. The large print version is available for easy reading.

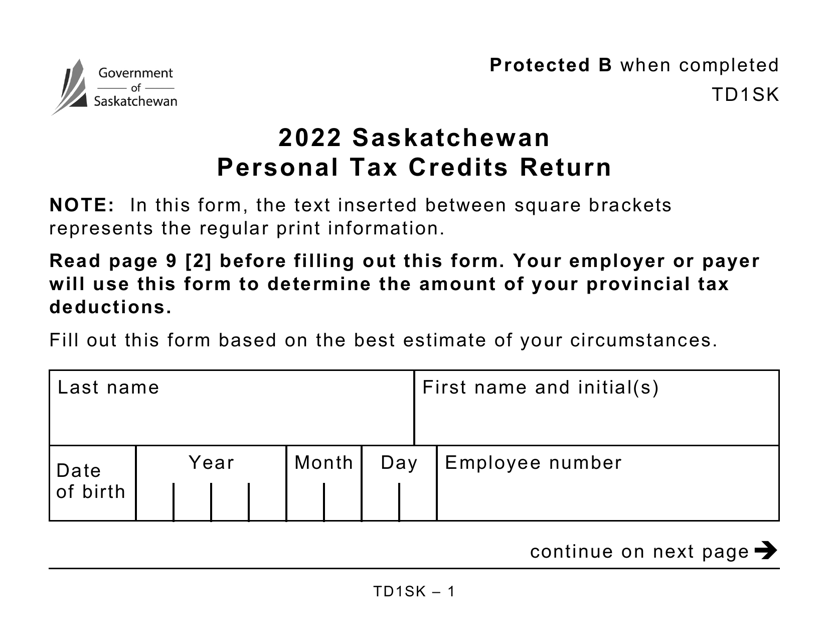

This form is used for residents of Saskatchewan in Canada to claim personal tax credits. It is available in a large print format for easier reading.

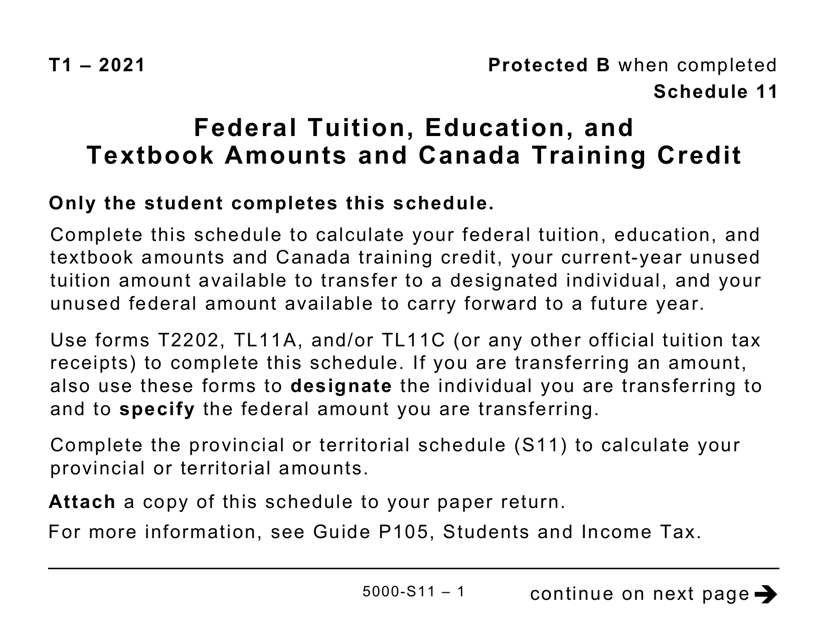

This Form is used for reporting federal tuition, education, and textbook amounts as well as the Canada Training Credit for tax purposes in Canada.

This Form is used for reporting federal tuition, education, and textbook amounts as well as the Canada Training Credit. It is designed in a large print format for easier readability.

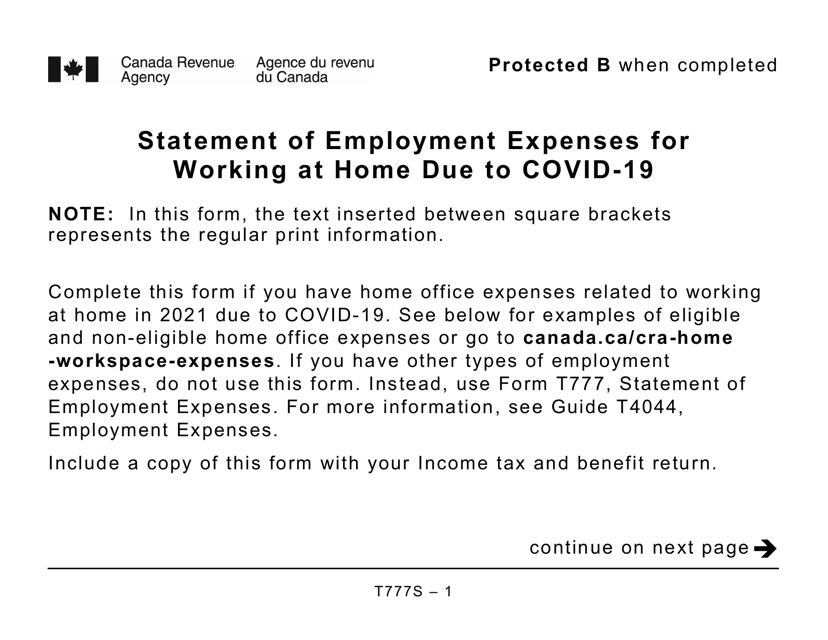

This form is used for reporting employment expenses related to working from home during the COVID-19 pandemic. It is specifically designed for individuals who require a large print format.

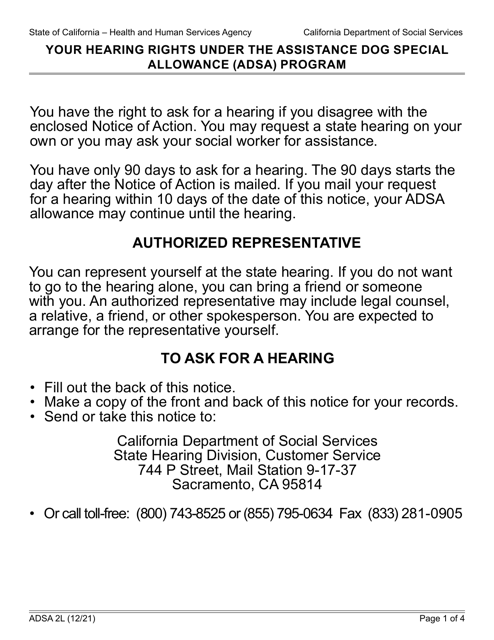

This form is used for requesting a hearing related to the Assistance Dog Special Allowance Program (ADSA) in California. The form is available in large print format.

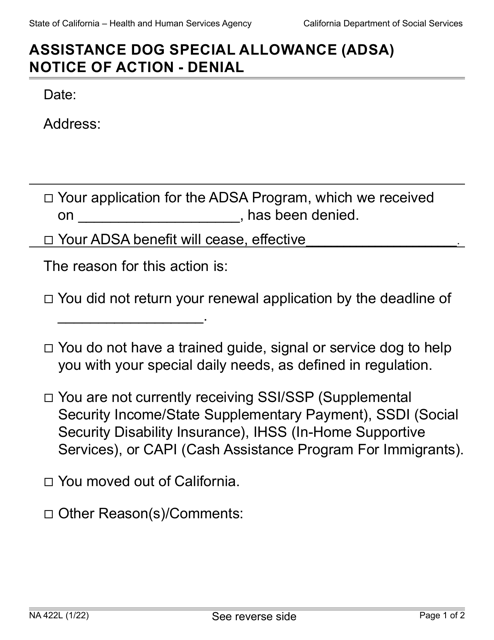

This Form is used for notifying individuals in California about the denial of their application for the Assistance Dog Special Allowance (ADSA) in a large print format.

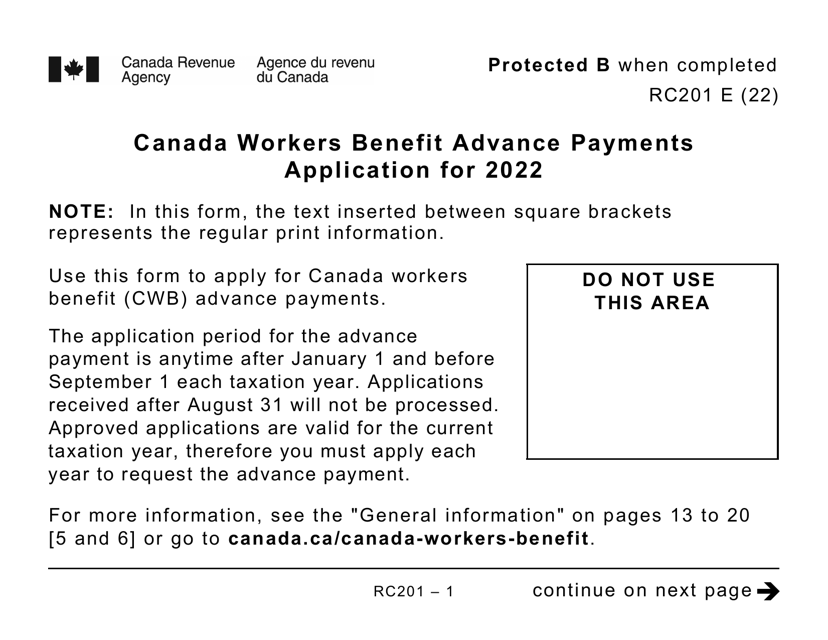

This Form is used for applying for advance payments of the Canada Workers Benefit in Canada. It is available in large print format for those who require it.

This document is a form for taxpayers in Canada to request relief from penalties and interest that may have been incurred. It is available in large print format.

This Form is used for making a joint election to split pension income in Canada. It is available in large print format.

This Form is used for designating a property as a principal residence by an individual in Canada. It is available in large print format.

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner on Schedule SK(S2) in a large print format.

This form is used for reporting tuition and education amounts for residents of Saskatchewan in Canada. It is specifically designed in large print format.

This form is used for applying for the Saskatchewan Credit in large print format in Canada. It is designed to accommodate individuals with visual impairments.

This document is a large print worksheet for Form 5008-D, which is used for calculating Saskatchewan tax in Canada.

This form is used for reporting Quebec Pension Plan contributions in a large print format in Canada.

This Form is used for reporting the Canada Workers Benefit for Quebec residents in a large print format.

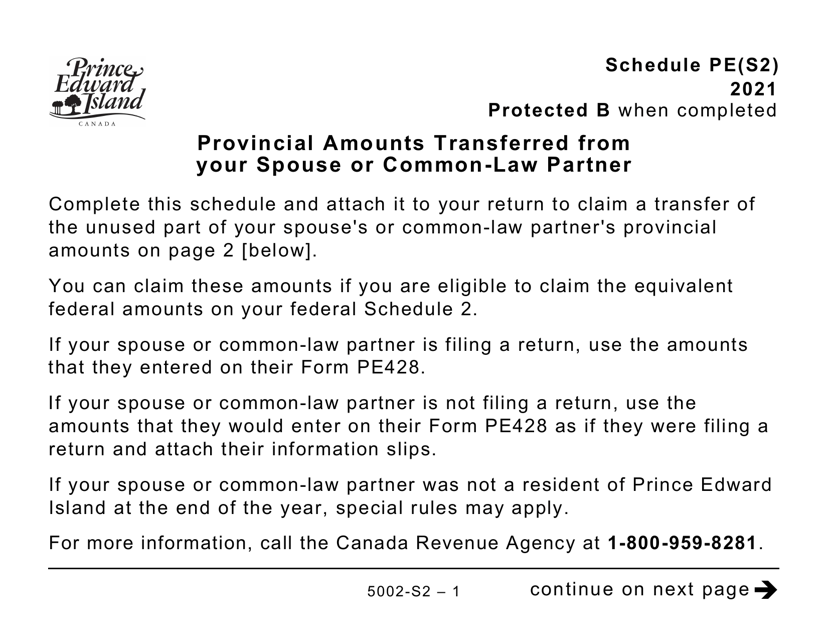

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner on Schedule PE(S2) in a large print format.

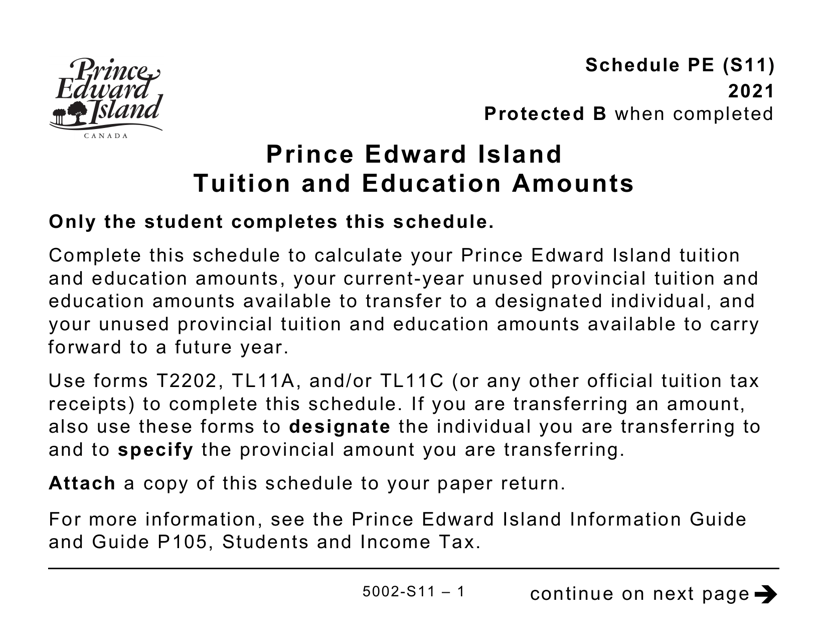

This form is used for reporting Prince Edward Island tuition and education amounts. It is specifically designed for individuals with visual impairments as it is available in large print format.

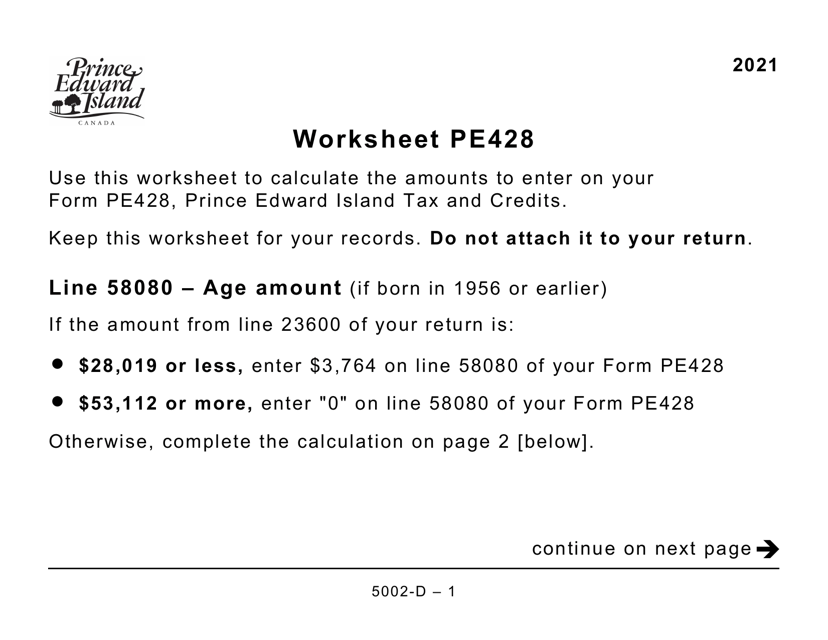

This Form is used for completing a worksheet for Prince Edward Island residents in large print format.

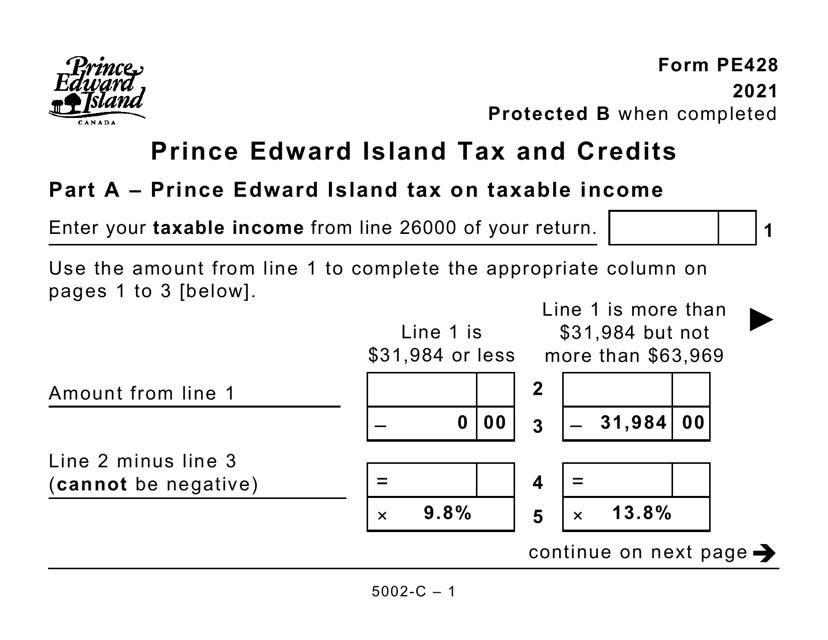

This form is used for filing taxes and claiming credits in Prince Edward Island, Canada. It is available in large print format.

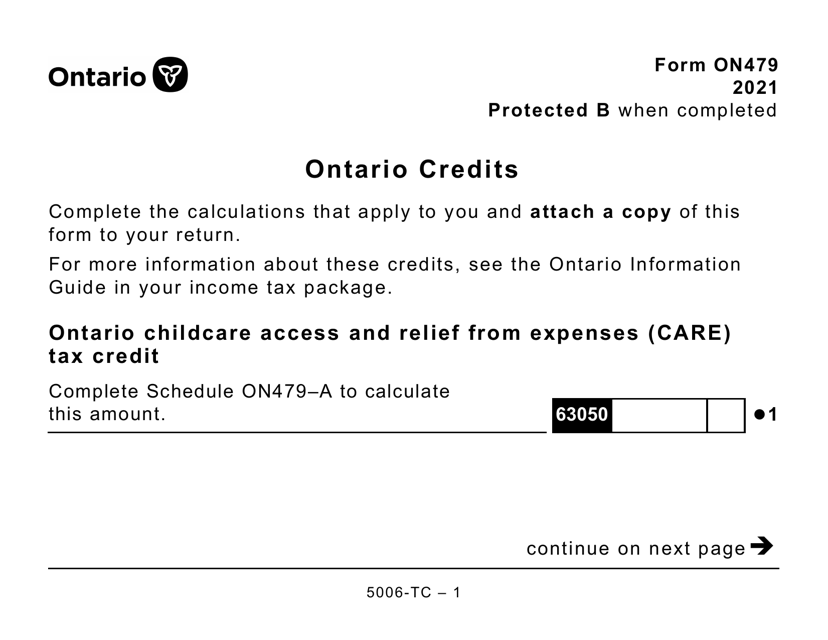

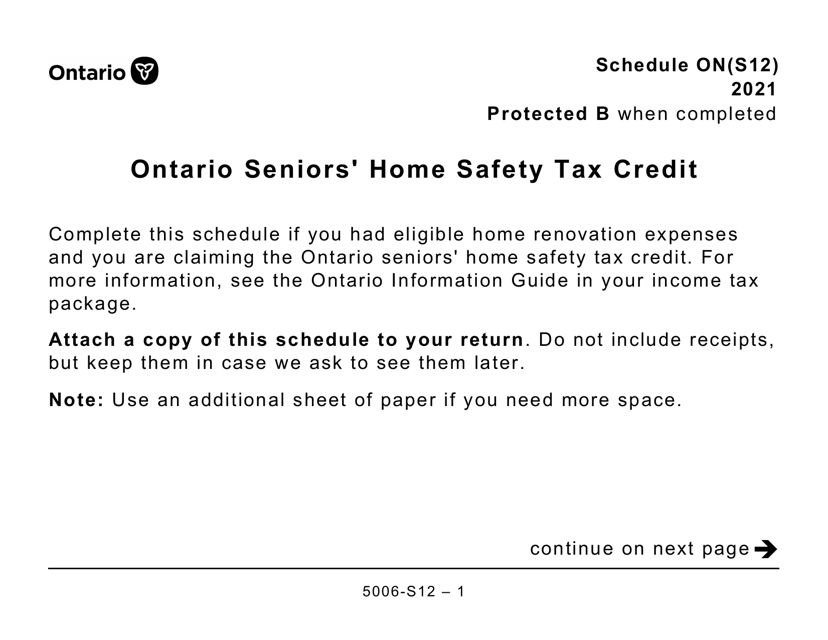

This form is used for applying for the Ontario Seniors' Home Safety Tax Credit in Canada. It is a large print version of the schedule, specifically designed for seniors.

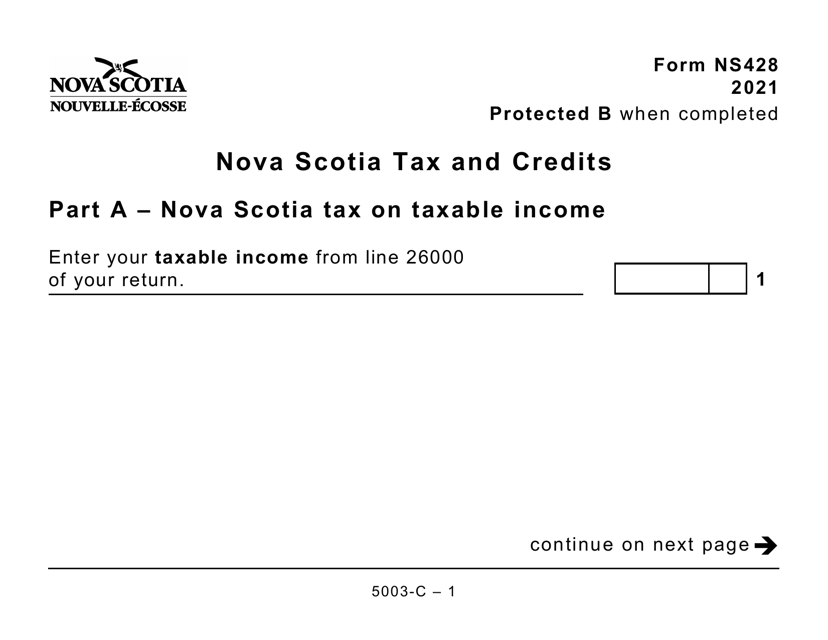

This form is used for reporting tax and claiming credits in the province of Nova Scotia, Canada. It is a large print version of Form 5003-C (NS428).

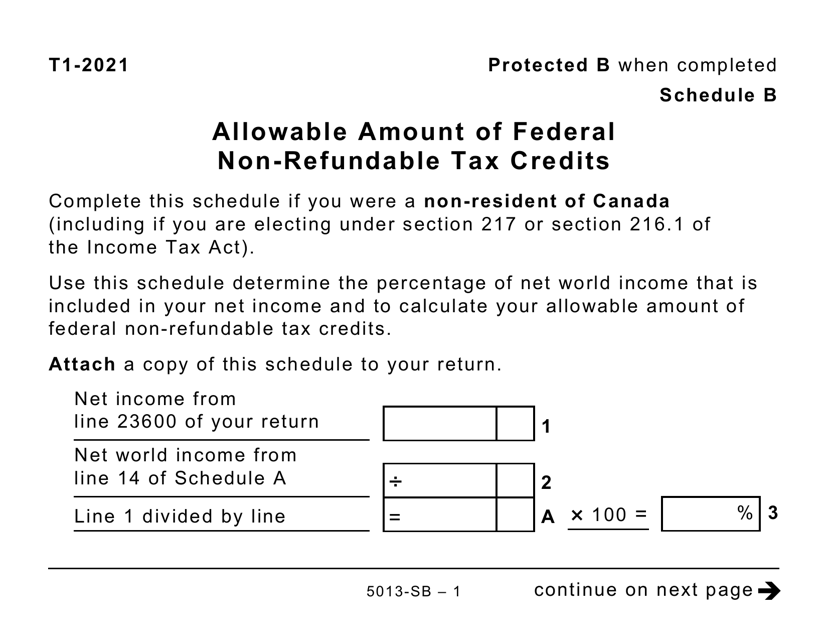

This document for reporting the allowable amount of federal non-refundable tax credits in Canada, in large print format.

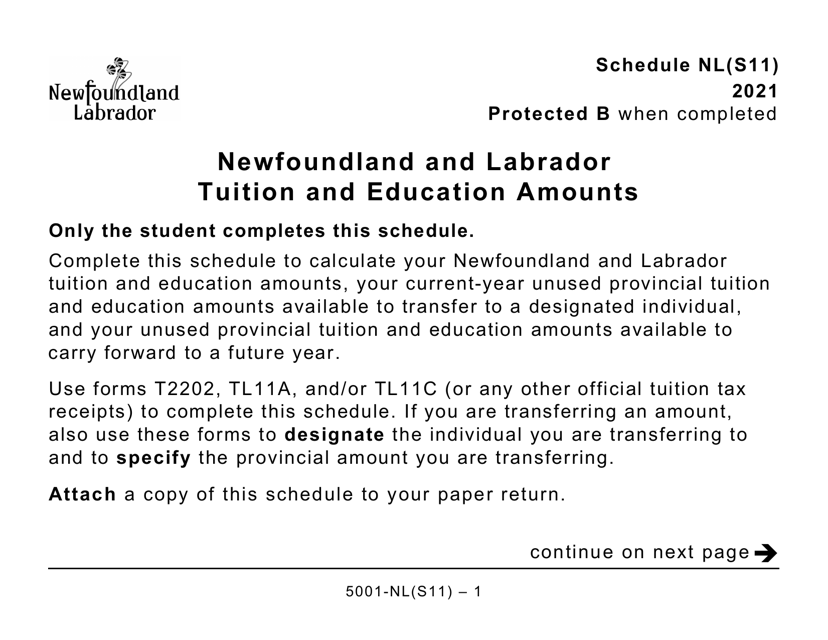

This form is used for reporting tuition and education amounts for residents of Newfoundland and Labrador in Canada. It is specifically designed for individuals with visual impairments as it is available in large print format.

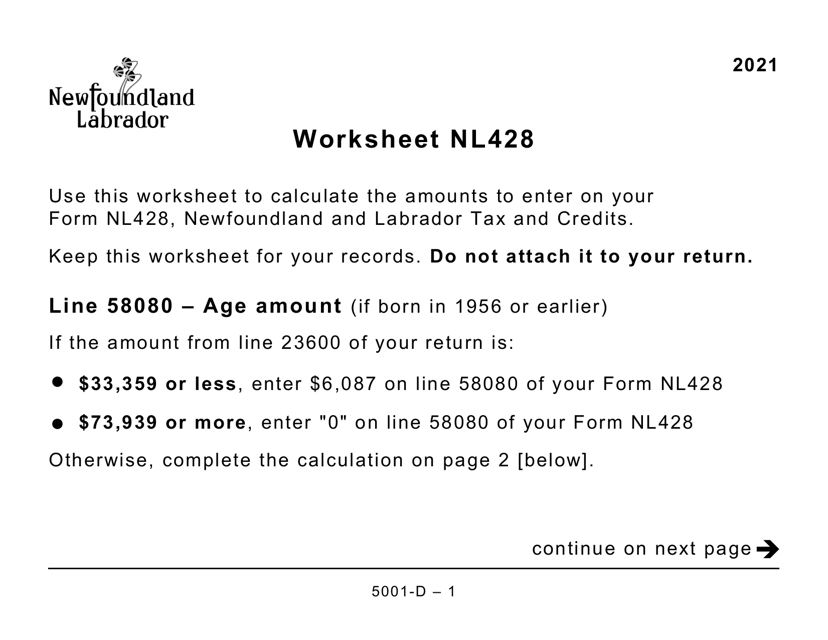

This document is a worksheet form specifically for residents of Newfoundland and Labrador in Canada. It is designed for individuals who require large print materials.

This Form is used for reporting provincial amounts transferred from your spouse or common-law partner in New Brunswick. It is a large print version of Schedule NB(S2) for Canadian residents.

This Form is used for applying for the New Brunswick Seniors' Home Renovation Tax Credit. This tax credit is applicable to seniors residing in New Brunswick who have made eligible renovations to their homes. It is available in a large print format for easier accessibility.

This document is a large print worksheet form for residents of New Brunswick, Canada. It is used for filling out the Form 5004-D and is specifically designed for those who require larger print.

This document is a large print version of Form 5007-TC (MB479) used in Manitoba, Canada. It is used to claim certain tax credits in Manitoba.