Other Taxes Templates

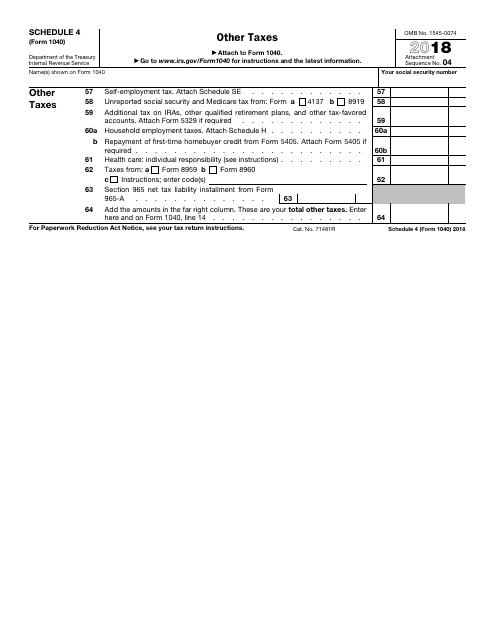

Other Taxes

Looking for information and resources on various tax-related matters beyond income and sales tax? Look no further than our comprehensive collection of Other Taxes

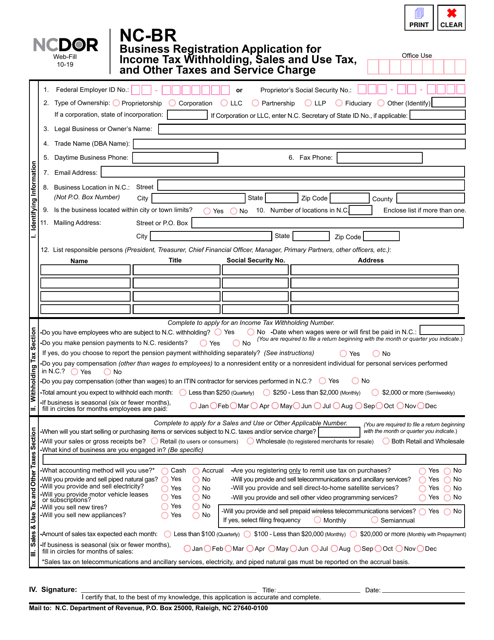

documents. This collection comprises a wide range of forms, schedules, and applications that can help you navigate the complexities of tax regulations.If you're a business owner in North Carolina, you may need to fill out the Form NC-BR Business Registration Application for Income Tax Withholding, Sales and Use Tax, and Other Taxes

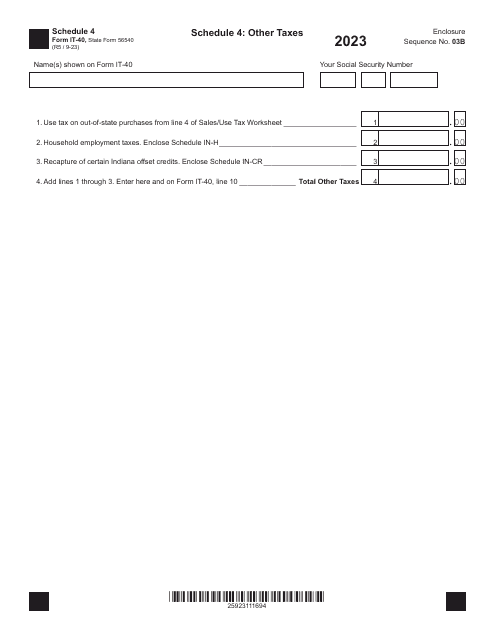

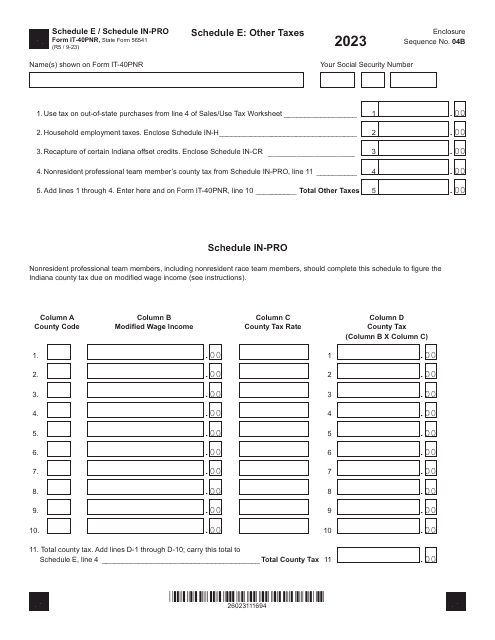

and Service Charge. This form ensures that you comply with the state's tax requirements and properly register your business.Alternatively, if you operate in Indiana, the Form IT-40 Schedule 4 Other Taxes

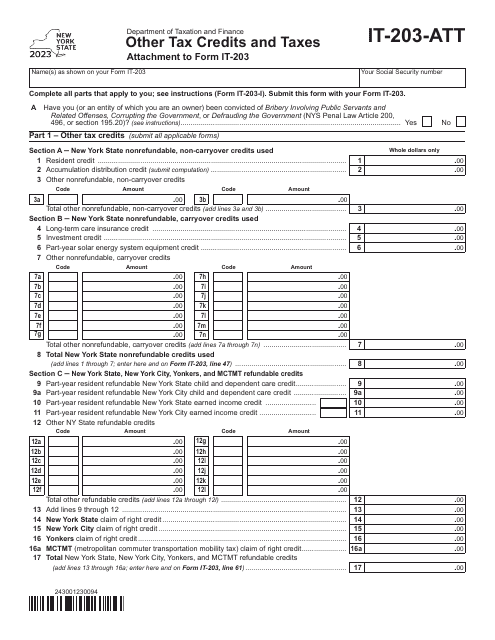

is a crucial document to report your other tax obligations. This schedule allows businesses and individuals to accurately report and pay their miscellaneous tax liabilities.Additionally, individuals and businesses in New York may need to refer to the Form IT-203-ATT Other Tax Credits and Taxes. This form covers various credits and taxes beyond income tax, ensuring that you maximize potential credits and remain compliant with state tax regulations.

Our Other Taxes

document collection goes beyond these examples, providing you with a wealth of resources to understand and fulfill your other tax obligations. Whether you need to report excise taxes, property taxes, or any other miscellaneous taxes, our collection is your one-stop destination.Navigate the intricacies of tax compliance with ease, thanks to our comprehensive collection of Other Taxes

documents. Stay updated on the latest tax regulations in your state, fulfill your tax obligations accurately, and avoid unnecessary penalties. Explore our collection today and ensure your tax compliance journey is smooth and hassle-free.Documents:

12

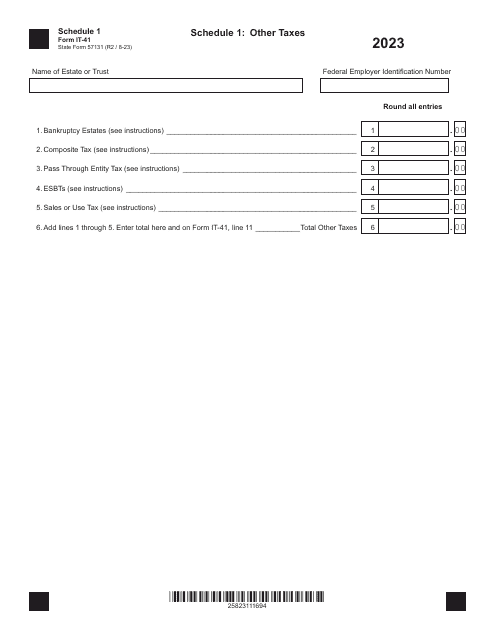

This Form is used for reporting other types of taxes that do not fit on the main IRS Form 1040.