Investment Portfolio Templates

An investment portfolio, also known as portfolio investments, is a collection of financial assets or securities that an individual or organization holds with the aim of generating a return on investment. It serves as a diversified investment strategy to minimize risk and maximize potential returns.

Managing an investment portfolio requires careful analysis, research, and decision-making. Investors can choose from a variety of investment options, including stocks, bonds, mutual funds, real estate, and more. By diversifying their portfolio across various asset classes and industries, investors can reduce the impact of market volatility on their overall returns.

Monitoring and evaluating the performance of an investment portfolio is essential for making informed investment decisions. Regularly reviewing the portfolio allows investors to identify underperforming assets, rebalance allocations, and adjust strategies to align with their financial goals.

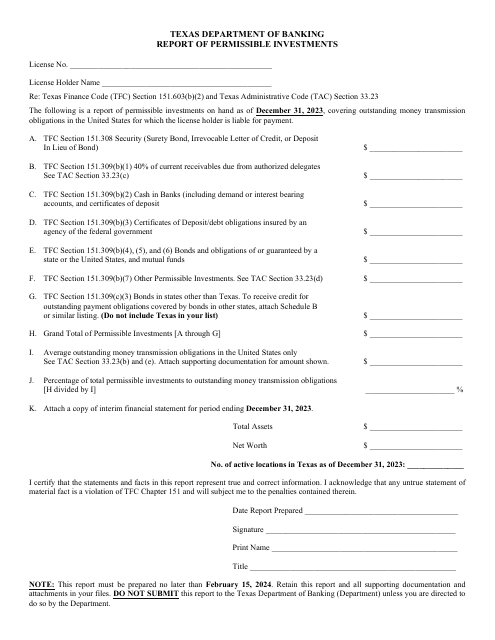

In order to provide transparency and accountability, regulatory bodies like the Securities and Exchange Commission (SEC) require companies to report their portfolio investments. These reports, such as the Form N-PORT (SEC Form 2940) Monthly Portfolio Investments Report, help investors make informed decisions based on the holdings and performance of investment funds.

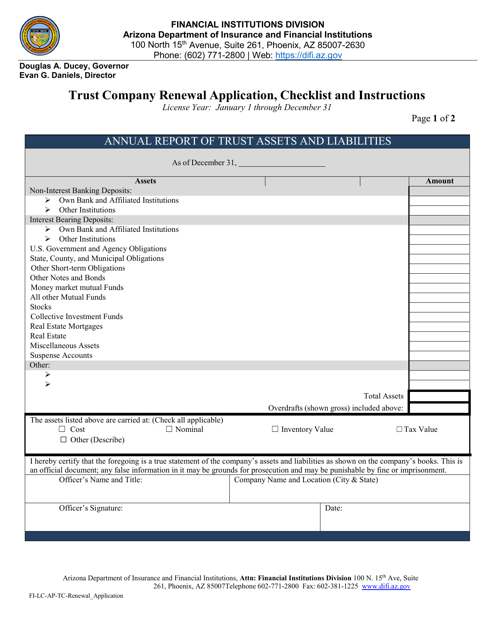

For individual investors, keeping track of their investment portfolio is crucial for long-term financial planning. Annual reports of trust assets and liabilities, like the one required in Arizona, provide a comprehensive overview of an individual's investments and can help guide investment strategies.

Whether you are an individual looking to build your investment portfolio or a company managing a diverse range of investments, having a well-structured and carefully managed portfolio is essential for long-term financial success. Investment portfolios, or portfolio investments, allow investors to allocate their funds strategically and increase their chances of achieving their financial objectives.

Documents:

6

This document examines the impact of conflicting investment advice on retirement savings. It discusses the potential consequences of receiving conflicting information and offers insights on how to navigate this issue.

This form is used for the registration of separate accounts organized as unit investment trusts.

This document provides a yearly summary of the assets and liabilities of a trust in the state of Arizona. It includes detailed financial information and helps to ensure transparency and accountability.