Tax Exempt Entity Templates

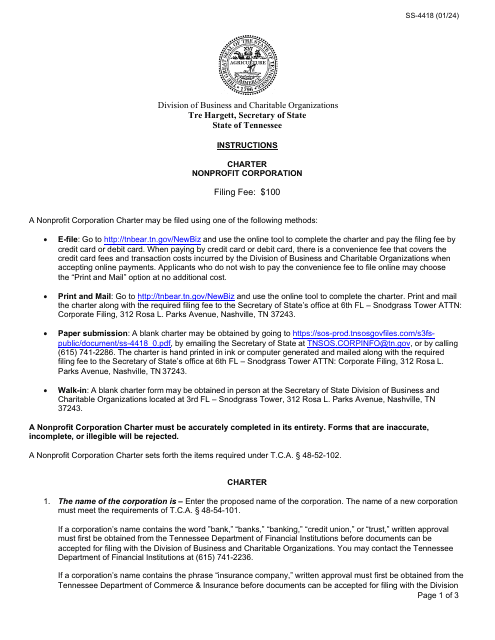

Are you a tax-exempt entity or looking for information about tax-exempt entities? We've got you covered! Our comprehensive collection of documents for tax-exempt entities provides everything you need to navigate the complex world of tax-exempt status. Whether you're a nonprofit organization, charitable foundation, or government entity, our documents will guide you through the process and ensure compliance with IRS regulations.

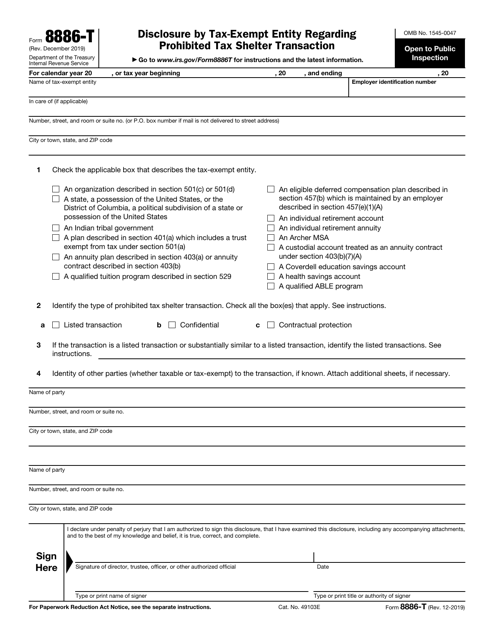

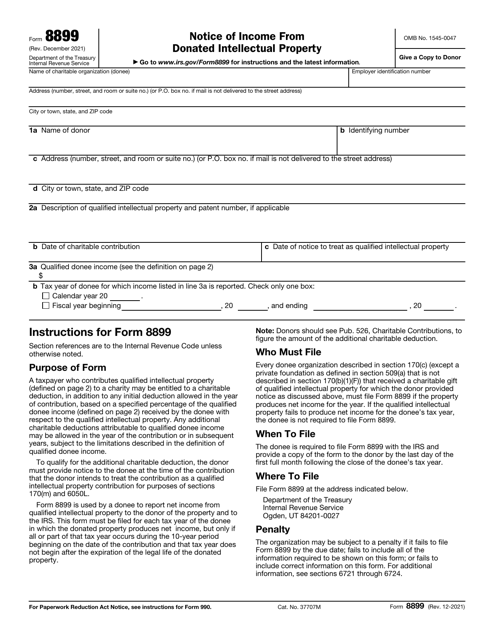

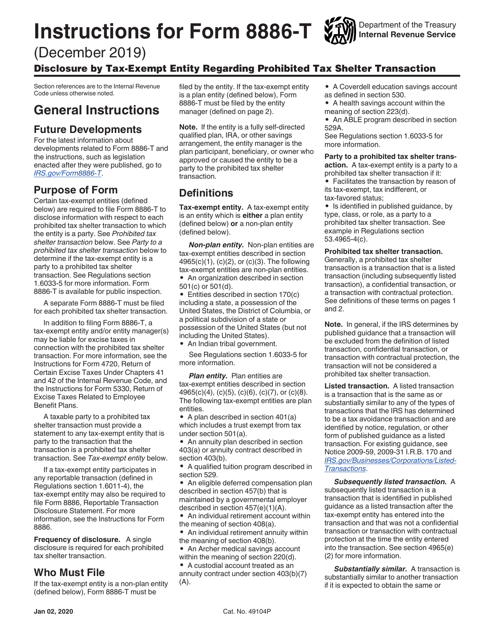

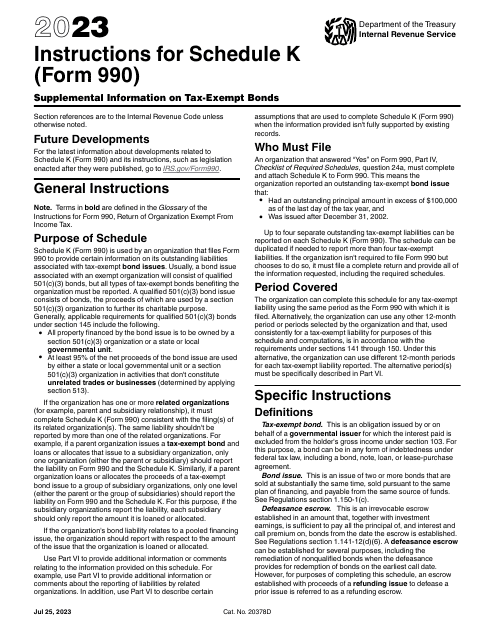

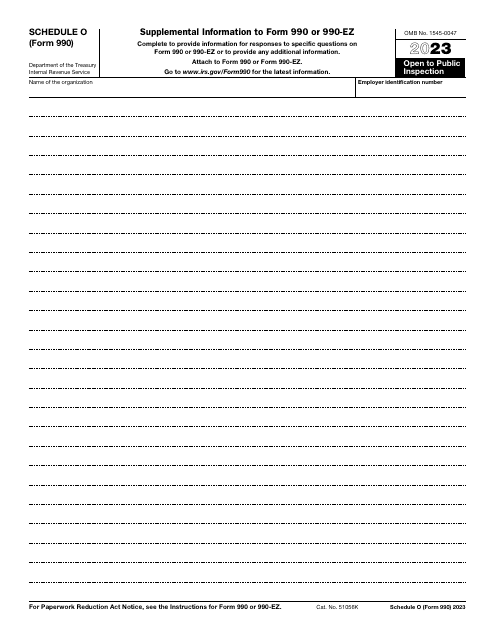

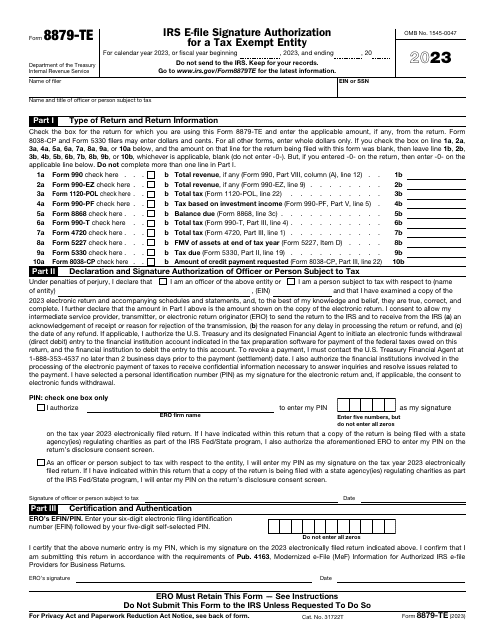

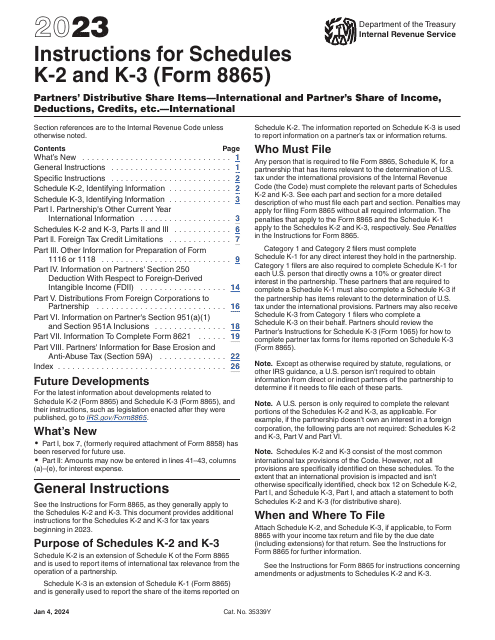

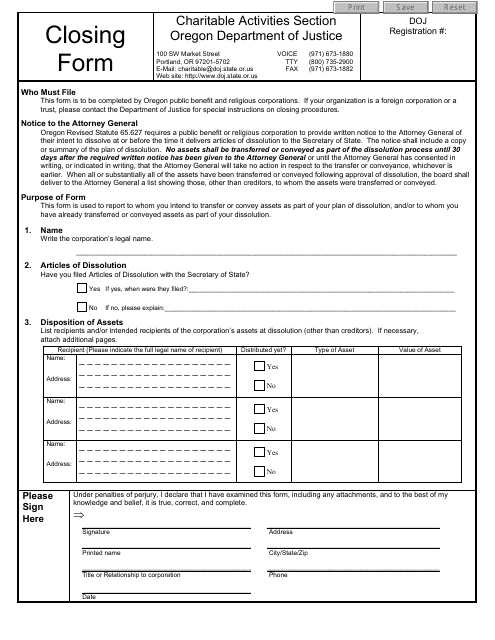

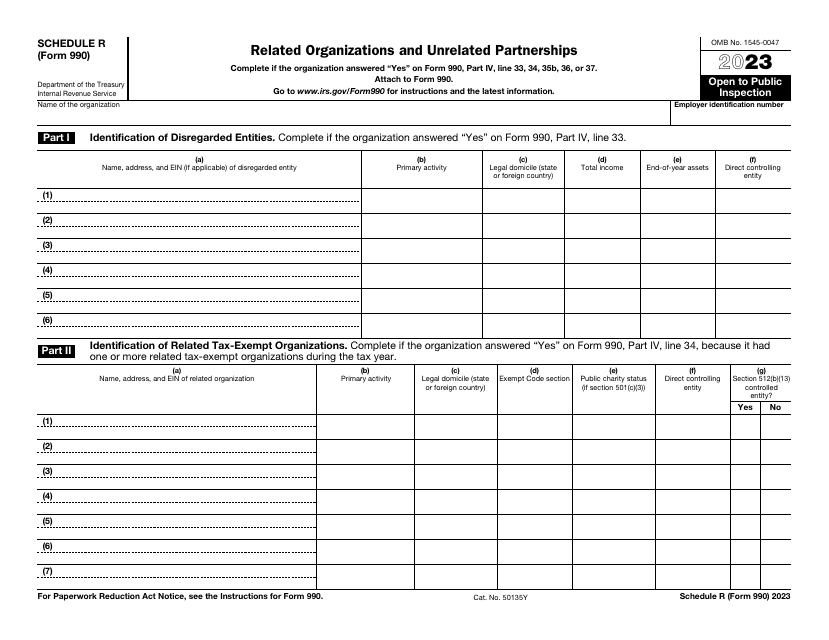

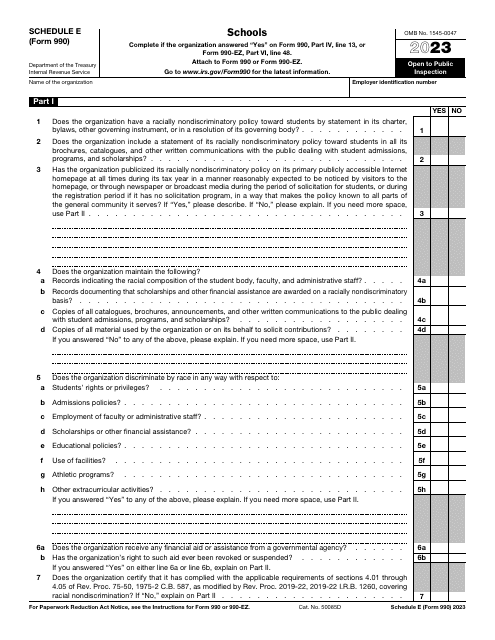

Discover the tax-exempt entity documents you need, including IRS Form 8886-T Disclosure, Instructions for IRS Form 8886-T Disclosure, IRS Form 990 Schedule O Supplemental Information, Instructions for Charitable Activities Closing Form, and more. With our extensive library, you'll find the resources to understand tax laws, report tax shelter transactions, file necessary forms, and easily meet your tax obligations.

Don't let tax compliance bog you down. Streamline your tax-exempt entity processes with our user-friendly documents. We provide clear instructions, helpful tips, and key insights to help you stay on top of your tax-exempt status. Stay informed, avoid penalties, and maximize the benefits of being a tax-exempt entity with our trusted documents.

Browse our comprehensive collection of tax-exempt entity documents today. Whether you're a beginner or an expert, our documents will help you navigate the intricacies of tax-exempt status. Take control of your tax-exempt entity and ensure compliance with the IRS. Start exploring our documents now!

Documents:

14

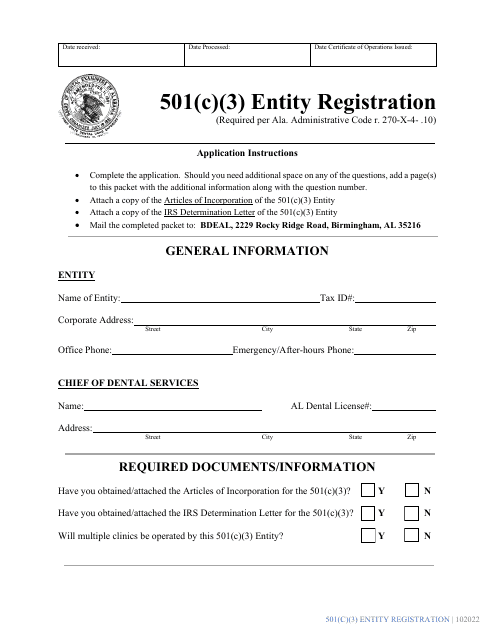

This document is used for the registration of a 501(c)(3) entity in the state of Alabama.