Revenue Bonds Templates

Are you looking for investment opportunities that provide a steady stream of income? Revenue bonds, also known as revenue bonds or revenue bond investing, could be an attractive option for you.

Revenue bonds are a type of investment instrument issued by various entities, such as states, municipalities, or government agencies, to finance specific revenue-generating projects. These bonds are backed by the income generated by the project they finance, such as toll roads, airports, hospitals, or water and sewer systems.

Investing in revenue bonds can be a smart move for investors seeking stable returns. The interest and principal payments on these bonds are funded by the revenue generated by the project, providing a predictable income stream. The repayment of revenue bonds is not dependent on the general tax revenues of the issuing entity, making them a more secure investment compared to other types of bonds.

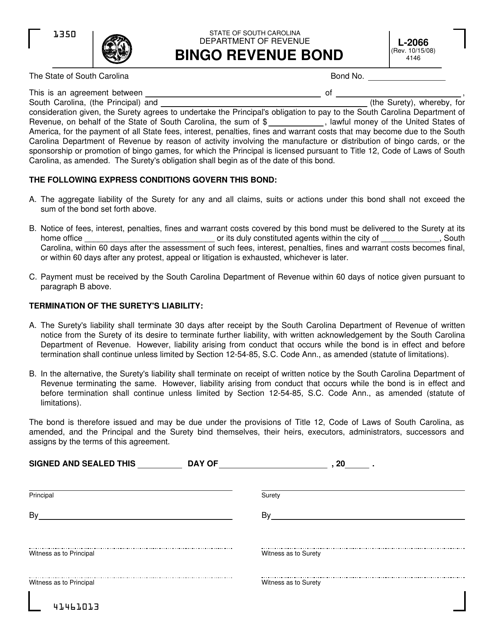

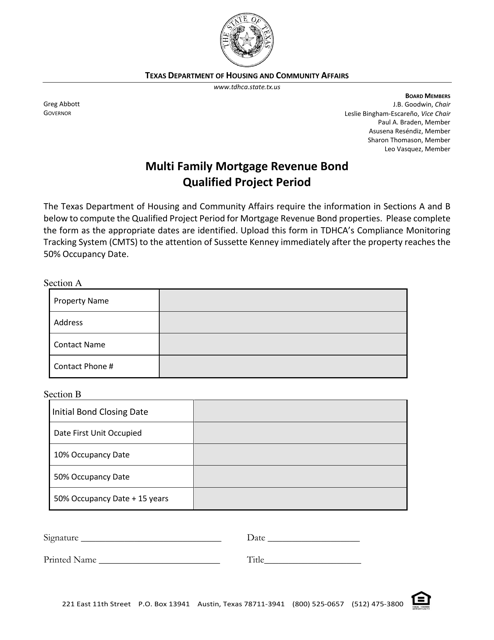

One example of a revenue bond is the Form L-2066 Bingo Revenue Bond issued by South Carolina. This bond is specifically designed to finance bingo-related projects and offers investors the opportunity to support a recreational activity while earning regular interest payments. Similarly, the Multi Family Mortgage Revenue Bond Qualified Project Period issued by Texas is another example of a revenue bond that enables investors to fund affordable housing initiatives.

If you're interested in investing in revenue bonds, you may come across alternate names such as revenue bond investing or investing in revenue-generating projects. These terms refer to the same concept and can provide you with additional information on how to diversify your investment portfolio.

Investing in revenue bonds can be a reliable and rewarding way to earn income while supporting public infrastructure or community development. By considering revenue bonds as an investment option, you can contribute to the growth and improvement of various projects and enjoy consistent returns on your investment.

Documents:

5

This form is used for reporting and tracking revenue generated from bingo games in South Carolina.

This document pertains to the qualified project period for multi-family mortgage revenue bonds in Texas. It provides information on the duration of time during which these bonds can be used for financing qualified projects.