Provincial Sales Tax Templates

Are you a business owner in Canada? Are you aware of the provincial sales tax (PST) requirements in your province? Understanding and complying with PST regulations is important to avoid penalties and ensure the smooth operation of your business.

At USA, Canada, and other countries document knowledge system, we provide a comprehensive collection of documents related to provincial sales tax. Whether you are looking for forms to apply for a vendor's license or consumer permit, seek rebates on energy-efficient household appliances, file your provincial sales tax return, or complete a casual return, we have you covered.

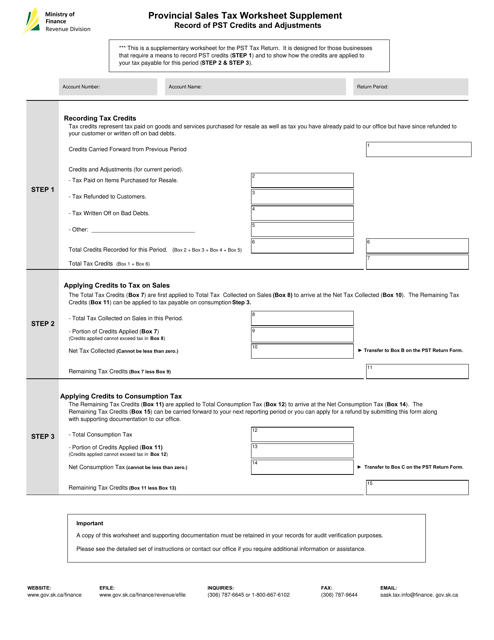

Our extensive database includes documents specific to different provinces in Canada, such as Saskatchewan. We also offer supplementary resources like the Provincial Sales Tax Worksheet Supplement, designed to simplify the calculation of your tax liabilities.

Our webpage is your go-to resource for all your provincial sales tax needs. Stay informed and remain compliant with the alternate names for PST documents, accessible through our user-friendly platform. .

Documents:

5

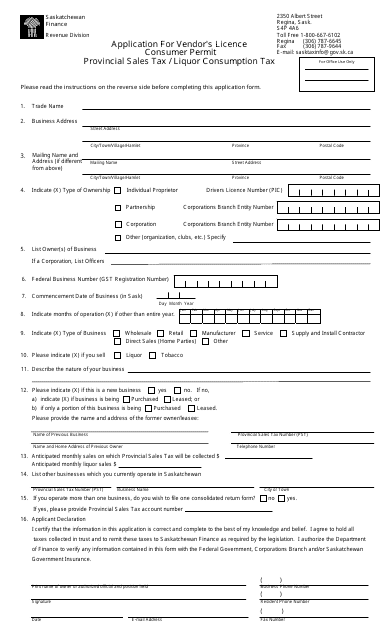

This document is an application form for obtaining a Vendor's Licence and Consumer Permit for selling products subject to Provincial Sales Tax and Liquor Consumption Tax in Saskatchewan, Canada.

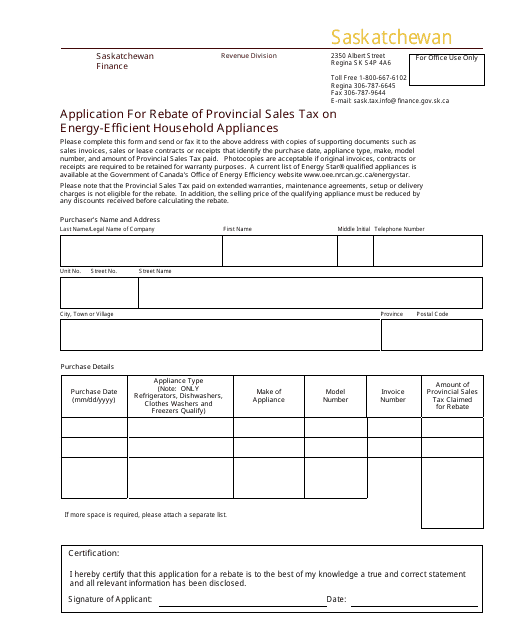

This form is used for applying for a rebate on the provincial sales tax for energy-efficient household appliances in Saskatchewan, Canada.

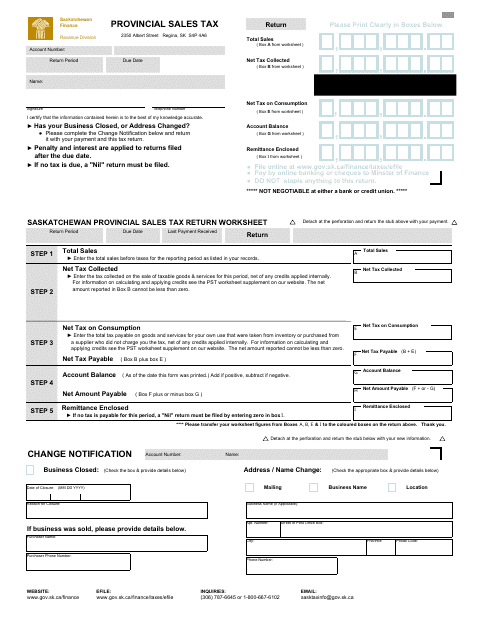

This Form is used for reporting and remitting the Provincial Sales Tax in the province of Saskatchewan, Canada.

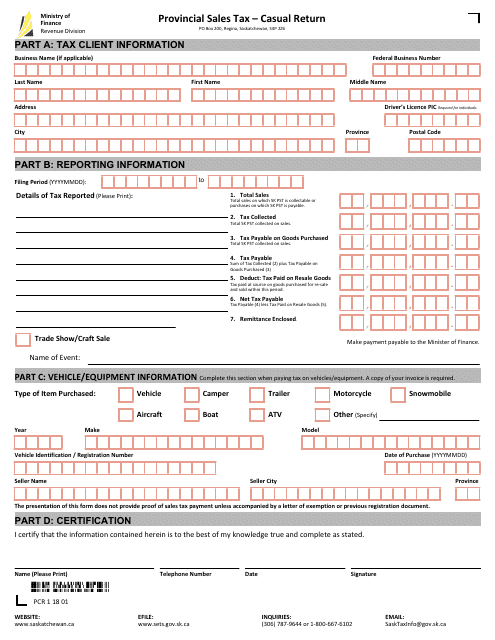

This form is used for reporting and remitting provincial sales tax on casual transactions in the province of Saskatchewan, Canada. It is required for individuals or businesses who are not registered for sales tax but make occasional sales in the province.

This document is a supplement for the Provincial Sales Tax Worksheet in Saskatchewan, Canada. It provides additional information and calculations specific to the province's sales tax requirements.