Non Employee Compensation Templates

Non-Employee Compensation is an essential aspect of financial management for organizations that engage individuals or entities for services outside the traditional employer-employee relationship. This category of documents, also known as Non-Employee Compensation or 1099-MISC Documentation, encompasses a range of forms, instructions, and check request templates designed to ensure accurate reporting and compliance.

Whether you are a university, a government agency, or a private enterprise, handling non-employee compensation requires careful attention to detail. Our collection of documents provides you with the necessary tools to streamline the process and meet all legal obligations.

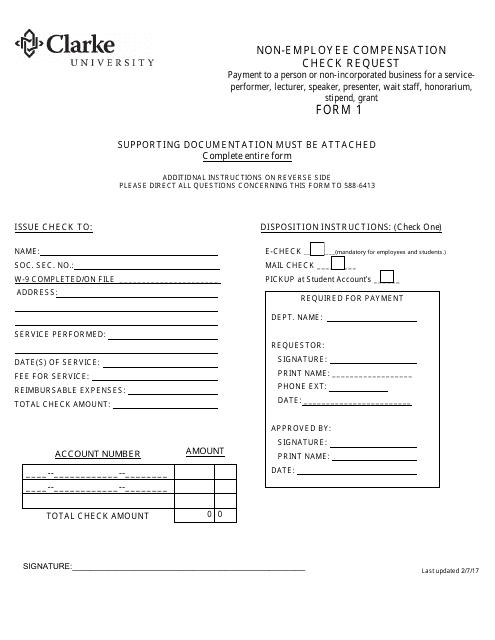

For instance, our Non-Employee Compensation Check Request Form offers a standardized template that simplifies the recording and approval of payments made to non-employees. This form enables effective financial record-keeping, reducing the risk of errors or discrepancies.

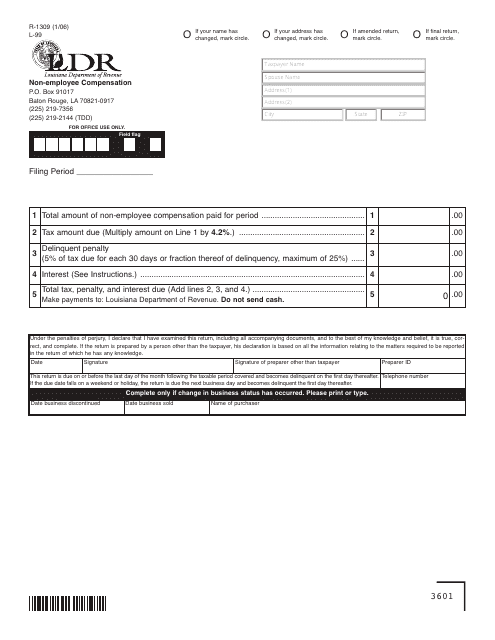

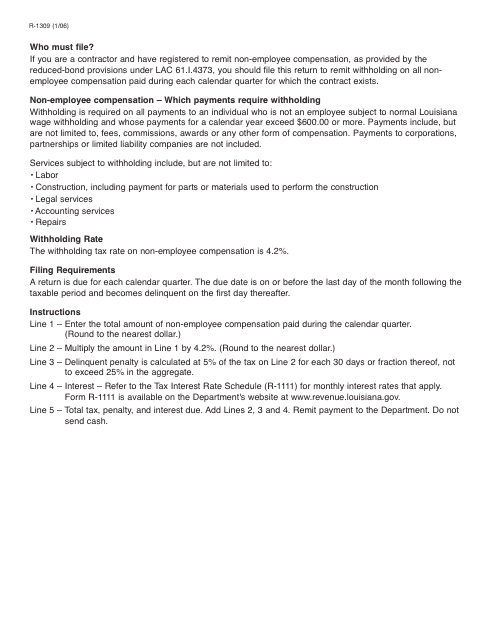

Additionally, we have Form R-1309, also known as Form L-99, specifically designed for non-employee compensation reporting in the state of Louisiana. Accompanied by clear and concise instructions, this form ensures accurate reporting and adherence to state regulations.

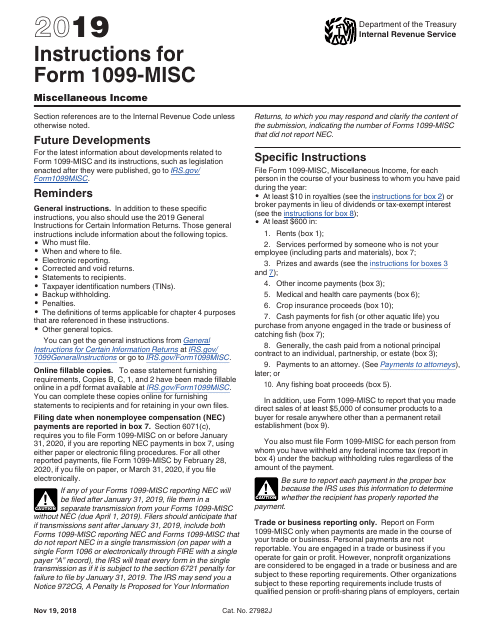

Considering the complex nature of non-employee compensation reporting, our collection also includes Instructions for IRS Form 1099-MISC. These instructions provide detailed guidance on reporting requirements, permissible deductions, and other essential considerations, ensuring compliance with federal tax regulations.

Whether you are an organization seeking to accurately report non-employee compensation or an individual navigating the intricacies of tax reporting, our comprehensive collection of non-employee compensation documents is your go-to resource. With user-friendly forms, clear instructions, and alternate names such as Non-Employee Compensation or 1099-MISC Documentation, we empower you to stay on top of your financial responsibilities and avoid potential pitfalls.

Documents:

5

This type of document is used by Clarke University to request non-employee compensation checks.

This form is used for reporting non-employee compensation in the state of Louisiana.

This document is used for reporting non-employee compensation in the state of Louisiana.

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.