Floor Stock Templates

Floor stock, also known as floor stocks, refers to the inventory of goods or materials that are kept readily available on the premises of a business or organization. These items are typically stored in or near the main floor or retail area, making them easily accessible for immediate use or sale.

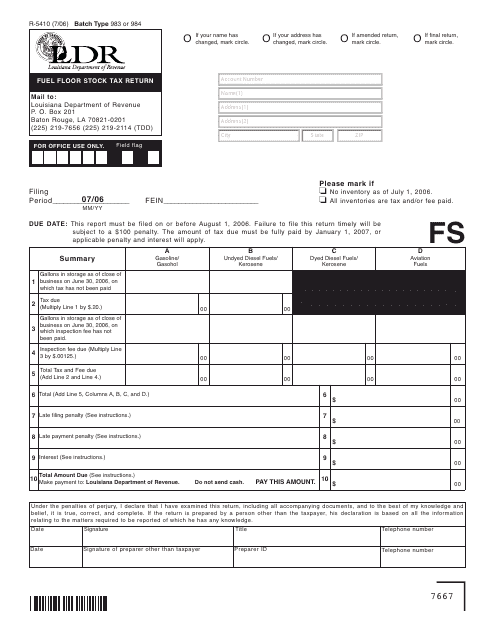

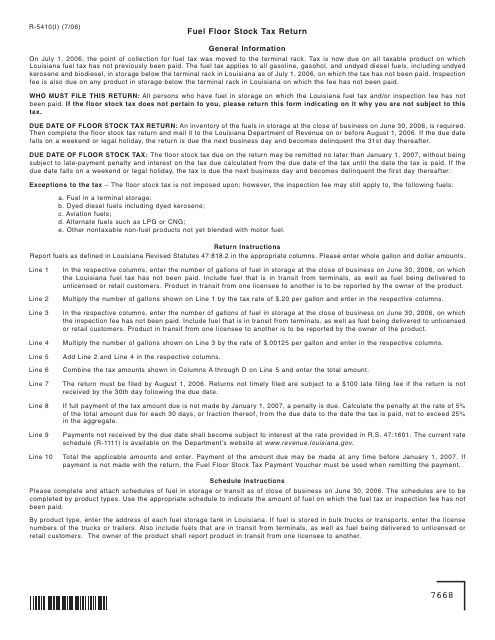

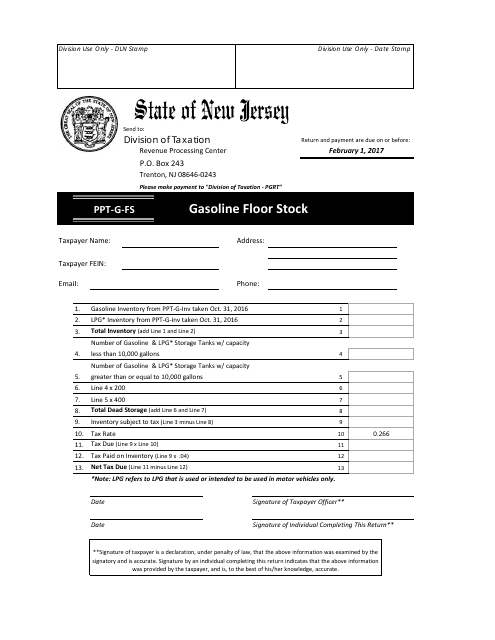

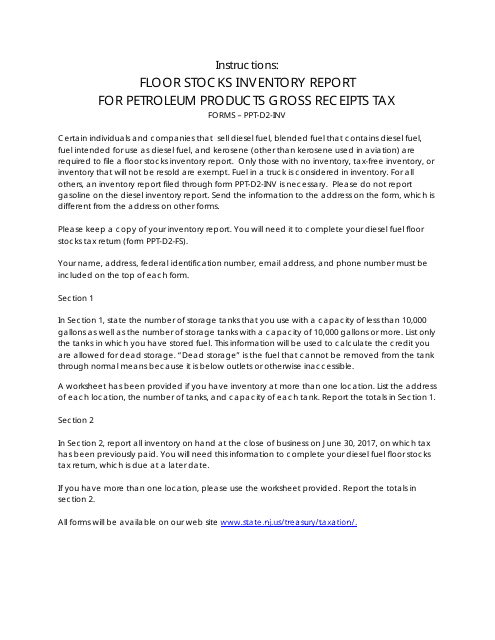

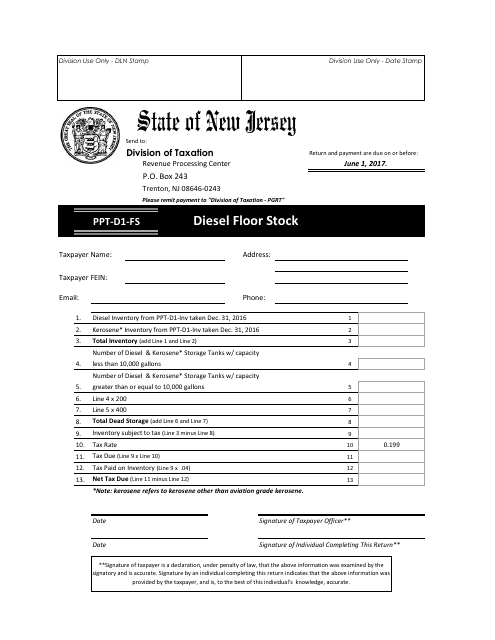

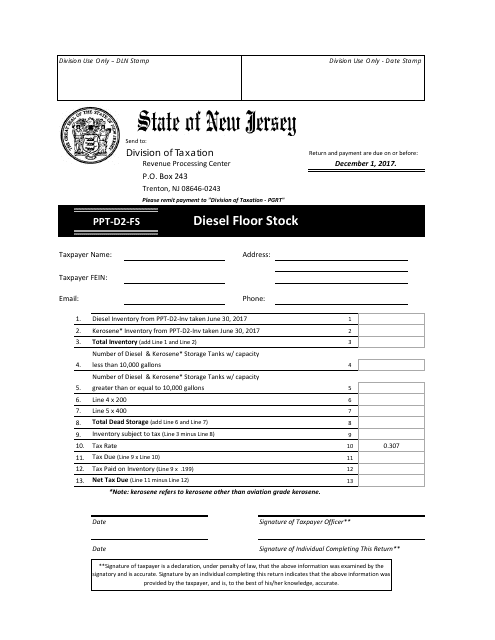

Floor stock is an essential aspect of many industries, including the fuel and petroleum industry. For instance, fuel floor stock tax returns, such as the Form R-5410 Fuel Floor Stock Tax Return in Louisiana, are used to report and calculate the tax liability on the fuel inventory held by businesses. Similarly, other states like New Jersey have specific forms, such as Form PPT-G-FS for gasoline floor stock and Form PPT-D1-FS and PPT-D2-FS for diesel floor stock, to regulate and monitor the inventory of these fuels.

By maintaining floor stock, businesses can ensure they have an adequate supply of goods readily available to meet customer demands. This can help minimize delays in service or delivery, improve customer satisfaction, and ultimately drive sales. Additionally, having floor stock can also be a strategic advantage in times of supply disruptions or emergencies, as businesses won't have to rely solely on external suppliers.

If you own or manage a business that deals with floor stock, it is crucial to comply with the relevant regulations and reporting requirements. Understanding and fulfilling your obligations, such as filing accurate tax returns, can help you avoid penalties and maintain a good standing with the authorities.

At [Your Business Name], we specialize in providing comprehensive assistance and guidance for managing floor stock and complying with related regulations. Our team of experts can help you understand the specific requirements in your jurisdiction, assist with preparing and filing tax returns, and offer valuable insights to optimize your floor stock management practices.

Don't let floor stock become a burden or a source of uncertainty for your business. Contact [Your Business Name] today to learn more about how we can support you in effectively managing your floor stock and staying compliant with all applicable regulations.

Documents:

9

This form is used for reporting and paying fuel floor stock tax in the state of Louisiana. It is required for businesses that store fuel for sale or use in the state.

This Form is used for filing the Fuel Floor Stock Tax Return in the state of Louisiana. It provides instructions for reporting and paying taxes on fuel that is in stock for future use.

This Form is used for reporting and tracking gasoline floor stock inventory in the state of New Jersey.

This document provides instructions for completing Form PPT-D2-INV, which is used to report floor stocks inventory for petroleum products gross receipts tax in New Jersey.

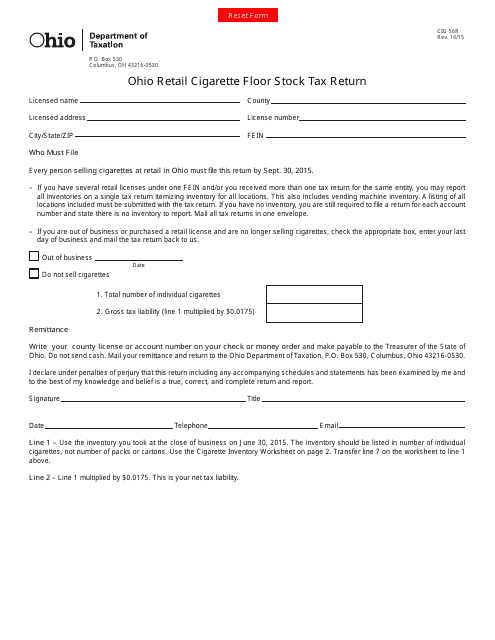

This form is used for reporting and paying the retail cigarette floor stock tax in the state of Ohio. Retailers of cigarettes must file this tax return to calculate and remit the required tax on their cigarette inventory.

This form is used for tracking diesel fuel floor stock in New Jersey.

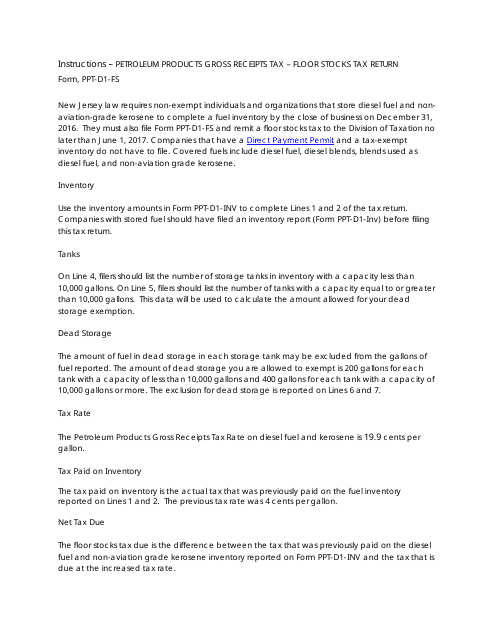

This form is used for reporting and paying the Petroleum Products Gross Receipts Tax (Floor Stocks Tax) in New Jersey. It provides instructions on how to correctly fill out and submit the tax return.

This Form is used for reporting diesel fuel floor stock in New Jersey.

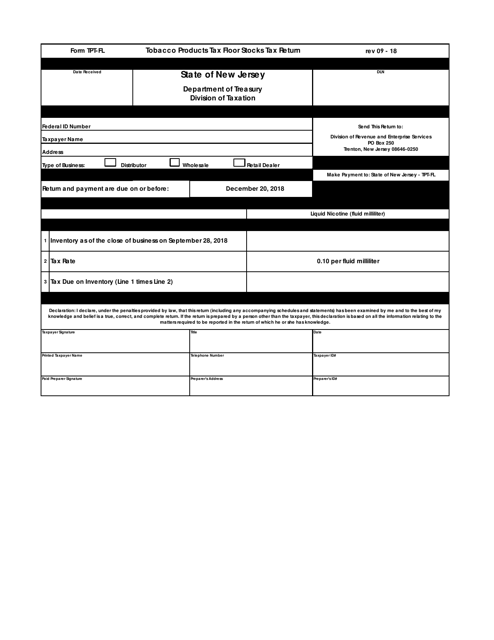

This form is used for reporting and paying taxes on tobacco products held in stock in New Jersey.