Tax Jurisdiction Templates

Tax Jurisdiction

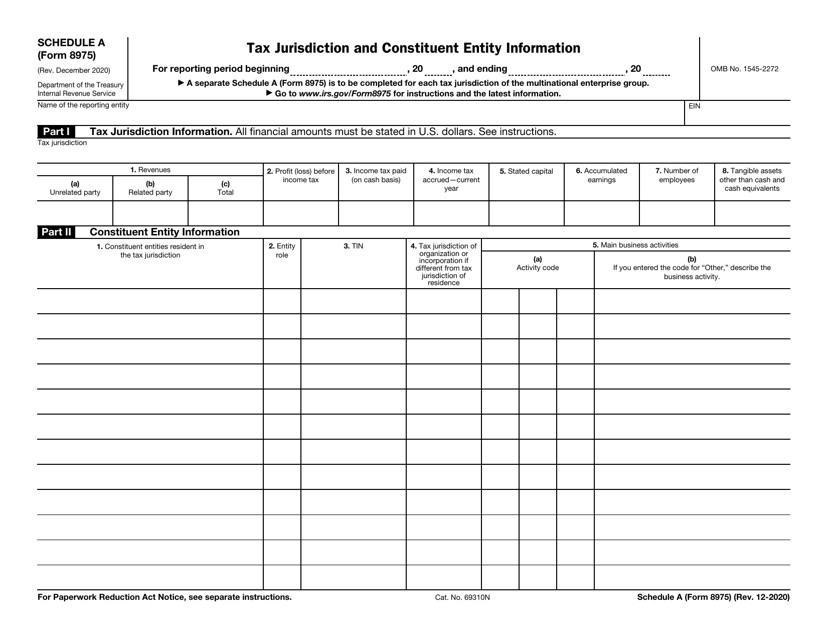

Ensure Compliance with Tax Regulations Across Multiple Jurisdictions

Navigating the complex landscape of tax regulations can be challenging, especially when operating in multiple jurisdictions. To help businesses and individuals stay on top of their tax obligations, our tax jurisdiction services provide comprehensive support and guidance.

Our tax jurisdiction services are designed to assist businesses and individuals in accurately determining their tax liabilities based on the specific requirements of each jurisdiction. Whether you are a multinational corporation, a small business, or an individual taxpayer, understanding and complying with tax regulations is essential to avoid penalties and legal issues.

Our team of experienced tax professionals is well-versed in the intricacies of tax codes and regulations across various jurisdictions, including federal, state, and local levels. We keep up-to-date with the latest changes in tax laws and utilize advanced technology to ensure accurate calculations and reporting.

With our tax jurisdiction services, you can:

-

Ensure Accuracy in Determining Tax Liabilities: We analyze your business operations and income sources to accurately determine your tax liabilities for each jurisdiction you operate in. This helps you avoid underpayment or overpayment of taxes, minimizing potential financial risks.

-

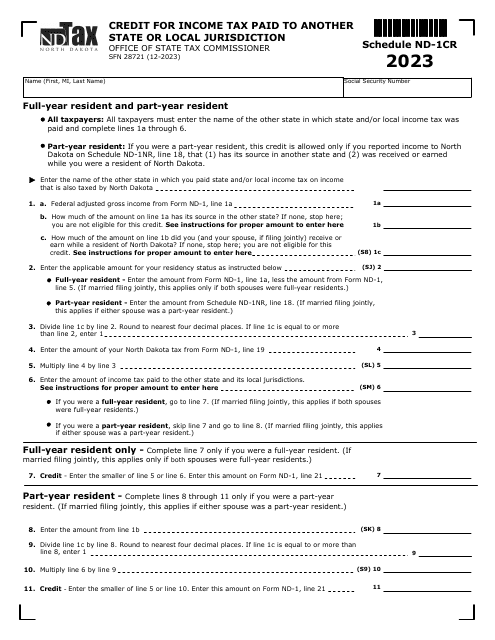

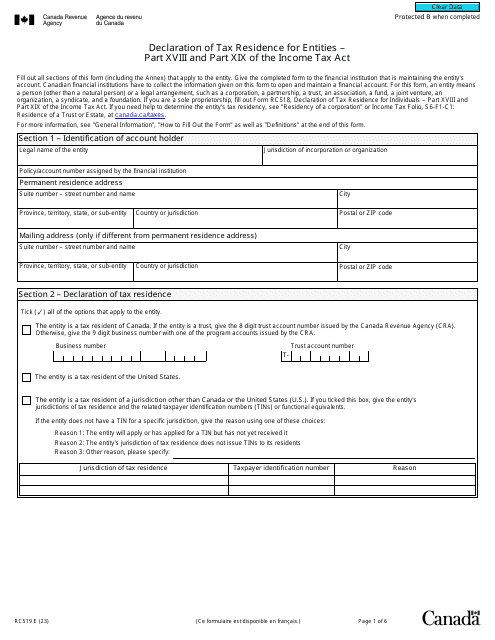

Stay Compliant with Tax Regulations: Our team closely monitors tax regulations across different jurisdictions to ensure you stay compliant with all filing requirements. We assist in preparing and submitting the necessary forms and documentation, saving you time and effort.

-

Minimize Tax Burden through Strategic Planning: By understanding the tax regulations and incentives available in each jurisdiction, we help you optimize your tax position. Our tax professionals devise strategic plans that maximize deductions and credits, reducing your overall tax burden.

-

Expert Guidance and Support: Our team of dedicated tax professionals is always available to answer your questions and provide personalized guidance. We believe in building long-term relationships with our clients, offering ongoing support as your business grows and tax regulations evolve.

Our tax jurisdiction services are suitable for businesses and individuals operating in multiple jurisdictions, including multinational corporations, e-commerce platforms, real estate investors, and freelancers. We understand the unique challenges faced by each client and tailor our services to meet their specific needs.

Partner with us and gain peace of mind knowing that your tax obligations are handled efficiently and accurately across multiple jurisdictions. Maximize your compliance and minimize your tax burden with our comprehensive tax jurisdiction services. Contact us now to schedule a consultation and discover how we can help you navigate the complex world of tax regulations.

Documents:

13

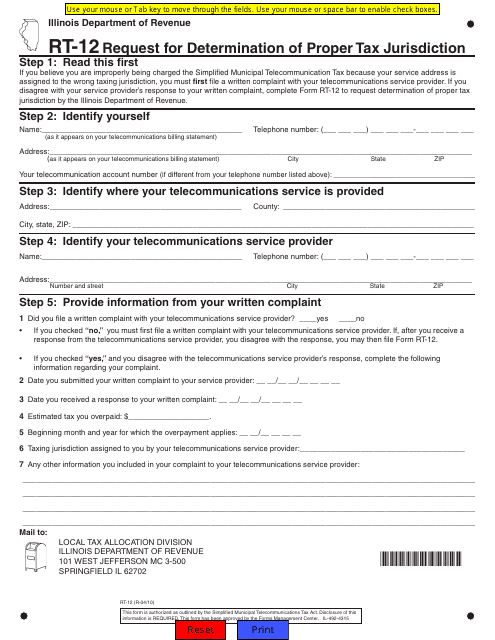

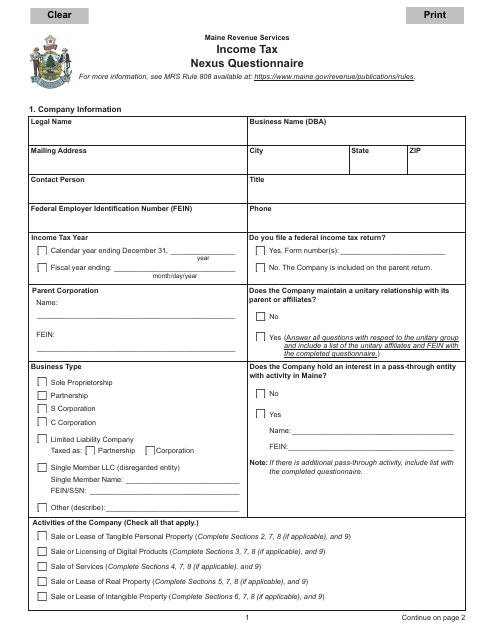

This form is used for requesting a determination of the proper tax jurisdiction in the state of Illinois.

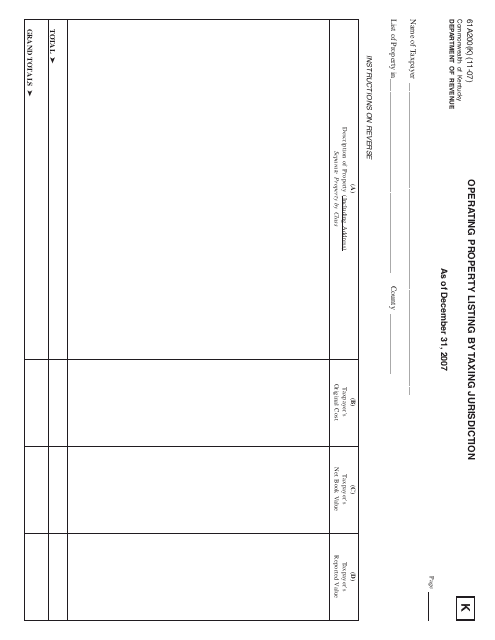

This form is used for listing operating properties by taxing jurisdiction in the state of Kentucky.

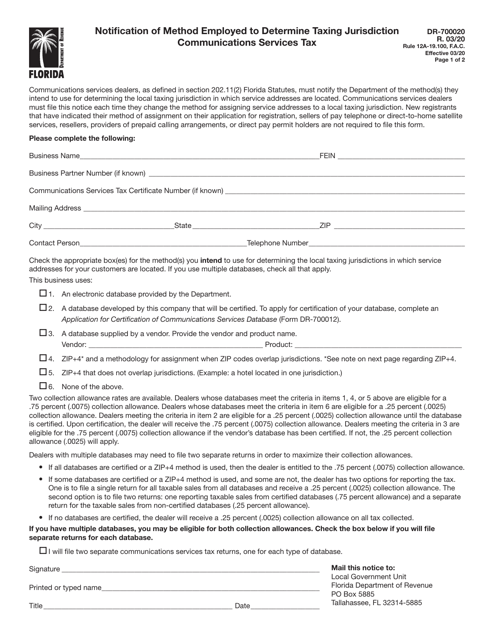

This form is used for notifying the method employed to determine taxing jurisdiction in the state of Florida.

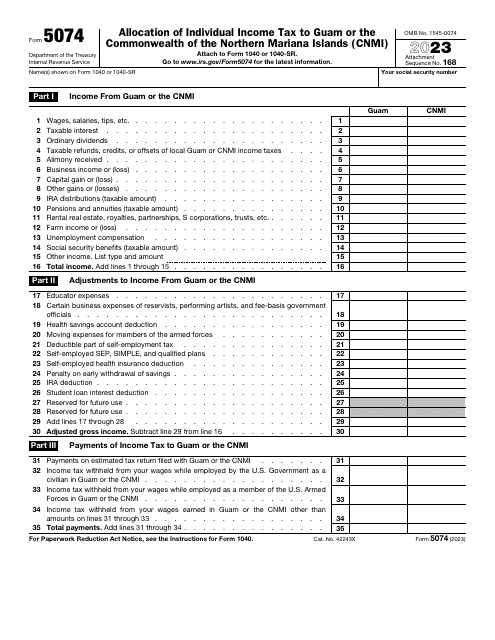

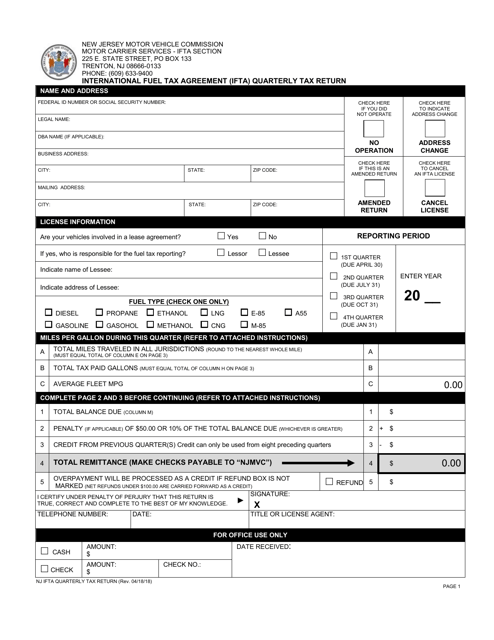

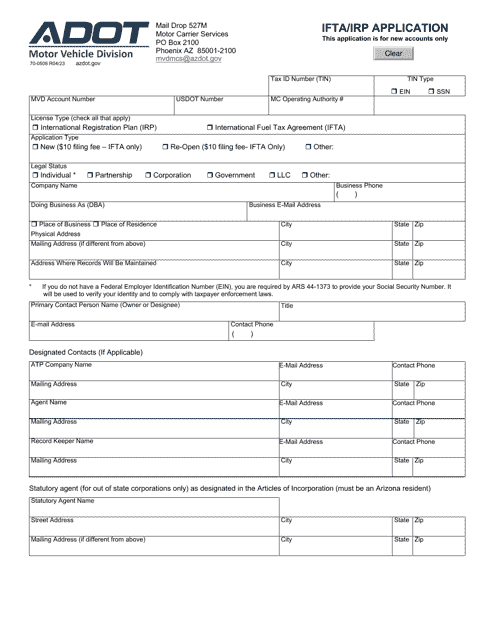

This document is used for submitting the quarterly tax return for the International Fuel Tax Agreement (IFTA) in the state of New Jersey.