Tax Amount Templates

Are you searching for information about tax amounts? Look no further! Our website provides comprehensive resources on tax amounts, also known as tax allocations or tax liabilities.

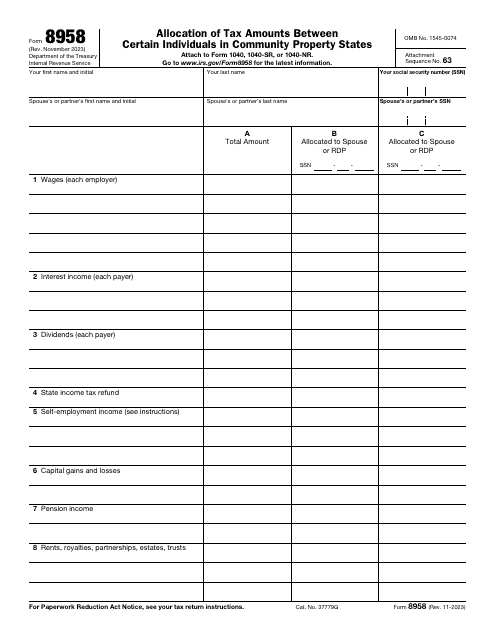

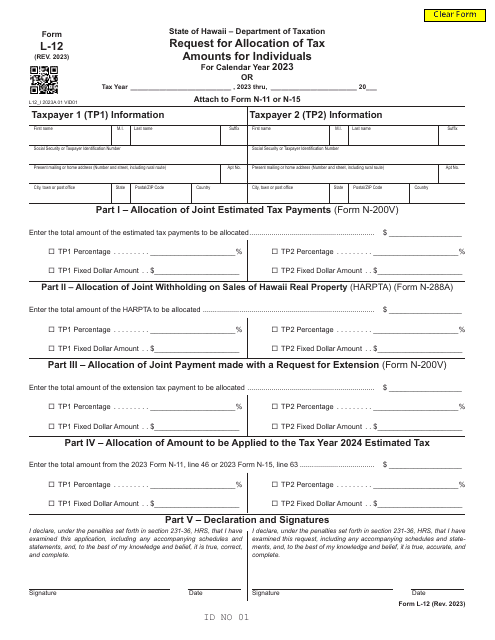

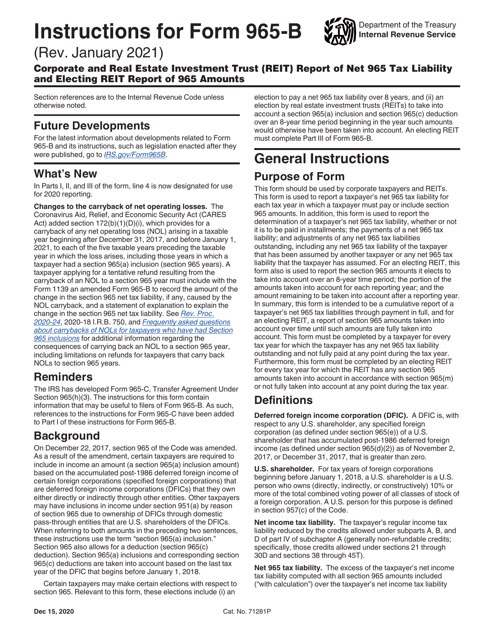

Whether you are an individual or a business entity, understanding your tax obligations is crucial. Our collection of documents covers a wide range of tax-related topics, including the allocation of tax amounts between individuals in community property states, requests for tax amount allocation in specific regions like Hawaii, and reports of net tax liability and electing Reit amounts for corporations and real estate investment trusts.

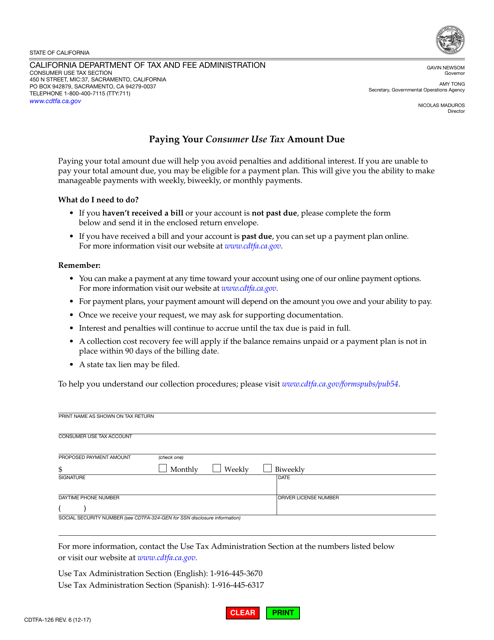

If you reside in California, we have information on how to pay your consumer use taxamount due, as well as resources on fines, penalties, and other tax-related amounts through IRS Form 1098-F. Our goal is to provide you with the necessary guidance and knowledge to navigate the complexities of tax amounts while ensuring compliance with tax regulations.

Whether you're an individual taxpayer, a business owner, or a tax professional, our website offers valuable insights and resources to help you manage your tax obligations more effectively. Stay informed, make informed decisions, and ensure that your tax amounts are handled accurately and legally.

Visit our website to access these valuable tax documents and gain a better understanding of tax amounts.

Documents:

5

This Form is used for paying the amount of Consumer Use Tax that is due in California.

This is an IRS form governmental entities prepare and file in order to inform the government about deductible payments like fines and penalties they have made during a particular calendar year.