Employee Taxes Templates

Are you responsible for handling employee taxes? Looking for the necessary forms and information to ensure proper tax withholdings for your employees? Look no further. Our comprehensive collection of employee tax documents, also known as employee tax forms or employees tax form, is here to assist you.

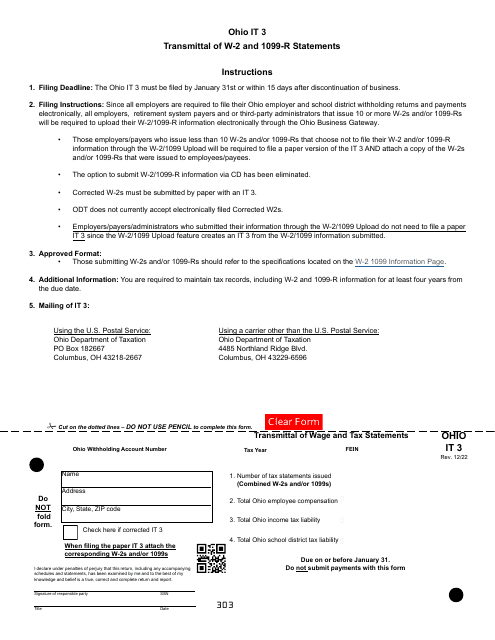

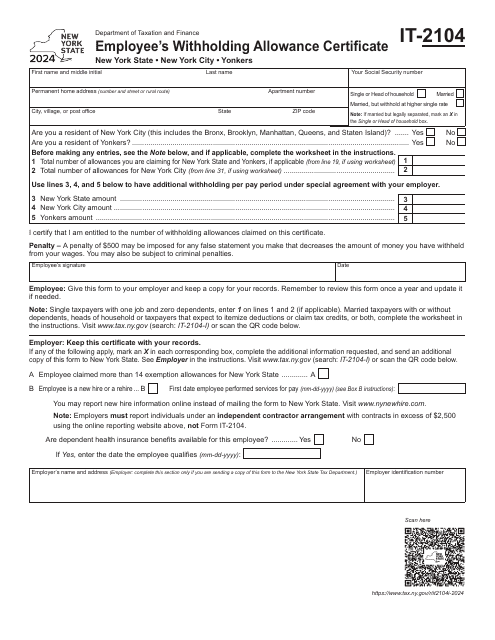

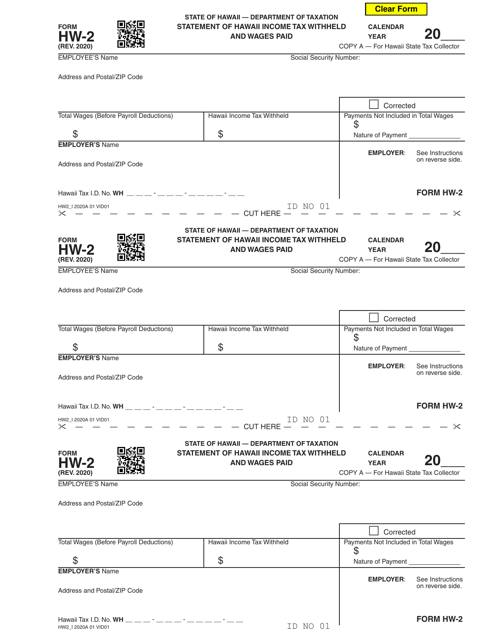

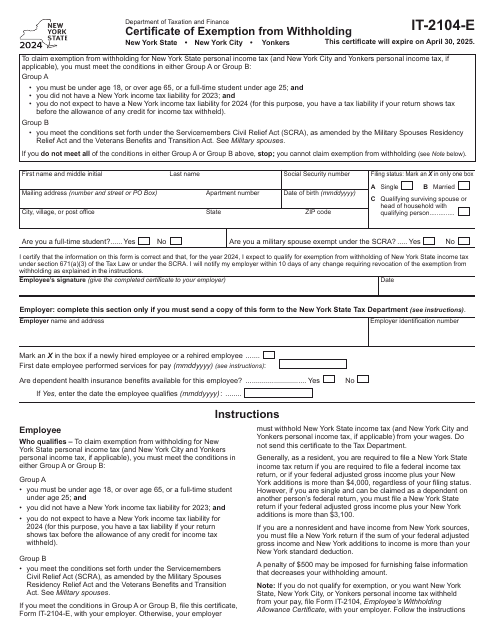

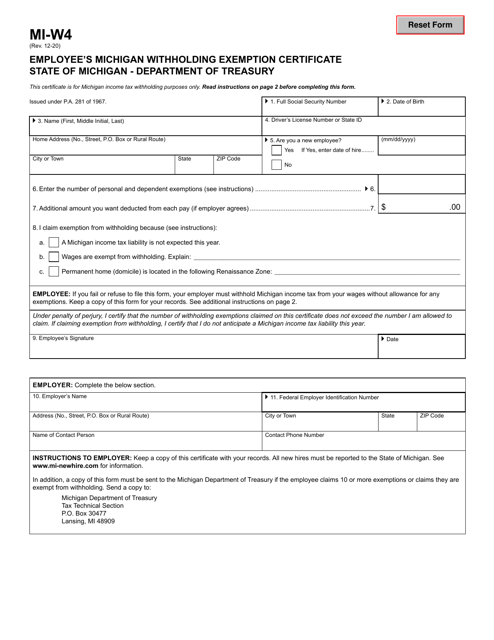

Navigating the complex world of tax compliance can be a daunting task, but with our extensive library of resources, you can easily find the specific forms you need. From IRS Form W-2GU Guam Wage and Tax Statement to Form 150-101-402 (OR-W-4) Oregon Withholding - Oregon, we have the variety of tax forms from different regions that you require. We also offer essential forms such as Form MI-W4 Employee's Michigan Withholding Exemption Certificate - Michigan and Form IT-2104 Employee's Withholding Allowance Certificate - New York.

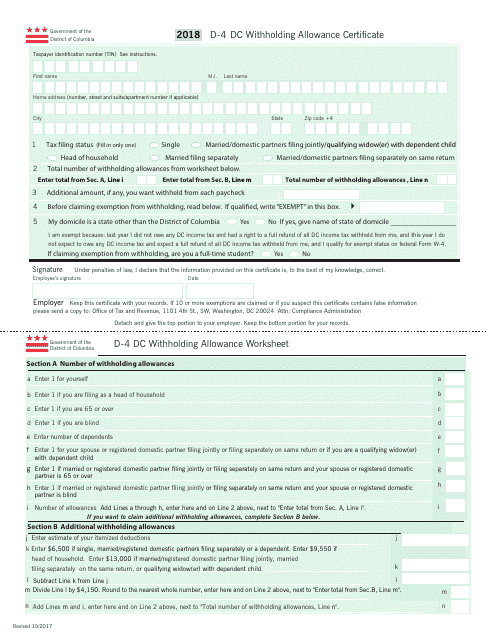

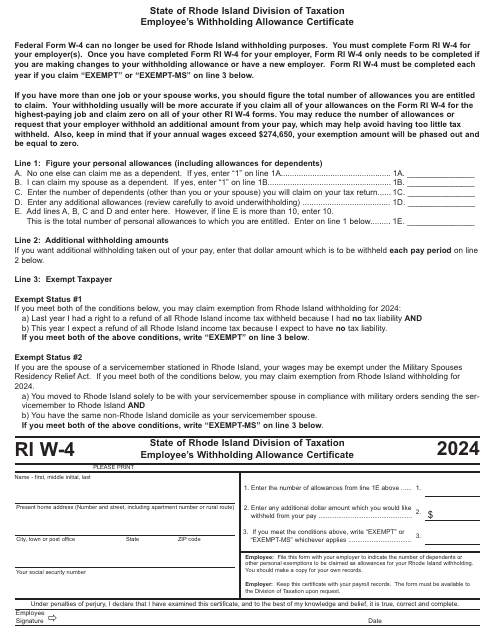

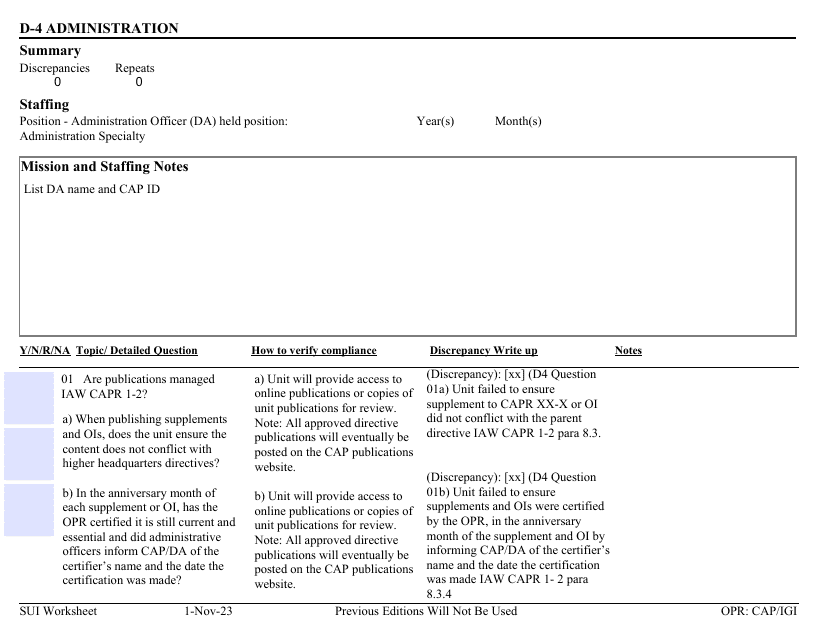

Our robust collection of employee tax documents includes alternate variations of tax forms so that you can select the one that best suits your needs. With options like Form D-4 Sui Worksheet - Administration, you can rest assured that we have you covered, regardless of your location or specific requirements.

Simplify your tax compliance process and streamline your administrative tasks by utilizing our extensive employee tax document collection. Save time and effort by accessing all the necessary forms in one place, ensuring accuracy and efficiency when it comes to tax withholdings for your employees.

With our user-friendly system and extensive range of documents, managing employee taxes has never been easier. Take advantage of our comprehensive employee tax documents today and experience the convenience and peace of mind that comes from having all the necessary resources at your fingertips.

Documents:

39

This form is used for Washington, D.C. residents to determine the amount of tax to be withheld from their paycheck.

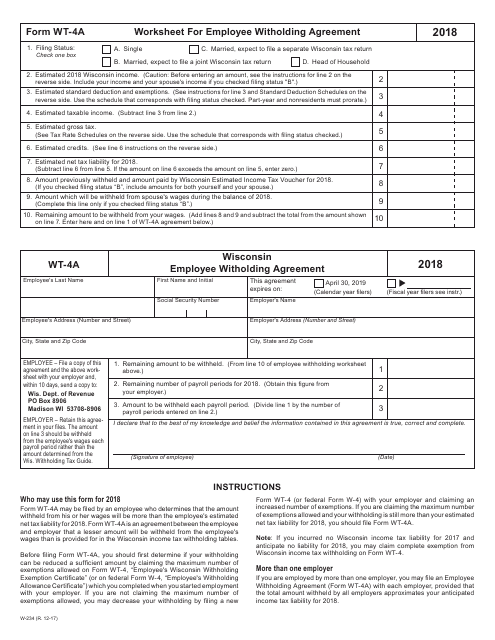

This Form is used for calculating employee withholding agreement in Wisconsin.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

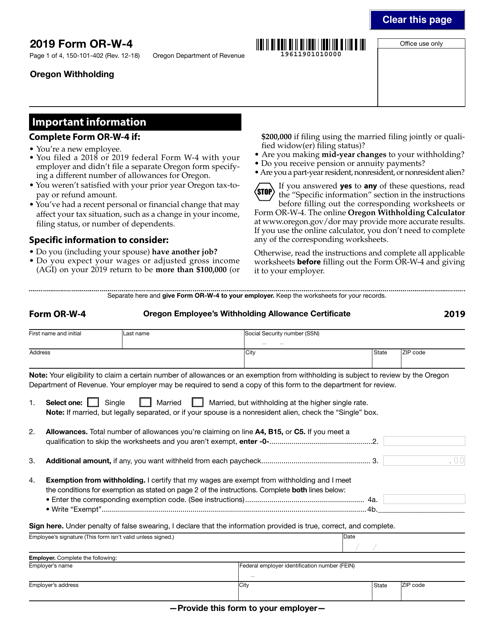

This form is used for Oregon residents to determine the correct amount of state income tax to withhold from their wages.

Use this application to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer.

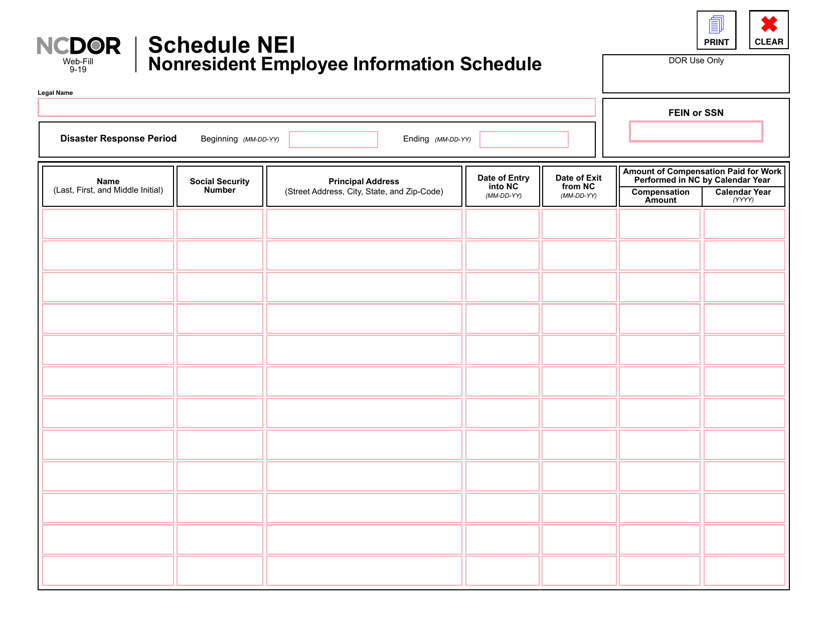

This document is used for reporting nonresident employee information in North Carolina.

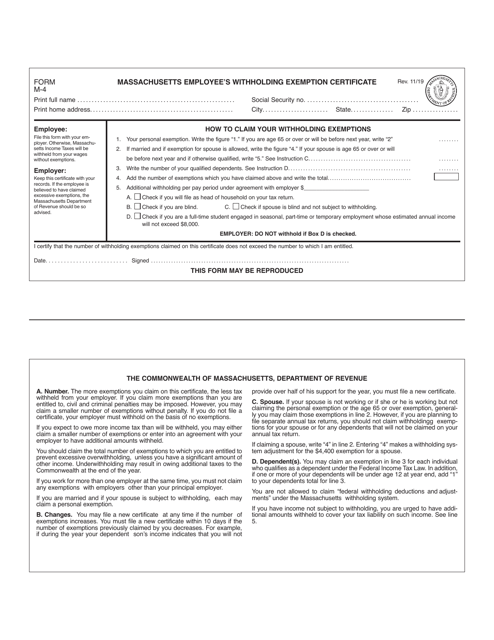

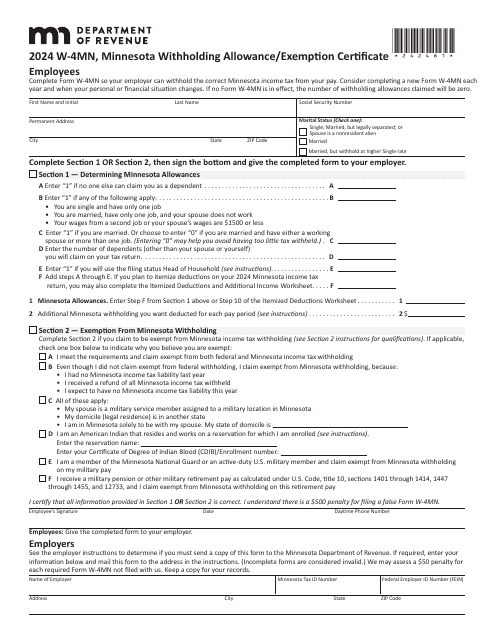

This Form is used for employees in Massachusetts to declare their withholding exemptions for income tax purposes.

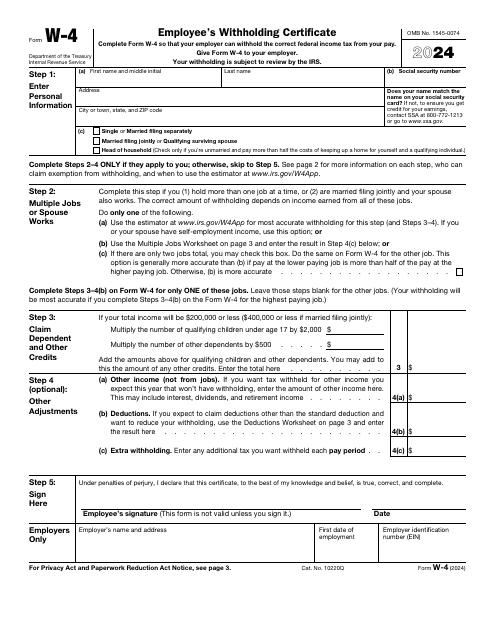

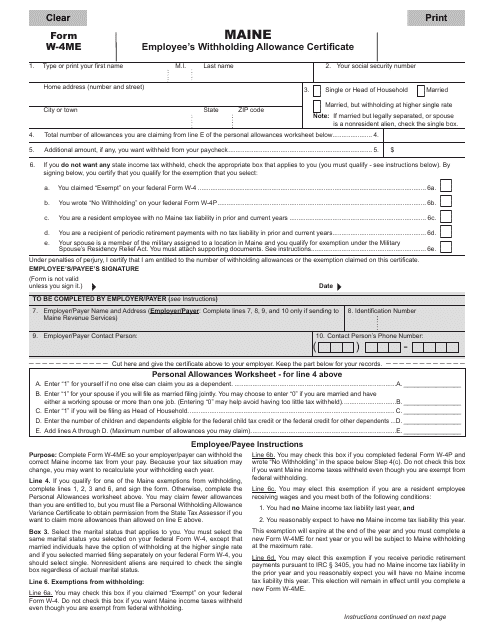

This Form is used for employees to provide their withholding information to their employer. It helps determine the amount of federal income tax to be withheld from their paycheck.

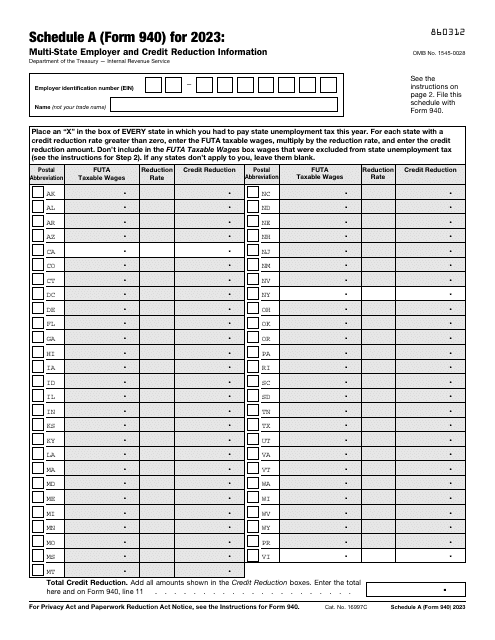

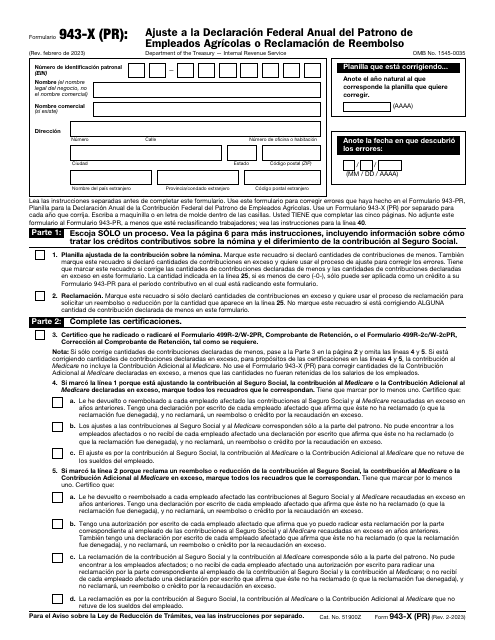

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

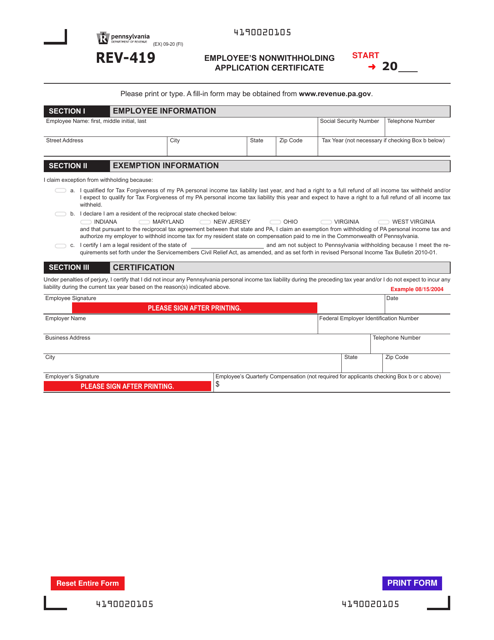

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

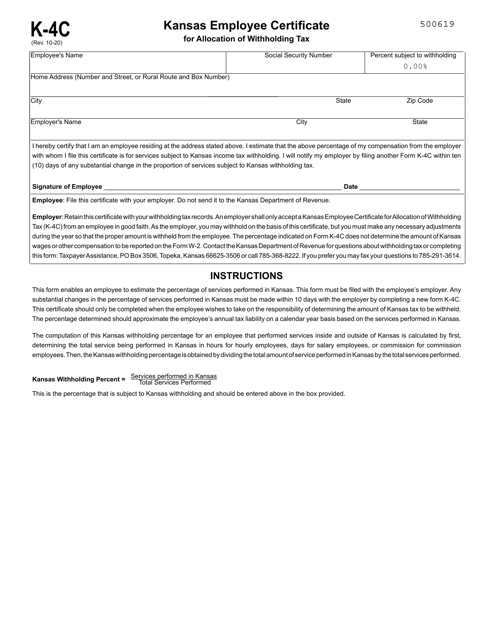

This form is used for Kansas employees to allocate their withholding tax.

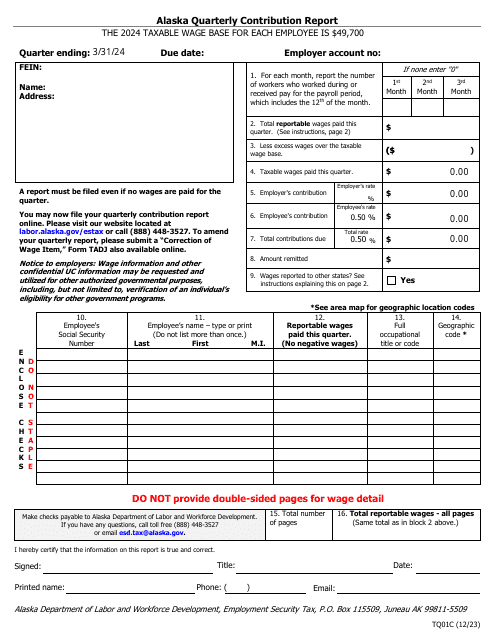

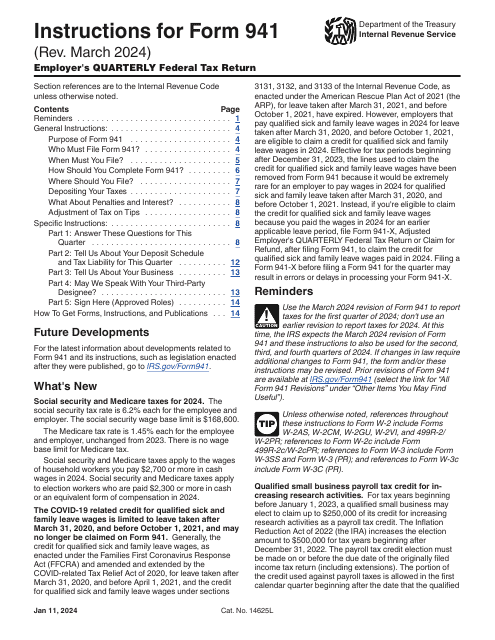

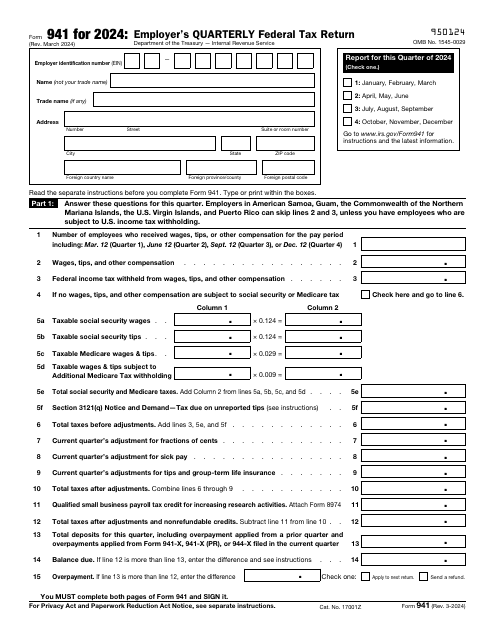

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

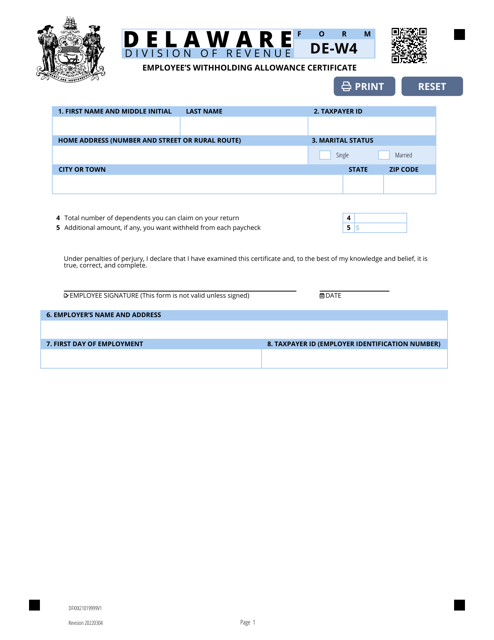

This form is used by employees in Delaware to determine their withholding allowances and calculate the correct amount of federal income tax to be withheld from their wages.

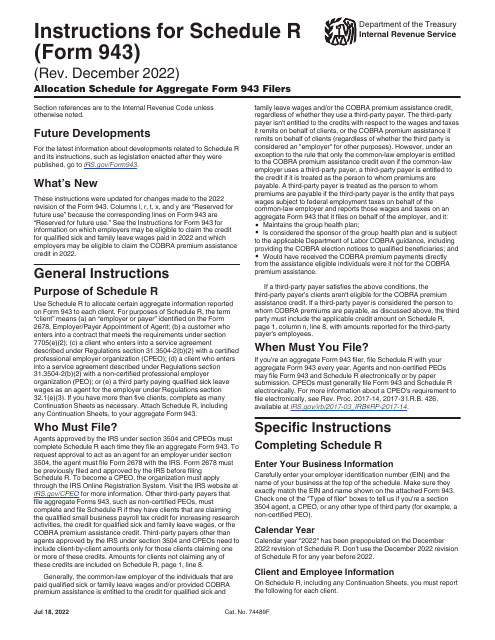

This form is used for allocating wages and taxes for employers who file an Aggregate Form 943 with the IRS. It provides instructions on how to accurately report employee wages and taxes for agricultural workers.