Tax Benefits Templates

Documents:

418

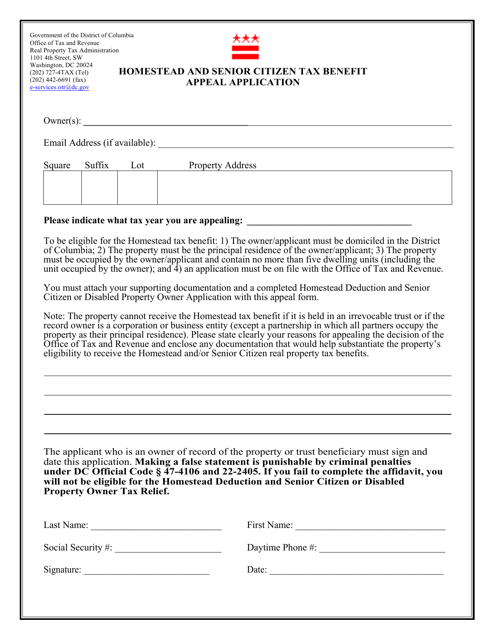

This document is used for appealing the denial of homestead and senior citizen tax benefits in Washington, D.C.

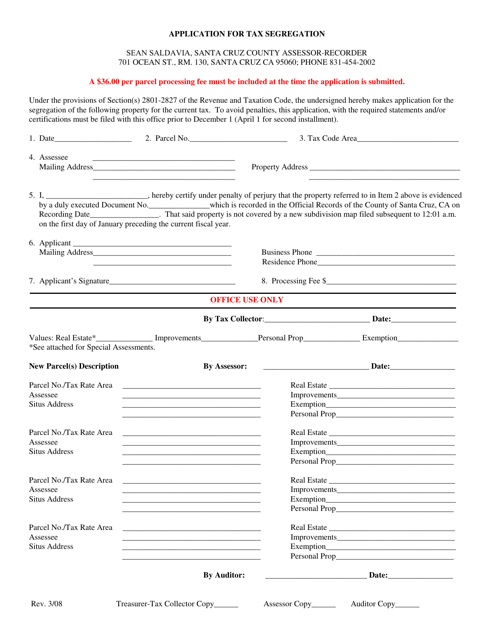

This document is an application form used in Santa Cruz County, California for requesting tax segregation. Tax segregation is a method of allocating costs of real property between different asset classes to optimize tax deductions.

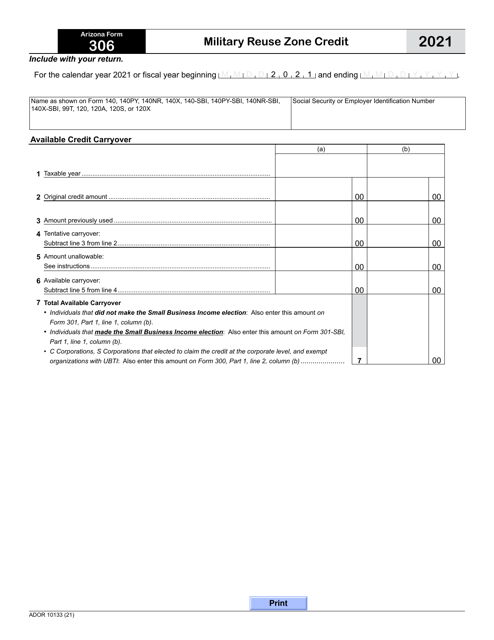

This form is used for claiming the Military Reuse Zone Credit in Arizona.

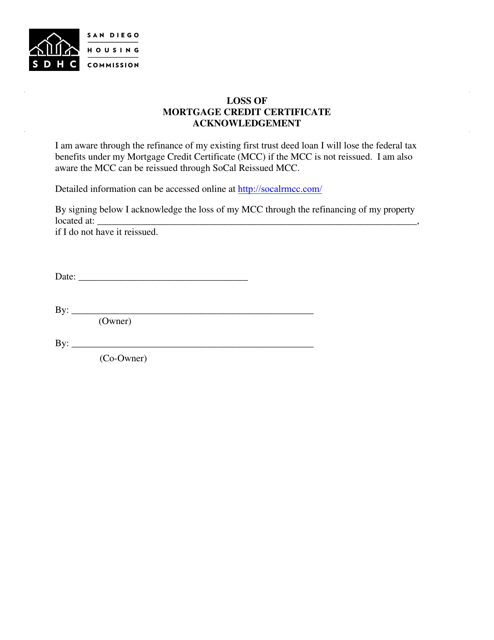

This type of document is an acknowledgement of the loss of a Mortgage Credit Certificate issued by the City of San Diego, California. It is used to report the loss and request a replacement certificate.

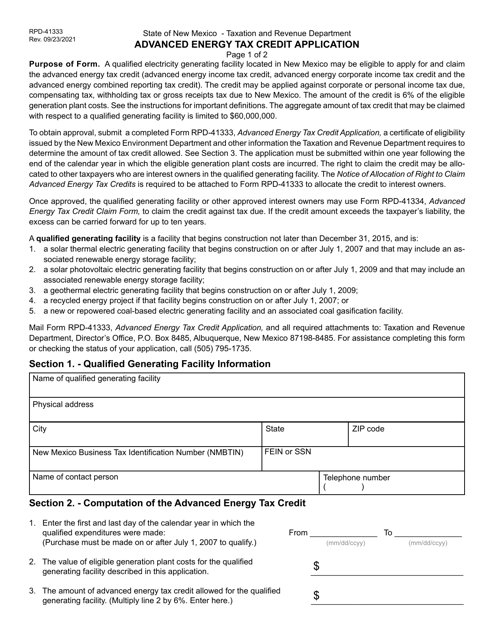

This form is used for applying for the Advanced Energy Tax Credit in the state of New Mexico.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.