Employer Quarterly Report Templates

Are you looking for a convenient and streamlined way to submit your employer quarterly reports? Look no further! Our comprehensive collection of employer quarterly report forms provides everything you need to effortlessly fulfill your reporting obligations. Whether you're an employer in Florida, Delaware, Kentucky, or any other state, our user-friendly forms will make the process a breeze.

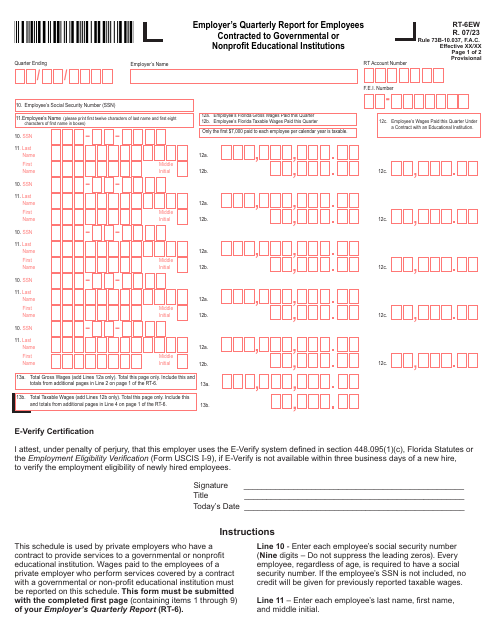

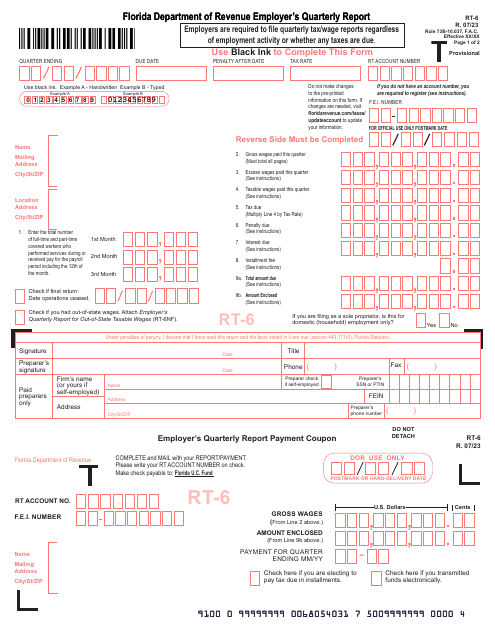

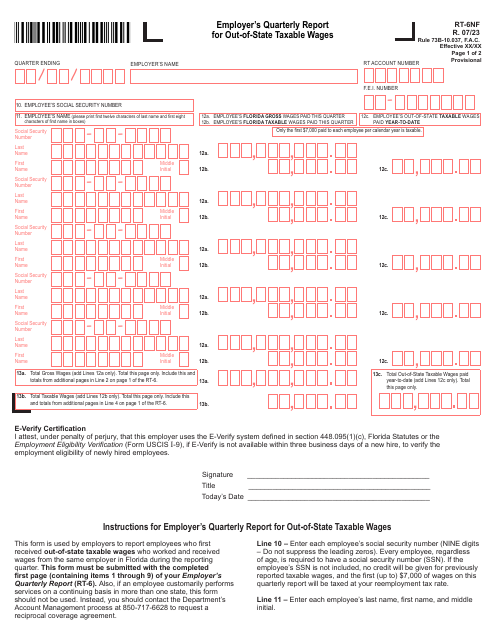

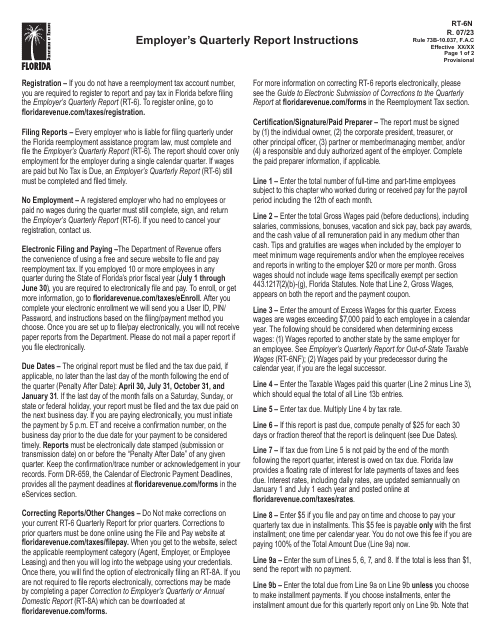

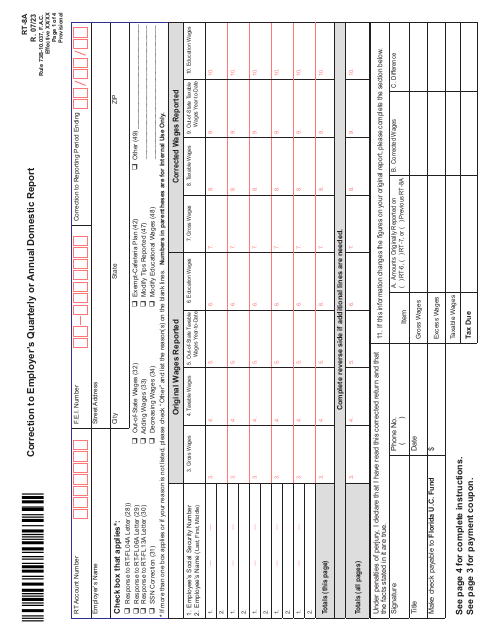

Our employer quarterly report forms are designed to meet the specific requirements of each state, ensuring compliance with the relevant tax and wage regulations. With our easy-to-use continuation sheets, you can provide detailed information on employee wages, taxes withheld, and other essential data without any hassle. Whether you are an employer in the private sector or contracted to governmental or nonprofit educational institutions, we have the appropriate forms to meet your needs.

Our employer quarterly report forms are also known as employer quarterly reports or employer's quarterly report forms. These documents are an essential part of maintaining accurate records and ensuring compliance with tax and wage laws. Failing to submit these reports on time can result in penalties and unnecessary stress. Don't let that happen to you - trust our reliable forms to simplify the process and keep you on track.

When it comes to employer quarterly reporting, accuracy and efficiency are key. Our employer quarterly report forms offer a reliable and efficient way to report your wages and taxes without any hassle. With our user-friendly format and clear instructions, you can easily navigate through the reporting process and submit your reports on time, every time.

So why waste time and risk penalties? Take advantage of our comprehensive collection of employer quarterly report forms today. Simplify your reporting obligations and ensure compliance with tax and wage laws. Trust us to provide you with the tools you need to streamline your reporting process and stay on top of your employer reporting requirements. Don't let the stress of employer quarterly reporting get in the way - let our forms do the work for you.

Documents:

13

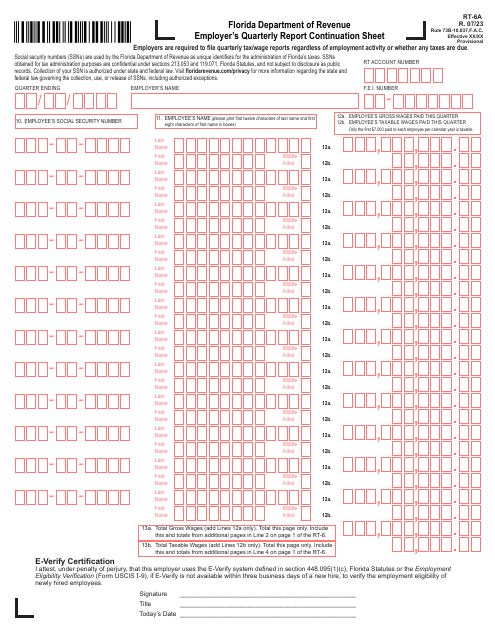

This is a legal document used to inform the Florida Department of Revenue (DOR) about the total number of all employees who performed services or received pay, their gross, excess, and taxable wages.

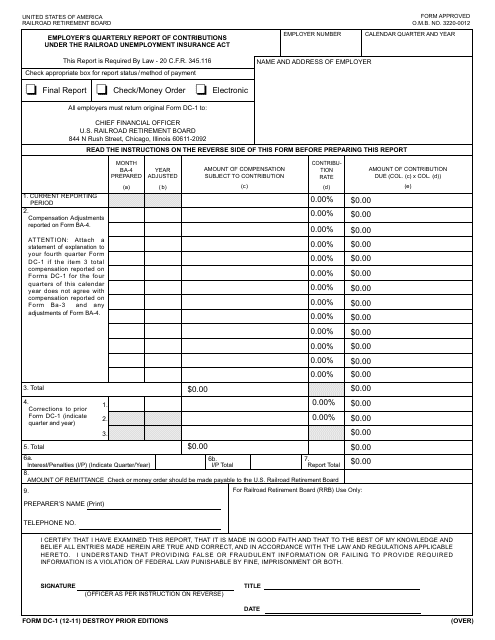

Form DC-1 Employer's Quarterly Report of Contributions Under the Railroad Unemployment Insurance Act

This form is used for employers to report their quarterly contributions under the Railroad Unemployment Insurance Act.

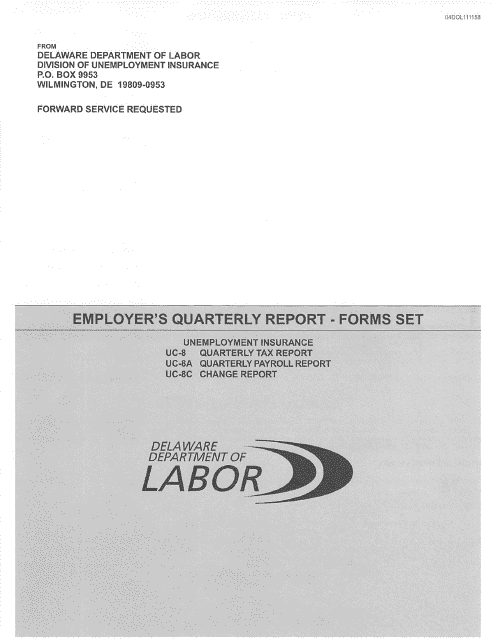

This form is used for employers in Delaware to report their quarterly tax information.

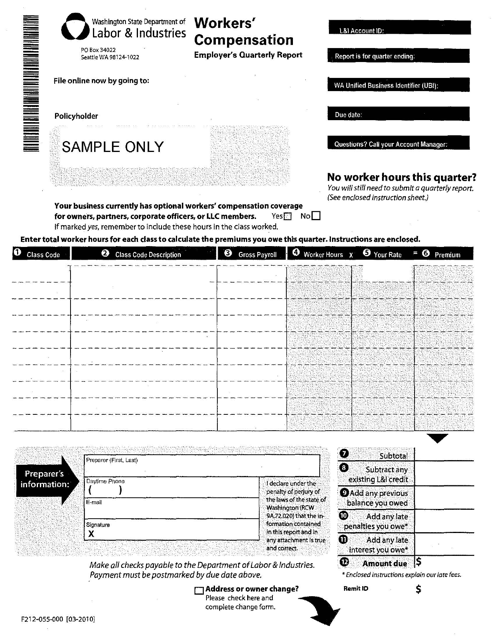

This Form is used for employers in Washington to report their quarterly workers' compensation information. It helps them keep track of their employees' injuries, medical treatment, and other related expenses.

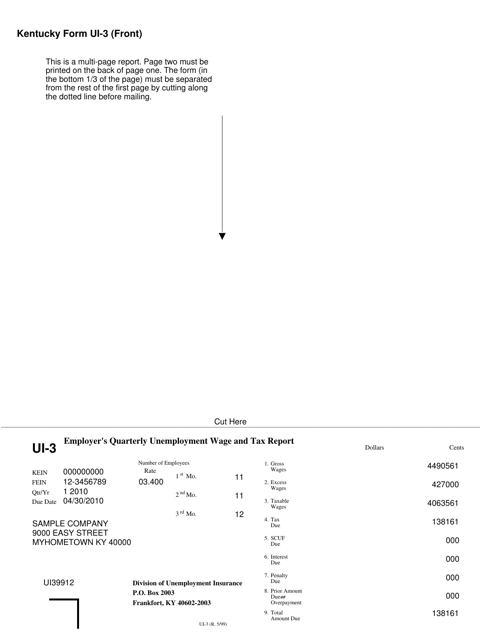

This form is used for employers in Kentucky to report tax and wage details on a quarterly basis.