Intangible Personal Property Templates

Intangible Personal Property

Welcome to our webpage dedicated to intangible personal property! Whether you refer to it as intangible personal property, or by its alternate names, this collection of documents is essential for understanding and managing your intangible assets.

In today's modern world, many valuable assets are intangible in nature. These could include things like patents, copyrights, trademarks, and various types of contractual rights. These assets may not have a physical form, but they hold immense value for individuals and businesses alike.

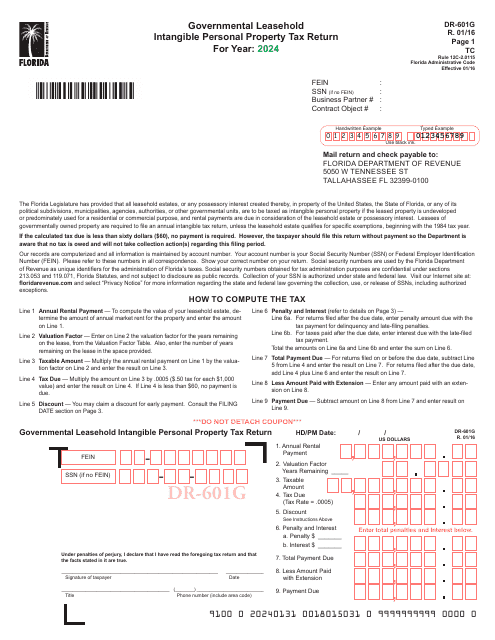

Our collection of documents covers a wide range of topics related to intangible personal property. From reporting the contents of safe deposit boxes to filing tax returns for intangible property, we have you covered. No matter which state or region you reside in, our documents are tailored to provide accurate and up-to-date information specific to your local jurisdiction.

Managing intangible personal property can be a complex task, but our documents make it easier. They provide clear instructions and guidelines to ensure compliance with relevant laws and regulations. Our goal is to simplify the processes involved in valuing, reporting, and protecting your intangible assets.

Whether you are an individual looking to protect your creative work or a business seeking to safeguard your intellectual property, our documents are designed to assist you every step of the way. By utilizing our resources, you can better understand the legal requirements surrounding intangible personal property and take proactive measures to safeguard your valuable assets.

Explore our collection of documents today and gain the knowledge and tools necessary to effectively manage your intangible personal property. Trust us to provide you with accurate, reliable, and user-friendly resources to help you navigate the complexities of intangible assets.

Documents:

5

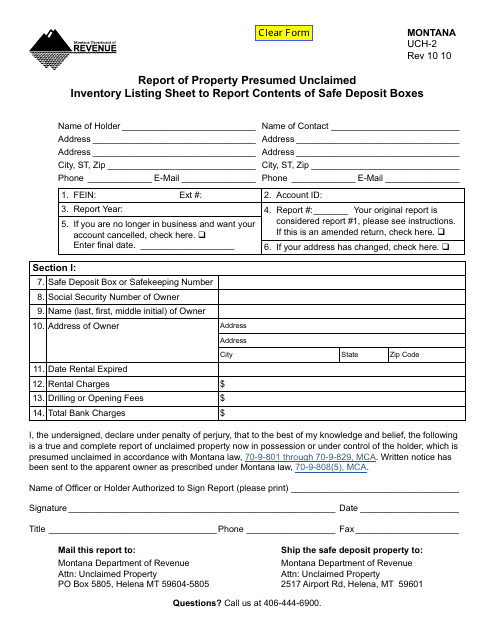

This Form is used to report the contents of safe deposit boxes that are presumed to be unclaimed in the state of Montana.

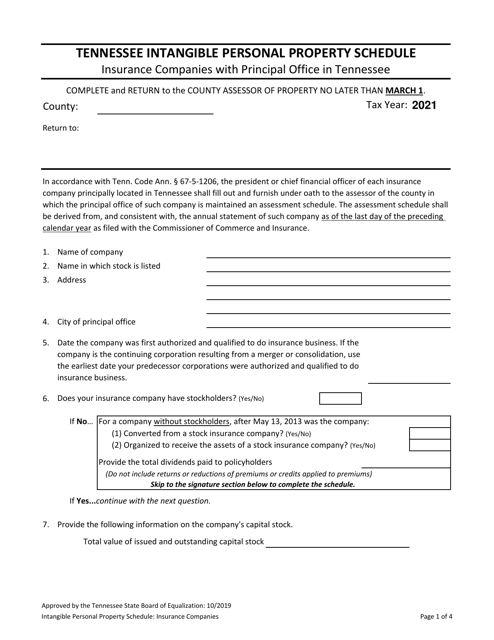

This form is used for reporting intangible personal property in Tennessee. It is required by the Tennessee Department of Revenue.