Veterans Property Tax Exemption Templates

Are you a veteran looking for information on how to save on your property taxes? Look no further than the Veterans Property Tax Exemption, also known as the Veteran Property Tax Exemption or the Veteran Property Tax Exemption Form.

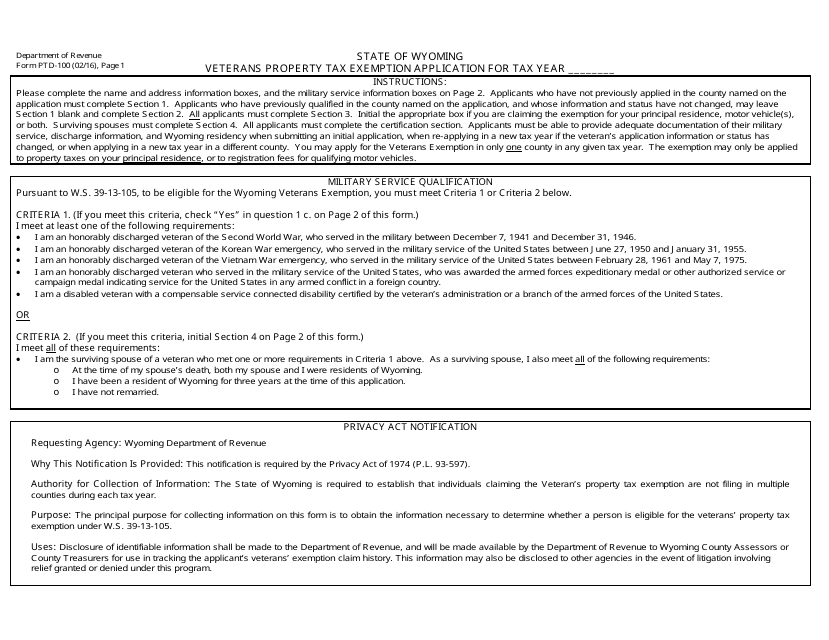

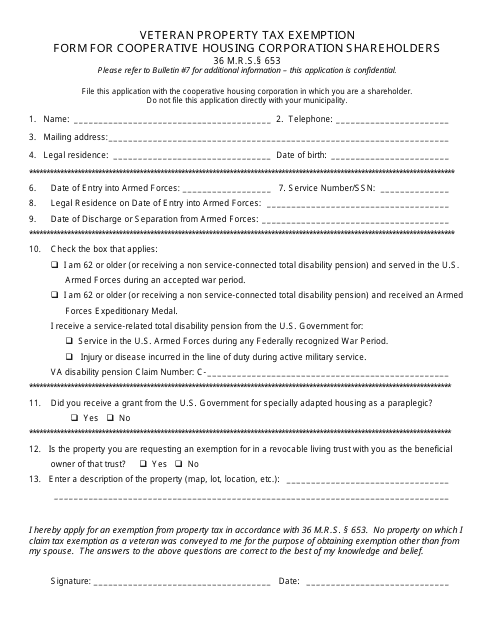

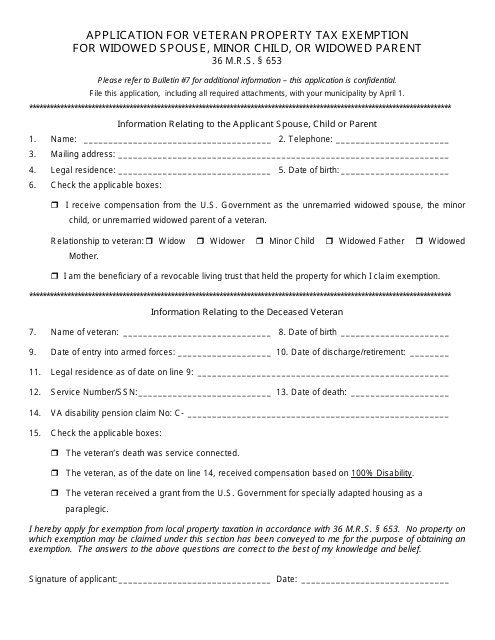

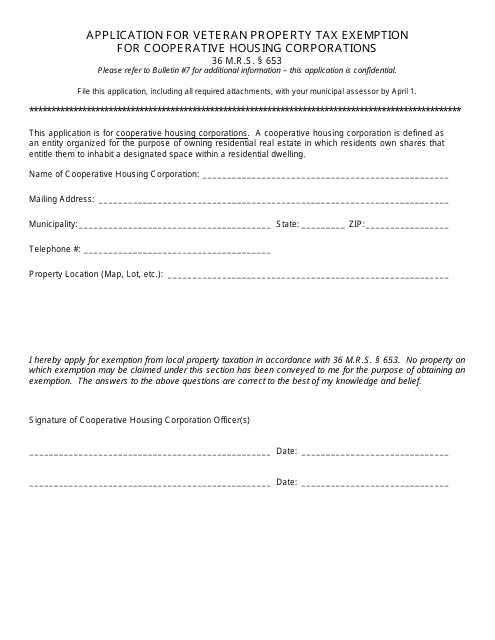

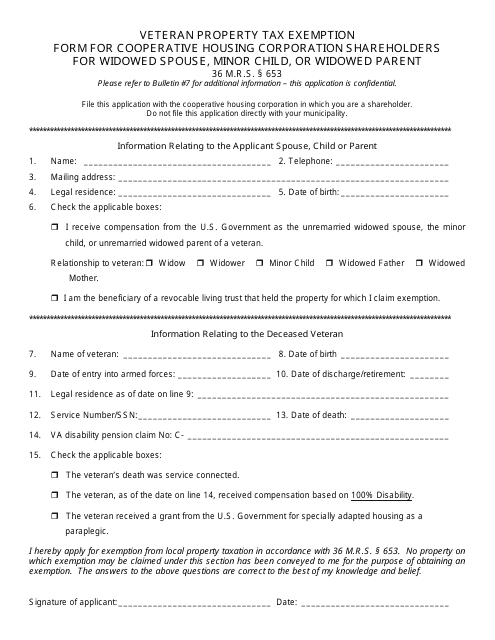

Veterans who qualify for this program can apply for various forms, such as the Form PTD-100 Veterans Property Tax Exemption Application in Wyoming or the Form PTF-653-E Veteran Property Tax Exemption Form for Cooperative Housing Corporation Shareholders in Maine. If you live in Maine and are a shareholder in a cooperative housing corporation, you can also utilize the Form PTF653-2C Application for Veteran Property Tax Exemption.

The Veterans Property Tax Exemption is an opportunity for veterans to receive a deduction or exemption on their property taxes, saving them money each year. It's important to know the specific requirements and criteria for your state, as each state may have different regulations and guidelines.

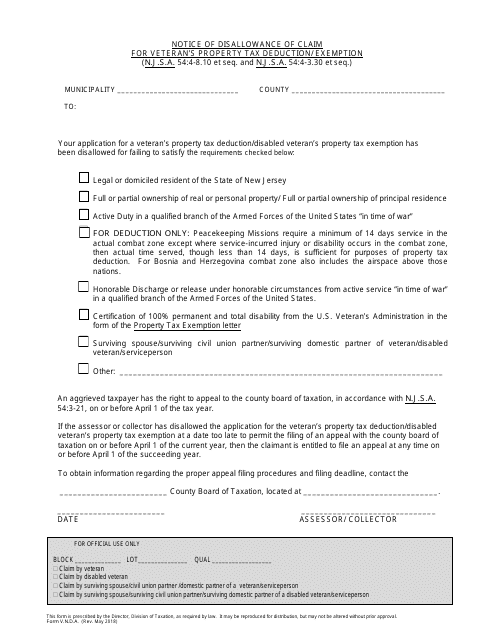

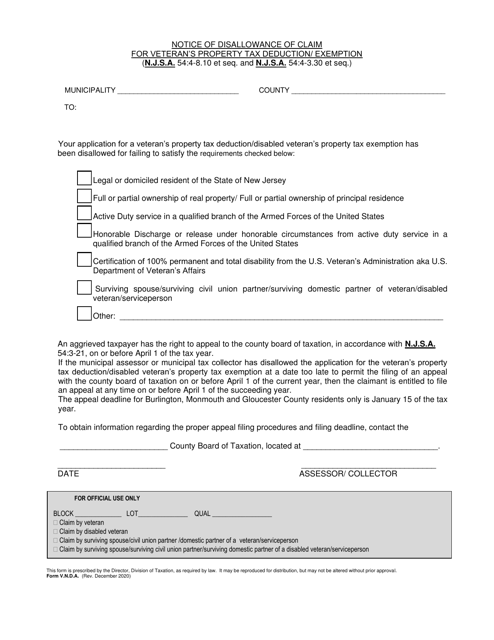

In New Jersey, for example, veterans can apply for the Form V.N.D.A. Notice of Disallowance of Claim for Veteran's Property Tax Deduction/Exemption or the Notice of Disallowance of Claim for Veteran's Property Tax Deduction/Exemption. These forms inform veterans of any disallowance of their claim for the exemption and provide necessary information for the appeal process.

If you are a veteran looking to take advantage of the Veterans Property Tax Exemption program, be sure to explore the available forms and resources specific to your state. By utilizing this benefit, you can potentially save a significant amount of money on your property taxes each year.

Documents:

7

This Form is used for applying for the Veterans Property Tax Exemption in Wyoming.

This form is used for cooperative housing corporation shareholders in Maine to apply for a veteran property tax exemption.

This form is used for applying for a property tax exemption in Maine for the widowed spouse, minor child, or widowed parent of a veteran.

This form is used for applying for a property tax exemption for veteran residents of cooperative housing corporations in the state of Maine.

This Form is used for claiming property tax exemption for widowed spouses, minor children, or widowed parents who are shareholders of cooperative housing corporations in Maine.

This form is used for submitting a notice of disallowance of a claim for veteran's property tax deduction or exemption in New Jersey.

This document is used to inform veterans that their claim for property tax deduction or exemption in New Jersey has been disallowed.