School District Income Tax Templates

If you are a resident of a school district in Ohio, you may be familiar with the school district income tax. This tax is an additional tax imposed on top of the state income tax, and it is used to fund local schools and education programs. The school district income tax is calculated based on your taxable income and the tax rate set by your school district.

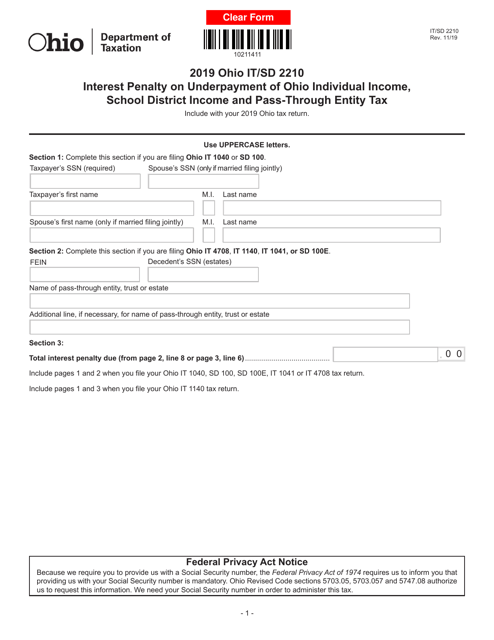

Filing your school district income tax return can be a complex process, especially if you have multiple sources of income or if you are a pass-through entity. To ensure that you comply with all tax laws and regulations, it is important to have access to the relevant forms and documentation.

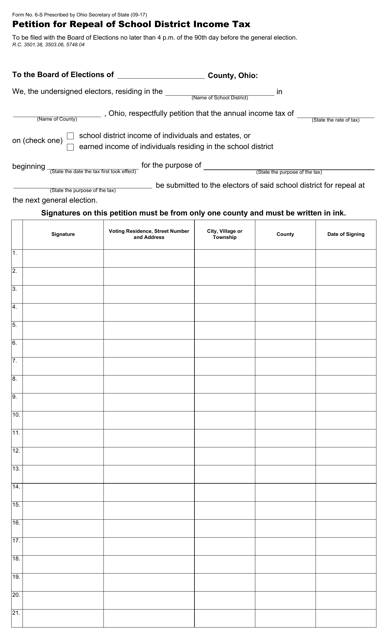

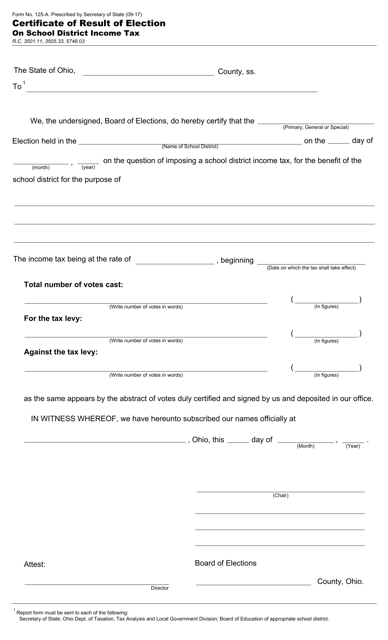

At our website, we offer a comprehensive collection of documents related to the school district income tax in Ohio. Whether you need Form IT/SD2210 for calculating interest penalties, Form 6-S for petitioning the repeal of the tax, or Form 125-A for obtaining the certificate of election results, you can find all the necessary forms and instructions here.

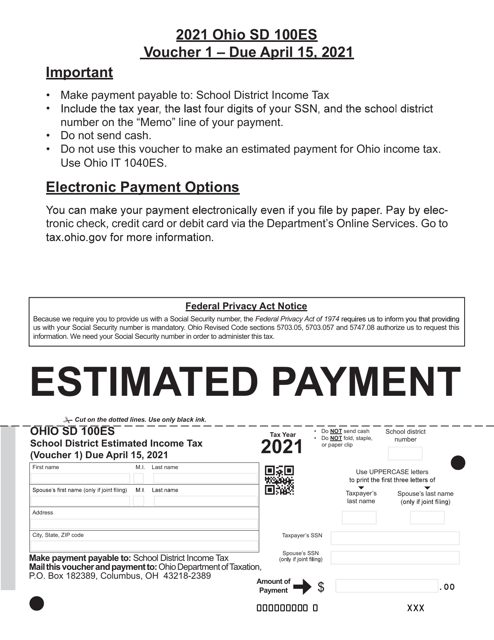

Our website also provides resources for estimating and paying your school district income tax. You can download Form SD100ES, which is the estimated income tax voucher, to make quarterly payments throughout the year. Additionally, we offer helpful guides and articles to assist you in understanding the tax laws and regulations surrounding the school district income tax.

With our easy-to-use search function, you can quickly find the specific documents you need. Whether you are an individual taxpayer, a business owner, or a tax professional, our website is your one-stop destination for accessing the school district income tax forms and information you need.

Don't let the complexity of the school district income tax overwhelm you. Visit our website today and take advantage of our comprehensive collection of documents and resources to ensure that you remain compliant and informed.

Documents:

5

This Form is used for petitioning the repeal of a school district income tax in Ohio.

This Form is used for reporting the results of an election regarding the school district income tax in Ohio. It helps to certify the outcome of the election.

This Form is used for Ohio school district residents to submit their estimated income tax payments.