Tax Reduction Templates

Are you looking to lower your tax burden? Explore our comprehensive collection of resources and information on tax reduction strategies. Whether you're a homeowner seeking property tax relief or a business owner looking to take advantage of reduced tax rates, we've got you covered.

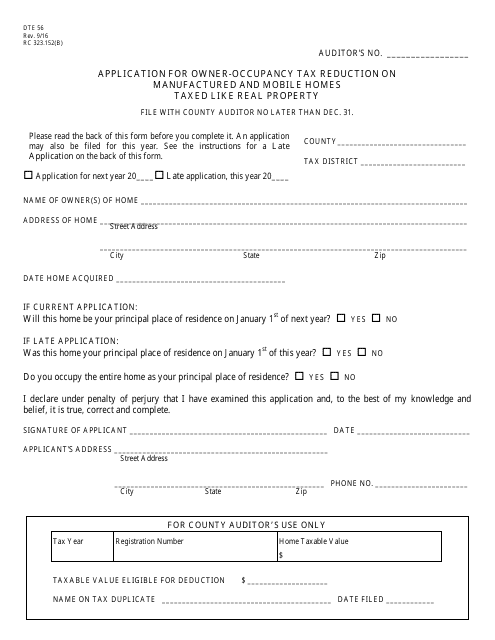

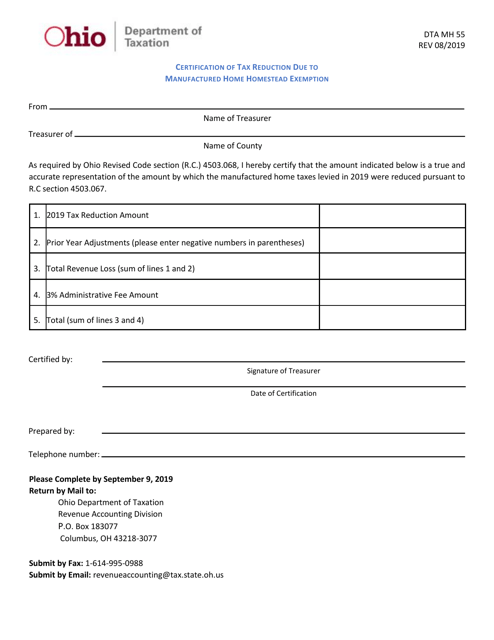

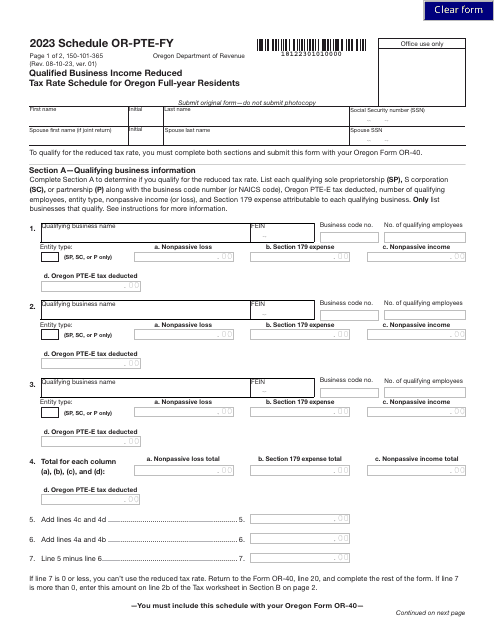

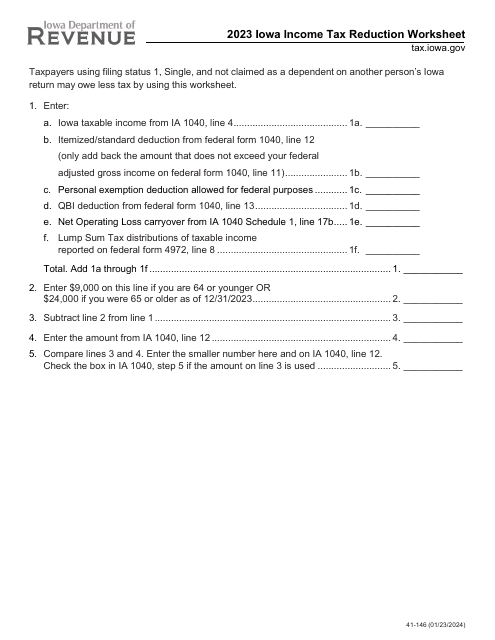

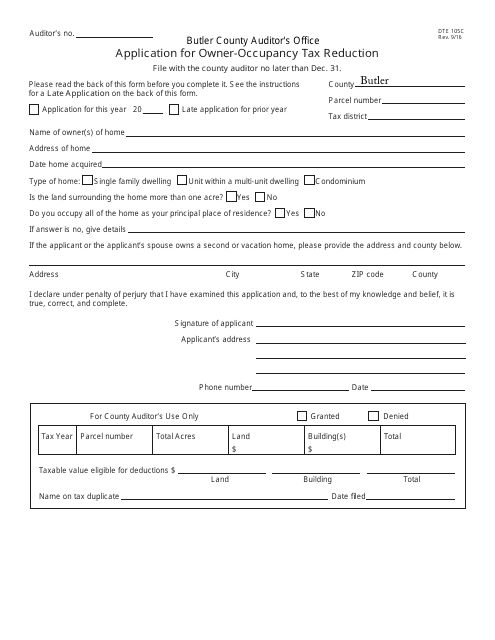

Our collection of tax reduction documents features a wide range of forms and applications that can help you save money on your taxes. For example, if you own a manufactured or mobile home in Ohio, you may be eligible for the Owner-Occupancy Tax Reduction on Manufactured and Mobile Homes Taxed Like Real Property. Similarly, Oregon residents can benefit from the Qualified Business Income Reduced Tax Rate Schedule, designed to reduce taxes for qualified businesses.

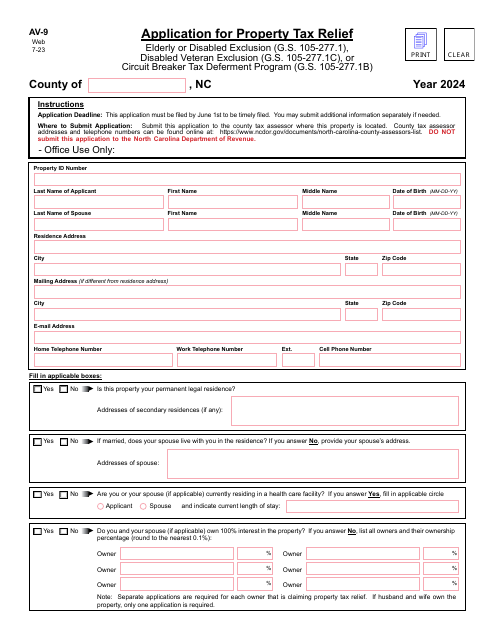

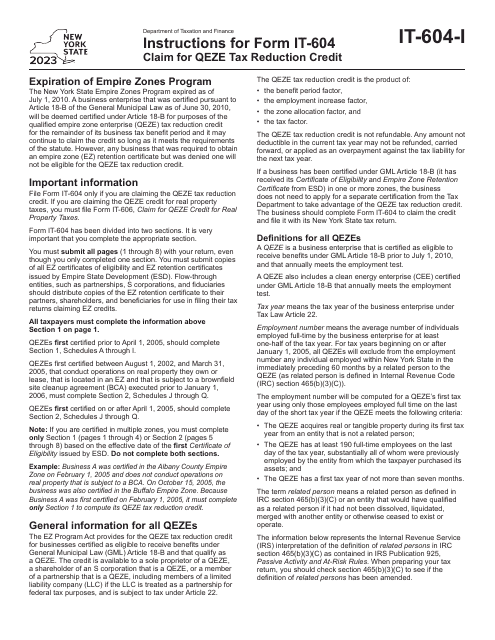

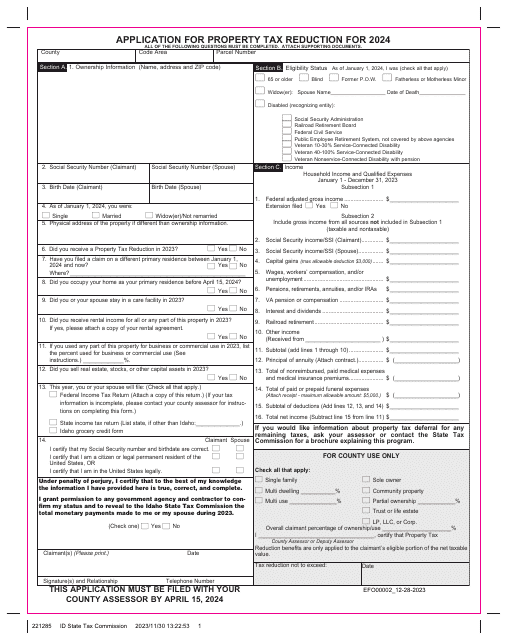

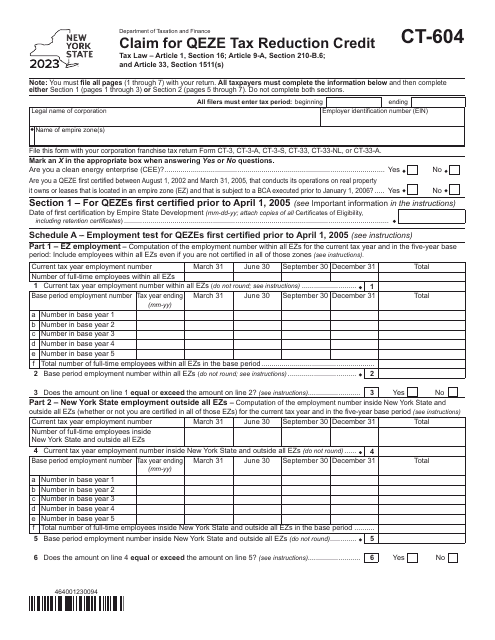

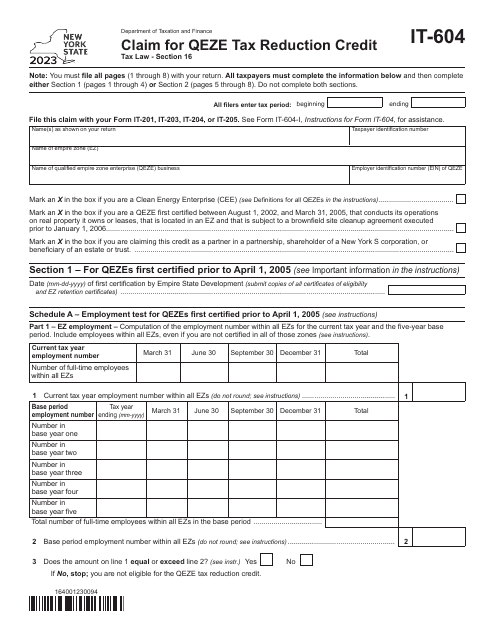

If you're a New York resident, our collection includes the Claim for Qeze Tax Reduction Credit form, allowing you to potentially lower your tax liability. Meanwhile, North Carolina residents can take advantage of the Application for Property Tax Relief to explore potential savings opportunities.

No matter where you live or what your tax situation may be, our tax reduction documents are designed to provide you with the information and resources you need to reduce your tax burden. Explore our collection today and start saving on your taxes.

Documents:

31

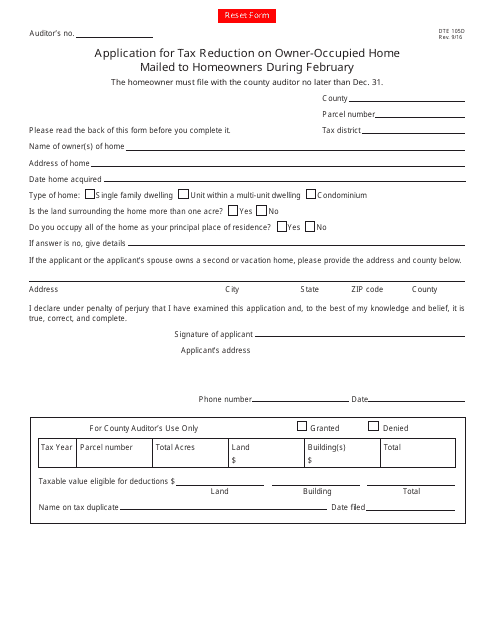

This form is used for applying for a tax reduction on owner-occupied homes in Ohio. It is mailed to homeowners during February.

This form is used for applying for an owner-occupancy tax reduction on manufactured and mobile homes taxed like real property in the state of Ohio.

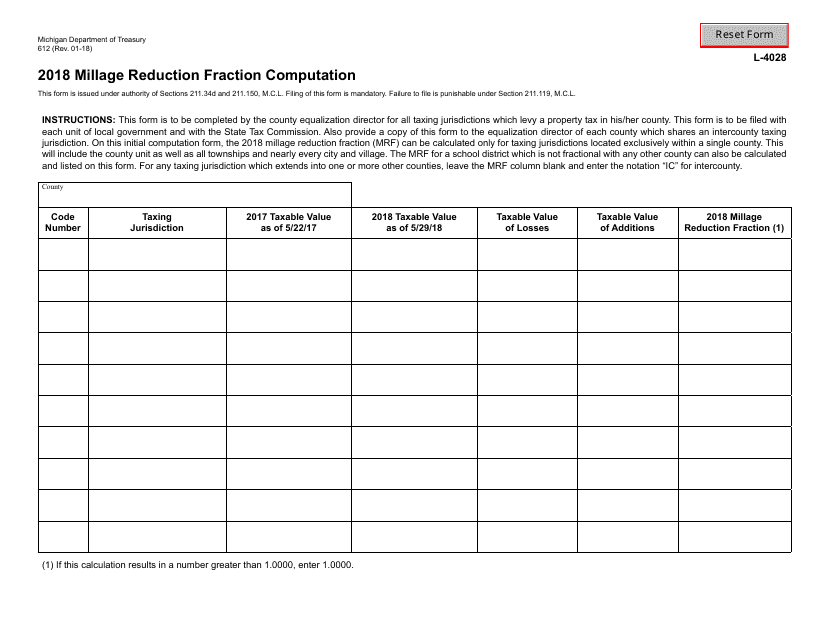

This form is used for calculating the millage reduction fraction in the state of Michigan.

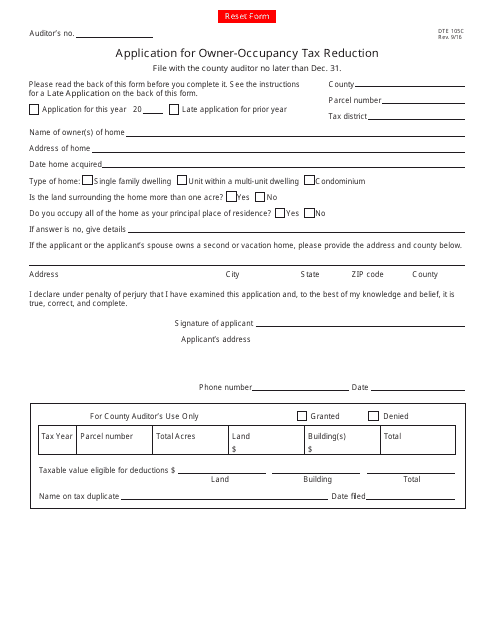

This form is used for applying for the Owner-Occupancy Tax Reduction in Ohio.

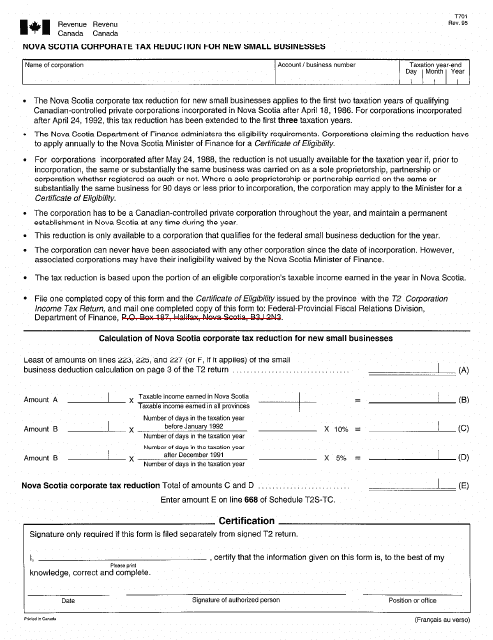

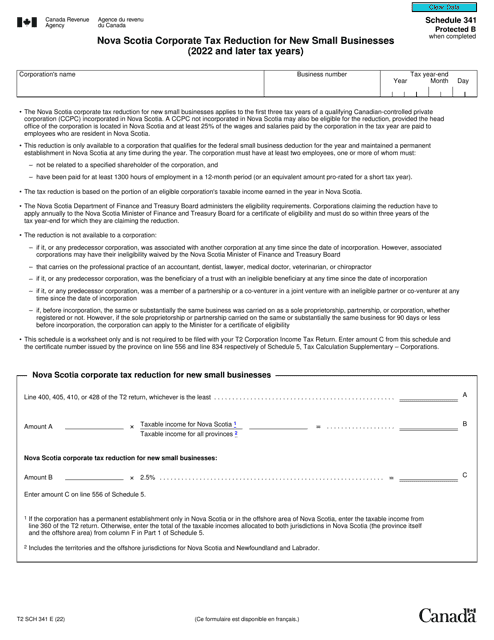

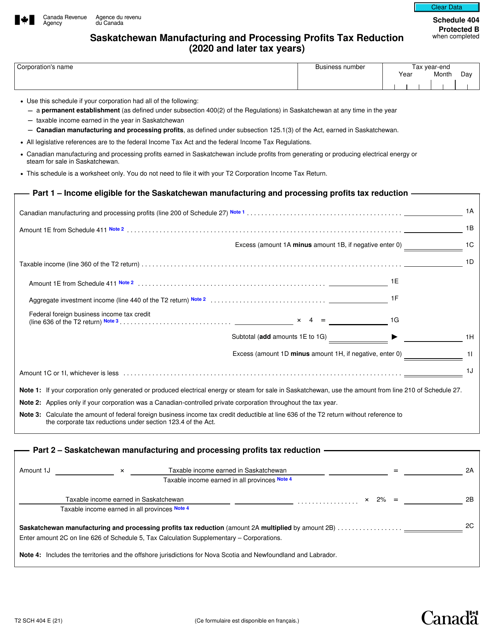

This form is used for claiming a tax reduction for new small businesses in Nova Scotia, Canada.

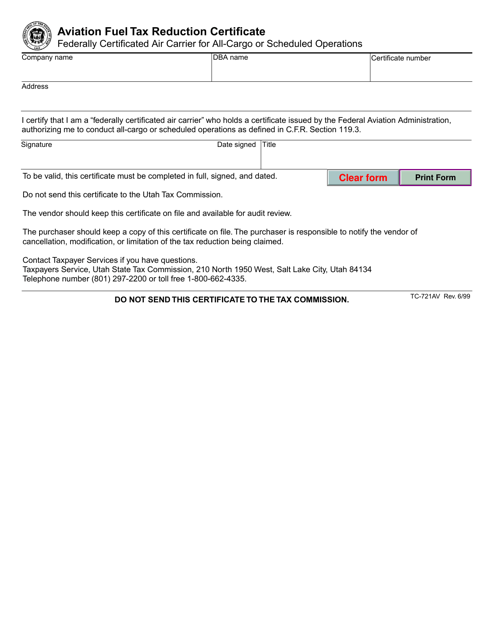

This form is used for applying for an aviation fuel tax reduction certificate in the state of Utah. It is specifically designed for individuals or businesses involved in the aviation industry who qualify for a tax reduction on aviation fuel.

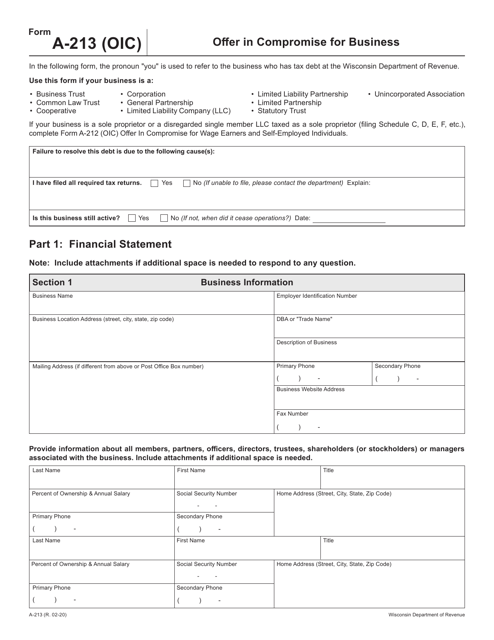

This form is used for making an offer in compromise for a business located in Wisconsin.

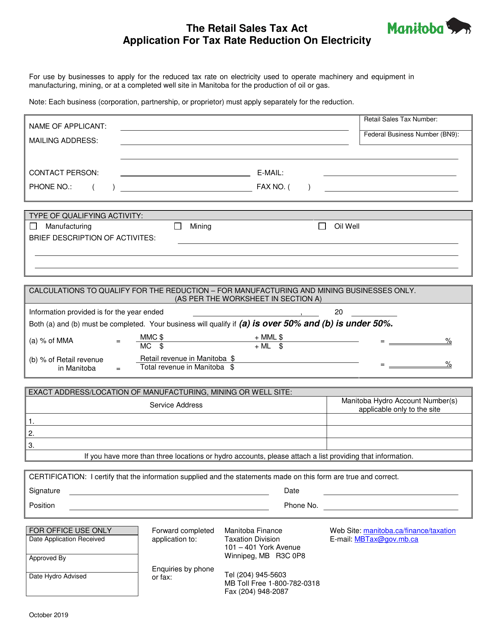

This form is used for applying for a tax rate reduction on electricity in Manitoba, Canada. It allows residents to potentially receive a lower tax rate on their electricity bills.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

This document is used for applying for a Greenbelt Assessment in Williamson County, Tennessee.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

This Form is used for applying for a tax abatement on real property in Washington, D.C.