Foreign Partner Templates

Are you doing business with foreign partners? Looking for guidance on how to handle payments and taxes involving these partnerships? Our comprehensive collection of documents, also known as the Foreign Partner documents, is here to help you navigate through the complexities.

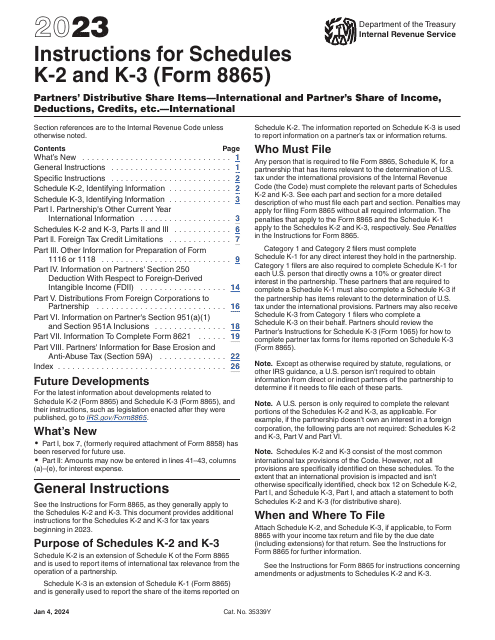

From payment vouchers to tax forms, our documents cover everything you need to know about managing your relationships with foreign partners. Whether you are withholding payments or reporting U.S. person's interests in foreign partnerships, our instructions and forms provide clear guidance to ensure compliance with the relevant regulations.

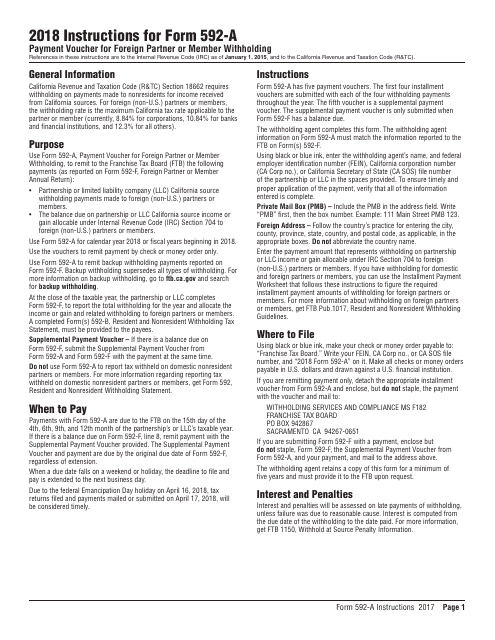

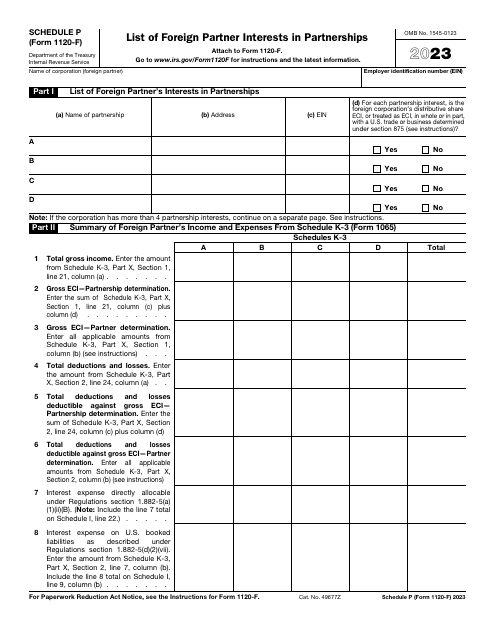

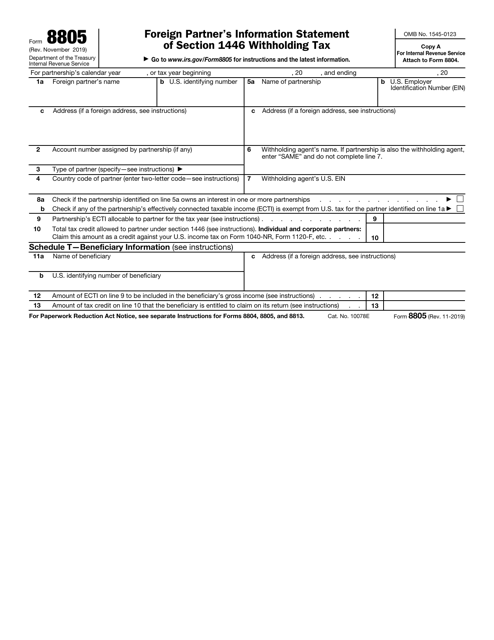

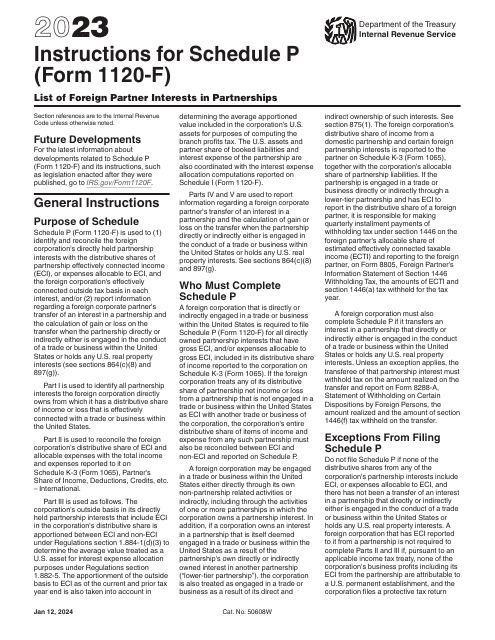

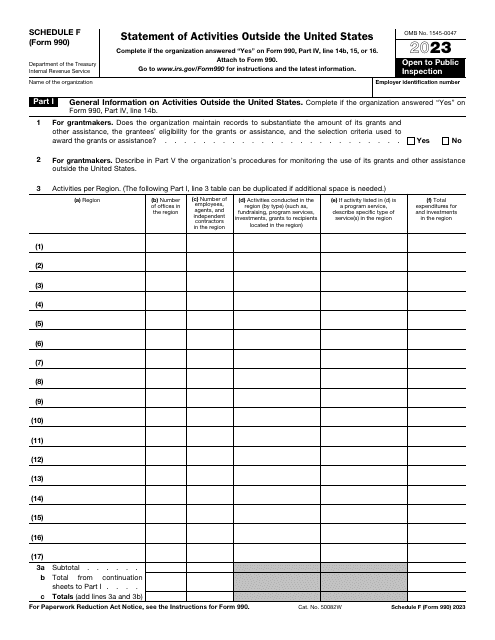

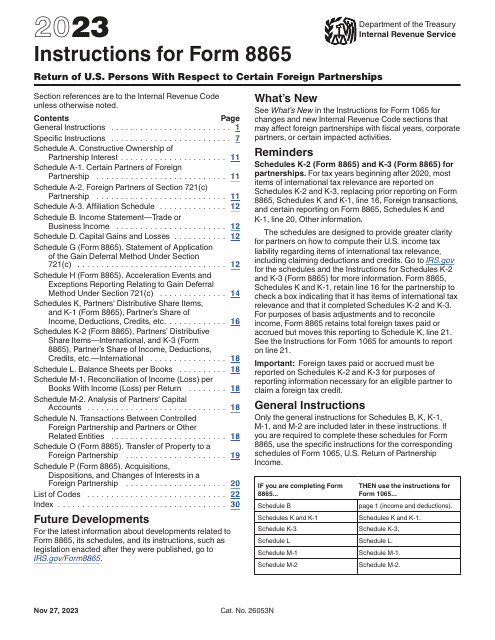

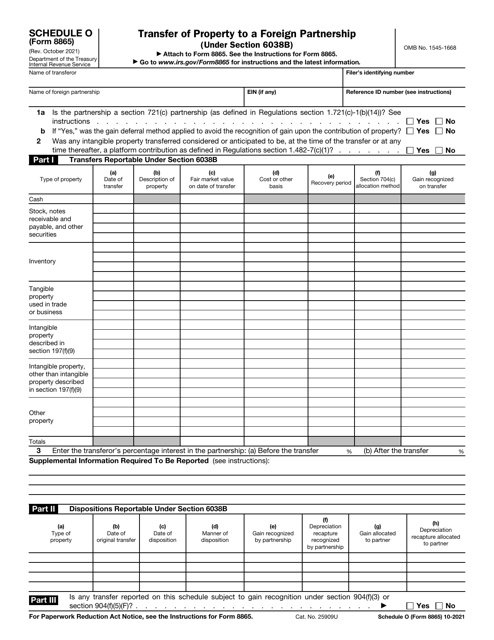

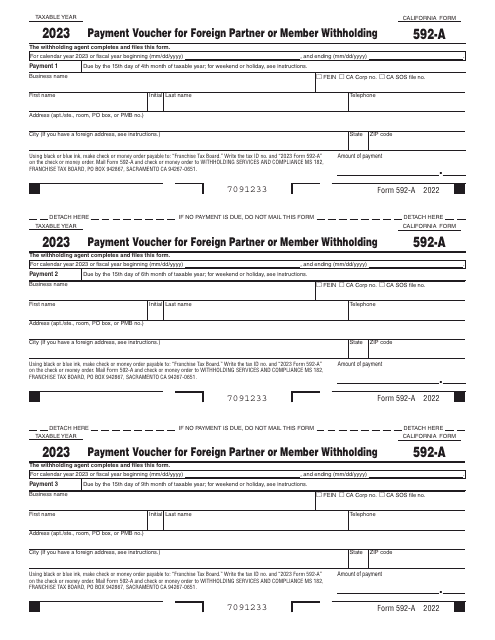

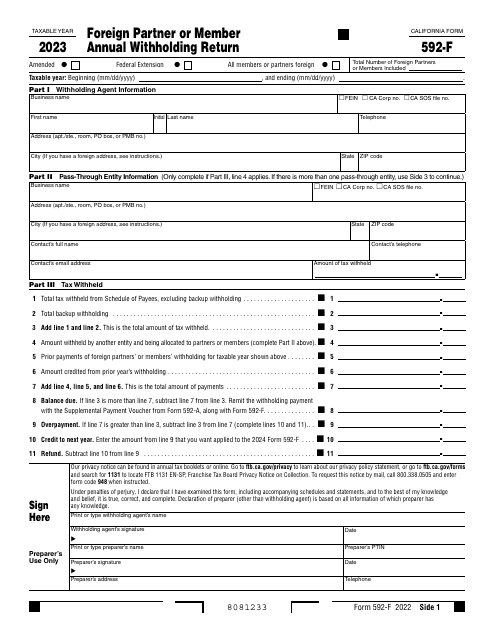

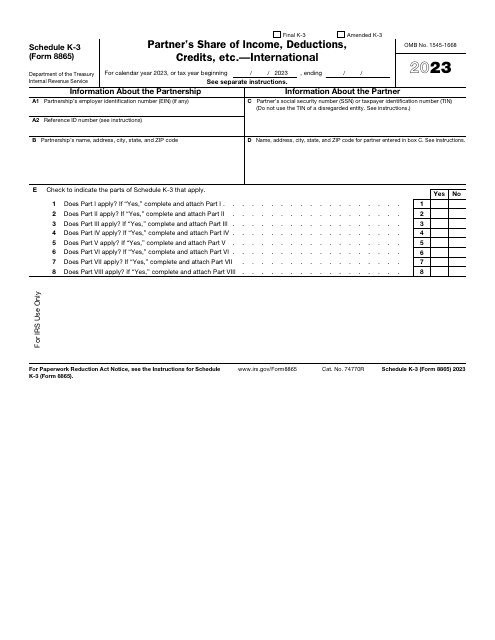

Stay organized and fulfill your obligations with ease. Our Foreign Partner documents offer step-by-step instructions forfilling out forms such as Form 592-A Payment Voucher for Foreign Partner or Member Withholding - California, IRS Form 1120-F Schedule P List of Foreign Partner Interests in Partnerships, and IRS Form 8865 Return of U.S. Persons With Respect to Certain Foreign Partnerships. We also provide detailed guidance on completing IRS Form 8865 Schedule K-2 and K-3.

Don't let the complexities of dealing with foreign partners overwhelm you. Access our collection of Foreign Partner documents and stay informed about the payment and tax obligations in your international business ventures. With our clear instructions and easy-to-use forms, you can streamline your processes and stay compliant every step of the way.

Documents:

12

This form is used for making payment voucher for withholding taxes on foreign partners or members in California.