Education Tax Deduction Templates

Education Tax Deduction

Are you looking for ways to save money on your education expenses? Look no further than the Education Tax Deduction

, also known as educational tax deductions or education tax deductions. This valuable benefit allows eligible individuals to deduct certain education-related expenses from their taxes, reducing their overall tax liability.Under the Education Tax Deduction

, you may be able to claim deductions for a wide range of education-related costs, including tuition fees, textbooks, supplies, and even certain student loan interest payments. By taking advantage of these deductions, you can potentially save a significant amount of money on your taxes.To qualify for the Education Tax Deduction

, you must meet certain criteria set by your country's tax authorities. Different countries may have different rules and regulations regarding education tax deductions, so it's essential to familiarize yourself with the specific requirements in your jurisdiction.In the United States, for example, you may be eligible for the Education Tax Deduction

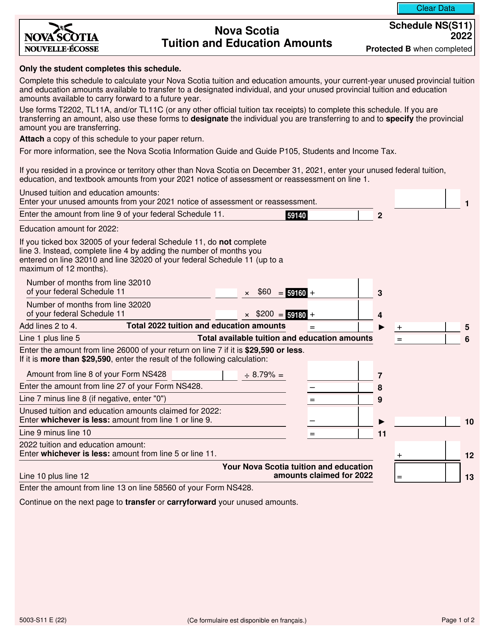

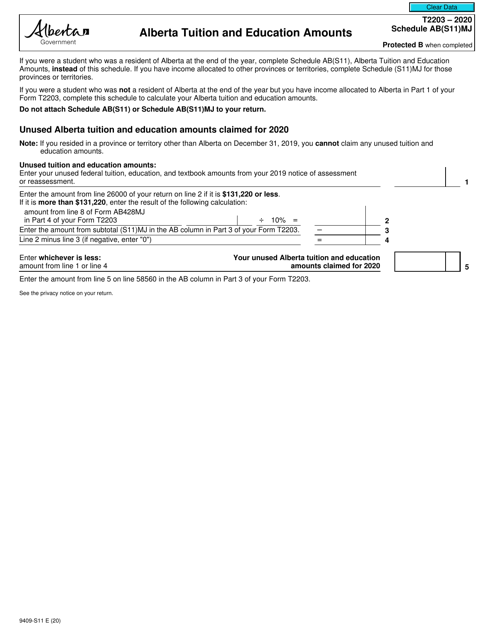

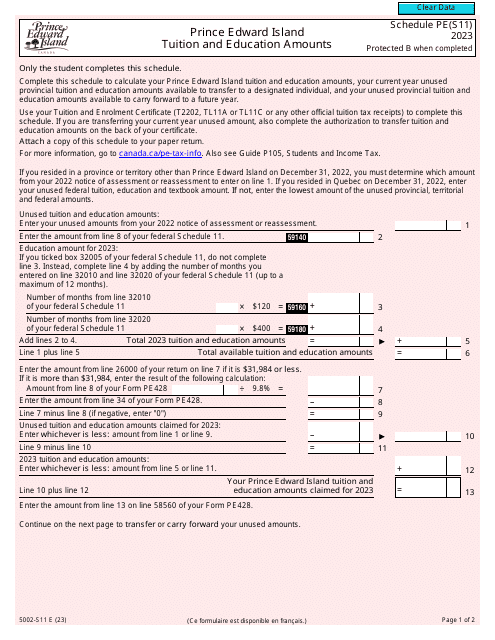

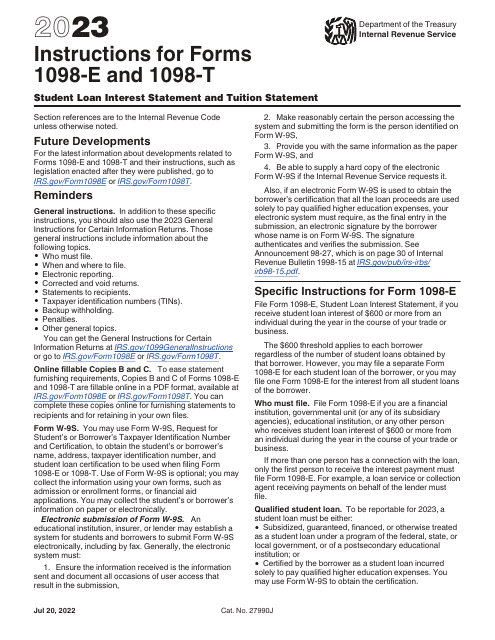

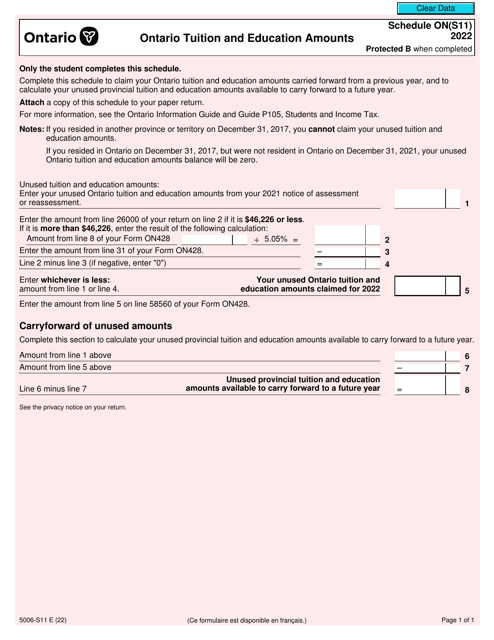

if you meet the criteria outlined in IRS Form 1098-E and 1098-T. These forms provide instructions on how to properly claim your education-related deductions and ensure compliance with the Internal Revenue Service (IRS).Similarly, in Canada, there are various provincial-specific forms such as Form 5003-S11 Schedule NS(S11), Form T2203 (9409-S11) Schedule AB(S11)MJ, and Form 5002-S11 Schedule PE(S11), to name a few. These forms allow individuals to deduct their provincial tuition and education amounts, providing additional tax benefits.

Taking advantage of the Education Tax Deduction

not only helps you save money but also encourages and supports lifelong learning. Whether you're pursuing a degree, updating your skills, or furthering your education, these deductions can help offset the financial burden and make education more affordable.Remember, every dollar saved through education tax deductions is a dollar that can be reinvested in your own personal growth and development. So, don't miss out on this valuable opportunity to save on your education-related expenses. Explore the various education tax deductions available in your country and consult a tax professional if needed to ensure you're maximizing your potential tax savings.

Documents:

5