Interest Computation Templates

Are you looking for information on interest computation? Our webpage provides a comprehensive overview of interest computation methods, forms, and guidelines.

Interest computation plays a crucial role in various financial calculations, ensuring accurate and fair results. Whether you are an individual, a business owner, or a tax professional, understanding the interest computation process is essential to comply with tax regulations and make informed financial decisions.

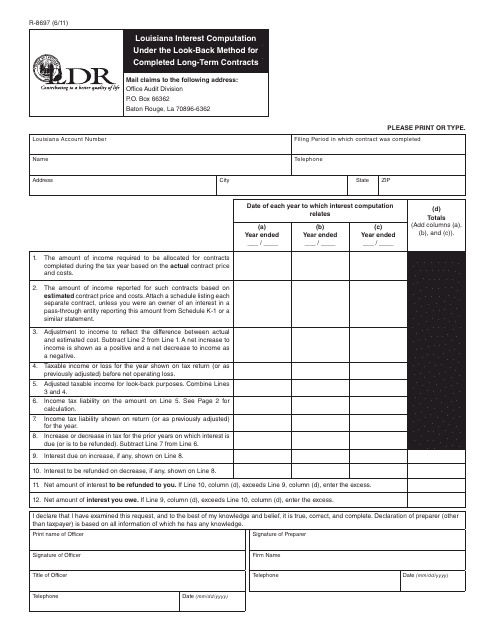

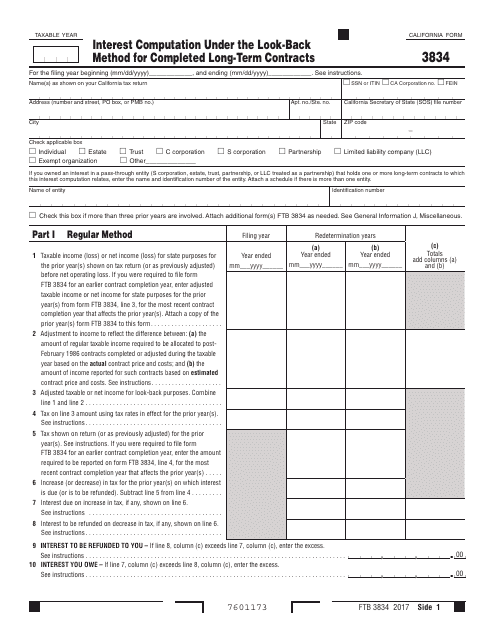

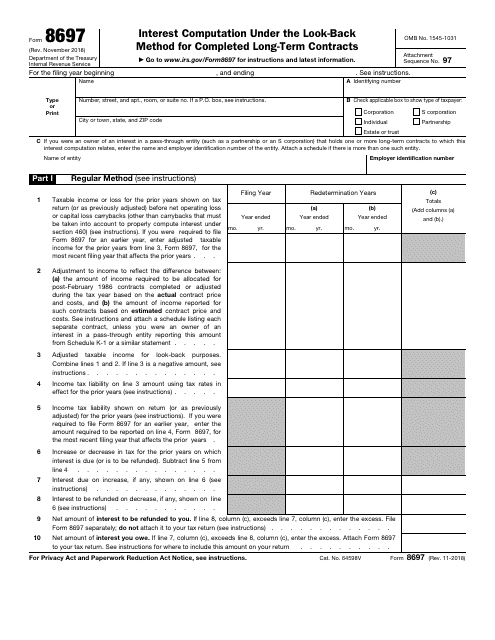

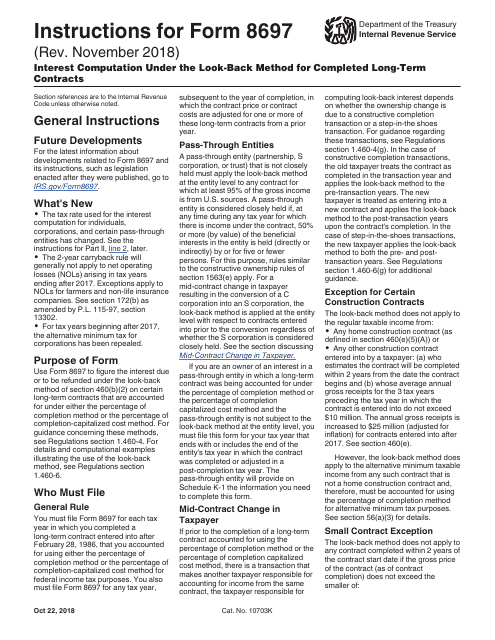

Our webpage offers detailed information on interest computation under the look-back method for completed long-term contracts. This method, as specified in Form FTB3834 (California) and IRS Form 8697, helps businesses accurately calculate interest on long-term contracts that span several years.

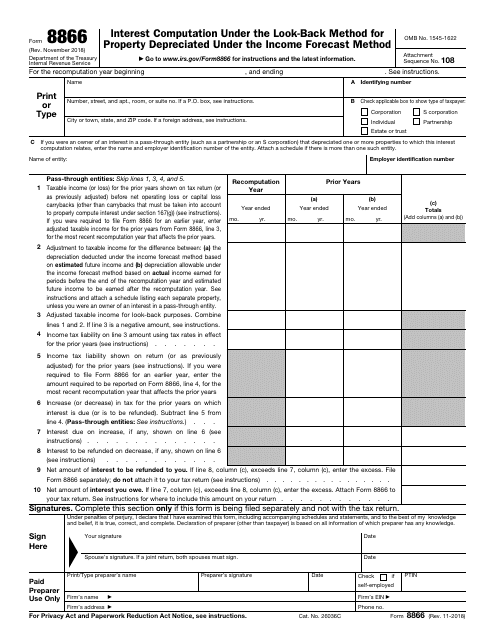

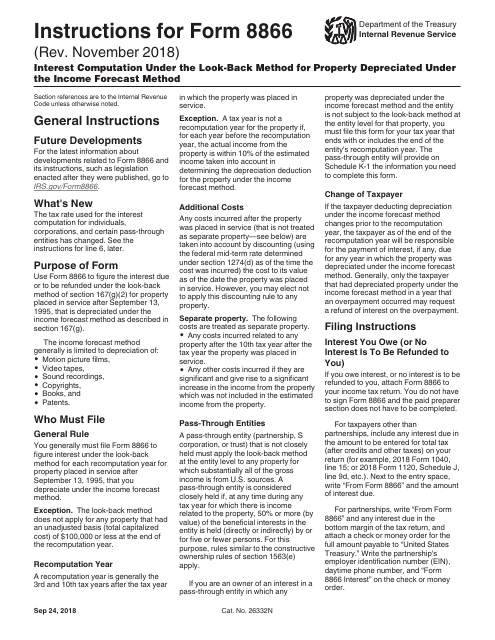

Additionally, we cover interest computation under the look-back method for property depreciated under the income forecast method, as outlined in IRS Form 8866. This form provides instructions for accurately computing interest on property depreciation, ensuring fair outcomes.

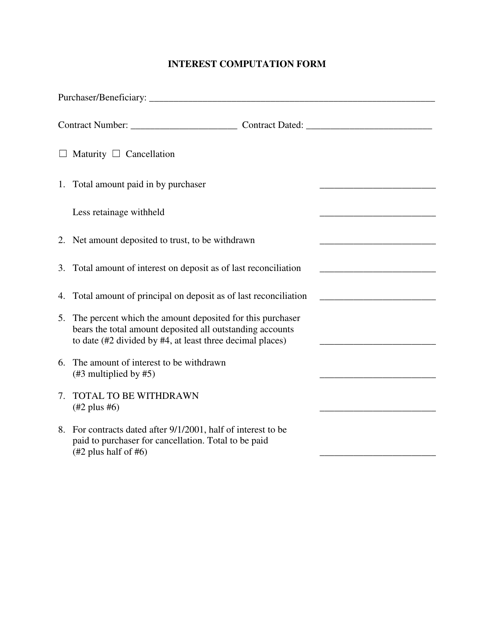

For individuals and businesses in Texas, our webpage also features an interest computation form specific to the state, guiding taxpayers on calculating interest in accordance with Texas regulations.

Our webpage aims to simplify the interest computation process by providing step-by-step instructions, examples, and useful resources. Whether you need to determine interest owed or calculate interest income, our comprehensive information will assist you in understanding and complying with interest computation requirements.

Visit our webpage to access valuable information on interest computation methods, forms, and guidelines. Learn how to accurately calculate interest for tax purposes, long-term contracts, and property depreciation. Stay informed and make sound financial decisions with our comprehensive resources on interest computation.

Documents:

7

This form is used for calculating interest under the look-back method for completed long-term contracts in the state of Louisiana.

This form is used for calculating interest under the look-back method for completed long-term contracts in California.

This form is used for calculating interest using the look-back method for completed long-term contracts.

This form is used for calculating interest under the look-back method for property that has been depreciated using the income forecast method.

This Form is used for calculating interest under the look-back method for long-term contracts completed by the IRS. It provides instructions on how to determine the interest amount and report it accurately on your tax return.

This document provides instructions on how to calculate interest using the look-back method for property depreciated under the income forecast method. It is used for IRS Form 8866.

This form is used for calculating interest in the state of Texas. It is utilized to determine the amount of interest owed or earned on financial transactions such as loans, mortgages, or investments.